Search Market Research Report

Food Emulsifiers and Texturizers Market Size, Share Global Analysis Report, 2023 – 2030

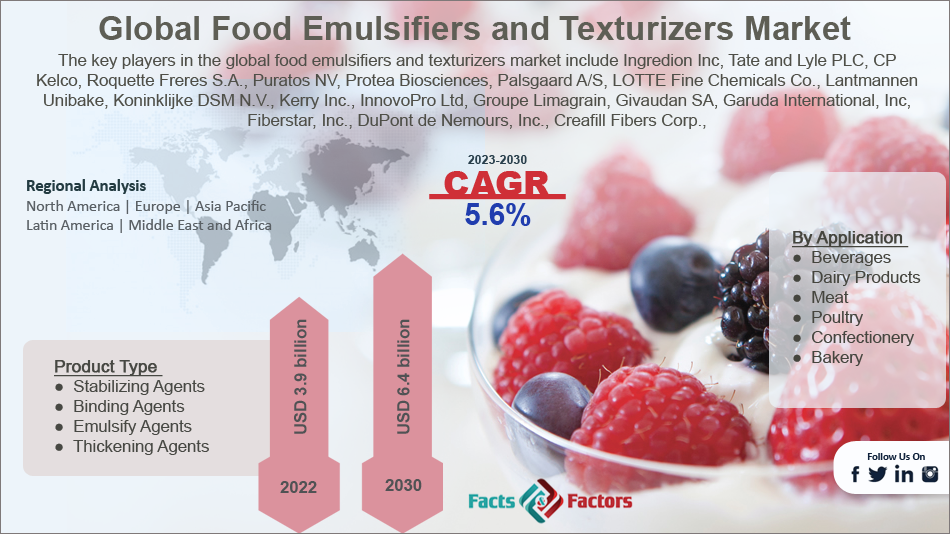

Food Emulsifiers and Texturizers Market Size, Share, Growth Analysis Report By Application (Beverages, Dairy Products, Meat, Poultry, Confectionery, Bakery), By Product Type (Stabilizing Agents, Binding Agents, Emulsify Agents, Thickening Agents), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

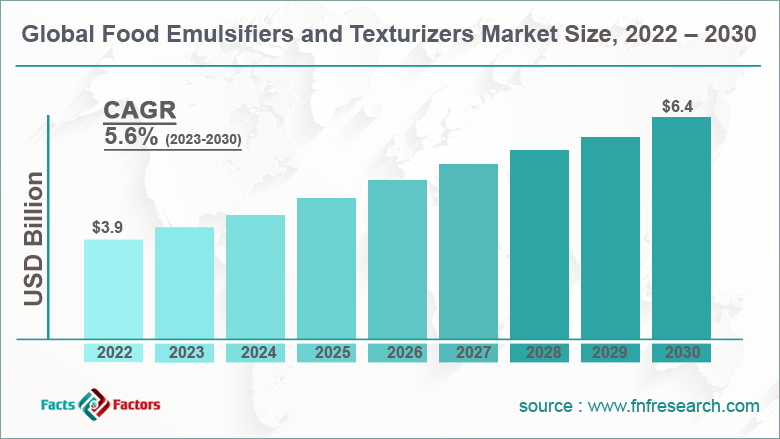

[226+ Page Report] According to the report published by Facts & Factors, the global food emulsifiers and texturizers market size was valued at USD 3.9 billion in 2022 and is anticipated to surpass USD 6.4 billion during the predicted period. The market is expected to grow with a CAGR of 5.6% between 2023-2030. The global food emulsifiers and texturizers market report offer detailed insights into the market dynamics. It presents comprehensive projections on growth drivers, restraining factors, lucrative opportunities, and challenges.

Market Overview

Market Overview

Emulsifiers are the kind of natural substances mono-, diglycerides, lecithin, and other synthetic derivatives. The major purpose of these products is to help oils and flavors get mixed and dispersed throughout the food uniformly. Texturization agents help to modify and add texture to the mouth feel of food items. These items are widely used in dairy, savory, bakery, snacks, dairy, meat, and poultry products.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the food emulsifiers and texturizers market is estimated to grow annually at a CAGR of around 5.6% over the forecast period (2023-2030).

- In terms of revenue, the global market size was valued at around USD 3.9 billion in 2022 and is projected to reach USD 6.4 billion by 2030.

- The high demand for low-calorie food products is likely to boost the food emulsifiers and texturizers market growth.

- Based on the application, the bakery segment accounts for the largest share of the global market.

- Based on the product type, the thickening agent dominates the global market.

- Based on region, North America is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- High demand for low-calorie food products is likely to propel the market's growth.

The growing prevalence of cardiovascular diseases and obesity issues over the past few years is expected to propel the demand for low-fat food products. These texturizing agents hold the ability to substitute the calorie full oils and fats with low-fat content, thereby permitting the formulations to become a more healthy choice.

Such improved formulations make use of food texturizers agents as the fat mimetic. Texturizing agents are extensively used for people suffering from dysphagia or swallowing complexity. Manufacturers use different texturizing agents according to their uniqueness and advantages.

Apart from offering the texture of the food products, these agents also improve the appeal and palatability of the food. Fast-changing lifestyles led to extensive innovations, particularly in the food and beverage field. The best example is ready-to-drink beverages. The busy pace of today's lifestyle severely impacted the lives of people.

Consumers are finding alternative products focusing on the ingredients included in the product. For example, ready-to-drink coffee and tea are gaining immense traction among people because these have emerged as instant healthy options available to people.

Restraints

Restraints

- Health issues associated with emulsifiers and texturizers are likely to impede the growth of the global market.

Food texturizers are largely derived from diverse sources like seaweeds, animals, plants, and others. Also, there are certain synthetic texturizers that are used in the food and beverage industry. However, the growing health consciousness and awareness among people regarding the ingredients used in food products is likely to impede the growth of the global food emulsifiers and texturizers market.

Opportunities

Opportunities

- The growing requirement for texturizing agents in infant formula is likely to offer lucrative growth opportunities in the global market.

The gastroesophageal reflux and dysphagia issues among infants, particularly in neonatal intensive care units, are likely to widen the scope of the global food emulsifiers and texturizers industry in the forthcoming years. The food texturizer agents help make the milk formulation thick without altering its original texture.

Also, the risk of food coming back from the esophagus is resolved by adding these texturizing agents in the Infant formulas. Therefore, such a landscape is likely to create potential opportunities for food texturizers in the global food emulsifiers and texturizers market over the predicted period.

However, the growing swallowing disorder in aging adults is also likely to boost the demand for food texturizing agents. The texturizing agents help slow down the flow of food and fluids, thereby offering more coordinated time for the swallowing process and helping people ingest the food products.

Challenges

Challenges

- Rising healthcare costs and growing awareness among people regarding the nutrition requirement are big challenges in the global market.

The increasing awareness among people regarding eating nutritional-dense food and buying food items by reading the ingredient label is a big challenge in the global market. Additionally, the growing healthcare cost is further restricting people from compromising their health by consuming processed food. Therefore, such a landscape is likely to hamper the growth of the global food emulsifiers and texturizers market.

Segmentation Analysis

Segmentation Analysis

The global food emulsifiers and texturizers market can be segmented into application, product type, and region.

By application, the market can be segmented into beverages, dairy products, meat, poultry, confectionery, bakery, and others. The bakery segment accounts for the largest share of the global food emulsifiers and texturizers market due to the growing demand for bakery products among middle-aged consumers.

By product type, the food emulsifiers and texturizers can be segmented into stabilizing agents, binding agents, emulsifying agents, thickening agents, and others. The thickening agent dominates the global food emulsifiers and texturizers market.

Recent Developments:

Recent Developments:

- Tate and Lyle PLC, in Feb 2023, announced the launch of its brand with the company's new narrative. Tate and Lyle PLC, a leader in ingredient solutions for healthier food and beverages, are ready to rebrand itself with the purpose of transforming lives through the science of food.

- Kerry Group, in April 2023, reported an increase of 10.3% in the first quarter of its financial year, led by strong growth in the food service channel in Europe and APMEA.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 3.9 Billion |

Projected Market Size in 2030 |

USD 6.4 Billion |

CAGR Growth Rate |

5.6% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Ingredion Inc, Tate and Lyle PLC, CP Kelco, Roquette Freres S.A., Puratos NV, Protea Biosciences, Palsgaard A/S, LOTTE Fine Chemicals Co., Lantmannen Unibake, Koninklijke DSM N.V., Kerry Inc., InnovoPro Ltd, Groupe Limagrain, Givaudan SA, Garuda International Inc, Fiberstar Inc., DuPont de Nemours Inc., Creafill Fibers Corp., CP Kelco ApS, Corbion N.V., Compania Espanola de Algas Marinas S.A., Cargill Inc, Bunge Loders Croklaan B.V., BASF SE, Agrinnovation Ltd., and others. |

Key Segment |

By Application, Product Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America is expected to grow significantly in the global market.

North America is the fastest-growing region in the global food emulsifiers and texturizers market. Also, it is projected to swipe the major market share and volume during the forecast period. The surge in innovation and tech development in the food ingredients field is expected to augment the growth of the regional market. The growing demand for processed food in the region is due to the hectic lifestyle of the people. The busy and hectic lifestyle of the people does not allow them to cook food from raw materials. Therefore, there is a high requirement for these ingredients in the region.

Asia Pacific is expected to be the fastest growing reason in the global food emulsifiers and texturizers industry owing to the rapidly emerging food processing industry in developing economies like India, China, and Japan. The growing disposable income of people and rising living standards are likely to further accentuate the growth of the regional market.

However, Europe is also likely to grow significantly in the forthcoming years due to the presence of prominent market leaders in the region. Additionally, the constant improvements in food technology are likely to strengthen the growth of the regional market.

Competitive Analysis

Competitive Analysis

- Ingredion Inc

- Tate and Lyle PLC

- CP Kelco

- Roquette Freres S.A.

- Puratos NV

- Protea Biosciences

- Palsgaard A/S

- LOTTE Fine Chemicals Co.

- Lantmannen Unibake

- Koninklijke DSM N.V.

- Kerry Inc.

- InnovoPro Ltd

- Groupe Limagrain

- Givaudan SA

- Garuda International Inc

- Fiberstar Inc.

- DuPont de Nemours Inc.

- Creafill Fibers Corp.

- CP Kelco ApS

- Corbion N.V.

- Compania Espanola de Algas Marinas S.A.

- Cargill Inc

- Bunge Loders Croklaan B.V.

- BASF SE

- Agrinnovation Ltd.

The global food emulsifiers and texturizers market is segmented as follows:

By Application Segment Analysis

By Application Segment Analysis

- Beverages

- Dairy Products

- Meat

- Poultry

- Confectionery

- Bakery

By Product Type Segment Analysis

By Product Type Segment Analysis

- Stabilizing Agents

- Binding Agents

- Emulsify Agents

- Thickening Agents

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Ingredion Inc

- Tate and Lyle PLC

- CP Kelco

- Roquette Freres S.A.

- Puratos NV

- Protea Biosciences

- Palsgaard A/S

- LOTTE Fine Chemicals Co.

- Lantmannen Unibake

- Koninklijke DSM N.V.

- Kerry Inc.

- InnovoPro Ltd

- Groupe Limagrain

- Givaudan SA

- Garuda International Inc

- Fiberstar Inc.

- DuPont de Nemours Inc.

- Creafill Fibers Corp.

- CP Kelco ApS

- Corbion N.V.

- Compania Espanola de Algas Marinas S.A.

- Cargill Inc

- Bunge Loders Croklaan B.V.

- BASF SE

- Agrinnovation Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors