Search Market Research Report

Automotive Viscosity Index Improvers Market Size, Share Global Analysis Report, 2025 - 2034

Automotive Viscosity Index Improvers Market Size, Share, Growth Analysis Report By Type (Polymethacrylate, Olefin Copolymer, Polyisobutylene), By End User (Manufacturing, Food Processing, Mining, Construction, Power Generation), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

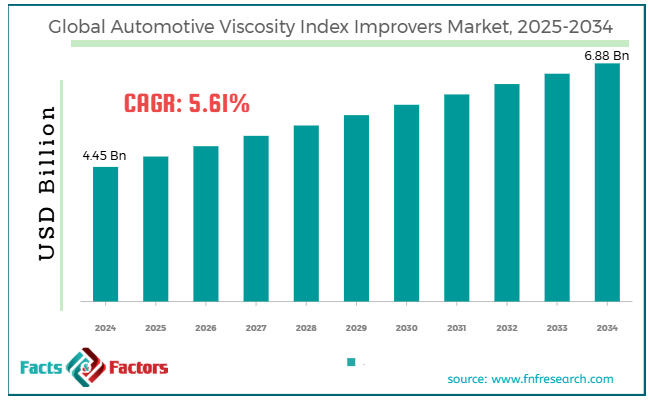

[220+ Pages Report] According to Facts & Factors, the global automotive viscosity index improvers market size was worth around USD 4.45 billion in 2024 and is predicted to grow to around USD 6.88 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.61% between 2025 and 2034.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global automotive viscosity index improvers market is estimated to grow annually at a CAGR of around 5.61% over the forecast period (2025-2034)

- In terms of revenue, the global automotive viscosity index improvers market size was valued at around USD 4.45 billion in 2024 and is projected to reach USD 6.88 billion by 2034.

- The automotive viscosity index improvers market is projected to grow significantly due to rising demand for high-performing lubricants in industrial and automotive applications, mounting adoption of semi-synthetic and synthetic oils, and increasing emphasis on reducing carbon emissions.

- Based on type, the polymethacrylate segment is expected to lead the market, while the olefin copolymer segment is expected to grow considerably.

- Based on end-user, the manufacturing segment is expected to lead the market as compared to the food processing segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Market Overview

Market Overview

Automotive viscosity index improvers are the oil-soluble polymer additives used in transmission fluids and engine oils to improve their temperature effect performance. These compounds support maintaining optimal oil thickness across various temperatures, ensuring it remains thick enough at high temperatures to provide suitable protection and lubrication, while also providing sufficient fluid at low temperatures for cold starts. T

he worldwide automotive viscosity index improvers market is anticipated to progress remarkably over the forecast period owing to the rising demand for high-performing engines, stringent environmental rules, and the automotive industry's progress. New vehicles need lubricants that offer optimal performance in different temperatures.

With the growth of high-performing engines and heavy adoption of semi-synthetic and synthetic oils, the demand for viscosity index improvers is also surging to offer the best engine performance. Governments worldwide are introducing stringent standards, compelling producers to develop lubricants that reduce carbon emissions and improve fuel efficiency.

Furthermore, the growth of the automotive sector in developing markets is another key propeller. The increasing production of automobiles and the demand for improved lubricants with advanced properties result in a high demand for VI improvers.

Nonetheless, the global market is restrained by high prices of raw materials and compatibility concerns with diverse oil formulations. The cost of raw materials used in manufacturing viscosity index improvers, like polymers and base oils, is volatile and associated with crude oil prices. These variations may result in supply chain disturbances and high production prices.

Moreover, not all VI improvers are compatible with all forms of engines. Producers should ensure that their formulation does not cause poor performance or extreme wear, which could be a technical barrier.

However, a few opportunities to flourish in the global automotive viscosity index improvers industry include a shift towards bio-based VI improvers and growing partnerships and collaborations. There is a rising trend towards creating bio-based and environmentally-friendly VI improvers. These additives are ideal for eco-friendly and sustainable products, allowing producers to differentiate their offerings and bring modernizations.

In addition, associations between lubricant producers, additive manufacturers, and OEMs offer opportunities to produce modified solutions that satisfy diverse demands, resulting in industry growth.

Growth Drivers

Growth Drivers

- Will the mounting demand for high-performance lubricants drive the automotive viscosity index improvers market growth?

High-performing oils are designed to provide extended intervals between oil changes and withstand high operating temperatures. Viscosity index improvers play a key role in this formula, enabling the oil to function well at high and low temperatures. This prevents it from thickening when cold and thinning when heated.

As manufacturers and users demand durable and more fuel-efficient automobiles, there is a surging pressure for high-performing lubricants. These oils are essential for safeguarding engine parts over the upcoming period, maintaining viscosity, and reducing engine friction.

- Improvements in automotive engine technologies propel the industry's growth

Engine technologies are growing more complex with variable valve timing, turbocharging, and high engine speeds. All of these add pressure to the lubricants. Therefore, these technologies need enhanced lubrication products in order to maintain optimal engine performance while minimizing depreciation and loss.

Newer automotive engines, especially hybrid, high-performing, and electric vehicles, need lubricants that maintain persistent viscosity under high-temperature variations. VII additives are essential in modern oils to guarantee efficient performance in these improved engines.

Restraints

Restraints

- Do performance limitations and compatibility issues adversely impact the automotive viscosity index improvers market progress?

Viscosity indexes are specially designed to alter the oil's viscosity as a reaction to changes in temperature. Still, they should rightly function with other chemical additives like detergents, anti-wear agents, and dispersants. When VIs fail compatibility with some formulations, they might cause deteriorated oil performance, resulting in engine damage or inefficiencies. In particular, shear instability may decrease performance in stressful situations or high temperatures.

Viscosity index improvers should be compatible with different base oils and additive forms in lubricant formulations. Compatibility concerns may arise when the viscosity additives communicate poorly with other parts. This results in oil thickening, shear instability, and reduced high-temperature performance.

Opportunities

Opportunities

- How will developments in polymer chemistry positively impact the automotive viscosity index improvers market growth?

Novel polymers are designed to offer the best shear resistance, guaranteeing that the viscosity of oils is stable even in high temperatures or stressful conditions. These modernizations are especially vital for high-performing engines, where viscosity consistency is required to enhance fuel efficiency and reduce wear. Currently, companies are discovering the use of bio-based viscosity index polymers obtained from renewable bases. These support the rising demand for sustainable products in the global automotive sector, ultimately affecting the automotive viscosity index improvers industry.

Constant modernizations in polymer chemistry offer an exciting opportunity to develop durable and efficient viscosity index improvers. Improvements in this domain have created bio-based polymers, shear-stable polymers, and high-performing VI additives that enhance oil viscosity at different temperatures and offer enhanced durable performance.

Challenges

Challenges

- Intense competition from substitute technologies restricts the growth of the market

Alternative lubricants like synthetic oils are made to offer improved shear stability, greater fuel efficiency, and high thermal resistance without depending on VI improvers. In addition, nano-lubricants and friction modifiers are gaining prominence because of their potential to enhance fuel economy and reduce friction better than traditional lubricants with viscosity index improvers.

One of the key challenges the automotive viscosity index improvers market faces is the intensifying competition from substitute technologies like friction modifiers, synthetic lubricants, and nano-lubricants. The substitutes offer enhanced performance without needing conventional VI improvers, which might hamper the overall demand for VIs in a few applications.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 4.45 Billion |

Projected Market Size in 2034 |

USD 6.88 Billion |

CAGR Growth Rate |

5.61% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

SSI Schaefer, Dematic, Interlake Mecalux, Uline, AK Material Handling Systems, Global Industrial, Nedcon, Ridg-U-Rak, Kardex Remstar, Hannibal Industries, The Stow Group, Wynright Corporation, Harpak-ULMA, Racking Systems Inc., Frazier Industrial Company, and others. |

Key Segment |

By Type, By End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global automotive viscosity index improvers market is segmented based on type, end user, and region.

Based on type, the global automotive viscosity index improvers industry is divided into polymethacrylate, olefin copolymer, and polyisobutylene. The polymethacrylate segment has registered the maximum market share in recent years and is expected to grow remarkably in the coming years. It is prominently used because of its low temperature, optimal shear stability, and viscosity performance in different temperature ranges. These VI improvers are widely preferred in a broader range of automobile lubricants, such as transmission fluids and engine oils, due to their potential to maintain the best viscosity in hot and cold conditions. Polymethacrylate’s leading share is backed by its proven performance and versatility in meeting the needs of new high-performing engines. It is usually used in multigrade and synthetic lubricants, which are largely demanded by the automotive market.

Based on end-user, the global automotive viscosity index improvers market is segmented into manufacturing, food processing, mining, construction, and power generation. The manufacturing segment registered a considerable market share due to the high demand for lubricants in machinery, automotive, and equipment manufacturing, wherein superior-performing oils are vital for longevity and machine operation. Automakers use VI improvers in engine oils, industrial lubricants, and transmission fluids for various vehicles and heavy machinery.

The manufacturing segment consumes the most significant share of automotive lubricants, comprising engine oils that need VI improvers for high-temperature performance. Automotive production is directly proportional to the demand for VII, which increases the dominance of the manufacturing end-user segment.

Regional Analysis

Regional Analysis

- What factors will aid North America in witnessing significant growth in the automotive viscosity index improvers market?

North America registered a remarkable market share in the past years and is expected to continue its dominance owing to the strong automotive sector, technical improvements, heavy R&D investments, and surging industrial applications. The automotive sector is a leading propeller of the region's need for viscosity index improvers. The United States has a well-developed automotive industry with rising sales of commercial automobiles used for logistics and short distances. This progress in automobile sales is associated with the increasing demand for high-performing lubricants that depend on VI improvers to maintain the best engine performance in diverse temperatures.

Moreover, the regional companies are leading in R&D in the lubricant additives market. The present advancements have fueled the development of VI improvers that advance the efficacy and performance of lubricants. These developments have strengthened North America's global automotive viscosity index improvers market ranking.

Furthermore, besides the automotive sector, VI improvers hold great applications in mining, construction, food processing, manufacturing, and power generation. The diverse industrial base in the region contributes to the persistent demand for superior-quality lubricants.

Europe is positioned as the second-leading region in the global automotive viscosity index improvers industry, backed by a strong automotive sector, strict ecological regulations, and key nations with a widespread manufacturing base. Europe boasts a strong automotive sector, with countries such as France, Germany, and Italy being home to prominent automobile manufacturers.

The demand for quality lubricants in Europe is vital since vehicle engines need oils that maintain enhanced viscosity in different temperatures. The EU imposes stringent ecological regulations that demand the development of improved lubricants that are eco-friendly and efficient. This elevates the demand for quality VI improvers.

Moreover, Germany holds the largest automotive market in the region, fueled by its huge manufacturing base. The UK is projected to progress notably by 2023, denoting speedy growth in demand for VI improvers.

Competitive Analysis

Competitive Analysis

The global automotive viscosity index improvers market lead players like:

- SSI Schaefer

- Dematic

- Interlake Mecalux

- Uline

- AK Material Handling Systems

- Global Industrial

- Nedcon

- Ridg-U-Rak

- Kardex Remstar

- Hannibal Industries

- The Stow Group

- Wynright Corporation

- Harpak-ULMA

- Racking Systems Inc.

- Frazier Industrial Company

Key Market Trends

Key Market Trends

- Amplified adoption of BIO-BASED VIIs:

There is a growing trend towards using bio-based and eco-friendly viscosity index improvers, fueled by regulatory pressures and rising ecological awareness. This inclination significantly reduces the environmental impact of additives and lubricants.

- Move toward Bio-Based and Synthetic Lubricants:

There is a rising preference for bio-based and synthetic lubricants due to their high-performance properties compared with traditional oils. Viscosity index improvers are vital in making these lubricants, guaranteeing enhanced performance under harsh temperatures and persistent viscosity.

The global automotive viscosity index improvers market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Polymethacrylate

- Olefin Copolymer

- Polyisobutylene

By End User Segment Analysis

By End User Segment Analysis

- Manufacturing

- Food Processing

- Mining

- Construction

- Power Generation

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- SSI Schaefer

- Dematic

- Interlake Mecalux

- Uline

- AK Material Handling Systems

- Global Industrial

- Nedcon

- Ridg-U-Rak

- Kardex Remstar

- Hannibal Industries

- The Stow Group

- Wynright Corporation

- Harpak-ULMA

- Racking Systems Inc.

- Frazier Industrial Company

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors