Search Market Research Report

Sustainable Aviation Fuel (SAF) Market Size, Share Global Analysis Report, 2025 – 2034

Sustainable Aviation Fuel (SAF) Market Size, Share, Growth Analysis Report By Platform Outlook (Unmanned Aerial Vehicles, Business & General Aviation, Military Aviation, Regional Transport Aircraft, Commercial, And Others), By Aircraft Type (Rotorcraft, Fixed Wings, And Others), By Fuel Types (Gas To Liquid, Power To Liquid Fuel, Hydrogen Fuel, And Biofuel), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

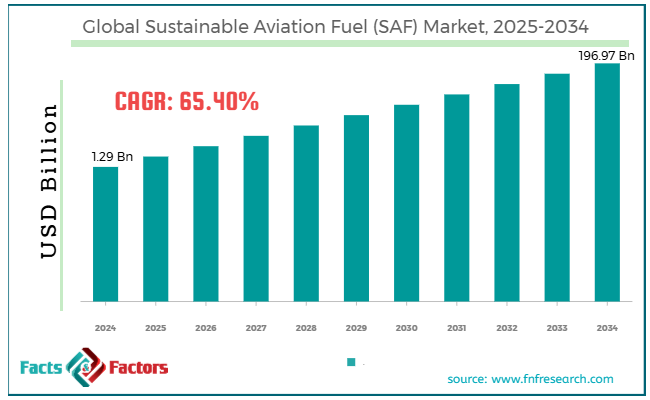

[221+ Pages Report] According to Facts & Factors, the global sustainable aviation fuel (SAF) market size was valued at USD 1.29 billion in 2024 and is predicted to surpass USD 196.97 billion by the end of 2034. The sustainable aviation fuel (SAF) industry is expected to grow by a CAGR of 65.40% between 2025 and 2034.

Market Overview

Market Overview

Sustainable aviation fuel refers to the fuel that can power aircraft without emitting carbon footprints, unlike conventional jet fuels. It is emerging as a key solution for decarbonizing the aviation sector and saving the climate. There are numerous benefits to adopting sustainable aviation. It is manufactured from many waste-derived sources like municipal solid waste, animal fats, algae, cooking oils, etc.

Also, it is compatible with different aircraft engines, reducing reliance on conventional jet fuels. Many leading airlines are using SAF blends to improve quality around airports and reduce the emissions of sulfur oxides and particulates.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global sustainable aviation fuel (SAF) market size is estimated to grow annually at a CAGR of around 65.40% over the forecast period (2025-2034).

- In terms of revenue, the global sustainable aviation fuel (SAF) market size was valued at around USD 1.29 billion in 2024 and is projected to reach USD 196.97 billion by 2034.

- The airline company's commitment to sustainability drives the growth of the global sustainable aviation fuel (SAF) market.

- Based on the platform outlook, the commercial segment is growing at a high rate and is projected to dominate the global market.

- Based on aircraft type, the fixed wings segment is anticipated to grow with the highest CAGR in the global market.

- Based on the fuel types, the biofuel segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Airline company's commitment to sustainability is the growth of the global market.

Airline companies all across the globe pledge to become carbon-neutral brands in the coming years, which is a key factor driving the growth of the global sustainable aviation fuel (SAF) market.

Leading players are heavily investing in SAF as a part of their corporate sustainability goals, as SAF is said to be the ideal solution to decarbonize the aviation sector. The government's support for achieving emissions targets further pushes the adoption of SAF globally.

Recently, governments in many countries have come up with blending mandates to increase the amount of SAF in aviation fuels. Technological advancements are another major factor strengthening the demand for SAF in the market. The ongoing feedstock processing and conversion technology innovations will help make SAF a more scalable option.

Technological advancements are also helping organizations reduce their processing cost and improve fuel yields. The innovation of advanced conversion pathways is promising, and there are growing opportunities for the economy all across the globe.

For instance, Airbus and TotalEnergies partnered in 2024 to reach carbon neutrality by 2050 and support decarbonizing efforts in the aviation sector.

Restraints

Restraints

- High production cost is expected to hinder the growth of the global market.

SAF is more expensive than conventional jet fuels, which is a major reason for the slow growth of the sustainable aviation fuel (SAF) industry during the forecast period.

Moreover, advanced technologies like power to liquid are capital-intensive and, therefore, are not scalable. The limited production capacity and processing complexities in the supply chain are further expected to negatively impact the industry's growth trajectory.

Opportunities

Opportunities

- Increasing investments are likely to foster growth opportunities in the global market.

Investors and oil companies are realizing the future of SAF as a critical clean energy transition asset. Therefore, they are investing heavily in SAF plants in order to expand their production capacity.

The rising air traffic forces companies to exercise low-emission travel with the best possible fuel options. Leading cargo operators like UPS and FedEx are also adopting SAF to decarbonize the entire supply chain.

Moreover, many airports are integrating SAF infrastructure into their fuel system to accelerate operations. Many airports like San Francisco International regularly distribute SAF to normalize its usage in the aviation supply chain. Feedstocks are becoming more prominent and scalable.

The increasing use of cooking oils, animal fats, and cultural residues is expected to revolutionize the global sustainable aviation fuel (SAF) market in the coming years.

For instance, Fulcrum BioEnergy collaborated with Kent in 2024 for the NorthPoint project that is likely to turn 600,000 tonnes of waste into 100 million liters of SAF.

Technology complexity is a big challenge in the global market.

Challenges

Challenges

There are certain fuel quality and safety standards even for SAF. New pathways need to get approval and certification, which is an expensive process. Therefore, such a landscape is anticipated to slow down the flourishing of start-ups in the SAF ecosystem, which is a big challenge in the sustainable aviation fuel (SAF) industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.29 Billion |

Projected Market Size in 2034 |

USD 196.97 Billion |

CAGR Growth Rate |

65.40% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

World Energy, WasteFuel, USA BioEnergy, TotalEnergies SE, SkyNRG BV, Shell, Sasol Corporation, SAF Plus International Group, Red Rock Biofuels, Preem AB, OMV Aktiengesellschaft, Northwest Advanced Bio-Fuels LLC, Neste, LanzaJet, Gevo Inc., Fulcrum BioEnergy Inc., DG Fuels, Cemvita, BP Plc, Amyris, Alder Energy LLC, Aemetis Inc., and others. |

Key Segment |

By Platform Outlook, By Aircraft Type, By Fuel Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global sustainable aviation fuel (SAF) market can be segmented into platform outlook, aircraft type, fuel types, and region.

On the basis of platform outlook, the market segment includes unmanned aerial vehicles, business & general aviation, military aviation, regional transport aircraft, commercial, and others. The commercial segment is expected to dominate the sustainable aviation fuel (SAF) industry during the forecast period.

Commercial airlines have the highest fuel consumption because of the large fleet sizes and frequent flight operations. International bodies like ICAO have released strict carbon emission regulations, encouraging airlines to adopt SAF to avoid penalties.

Many commercial carriers have pledged to net-zero emissions under corporate sustainability goals, which is also likely to promote the usage of SAF in commercial aircraft. In addition, they are adopting SAF to build their brand image and attract environmentally and ethically conscious passengers.

On the basis of aircraft type, the market can be segmented into rotorcraft, fixed wings, and others. The fixed wings segment is projected to witness the highest CAGR growth during the forecast period. The widespread use of fixed-wing aircraft in business, cargo, commercial, and military aviation sectors is one of the emerging factors driving the segment's growth. These aircraft help in both medium and long-haul flights, which is impossible with UAVs and rotary-wing vehicles.

However, fixed-wing aircraft can use SAF better than others. Companies are conducting trials to foster 100% SAF compatibility with these aircraft, which is further expected to revolutionize the global sustainable aviation fuel (SAF) market in the coming years.

Also, regulatory organizations are encouraging companies to use SAF in fixed-wing commercial fleets to reduce carbon emissions and compliance costs, which is also likely to positively influence the segment's growth. Fixed wings are widely used in e-commerce logistics and passenger transport, increasing the demand for SAF.

The production of SAF is being customized, particularly for fixed-wing aircraft requirements, which is also expected to foster developments in the segment. Moreover, the increasing investments in integrating SAF in fixed wings are also expected to propel the segment's growth.

On the basis of fuel type, the market can be segmented into gas to liquid, power to liquid fuel, hydrogen fuel, and biofuel. The biofuel segment accounts for the largest share of the sustainable aviation fuel (SAF) industry. Bio-based SAF is derived from vegetable oils and animal fats. Biofuel has high compatibility and better blending capacity with traditional jet fuel, which is attracting airlines.

Biofuel has a high production capacity and a mature supply chain, which is rapidly ramping up demand in the market. Airline companies have long-term contracts with SAF dealers. T

he government is also supporting the usage of biofuels with better tax credits and blending mandates. Therefore, such a landscape is expected to fuel the segment's growth in the coming years.

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is likely to account for the largest share of the global sustainable aviation fuel (SAF) market during the forecast period. The expansion strategy of SAF producers in North America in order to increase their annual production is expected to be a major growth factor in the regional market.

The United States is likely to dominate the market because of the high-level federal and state investments. Canada is also actively participating in increasing the sales revenue of the regional market by offering support with relaxations in rules and regulations.

Many government policies and initiatives are focused on increasing renewable aviation fuels in the market. Mexico is another major country that is projected to witness significant developments in the market because of the government's growing interest in SAF. Therefore, such a landscape is expected to foster growth opportunities in the regional market.

Asia Pacific is also expected to witness growth in the market in the coming years because of numerous factors. China is leading the regional market because of the growing investments in the biofuels industry in turning waste cooking oils into SAF.

Singapore is also showing potential to emerge as a strong country with heavy investment and supportive government policies, which will contribute immensely to the growth of the regional market in the long term. Japan and South Korea are undergoing many public-private partnerships to view the production of SAF and lower their reliance on fossil-based jet fuel.

Technological advancements are likely to leverage the production and distribution of SAF in APAC. Growing environmental awareness in the region is likely to revolutionize the regional market in the coming years.

For instance, Emirates and Neste extended their partnership in 2023 to offer around 3 million gallons of blended SAF for Emirates flights.

Competitive Analysis

Competitive Analysis

The key players in the global sustainable aviation fuel (SAF) market include:

- World Energy

- WasteFuel

- USA BioEnergy

- TotalEnergies SE

- SkyNRG BV

- Shell

- Sasol Corporation

- SAF Plus International Group

- Red Rock Biofuels

- Preem AB

- OMV Aktiengesellschaft

- Northwest Advanced Bio-Fuels LLC

- Neste

- LanzaJet

- Gevo Inc.

- Fulcrum BioEnergy Inc.

- DG Fuels

- Cemvita

- BP Plc

- Amyris

- Alder Energy LLC

- Aemetis Inc.

For instance, Airbus said it would invest in LanzaJet in 2024 to support the expansion of sustainable aviation fuel. Also, this investment will focus on developing alcohol to jet pathways.

The global sustainable aviation fuel (SAF) market is segmented as follows:

By Platform Outlook Segment Analysis

By Platform Outlook Segment Analysis

- Unmanned Aerial Vehicles

- Business & General Aviation

- Military Aviation

- Regional Transport Aircraft

- Commercial

- Others

By Aircraft Type Segment Analysis

By Aircraft Type Segment Analysis

- Rotorcraft

- Fixed Wings

- Others

By Fuel Types Segment Analysis

By Fuel Types Segment Analysis

- Gas To Liquid

- Power To Liquid Fuel

- Hydrogen Fuel

- Biofuel

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- World Energy

- WasteFuel

- USA BioEnergy

- TotalEnergies SE

- SkyNRG BV

- Shell

- Sasol Corporation

- SAF Plus International Group

- Red Rock Biofuels

- Preem AB

- OMV Aktiengesellschaft

- Northwest Advanced Bio-Fuels LLC

- Neste

- LanzaJet

- Gevo Inc.

- Fulcrum BioEnergy Inc.

- DG Fuels

- Cemvita

- BP Plc

- Amyris

- Alder Energy LLC

- Aemetis Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors