Search Market Research Report

Hospital Food Services Market Size, Share Global Analysis Report, 2025 - 2034

Hospital Food Services Market Size, Share, Growth Analysis Report By Type (Patient & Dining Services, Retail Services, Vending & Shops, and Other Services), By Settings (Acute Care Settings, Post-Acute Care Settings, Non-Acute Care Settings), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

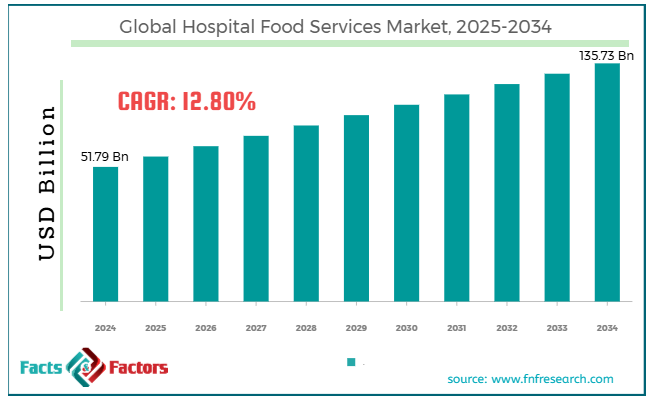

[220+ Pages Report] According to Facts & Factors, the global hospital food services market size was worth around USD 51.79 billion in 2024 and is predicted to grow to around USD 135.73 billion by 2034, with a compound annual growth rate (CAGR) of roughly 12.80% between 2025 and 2034.

Market Overview

Market Overview

Hospital food services play a crucial role in healthcare, offering nutritious, safe, and medically suitable meals to patients. These services promise that meals comply with specific dietary needs depending on patients' health status. Besides, these foods emphasize hygiene, timely meal delivery, and food safety, primarily aiming to improve patient satisfaction via improved taste, presentation, and variety. The worldwide hospital food services market is expected to grow considerably over the forecast period, driven by the growing hospital admissions, innovations in food production, and government initiatives and regulations. The growing rates of hospital admissions due to increasing cases of chronic illnesses, global health crises, and the aging population have notably fueled the demand for food services in hospitals. With the increasing admission of patients, the demand for high-quality and specialized food services rises.

Moreover, using advanced kitchen solutions like delivery systems, food preparation, and nutrition management software improves the quality and efficiency of hospital food services. These modernizations enhance service delivery and decrease operational costs. Most governments are adopting stringent hospital food safety, hygiene standards, and nutrition regulations. This is compelling hospitals to advance their food services, promising compliance with safety and health guidelines while enhancing patient experience.

However, the global market may face barriers like customization, dietary restrictions, and food safety and supply chain issues. Satisfying the unique nutritional needs of diverse patients, mainly those with multiple health conditions, may be challenging. Managing different dietary restrictions and preferences while promising balanced nutrition is difficult. This may negatively impact the cost-efficiency and efficacy of hospital food services.

Also, disturbances in the supply chain, ensuring the safe handling and storage of food, and the prevention of foodborne diseases may pose significant issues. Maintaining quality and food safety standards is vital, and any lapses may lead to health risks and patient dissatisfaction.

Nonetheless, some hospital food services market opportunities include a rise in medical tourism and health-conscious food trends. With the growing trend of medical tourism, hospitals that increasingly cater to global patients may find prospects to offer specialized services that comply with dietary and cultural preferences. This creates novel revenue streams and enhances patient satisfaction. The rising consumer demand for organic foods, healthy eating, and plant-based diets offers an opportunity to provide and innovate more sustainable and healthy meals. Hospitals can spend on this trend by providing food that promotes optimal wellness and health.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global hospital food services market is estimated to grow annually at a CAGR of around 12.80% over the forecast period (2025-2034)

- In terms of revenue, the global hospital food services market size was valued at around USD 51.79 billion in 2024 and is projected to reach USD 135.73 billion by 2034.

- The hospital food services market is projected to grow significantly owing to the growing number of hospital admissions, increasing health awareness, and enhancements in food production.

- Based on type, the patient & dining services segment is expected to lead the market, while the retail services segment is expected to grow considerably.

- Based on settings, the acute care settings segment is the dominating segment, while the post-acute care settings segment is projected to witness sizeable revenue over the forecast period.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- How will ethical sourcing and sustainability propel the hospital food services market growth?

There is an increasing trend towards sustainability in food services for hospitals. Hospitals are implementing practices such as using locally sourced and organic ingredients. They are also adopting waste-reduction initiatives and launching room-service dining models. These programs not only reduce ecological footprints but also improve patient satisfaction.

For instance, the novel patient catering facility based in Chichester, West Sussex, named St. Richard's Hospital, generates nearly 6000 meals a day on-site using fresh materials. This results in a 50% decrease in food wastage.

- Technological advancements in food service operations considerably fuel the market growth

Incorporating technology in hospital food services improves efficacy, decreases operational costs, and improves meal quality. Modernizations like automated meal ordering, AI-powered nutritional tracking, and lowering operational expenses are simplifying the operations of food services. These technologies allow hospitals to ensure timely food delivery, effectively handle inventory, and maintain high food hygiene and safety standards.

Moreover, implementing automated food service and energy-efficient equipment adds to sustainability goals and cost savings, thus fueling the global hospital food services market.

Restraints

Restraints

- The complexity of meeting dissimilar dietary requirements hampers the market progress

Hospital patients typically have diverse and complex nutritional needs, including special diets for chronic illnesses, allergies, and religious or cultural dietary restrictions. Meeting these requirements demands that hospitals spend on specialized ingredients, equipment, and staff training, thereby raising the complexity and costs of offering food services. This intricacy may restrict the progress of the global market by deterring hospitals from providing quality food services affordably.

For instance, hospitals in Taiwan are increasingly serving vegetarians with low sugar, salt, and fat, focusing on warm dishes rather than cold ones for enhanced patient recovery.

Opportunities

Opportunities

- Will associations with specialized food service providers positively fuel the hospital food services market growth?

Several hospitals are actively outsourcing operations to specialized providers that provide culinary innovation, expertise in nutrition, and food safety. These associations allow hospitals to concentrate on their core health services while promising quality food for staff, patients, and visitors. These partnerships are fueling innovation in hospital dining and adding to the overall enhancement of food service quality and the progress of the global hospital food services industry.

Challenges

Challenges

- Is balancing operational efficiency with sustainability a notable challenge in the hospital food services market growth?

Although sustainability is a rising focus, balancing environmentally friendly practices with operational efficacy presents challenges. Hospitals are increasingly implementing initiatives like minimizing waste, engaging diners regarding the significance of sustainability, and offering local and plant-based meals.

For example, NYC Health System served nearly 7,83,000 plant-based foods in 2024, decreasing carbon emissions by 36 percent and saving 59 cents per meal. Nonetheless, adopting these practices needs investment and careful planning.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 51.79 Billion |

Projected Market Size in 2034 |

USD 135.73 Billion |

CAGR Growth Rate |

12.80% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Compass Group, Elior Group, Morrison Management Specialists, Unidine Corporation, Medirest, ISS World, CulinArt Group, Trinity Services Group, Metz Culinary Management, Healthcare Services Group, Performance Foodservice, Bristol Culinary Group, TouchPoint Support Services, Aramark Healthcare, Sodexo Healthcare, and others. |

Key Segment |

By Type, By Settings, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global hospital food services market is segmented based on type, settings, and region.

Based on type, the global hospital food services industry is divided into patient & dining services, retail services, vending & shops, and other services. The patient & dining services segment registered a remarkable market share in the past few years and is expected to continue leading over the estimated period. The segment comprises food services directly offered to patients, which is the primary function of food services. It encompasses dietary planning, meal preparation, and delivery to patients depending on their health status, preferences, and nutritional requirements. The segmental growth is backed by patient care, the leading part of any healthcare setting. As the most significant part of the hospital's meal services, the segment continuously leads the industry share. The focus on meeting specific dietary needs and promising patient satisfaction increases the segment's dominance in the global industry.

Based on settings, the global hospital food services industry is segmented into acute care settings, post-acute care settings, and non-acute care settings. The acute care settings segment led the global market in 2024 and is projected to continue dominance over the estimated period. These settings are the healthcare facilities or hospitals that offer short-term and immediate treatment for life-threatening or severe health issues. These settings mainly comprise intensive care units, emergency rooms, and surgical units, where patients need continuous care. Acute hospitals hold the most significant patient turnover and the leading demand for tailored and specialized food services. Since these patients have particular dietary needs due to their health conditions, the food service in these settings should be highly controlled and specific to nutrition. The segment leads the industry due to the increasing patient pool and the vital role of nutrition in patient recovery.

Regional Analysis

Regional Analysis

- What factors will help North America witness significant growth in the hospital food services market over the forecast period?

North America held the leading share of the global hospital food services market in 2024 and is projected to continue leading over the estimated period. The key factors attributed to the regional growth comprise high healthcare expenditure, an increasing aging population, and a growing emphasis on patient satisfaction. The United States spends roughly USD 4.3 trillion on healthcare annually, accounting for 18% of GDP. This allows hospitals to invest in their food services and improve patient experience. The number of individuals aged 65 and older in the United States is expected to increase from 56 million to 73 million between 2020 and 2030. This fuels the demand for long-term care and specialized diets that need complete food services.

Also, patient satisfaction, which is comprised of the quality of meals, is a crucial factor in regional hospitals. The healthcare system's focus on enhancing the patient experience has increased investment in personalized, high-quality food services. Besides, regional growth is driven by technological improvements. North America is implementing advanced technology for food service management, including automated meal delivery services and nutritional management software, which improves patient care and operational efficiency.

Europe progresses as the second-leading region in the global hospital food services market after North America. This substantial growth is backed by a strong healthcare system, an aging population, and an emphasis on patient satisfaction. Europe has developed healthcare systems, with nations like Germany spending Euro 380 billion on healthcare yearly. This facilitates strong hospital food services, thus impacting the market progress. By 2030, the senior population in the European Union will increase by 25% of the regional population, thus fueling the demand for specialized diets and healthcare services.

Moreover, European hospitals are investing heavily in high-quality food services to enhance their patient-centered care, with nations such as the United Kingdom improving food offerings in NHS hospitals to promote recovery. Moreover, as 30% of individuals in the region prefer plant-based and organic foods, hospital food service providers are adapting to offer highly customized foods for patients with particular dietary needs.

Competitive Analysis

Competitive Analysis

The global hospital food services market profiles key players like:

- Compass Group

- Elior Group

- Morrison Management Specialists

- Unidine Corporation

- Medirest

- ISS World

- CulinArt Group

- Trinity Services Group

- Metz Culinary Management

- Healthcare Services Group

- Performance Foodservice

- Bristol Culinary Group

- TouchPoint Support Services

- Aramark Healthcare

- Sodexo Healthcare

Key Market Trends

Key Market Trends

- The growing integration of technology:

The use of advanced technology in hospital food services is rising. Utilizing automation in meal delivery, AI-based nutritional planning, digital menu ordering systems, and software used for dietary restriction management are simplifying food service operations.

- Eco-friendly and sustainability practices:

Sustainability is gaining prominence in the field of hospital food services. Hospitals aim to enhance food security, reduce food wastage, and lessen the ecological impact of their operations. This comprises using locally farmed produce, sustainable packaging, and organic ingredients.

The global hospital food services market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Patient & Dining Services

- Retail Services

- Vending & Shops

- Other Services

By Settings Segment Analysis

By Settings Segment Analysis

- Acute Care Settings

- Post-Acute Care Settings

- Non-Acute Care Settings

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Compass Group

- Elior Group

- Morrison Management Specialists

- Unidine Corporation

- Medirest

- ISS World

- CulinArt Group

- Trinity Services Group

- Metz Culinary Management

- Healthcare Services Group

- Performance Foodservice

- Bristol Culinary Group

- TouchPoint Support Services

- Aramark Healthcare

- Sodexo Healthcare

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors