09-Mar-2023 | Facts and Factors

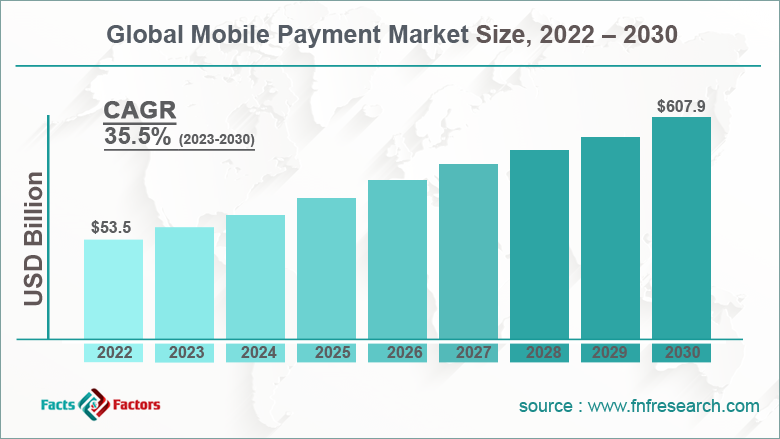

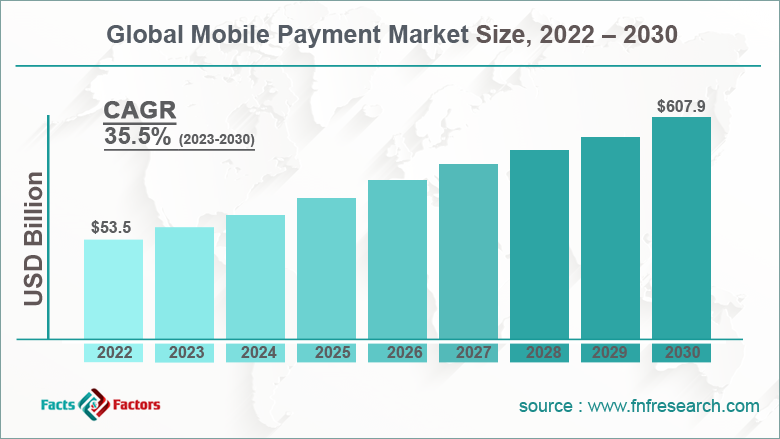

According to Facts and Factors, the global mobile payment market size was worth around USD 53.5 billion in 2022 and is predicted to grow to around USD 607.9 billion by 2030 with a compound annual growth rate (CAGR) of roughly 35.5% between 2023 and 2030.

Mobile payments are regulated activities that happen through a mobile device, including mobile wallets and mobile money transfers. That is, mobile payment technology enables one to make purchases online rather than with cash, checks, or actual credit cards. Mobile money can be used for "peer-to-peer" transactions or for making purchases at physical stores.

Browse the full “Mobile Payment Market Size, Share, Growth Analysis Report By Technology (Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, and Others), By Payment Type (B2B, B2C, B2G, and Others), By Location (Remote Payment and Proximity Payment), By Industry Vertical (BFSI, Healthcare, IT & Telecom, Media & Entertainment, Retail & E-commerce, Transportation and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030" report at https://www.fnfresearch.com/mobile-payment-market

Smartphone adoption is rising, and network infrastructure around the world has significantly improved, which are the main factors driving the mobile payment industry. Various retail establishments have been able to set up mobile-based payment options for their customers due to the accessibility of high-speed internet connectivity. The increased knowledge of the increased safety connected to using these transactions is helping to support this. These purchases are very safe because no account information or other sensitive user data is stored during the transactions. When a customer enters sensitive information about an account or credit card in a mobile application, the bank validates it and creates a token that stands in for the user's personal information.

Furthermore, the token, which is frequently combined with a one-time security password, is used to make the payments. Additionally, by effectively securing the payment gateway and personal information, these mobile payment apps integrate passcodes and/or biometric authentication methods, reducing the likelihood of security theft or fraud. However, the security concern regarding mobile payment is expected to hamper the growth of the market over the forecast period.

Segmental Overview

The global mobile payment market is segmented based on technology, payment type, location, industry vertical, and region.

Based on the location, the global market is bifurcated into remote payment and proximity payment. The remote payment segment is anticipated to capture the highest market share over the forecast period. Since remote payments do not necessitate face-to-face contact, they are growing in popularity, especially in light of the COVID-19 pandemic outbreak. To enable customers to make payments remotely, several businesses have released remote payment applications.

For instance, SumUp stated in March 2020 that mobile payments and invoicing would be available across Europe, enabling customers to make secure payments from a distance using their cell phones. The segment is anticipated to increase as a result of the growing use of virtual terminals for remote billing.

Based on the technology, the mobile payment industry is bifurcated into near-field communication, direct mobile billing, mobile web payment, SMS, interactive voice response system, mobile app, and others.

Based on the payment type, the global mobile payment industry is segmented into B2B, B2C, B2G, and others.

Based on the industry vertical, the global market is bifurcated into BFSI, healthcare, IT & telecom, media & entertainment, retail & e-commerce, transportation, and others. The BFSI segment is expected to grow at the highest CAGR over the forecast period.

Several institutions are actively attempting to roll out mobile payments, which will help the market expand. Businesses are concentrating on implementing a customized suite of all-encompassing payment solutions to address specific problems in the wealth management, financing, and insurance sectors. Banks now have new opportunities to provide more ease to their current customers and reach a sizable population of unbanked customers in developing nations via mobile banking and payments.

Regional Overview

The Asia Pacific is expected to hold the largest revenue share in the global mobile payment market over the forecast period. The main reason fueling the rapid expansion of the mobile payment market in this region is the rising adoption of smart appliances like smartphones. Additionally, the expansion of the mobile payment industry in this region is being supported by growing government initiatives as well as growing initiatives from mobile companies offering fast internet service.

The government of India, for instance, has a program called " Digital India" that aims to connect rural areas to high-speed internet networks. Vietnam has the mobile payments market's highest growth rate in the Asia-Pacific region. With about 86 percent of its people using mobile payments, China takes the lead. Thailand follows with about 67 percent.

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 53.5 Billion |

Projected Market Size in 2030 |

USD 607.9 Billion |

CAGR Growth Rate |

35.5% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Samsung Group, Google LLC (Alphabet Inc.), Apple Inc., Amazon.com Inc., Paypal Inc., Mastercard PLC, Visa Inc., American Express Co., Comviva Technologies Limited (A Tech Mahindra Company, WeChat (Tencent Holdings Limited), Alipay.com Co. Ltd (Ant Financial), Alibaba Group Holdings Limited, M Pesa, Money Gram International, FIS, LevelUp, One97 Communication, Orange, Oxigen, and others. |

Key Segment |

By Technology, Payment Type, Location, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape

The global mobile payment market is dominated by players like Samsung Group, Google LLC (Alphabet Inc.), Apple Inc., Amazon.com Inc., Paypal Inc., Mastercard PLC, Visa Inc., American Express Co., Comviva Technologies Limited (A Tech Mahindra Company, WeChat (Tencent Holdings Limited), Alipay.com Co. Ltd (Ant Financial), Alibaba Group Holdings Limited, M Pesa, Money Gram International, FIS, LevelUp, One97 Communication, Orange, and Oxygen, among others.

Recent Development:

- In March 2022, IZEAliant Technologies was acquired by RAZORPAY, an Indian supplier of full-stack financial solutions. By acquiring IZealiant, RAZORPAY will be able to assist banks with first-rate technological infrastructure, improving the payment experience for end users. Software solutions for financial institutions are offered by IZealiant Technologies, which is located in India.

- In March 2022, Tink, an open banking platform that enables financial institutions and fintech companies to create services and goods as well as move money, has been acquired by Visa. The partnership between Tink and Visa is anticipated to enhance client management of financial services, financial data, and financial resources.

The global mobile payment market is segmented as follows:

By Technology

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

By Payment Type

By Location

- Remote Payment

- Proximity Payment

By Industry Vertical

- BFSI

- Healthcare

- IT & Telecom

- Media & Entertainment

- Retail & E-commerce

- Transportation

- Others

By Region

- North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com