Search Market Research Report

Feed Additives Market Size, Share Global Analysis Report, 2023 – 2030

Feed Additives Market Size, Share, Growth Analysis Report By Additive (Acidifiers, Amino Acids, Antibiotics, Antioxidants, Binders, Enzymes, Flavors & Sweeteners, Minerals, Mycotoxin Detoxifiers, Phytogenics, Pigments, Prebiotics, Probiotics, Vitamins, and Yeast), By Livestock (Aquaculture, Poultry, Ruminants, and Swine), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

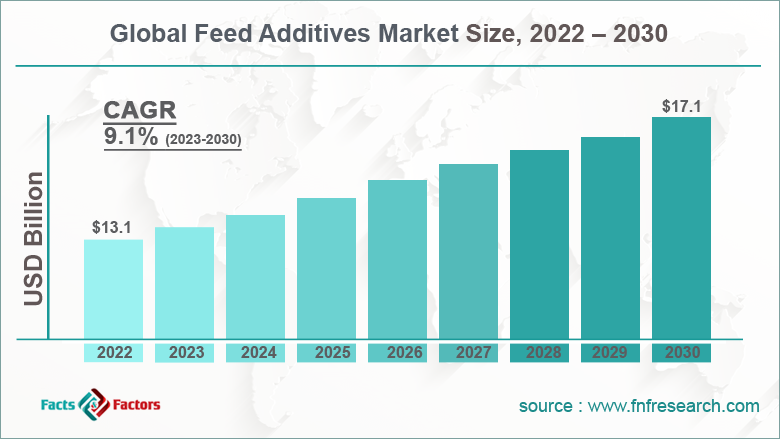

[229+ Page Report] According to the report published by Facts & Factors, the global feed additives market size was evaluated at $13.1 billion in 2022 and is slated to hit $17.1 billion by the end of 2030 with a CAGR of nearly 9.1% between 2023 and 2030. The feed additives market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace. The feed additives industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the report explores the investor and stakeholder space to help companies make data-driven decisions.

Market Overview

Market Overview

The European Commission has defined feed additives as products used in animal nutrition for enhancing animal feed quality and the quality of foods of animal origin including meat, milk, eggs, and fish. These feed additives are used for enhancing the performance and health of animals. Furthermore, the use of feed additives in animal nutrition is the use of the right additive at the right time and in the right amounts adhering to the legislations of the countries.

Moreover, feed additives added to animal feeds in the right proportion provides numerous benefits to animal breeders. Some of these benefits include improving the digestive ability of animals, enhancing feed quality, preserving feed nutrients, and improving the quality of animal products. Reportedly, feed additives are used for fulfilling the nutritive needs of animals for improving their breed for meat & milk, and other animal-based products.]

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global feed additives market is projected to expand annually at the annual growth rate of around 9.1% over the forecast timespan (2023-2030)

- In terms of revenue, the global feed additives market size was evaluated at nearly $13.1 billion in 2022 and is expected to reach $17.1 billion by 2030.

- The feed additives global market is anticipated to record massive growth over the forecast period owing to a rise in feed production, demand for livestock-based items, and a surge in livestock population.

- Based on additives, the amino acids segment is predicted to register the highest CAGR over the forecast timeline.

- In terms of livestock, the poultry segment is projected to dominate the segmental growth during the period from 2023 to 2030

- Region-wise, the North American Feed Additives market is projected to register the fastest CAGR of 14.1% during the assessment period.

Industry Growth Factors

Industry Growth Factors

- The need to make animal feed nutritive has led to massive market growth across the globe

The rise in feedstock farm sizes has catapulted the demand for feed additives in recent years. Apart from this, the commercialization of livestock farming, reduction of grazing lands, and the need for feed ingredients consisting of high nutritive value will accentuate the growth of the global feed additives market.

Moreover, the need for feed efficacy will further embellish the expansion of the global feed additives market. As per the International Feed Industry Federation, commercial feed production produces an estimated yearly turnover of more than $400 billion.

Furthermore, a rise in feed production, demand for livestock-based items, and a surge in livestock population will contribute majorly towards global market profits. Massive demand for high-quality animal-based proteins and awareness about the benefits provided by feed additives will expedite the size of the feed additives market.

In addition to this, the rising acceptance of precision-based livestock farming activities and government aid for using feed additives in animal feed has enlarged the scope of growth for the market across the globe.

Restraints

Restraints

- Rise in costs of raw components to hinder the global industry growth by 2030

The surge in raw material costs and a ban on the use of antibiotics can put brakes on the global feed additives industry growth in the near future. The easy availability of crop residues as feeds can further impede the global feed additives industry expansion.

Opportunities

Opportunities

- Use of botanical additives such as plant extracts as feed additives to open new vistas of growth for the global market

Feed additive manufacturers are adopting new kinds of natural feed additives along with new growth enhancers such as botanical additives like appropriate herb blends and plant extracts. This, in turn, is predicted to generate new growth opportunities for the global feed additives industry.

Challenges

Challenges

- Livestock chain and the need for improving feed additive sustenance are two big challenges faced by the global industry

The sustainability of feed additives and livestock chain are the two key challenges that can impact the growth of the feed additives industry globally.

Segmentation Analysis

Segmentation Analysis

The global feed additives market is sectored into additive, livestock, and region.

In terms of additives, the global feed additives market is sectored into phytogenics, enzymes, acidifiers, antibiotics, antioxidants, amino acids, prebiotics, binders, minerals, mycotoxin detoxifiers, flavors & sweeteners, pigments, vitamins, probiotics, and yeast segments.

Furthermore, the amino acid segment, which accounted for more than 70% of the global market share in 2022, is set to record the fastest CAGR of 5.1% over the forecasting period. The segmental surge in the next eight years can be attributed to the ability of amino acids in improving the development of animals.

Based on livestock, the feed additives industry across the globe is divided into ruminants, aquaculture, poultry, and swine segments. The poultry segment, which contributed for about three-fourths of the global industry share in 2022, is expected to rule the global industry expansion even in the foreseeable future. The growth of the segment in the coming years can be subject to growing awareness about animal health as well as customer inclination for particular yolk and meat leading to humongous penetration of feed additives in the poultry segment.

Recent Breakthroughs:

Recent Breakthroughs:

-

In the first half of 2021, Kemin Industries, a global ingredient supplier, launched KemTRACE Chromium-OR, a feed additive that can be used in the feed of animals such as horses, swine, broilers, and cattle. The move will provide impetus to the expansion of the feed additives market across the globe.

-

In the first quarter of 2021, Alltech, a U.S.-based firm in the animal feed supplements business, and DLG Group, a UK-based insurance firm, joined hands for bringing efficiency to the operations of livestock producers in Scandinavia. Reportedly, both firms have started of acquiring Karki-Agri Oy, a Finland-based firm. The move will contribute majorly to the growth of the feed additives industry in Europe.

-

In the second half of 2020, ADM Company introduced NutriPass L, a capsule lysine supplement in the feed of cows. The move will contribute sizably towards the growth of the feed additives business globally.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 13.1 Billion |

Projected Market Size in 2030 |

USD 17.1 Billion |

CAGR Growth Rate |

9.1% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Cargill Inc., DuPont, ADM, Evonik Industries, BASF SE, DSM AG, Novozymes Corporation, Ajinomoto, Chr Hansen, Nutreco, TEGASA, Alltech, Kemin Industries Inc., Palital Feed Additives B.V., Centafarm SRL, Novus International Inc., NUQO feed Additives, and others. |

Key Segment |

By Additive, Livestock, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Insights

Regional Insights

- Asia-Pacific Feed Additives Market to garner huge proceeds in the next eight years

Asia-Pacific, which accounted for more than 61% of the global feed additives market revenue in 2022, is anticipated to dominate the regional market growth during the projected timeline. The regional market expansion over 2023-2030 can be due to the large presence of livestock in countries such as Japan, Thailand, Indonesia, and India. In addition to this, there are a large number of feed mills in the countries such as Thailand, China, and Indonesia.

On the other hand, the North American feed additives industry is set to record the fastest CAGR of nearly 14.1% in the forecasting timeline. The growth of the market in the region can be credited to the rise in the sale of commercial seed in the countries such as the U.S. In addition to this, the presence of key product manufacturers in the region will contribute majorly to the regional industry size.

Competitive Space

Competitive Space

- Cargill Inc.

- DuPont

- ADM

- Evonik Industries

- BASF SE

- DSM AG

- Novozymes Corporation

- Ajinomoto

- Chr Hansen

- Nutreco

- TEGASA

- Alltech

- Kemin Industries Inc.

- Palital Feed Additives B.V.

- Centafarm SRL

- Novus International Inc.

- NUQO Feed Additives

The global feed additives market is segmented as follows:

By Additive Segment Analysis

By Additive Segment Analysis

- Acidifiers

- Amino Acids

- Antibiotics

- Antioxidants

- Binders

- Enzymes

- Flavors & Sweeteners

- Minerals

- Mycotoxin Detoxifiers

- Phytogenics

- Pigments

- Prebiotics

- Probiotics

- Vitamins

- Yeast

By Livestock Segment Analysis

By Livestock Segment Analysis

- Aquaculture

- Poultry

- Ruminants

- Swine

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Cargill Inc.

- DuPont

- ADM

- Evonik Industries

- BASF SE

- DSM AG

- Novozymes Corporation

- Ajinomoto

- Chr Hansen

- Nutreco

- TEGASA

- Alltech

- Kemin Industries Inc.

- Palital Feed Additives B.V.

- Centafarm SRL

- Novus International Inc.

- NUQO feed Additives

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors