Search Market Research Report

Propylene Oxide Market Size, Share Global Analysis Report, 2025 - 2034

Propylene Oxide Market Size, Share, Growth Analysis Report By Production Process (Chlorohydrin Process, Styrene Monomer Process, TBA Co-Product Process, Cumene-based Process, Hydrogen Peroxide Process), By Application (Polyether Polyols, Propylene Glycols, Propylene Glycol Ethers), By End-Use (Automotive, Building & Construction, Textiles & Furnishing, Chemicals & Pharmaceuticals), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

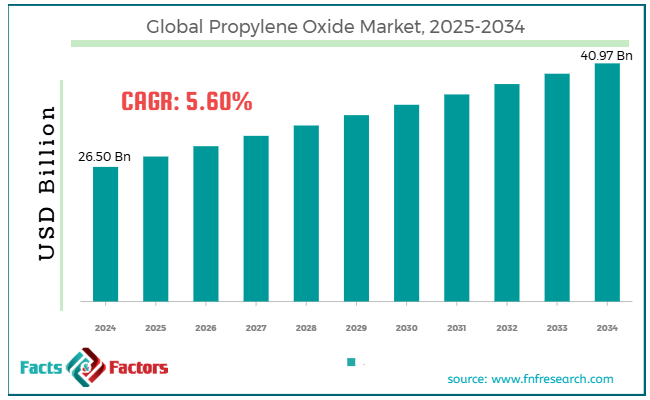

[221+ Pages Report] According to Facts & Factors, the global propylene oxide market size was worth around USD 26.50 billion in 2024 and is predicted to grow to around USD 40.97 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.60% between 2025 and 2034.

Market Overview

Market Overview

Propylene oxide is a colorless chemical compound. It is a flammable liquid and is mainly used as an intermediary in the production of different chemicals. It also holds applications in producing polyether polyols, which are vital for manufacturing polyurethane foams, adhesives, elastomers, and coatings. In some industries, it is also used to produce glycol ethers and as a sterilizing agent and fumigant. The worldwide propylene oxide market is fueled by growing demand for polyurethanes, rising use in construction and automotive sectors, and an inclination towards environmentally friendly products. The most significant application of propylene oxide is in making polyurethanes, which are broadly used in automotive, construction, and packaging. The rise of these sectors, especially in developing markets, is a leading driver for the demand for propylene oxide.

The chemical is also used to make polyurethane foams, adhesives, and coatings. They are broadly used in the construction and automotive industries for structural components and insulation. With the steady growth of these sectors, demand for propylene oxide significantly surges.

Also, there is a rising trend towards biodegradable and eco-friendly products. Propylene oxide-based products, such as bio-based polyurethanes, are highly preferred because of their greater sustainability compared to substitutes. This inclination is fueling the industry market.

Nonetheless, the global market is projected to be hindered by factors like volatility in raw materials and significant production costs. Propylene oxide is obtained from propylene, a byproduct of petroleum refining. Hence, variations in natural gas and crude oil may result in the price of propylene oxide, impacting its profitability and market stability.

Moreover, propylene oxide’s production comprises energy-intensive practices, which may lead to significant manufacturing costs. This may adversely affect profit margins and refrain newbies from entering the industry. Yet, the global market is opportunistic for the development of bio-based propylene oxide and the rising demand for flexible foams. There is a rising trend towards eco-friendly and sustainable chemicals. Growing research into bio-based PO offers an opportunity to meet the growing consumer needs for eco-friendly products and lessen reliance on fossil fuels.

Furthermore, flexible polyurethane foams made with propylene oxide are used mainly in diverse applications, comprising automotive seats, packaging, mattresses, and furniture. The elevated demand for comfortable, high-performing, durable foams offers a key opportunity for industry growth.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global propylene oxide market is estimated to grow annually at a CAGR of around 5.60% over the forecast period (2025-2034)

- In terms of revenue, the global propylene oxide market size was valued at around USD 26.50 billion in 2024 and is projected to reach USD 40.97 billion by 2034.

- The propylene oxide market is projected to grow significantly owing to the expanding applications in industries like construction, automotive, consumer goods, and textiles, inclination towards environmentally-friendly products, and surging demand for cleaning agents and surfactants.

- Based on production process, the chlorohydrin process segment is expected to lead the market, while the hydrogen peroxide process segment is expected to register considerable growth.

- Based on application, the polyether polyols segment is the dominating segment, while the propylene glycols segment is projected to witness sizeable revenue over the forecast period.

- Based on end-use, the automotive segment is expected to lead the market compared to the building & construction segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Will the mounting use of propylene oxide in consumer goods boost the growth of the propylene oxide market?

Consumer products like electronics, furniture, and more usually depend on polyurethane for foam insulation, cushioning, and protective packaging. With the global growth and demand for consumer goods, the demand for propylene oxide-based materials also rises. The key demanding sectors include electronics and technology, and the progress of e-commerce. The rising demand for smart goods like wearable devices, smartphones, and diverse home appliances fuels the need for materials like insulation components and foam cushions, which need PO-based polyurethanes.

Furthermore, the growth of online shopping has fueled the demand for resilient packaging materials, most of which are made of polyurethane. In addition, furniture, mattresses, and several home goods are equipped with flexible polyurethane foams obtained from propylene oxide.

- Technological improvements in the production process to fuel the market growth

Developing novel production methods for PO, like bio-based techniques and hydroperoxide methods, is aiding in improving environmental sustainability and reducing production prices. These modernizations are reducing carbon emissions from PO production and enhancing its efficiency, thus fueling its attraction in the propylene oxide market.

Many companies are experimenting with bio-based substitutes for conventional PO production with the help of green feedstock like biomass. The rising demand for eco-friendly manufacturing processes and green chemicals fuels this inclination towards sustainability.

The process has gained massive popularity in recent years owing to its minimal ecological impact on former materials and better efficiency. It is currently the leading technique for producing large-scale propylene oxide, mainly in Europe and North America.

Restraints

Restraints

- Does global imbalance of supply-demand and overcapacity unfavorably impact the progress of the propylene oxide market?

Global overcapacity in PO production has created an imbalance between demand and supply. The global propylene oxide industry is witnessing challenges due to surplus supply, resulting in financial pressures and price volatility for producers.

Covestro and LyondellBasell’s plan to permanently shut down their propylene oxide monomer and styrene production units in the Netherlands denotes the effect of weak demand and overcapacity in Europe. The company mentioned overcapacity, robust growth in imports from APAC, and high costs of European manufacturing as key reasons for the shutdown.

Opportunities

Opportunities

- How will surging use in the food & beverage industry contribute to the propylene oxide market growth?

Propylene oxide is also steadily used as a sterilization agent for food and packaging materials in the food & beverages industry and as a starch modifier. This improves the safety and quality of the food products.

In India, PO is increasingly used to sanitize packaging materials like plastic containers, films, and cartons, promising to extend shelf life and improve food safety. It also acts as a food starch modifier, thus enhancing stability and texture in diverse food items. The growing demand for processed foodstuffs and the rising focus on food safety are projected to fuel the consumption of propylene oxide in the food industry.

Challenges

Challenges

- Growing competition from alternate technologies restricts the growth of the propylene oxide market

Improvements in bio-based PO production techniques offer intense competition to conventional petrochemical procedures. The bio-based chemicals market is anticipated to touch USD 60 billion by 2030, significantly affecting the demand for traditional propylene oxide.

Several companies profiled in the market are discovering bio-based techniques for producing propylene oxide to satisfy the increasing demand for eco-friendly chemicals. These initiatives could transform the market landscape.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 26.50 Billion |

Projected Market Size in 2034 |

USD 40.97 Billion |

CAGR Growth Rate |

5.60% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

BASF, Dow Chemical Company, LyondellBasell Industries, Covestro AG, Shell Chemicals, ExxonMobil Chemical, Reliance Industries Limited, Huntsman Corporation, LG Chem, Formosa Chemicals & Fibre Corporation, Mitsui Chemicals, Taiwan Styrene Monomer Corp., China National Petroleum Corporation (CNPC), SK Innovation, Tosoh Corporation, and others. |

Key Segment |

By Production Process, By Application, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global propylene oxide market is segmented based on the production process, application, end-use, and region.

Based on production process, the global propylene oxide industry is divided into chlorohydrin process, styrene monomer process, TBA Co-product process, cumene-based process, and hydrogen peroxide process. The chlorohydrin process segment dominated the global market due to its persistent presence and comparatively lower production price than other techniques. It registers nearly 50-55% of the global production of propylene oxide. The said process has been broadly used in the making of propylene oxide. The process includes the reaction of propylene and chlorine. This forms propylene chlorohydrin, which is later oxidized to make propylene oxide.

Based on application, the global propylene oxide industry is segmented into polyether polyols, propylene glycols, and propylene glycol ethers. The polyether polyols segment held a notable market share in 2024, accounting for roughly 69% of global propylene oxide use. This segmental growth is attributed to the growing demand for flexible polyurethane foams in bedding, automotive interiors, furniture, and industrial applications. Polyether polyols are vital in producing polyurethanes, which hold applications in rigid foams for insulation, flexible foams for bedding and furniture, and adhesives, coatings, sealants, and elastomers.

Based on end-use, the global market is segmented as automotive, building & construction, textiles & furnishing, and chemicals & pharmaceuticals. In 2024, the automotive segment registered a substantial market share and is expected to continue its dominance over the forecast period as well. The surging demand for fuel-efficient, lightweight vehicles and the growing use of sustainable materials are driving the adoption of PO-based products in automotive applications, thereby fueling the growth of the global industry. PO derivatives, especially in polyether polyols, are important in producing foams used in vehicle interiors, comprising insulation, seating, and interior components.

Regional Analysis

Regional Analysis

- What factors will help Asia Pacific lead in the propylene oxide market over the forecast period

Asia Pacific captured a substantial market share in 2024 and is projected to lead in the future, too. The key factors driving the growth of the propylene oxide market include high industrial demand, progressing construction and automotive sectors, and urbanization and economic growth. Asia Pacific is home to several manufacturing centers across industries such as chemicals, construction, automotive, and more, which are major consumers of products made with propylene oxide. The demand for energy-efficient construction materials and lightweight vehicles is exceptionally high in India and China. This fuels the demand and use of propylene oxide products.

Furthermore, infrastructure development and rapid urbanization in countries such as India and China are driving demand for PO-based products in construction.

Europe holds the second-leading position in the global propylene oxide market, with growth attributed to the well-developed industrial base, green chemistry, sustainability initiatives, and higher demand from the consumer goods and construction sectors. Europe has a sophisticated automotive and chemical industry, and is the leading user of PO-based products like propylene glycols and polyether polyols. The region also imposed strict environmental rules and is leading in adopting highly ecological chemical production techniques like the Hydrogen Peroxide Process for making propylene oxide. This clean technique is gaining prominence in Europe owing to its recyclable nature.

Furthermore, the construction and building industry in the region also adds to the growing demand for PO-based products, including adhesives, insulation foams, and coatings. This aids the region's strong foothold in the industry.

Competitive Analysis

Competitive Analysis

The global propylene oxide market is led by players like:

- BASF

- Dow Chemical Company

- LyondellBasell Industries

- Covestro AG

- Shell Chemicals

- ExxonMobil Chemical

- Reliance Industries Limited

- Huntsman Corporation

- LG Chem

- Formosa Chemicals & Fibre Corporation

- Mitsui Chemicals

- Taiwan Styrene Monomer Corp.

- China National Petroleum Corporation (CNPC)

- SK Innovation

- Tosoh Corporation

Key Market Trends

Key Market Trends

- Broadening of applications:

Propylene oxide's versatility is largely used in diverse applications beyond its conventional uses. There is a rising demand for propylene oxide in biodegradable and sustainable materials and biomedical applications, including the production of bio-based healthcare products. This diversification is offering opportunities and fueling innovation in the industry.

- Inclination towards cleaner production processes:

There is a growing industry trend away from conventional techniques such as the chlorohydrin process toward more environmentally friendly alternatives, such as HPPO or the Hydrogen Peroxide Process. The HPPO technique offers a highly sustainable approach to producing propylene oxide to lessen environmental impact and industrial emissions.

The global propylene oxide market is segmented as follows:

By Production Process Segment Analysis

By Production Process Segment Analysis

- Chlorohydrin Process

- Styrene Monomer Process

- TBA Co-Product Process

- Cumene-based Process

- Hydrogen Peroxide Process

By Application Segment Analysis

By Application Segment Analysis

- Polyether Polyols

- Propylene Glycols

- Propylene Glycol Ethers

By End Use Segment Analysis

By End Use Segment Analysis

- Automotive

- Building & Construction

- Textiles & Furnishing

- Chemicals & Pharmaceuticals

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF

- Dow Chemical Company

- LyondellBasell Industries

- Covestro AG

- Shell Chemicals

- ExxonMobil Chemical

- Reliance Industries Limited

- Huntsman Corporation

- LG Chem

- Formosa Chemicals & Fibre Corporation

- Mitsui Chemicals

- Taiwan Styrene Monomer Corp.

- China National Petroleum Corporation (CNPC)

- SK Innovation

- Tosoh Corporation

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors