Search Market Research Report

Orthopedic Biomaterials Market Size, Share Global Analysis Report, 2025 - 2034

Orthopedic Biomaterials Market Size, Share, Growth Analysis Report By Material (Polymers, Ceramics & Bioactive Glasses, Calcium Phosphate Cement, Composites, Metal), By Application (Orthobiologics, Orthopedic Implants, Viscosupplementation, Joint Replacement, Bio-resorbable Tissue Fixation), By End-User (Hospitals, Orthopedic Clinics, Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

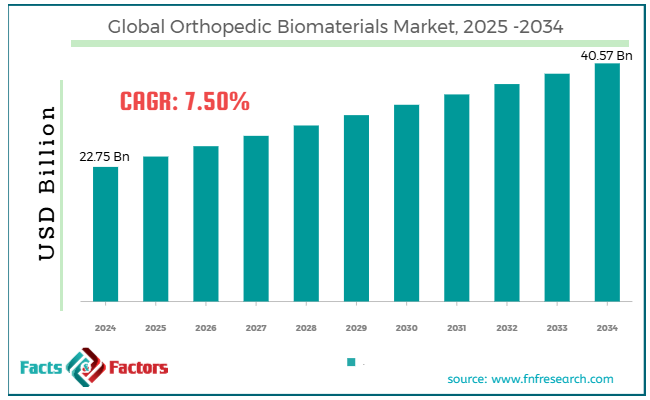

[221+ Pages Report] According to Facts & Factors, the global orthopedic biomaterials market size was worth around USD 22.75 billion in 2024 and is predicted to grow to around USD 40.57 billion by 2034, with a compound annual growth rate (CAGR) of roughly 7.50% between 2025 and 2034.

Market Overview

Market Overview

Orthopedic biomaterials are dedicated engineered materials that replace, repair, or support joints and bones in the human body. These materials are designed to work with biological systems and offer the required biocompatibility and mechanical strength. They are commonly used for bone plates, joint replacements, scaffolds for bone regeneration, and screws. The worldwide orthopedic biomaterials market is progressing because of the mounting cases of orthopedic disorders, technological improvements in medical science, and increasing demand for minimally invasive medical procedures. Musculoskeletal disorders like osteoporosis, arthritis, trauma injuries, and fractures are becoming increasingly common. This creates a bigger patient pool that demands effective orthopedic solutions, thus impacting the need for innovative biomaterials.

Moreover, continuous developments in manufacturing techniques and material science are surging the development of highly efficient and long-lasting orthopedic materials. Modernizations like 3D printing for tailored implants and enhanced biomaterials, such as hybrid composites and bioresorbable polymers, are intensifying the market.

In addition, minimally invasive orthopedic surgeries are gaining traction owing to short recovery time, less risk of infection, and less pain. This is fueling the need for advanced biomaterials to support these procedures.

Nevertheless, the risk of implant failure and material biocompatibility issues hampers the market. Though biomaterials are made to be durable, issues like wear and tear, implant failure, or infection may still happen. This increases the difficulty of accepting these materials in the future. It also hinders the material's reliability, thus preventing its use. Furthermore, despite improvements, the chances of allergic reactions, long-term inflammation, and implant rejection remain a leading concern.

However, improvements in 3D printing and the development of bioresorbable and bioactive materials are a few opportunistic factors propelling the growth of the orthopedic biomaterials industry. 3D printing technology helps customize patient-specific implants, thus enhancing results and decreasing complications. The ability to print complicated structures modified to the patient's unique anatomy offers a key opportunity for market growth. In addition, developing bioactive materials that promote bioresorbable materials and bone growth is transforming orthopedic treatments and offering long-term industry prospects.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global orthopedic biomaterials market is estimated to grow annually at a CAGR of around 7.50% over the forecast period (2025-2034)

- In terms of revenue, the global orthopedic biomaterials market size was valued at around USD 22.75 billion in 2024 and is projected to reach USD 40.57 billion by 2034.

- The orthopedic biomaterials market is projected to grow significantly owing to the growing cases of musculoskeletal disorders, the increasing aging population, and improvements in manufacturing techniques.

- Based on material, the metal segment is expected to lead the market, while the polymers segment is expected to grow considerably.

- Based on application, the orthopedic implants segment is the dominating segment among others, while the joint replacement segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the hospitals segment is expected to lead the market as compared to the orthopedic clinics segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- Does the growing adoption of minimally invasive surgical methods and medical tourism drive the orthopedic biomaterials market growth?

The inclination towards less painful surgeries has been a leading trend in orthopedic procedures. These methods offer advantages like improved patient outcomes and shorter recovery times. According to the American Academy of Orthopedic Surgeons, the number of knee replacements operated yearly in the United States will grow to roughly 3.5 million by 2030, highlighting the surging demand for innovative orthopedic biomaterials.

Furthermore, nations in APAC are gaining prominence in the field of orthopedic treatments. The availability of high-quality care at competitive rates is appealing to patients worldwide, fueling demand for orthopedic biomaterials in these regions.

- Heavy investments in research and development considerably fuel the market growth

Significant R&D investments are boosting innovation in the orthopedic biomaterials market. Companies are emphasizing the development of novel materials and solutions to improve the efficacy of orthopedic treatments. For instance, Evonik’s spending in Meditool, a China-based startup for 3D printed implants, is developing PEEK (polyether ketone) polymer for orthopedic uses.

These drivers contribute to the strong growth in the orthopedic biomaterials sector, resolving the changing needs of healthcare providers and patients globally.

Restraints

Restraints

- Biocompatibility issues and the risk of adverse reactions negatively impact market progress

Despite developments and advancements in material science, the risk of adverse effects from some orthopedic biomaterials is still prevalent. While several materials are biocompatible, difficulties like inflammation, infection, and rejection may arise, especially in patients with original sensitivities and health conditions. These risks may prevent doctors from using novel technologies and increase patient dissatisfaction, thus hampering the industry's progress.

Opportunities

Opportunities

- Will the development of smart biomaterials fuel the orthopedic biomaterials market growth?

The evolution of smart biomaterials integrating sensors to track parameters like temperature, strain, and healing procedure transforms postoperative care. These smart implants offer medical providers real-time data. This allows personalized treatment plans and enhances patient outcomes, fueling the orthopedic biomaterials industry's progress.

Moreover, developing economies, especially in Latin America and the Asia Pacific, are witnessing speedy growth in healthcare systems and access to medical services. This growth is fueling demand for orthopedic biomaterials as more individuals are looking for modernized treatments for musculoskeletal disorders.

Challenges

Challenges

- How do restricted reimbursement policies limit the growth of the orthopedic biomaterials market?

In several nations, reimbursement policies for orthopedic biomaterials are absent or restricted, thus increasing the difficulty for patients to afford modernized treatments. The lack of hurried reimbursement plans for these surgeries and procedures, comprising these materials, has increased financial strain on manufacturers and healthcare providers. Subsequently, the manufacturers are pressurized to reduce costs, which may impact the sustainability and profitability of biomaterial development.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 22.75 Billion |

Projected Market Size in 2034 |

USD 40.57 Billion |

CAGR Growth Rate |

7.50% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Stryker Corporation, Zimmer Biomet Holdings Inc., Johnson & Johnson (DePuy Synthes), Smith & Nephew plc, Medtronic plc, Orthofix Medical Inc., NuVasive Inc., Globus Medical Inc., B. Braun Melsungen AG, Wright Medical Group N.V., Arthrex Inc., Exactech Inc., CONMED Corporation, Biocomposites Ltd., Collagen Matrix Inc., and others. |

Key Segment |

By Material, By Application, By End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global orthopedic biomaterials market is segmented based on material, application, end-user, and region.

Based on material, the global orthopedic biomaterials industry is divided into polymers, ceramics & bioactive glasses, calcium phosphate cement, composites, and metal. The metal segment led the market in 2024 and will continue to dominate due to its superior mechanical properties, such as durability, high strength, and fatigue resistance. Materials like stainless steel, titanium alloys, and cobalt-chromium alloys are commonly used in orthopedic implants like fracture devices (plates, screws, rods), joint replacements, and spinal implants. Titanium, especially, is highly preferred for its corrosion resistance and biocompatibility.

Based on application, the global orthopedic biomaterials industry is segmented into ortho biologics, orthopedic implants, viscosupplementation, joint replacement, and bio-resorbable tissue fixation. The orthopedic implants category is expected to progress considerably over the coming years. This segment comprises devices used for fracture fixation, spinal surgery, and joint replacements. The growing elderly population fuels the demand for these implants, improvements in implant technology, and increasing cases of musculoskeletal disorders. Implants made from polymers, metals, and ceramics are vital in offering lasting solutions for deformities, fractures, and osteoarthritis.

Based on end-user industry, the global market is segmented into hospitals, orthopedic clinics, and others. The hospital segment captured the majority of market share due to the broader range of orthopedic surgeries performed in hospitals, including fracture repairs, joint replacements, trauma treatments, and spinal surgeries. Hospitals offer professional orthopedic departments with innovative surgical equipment and facilities, increasing the preference for hospitals for these procedures. The surging volume of patients needing surgical interventions and high-cost and complex orthopedic treatments adds to the hospitals' segment being the leading end user.

Regional Analysis

Regional Analysis

- How will North America witness significant growth in the orthopedic biomaterials market over the forecast period?

North America held a leading position in the global orthopedic biomaterials market in 2024. It will continue to dominate over the coming years, backed by high healthcare expenditure, technological improvements and R&D, growing cases of musculoskeletal disorders, and increased adoption of improved medical technologies. North America, especially the United States, has the highest healthcare spending globally. In the previous years, the United States spent USD 4.1 trillion on healthcare, making it the world's biggest healthcare sector. This significant investment backs the adoption of innovative medical technologies like orthopedic biomaterials and implants.

Moreover, the region is home to prominent companies and research institutes in the biomaterials and medical devices market. Companies are heavily investing in R&D for novel orthopedic materials and solutions, fueling the development of more improved biomaterials via 3D printing. In addition, the region's high prevalence of musculoskeletal disorders is adding to the surging demand for orthopedic treatments. These conditions comprise chronic joint illnesses like rheumatoid arthritis, osteoarthritis, and osteoporosis, which mainly demand orthopedic biomaterials to be dealt with.

Furthermore, North America is a leader in adopting superior medical technologies like minimally invasive surgeries and robot-assisted procedures. These tools need specialized orthopedic biomaterials for enhanced surgical outcomes, propelling the need for innovative materials.

Asia Pacific is the second-largest region in the global orthopedic biomaterials market, driven by an aging population, expanding healthcare infrastructure, rising consumer spending power, and an expanding middle class. One of the key industry propellers is the aging population. Older individuals are more likely to suffer from musculoskeletal disorders like fractures, osteoporosis, and osteoarthritis, which demand orthopedic interventions and advanced biomaterials for diverse procedures.

Also, the region has witnessed notable healthcare infrastructure improvements in the past few years, especially in developing economies like Southeast Asia, China, and India. Private organizations and governments are spending money on healthcare facilities, developing advanced treatments like surgeries that need biomaterials, and making them more accessible to the general populace.

Moreover, the growing middle class and increasing disposable income in the Asia Pacific nations add to the increased healthcare investments. With the growing disposable income of people, they are actively seeking advanced healthcare options like orthopedic treatments and surgeries that comprise costly biomaterials.

Competitive Analysis

Competitive Analysis

The leading players profiled in the global orthopedic biomaterials market include:

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Johnson & Johnson (DePuy Synthes)

- Smith & Nephew plc

- Medtronic plc

- Orthofix Medical Inc.

- NuVasive Inc.

- Globus Medical Inc.

- B. Braun Melsungen AG

- Wright Medical Group N.V.

- Arthrex Inc.

- Exactech Inc.

- CONMED Corporation

- Biocomposites Ltd.

- Collagen Matrix Inc.

Key Market Trends

Key Market Trends

- Development of smart biomaterials:

Today, implants are designed with embedded sensors to monitor temperature, strain, and stress. These innovative biomaterials enable real-time tracking of the implant's performance and recovery process. This allows early detection of complications and enhances patient outcomes.

- Growing number of mergers & acquisitions:

Companies in the global market are actively engaged in acquisitions and mergers to blend specializations, boost innovations, and expand their product offerings. This trend helps companies efficiently deal with the intense competition in a speedily transforming market and tap unexplored regions.

The global orthopedic biomaterials market is segmented as follows:

By Material Segment Analysis

By Material Segment Analysis

- Polymers

- Ceramics & Bioactive Glasses

- Calcium Phosphate Cement

- Composites

- Metal

By Application Segment Analysis

By Application Segment Analysis

- Orthobiologics

- Orthopedic Implants

- Viscosupplementation

- Joint Replacement

- Bio-resorbable Tissue Fixation

By End User Segment Analysis

By End User Segment Analysis

- Hospitals

- Orthopedic Clinics

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Johnson & Johnson (DePuy Synthes)

- Smith & Nephew plc

- Medtronic plc

- Orthofix Medical Inc.

- NuVasive Inc.

- Globus Medical Inc.

- B. Braun Melsungen AG

- Wright Medical Group N.V.

- Arthrex Inc.

- Exactech Inc.

- CONMED Corporation

- Biocomposites Ltd.

- Collagen Matrix Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors