Search Market Research Report

Mobile Payment Market Size, Share Global Analysis Report, 2023 – 2030

Mobile Payment Market Size, Share, Growth Analysis Report By Technology (Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, and Others), By Payment Type (B2B, B2C, B2G, and Others), By Location (Remote Payment and Proximity Payment), By Industry Vertical (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

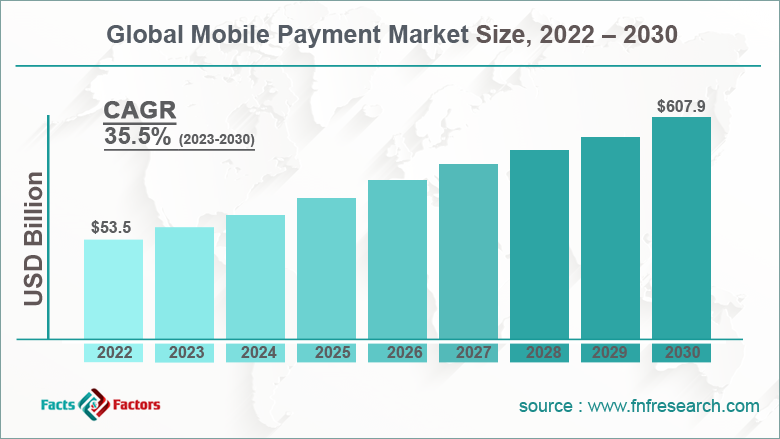

[229+ Pages Report] According to the report published by Facts and Factors, the global mobile payment market size was worth around USD 53.5 billion in 2022 and is predicted to grow to around USD 607.9 billion by 2030 with a compound annual growth rate (CAGR) of roughly 35.5% between 2023 and 2030. The report analyzes the global mobile payment market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the mobile payment industry.

Market Overview

Market Overview

The term "mobile payment" describes an automated payment method performed using a mobile device while being financially supervised by regulatory bodies. It is a type of electronic payment in which mobile devices are used to approve, start, and validate financial transactions. These methods entail using a mobile application that is connected to the user's financial information. The presence of point-of-sale (POS) terminals and nearfield communications facilitates the exchange of money.

Customers can pay with greater security due to mobile POS systems because they don't store user data on the merchant's POS device. The hassle of handling traditional payment methods, such as cash and cheques, has been reduced by the use of mobile payments. Users now have greater convenience and data protection owing to these automated systems. They are therefore widely used in many different operational segments across many different end-use businesses, such as food service, retail, and entertainment.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global mobile payment market is estimated to grow annually at a CAGR of around 35.5% over the forecast period (2023-2030).

- In terms of revenue, the global mobile payment market size was valued at around USD 53.5 billion in 2022 and is projected to reach USD 607.9 billion, by 2030.

- The growing e-commerce industry across the globe is expected to drive mobile payment industry growth over the forecast period.

- Based on the technology, the mobile web payment segment accounted for the largest market share in 2022.

- Based on the payment type, the B2B segment is expected to hold the dominant position over the forecast period.

- Based on region, the Asia Pacific is expected to hold the largest revenue share during the forecast period.

Growth Drivers

Growth Drivers

- Increasing Use of Mobile POS is expected to drive the market growth

The ability of smartphones to accept payments immediately has been greatly benefited by mobile point of sale. The mPOS technology frees all companies from their in-person and brick-and-mortar transactions. The use of mPOS devices limits liability because they reduce the risk of security breaches and make it simpler and faster to comply with regulations. Transactions are encrypted, and card information is not kept on the mPOS device. Mobile money payments can now have an additional layer of protection due to the use of biometrics like fingerprint and facial recognition with mPOS. Employees can view previous transactions, internet browsing history, loyalty points, and other information with mPOS to better understand customer needs. These tools have improved customer experience, but also improve staff performance.

Restraints

Restraints

- Security concerns and inconvenience to the online mode of payment act as a major restraint

Even though mobile payment solutions offer several benefits like improved operability, reliability, and flexibility, end users are still heavily reliant on cash for their everyday activities. People are hesitant to embrace new technologies because they have been using the traditional payment method for a while. Due to their habits, customers feel secure using the conventional method of payment when the transaction amount is high. Additionally, it is anticipated that the security issue regarding mobile payments will restrain the global mobile payment industry market expansion.

Opportunities

Opportunities

- Contactless payments to be used as a result of the COVID-19 pandemic

As consumers and companies are compelled to alter their purchasing behaviors due to the COVID-19 pandemic, this has had a significant effect on the mobile money market. Given the importance of contactless payments for transactions, there has been a phenomenal increase in the use of mobile wallets. Many users have tried mobile wallets because they want to avoid using cash or cards to prevent the COVID-19 virus from spreading. Mobile money is crucial for every transaction because the COVID-19 disaster makes every day more difficult and consumers have grown accustomed to using digital payments.

Challenges

Challenges

- Insufficient confidence in mobile payments poses a major challenge

A significant factor that will constrain the mobile payment industry market during the forecast period is low confidence in mobile payments. For instance, a report released by YourGov found that 38% of mobile users have low confidence in security and that 43% of users don't believe in mobile payments. Thus, acting as a major challenge for market growth.

Segmentation Analysis

Segmentation Analysis

The global mobile payment industry is segmented based on technology, payment type, location, industry vertical, and region.

Based on the technology, the global market is bifurcated into near-field communication, direct mobile billing, mobile web payment, SMS, interactive voice response system, mobile app, and others. The mobile web payment segment accounted for the largest market share in 2022 and is expected to continue this pattern over the forecast period. The security and adaptability that mobile online payment solutions offer can be credited to the segment's expansion. The segment's development is also encouraged by the rising popularity of m-commerce. The ability to correctly bookmark and have a URL for the mobile web payment platforms makes it simpler for users to return to or share the website.

On the other hand, the near-field communication segment is growing at the fastest rate during the projected period. NFC technology enables customers to instantly redeem their coupons using mobile phones and helps retailers to incorporate customer loyalty programs into their payment processes. The expansion of e-commerce platforms and the ongoing application of cutting-edge technologies in financial transactions are anticipated to fuel the segment's development. The adoption of NFC-based payments is anticipated to be fueled by factors like the rising popularity of wearable payment technology and the expanding mobile commerce trend.

Based on the location, the global market is bifurcated into remote payment and proximity payment.

Based on the industry vertical, the global market is bifurcated into BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation, and Others.

Based on the payment type, the global mobile payment industry is segmented into B2B, B2C, B2G, and others. The B2B segment is expected to hold the dominant position over the forecast period. Private equity and venture capital companies' aggressive B2B payment investments are generating new growth prospects.

For instance, Rupifi, a provider of B2B payment applications, raised USD 25 million in a series-A round of financing in January 2022. Tiger Global Management, LLC and Bessemer Venture Partners served as the round's lead investors. For distributors, merchants, and sellers, Rupifi intends to use this financing to develop a complete B2B checkout product and omnichannel mobile-first B2B payment solutions. In addition, banks are embracing B2B smartphone payments more and more to improve the user experience for business clients.

Recent Developments:

Recent Developments:

- In March 2022, Tink, an open banking platform that enables financial institutions and fintech companies to create services and goods as well as move money, has been acquired by Visa. The partnership between Tink and Visa is anticipated to enhance client management of financial services, financial data, and financial resources.

- In February 2022, Apple made plans to make Touch to Pay available on iPhones. With the help of the iPhone and iOS app, the new feature will enable businesses to take Apple Pay and other contactless payment methods using their mobile devices.

- In March 2022, IZEAliant Technologies was acquired by RAZORPAY, an Indian supplier of full-stack financial solutions. By acquiring IZealiant, RAZORPAY will be able to assist banks with first-rate technological infrastructure, improving the payment experience for end users. Software solutions for financial institutions are offered by IZealiant Technologies, which is located in India.

- In August 2022, a deal has been made for the Polish Payment Standard (PSP), which runs the BLIK mobile payment solution, to acquire all of the shares of Viamo, a mobile payment platform. The action is a component of the business's plan to expand internationally.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 53.5 Billion |

Projected Market Size in 2030 |

USD 607.9 Billion |

CAGR Growth Rate |

35.5% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Samsung Group, Google LLC (Alphabet Inc.), Apple Inc., Amazon.com Inc., Paypal Inc., Mastercard PLC, Visa Inc., American Express Co., Comviva Technologies Limited (A Tech Mahindra Company, WeChat (Tencent Holdings Limited), Alipay.com Co. Ltd (Ant Financial), Alibaba Group Holdings Limited, M Pesa, Money Gram International, FIS, LevelUp, One97 Communication, Orange, Oxigen, and others. |

Key Segment |

By Technology, Payment Type, Location, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific is expected to hold the largest revenue share during the forecast period

The Asia Pacific is expected to hold the largest market share over the forecast period. Throughout the projection period, market development in the region is anticipated to be driven by a changing lifestyle, the newest online retailing trends, and rising smartphone penetration. For instance, according to the India Brand Equity Foundation, From US$ 3.95 billion in FY21 to US$ 26.93 billion in 2027, the Indian online grocery industry is predicted to grow at a CAGR of 33%. India's consumer digital economy is predicted to expand from US$ 537.5 billion in 2020 to US$ 1 trillion by 2030, primarily due to the rapid proliferation of online services like e-commerce and tech in the nation.

Moreover, according to the GSMA, the unique mobile subscribers in the Asia Pacific are expected to reach 3.0 billion by 2025. Growth opportunities for the regional market are anticipated as a result of the growing government efforts in the Asia Pacific nations to go cashless. Fintech companies and banks now have a new opportunity to provide mobile banking solutions to underserved and unbanked customers in remote regions as a result of the widespread adoption of mobile technology in developing nations.

North America is expected to grow significantly during the forecast period. It is distinguished by the presence of several key market participants. The region has also been an early adopter of cutting-edge technologies. The growing number of unmanned stores in the United States is also driving mobile payment adoption. The expansion of the e-commerce industry is the main reason for the widespread adoption of mobile payment solutions in North America.

Competitive Analysis

Competitive Analysis

- Samsung Group

- Google LLC (Alphabet Inc.)

- Apple Inc.

- Amazon.com Inc.

- Paypal Inc.

- Mastercard PLC

- Visa Inc.

- American Express Co.

- Comviva Technologies Limited (A Tech Mahindra Company

- WeChat (Tencent Holdings Limited)

- Alipay.com Co. Ltd (Ant Financial)

- Alibaba Group Holdings Limited

- M Pesa

- Money Gram International

- FIS

- LevelUp

- One97 Communication

- Orange

- Oxigen

The global mobile payment market is segmented as follows:

By Technology Segment Analysis

By Technology Segment Analysis

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

By Payment Typ Segment Analysis

By Payment Typ Segment Analysis

- B2B

- B2C

- B2G

- Others

By Location Segment Analysis

By Location Segment Analysis

- Remote Payment

- Proximity Payment

By Industry Vertical Segment Analysis

By Industry Vertical Segment Analysis

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Samsung Group

- Google LLC (Alphabet Inc.)

- Apple Inc.

- Amazon.com Inc.

- Paypal Inc.

- Mastercard PLC

- Visa Inc.

- American Express Co.

- Comviva Technologies Limited (A Tech Mahindra Company

- WeChat (Tencent Holdings Limited)

- Alipay.com Co. Ltd (Ant Financial)

- Alibaba Group Holdings Limited

- M Pesa

- Money Gram International

- FIS

- LevelUp

- One97 Communication

- Orange

- Oxigen

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors