Search Market Research Report

Smart Orthopedic Implants Market Size, Share Global Analysis Report, 2023 – 2030

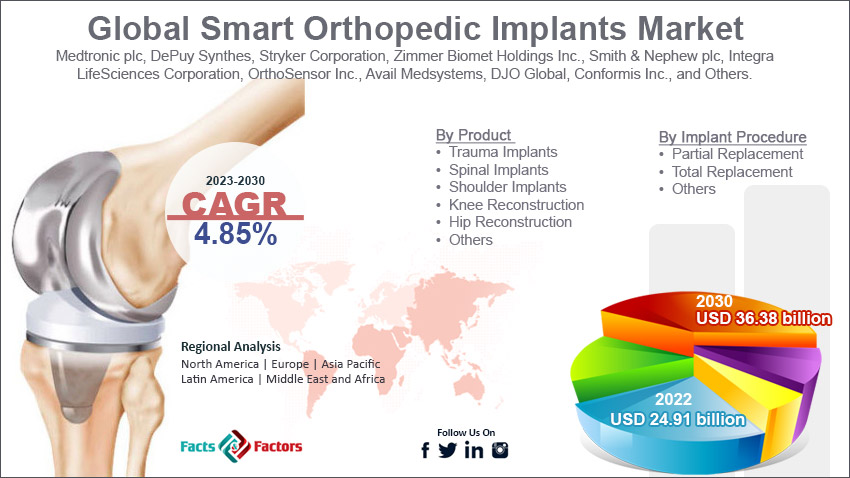

Smart Orthopedic Implants Market Size, Share, Growth Analysis Report By End-User (Hospitals, Speciality Centers, And Others), By Product (Trauma Implants, Spinal Implants, Shoulder Implants, Knee Reconstruction, Hip Reconstruction, And Others), By Implant Procedure (Partial Replacement, Total Replacement, And Others), By Components (Electronic Components And Implants), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

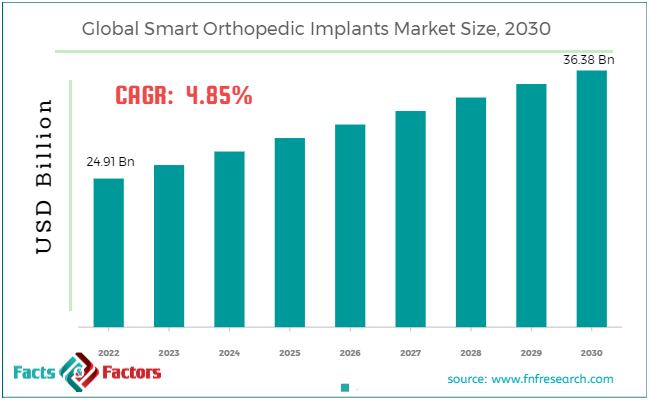

[224+ Pages Report] According to Facts and Factors, the global smart orthopedic implants market size was valued at USD 24.91 billion in 2022 and is predicted to surpass USD 36.38 billion by the end of 2030. The smart orthopedic implants industry is expected to grow by a CAGR of 4.85%.

Market Overview

Market Overview

Smart orthopedic implants are medical devices well integrated with advanced technologies to offer effective treatment of orthopedic conditions to enhance patient monitoring and diagnostics. These implants make use of electronic components, connectivity features, sensors, and data analytics to offer real-time information regarding the performance of the implants along with the patient's overall well-being.

However, the integration of smart features aims to offer better patient outcomes with increased efficiency in healthcare delivery and patient care.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global smart orthopedic implants market size is estimated to grow annually at a CAGR of around 4.85% over the forecast period (2023-2030).

- In terms of revenue, the global smart orthopedic implants market size was valued at around USD 24.91 billion in 2022 and is projected to reach USD 36.38 billion by 2030.

- Global shift towards patient-centric healthcare is driving the growth of the global smart orthopedic implants market.

- Based on the end-users, the other segment is growing at a high rate and is projected to dominate the global market.

- Based on the product, the knee reconstruction segment is projected to swipe the largest market share.

- Based on the implant procedure, the total replacement procedure segment is expected to dominate the global market.

- Based on the component, the electronic component segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period

Growth Drivers

Growth Drivers

- Growing prevalence of orthopedic conditions is likely to drive the growth of the global market.

Surging incidences of orthopedic disorders like fractures and osteoarthritis are driving the demand for smart implants. Further, the global aging population is fostering a high incidence rate of degenerative orthopedic conditions, which often require orthopedic procedures.

Therefore, such a landscape is expected to boost the growth of the global smart orthopedic implants market in the forthcoming years. However, the ongoing technological advancements in sensors, connectivity, and data analytics also contribute to the development of more sophisticated smart orthopedic implants. Manufacturers are innovating with the improved capabilities of these devices, which is expected to widen the scope of the industry.

The smart orthopedic implants offer analysis of data associated with biometrics, wear and tear, and other relevant parameters. Such information helps healthcare professionals in the early diagnosis and treatment planning of the patients. For instance, Stryker successfully took over OrthoSensor, Inc. in January 2021. The latter is a well-reputed company that specializes in sensor technology for total joint replacement.

Restraints

Restraints

- Global shift towards patient-centric healthcare is expected to foster growth opportunities in the global market.

The global shift towards patient-centric healthcare is paving new avenues for the growth of the smart orthopedic implants industry. Moreover, there is a surging emphasis on personalized medicine and the adoption of smart orthopedic implants, which offer real-time monitoring and personalized treatment plans.

Smart orthopedic implants are ideal for invasive procedures and are increasingly becoming popular because of the reduced recovery time and lower healthcare costs. Such a landscape is poised to widen the scope of the market.

For instance, Zimmer Biomet got FDA clearance in August 2021. Also, it was granted a De Novo classification for coming up with smart knee implants. It is the world’s first product for total knee replacement surgery.

Opportunities

Opportunities

- High cost of technologies is likely to hamper the growth of the global market.

The inclusion of fitness technologies like data analytics, connectivity, and sensors increases the final cost of orthopedic implants. Therefore, affordability is expected to emerge as a huge barrier in the global smart orthopedic implants market. Also, the lack of comprehensive reimbursement policies is further expected to hinder the adoption of smart orthopedic implants.

Challenges

Challenges

- Data security and privacy concerns are a challenge in the global market.

The collection and translation of patient data by smart implants are likely to raise concerns regarding patients' privacy. Also, the growing number of cyber-attacks is further posing barriers to the smart orthopedic implants industry.

Segmentation Analysis

Segmentation Analysis

The global smart orthopedic implants market can be segmented into end-user, product, implant procedures, components, and region.

By end-user, the market can be segmented into hospitals, specialty centers, and others. The other segment accounts for the largest share of the smart orthopedic implants industry. The segment includes orthopedic clinics and ambulatory surgical centers.

The use of these smart orthopedic implants in outpatient settings like orthopedic clinics and ambulatory surgical centers aligns with the broader trend of emerging patient care in the market. These centers offer numerous advantages like reduced hospital stays, more convenience, cost-effectiveness, and several others.

Also, these smart orthopedic implants require minimally invasive procedures, which are commonly performed in outpatient settings. The ongoing integration of smart features in orthopedic implants further improves monitoring and post-operative care, thereby making it ideal for outpatient settings where patient recovery and follow-ups are critical.

By product, the market can be segmented into trauma implants, spinal implants, shoulder implants, knee reconstruction, hip reconstruction, and others. The knee reconstruction segment is estimated to grow with the fastest CAGR during the anticipated period. Knee orthopedic problems like injuries and osteoarthritis are highly prevalent in today’s society, especially among old age people.

Therefore, it is driving the immense demand for knee reconstruction procedures all across the globe. Furthermore, healthcare providers and patients are inclined more toward smart orthopedic implants because of their improved monitoring capabilities. Also, it leads to the early detection of potential issues in improved post-operative care, which is further expected to foster developments in the segment.

By implant procedure, the market can be segmented into partial replacement, total replacement, and others. The total replacement procedure segment is poised to witness a high growth rate during the forecast period. The aging population is associated with growing incidences of orthopedic conditions, including degenerative joint diseases.

Therefore, it is likely to drive the high demand for joint knee placement procedures. Advancements in smart orthopedic implant technology, like data connectivity and sensors, are further converging people's interest in total joint replacement procedures. These advancements help enhance diagnostic monitoring and overall patient outcomes. Such a landscape is anticipated to foster growth opportunities in the global smart orthopedic implants market.

By component, the market can be segmented into electronic components and implants. The electronic component segment is anticipated to swipe the largest share of the global market. The advancements in electronic components like enhanced connectivity, improved sensor technology, and miniaturization are expected to foster the development of more sophisticated smart orthopedic implants.

Furthermore, the increasing acceptance of Internet of Things technology in the healthcare sector is paving new avenues for growth prospects in the segment. Also, the electronic components facilitate data exchange and connectivity between the external devices and implants, which further improves the patient care experience.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 24.91 Billion |

Projected Market Size in 2030 |

USD 36.38 Billion |

CAGR Growth Rate |

4.85% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Medtronic plc, DePuy Synthes, Stryker Corporation, Zimmer Biomet Holdings Inc., Smith & Nephew plc, Integra LifeSciences Corporation, OrthoSensor Inc., Avail Medsystems, DJO Global, Conformis Inc., and Others. |

Key Segment |

By End-User, By Product, By Implant Procedure, By Components, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is expected to witness developments in the global smart orthopedic implants market during the forecast period. The regional market is likely to be highly influenced by the constantly ageing population and the growing prevalence of orthopedic conditions.

However, the regional market is known to be the hub of technological advancements, which is likely to support its growth trajectory further. The United States and Canada are at the forefront of the industry because of the region's commitment to advancing healthcare technologies.

Furthermore, regulatory approvals from authorities like the US Food and Drug Administration also encourage the adoption of smart orthopedic implants, and therefore, companies easily get FDA clearance in the region, which is also likely to support the region’s growth trajectory.

Asia Pacific is likely to see a steady growth rate in the coming years because of the fast-growing ageing population and improving healthcare infrastructure in the region. The region is expected to be a rapidly growing market for smart orthopedic implants. The surging prevalence of orthopedic disorders like fractures and osteoarthritis is driving the demand for orthopedic interventions like smart orthopedic implants.

Countries in the region are adopting advanced healthcare technologies that demand the integration of smart features in orthopedic implants. The presence of major market players in the region is fostering developments in the market. Local companies are collaborating with global players to come up with growth prospects in the region in the coming years, which are expected to support the growth of the regional market further.

Competitive Analysis

Competitive Analysis

The key players in the global smart orthopedic implants market include:

- Medtronic plc

- DePuy Synthes

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Smith & Nephew plc

- Integra LifeSciences Corporation

- OrthoSensor Inc.

- Avail Medsystems

- DJO Global

- Conformis Inc.

For instance, Medtronic plc said to complete its friendly tender offer for France-based Medicrea International, a company specializing in spinal surgery with the help of artificial intelligence (AI) in November 2020.

The global smart orthopedic implants market is segmented as follows:

By End-User Segment Analysis

By End-User Segment Analysis

- Hospitals

- Speciality Centers

- Others

By Product Segment Analysis

By Product Segment Analysis

- Trauma Implants

- Spinal Implants

- Shoulder Implants

- Knee Reconstruction

- Hip Reconstruction

- Others

By Implant Procedure Segment Analysis

By Implant Procedure Segment Analysis

- Partial Replacement

- Total Replacement

- Others

By Components Segment Analysis

By Components Segment Analysis

- Electronic Components

- Implants

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Medtronic plc

- DePuy Synthes

- Stryker Corporation

- Zimmer Biomet Holdings Inc.

- Smith & Nephew plc

- Integra LifeSciences Corporation

- OrthoSensor Inc.

- Avail Medsystems

- DJO Global

- Conformis Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors