Search Market Research Report

Specialty Chemical Market Size, Share Global Analysis Report, 2025 – 2034

Specialty Chemical Market Size, Share, Growth Analysis Report By Type (Agrochemicals, Flavors, Fragrances & Personal Care Active Ingredients, Dyes & Pigments, Water Treatment, Bio-Based, Construction & Textile Chemicals, Surfactants & Polymer Additives, and Others), By Source (Crude Oil, Naphtha, Ethane & Propane Butane & Wood, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

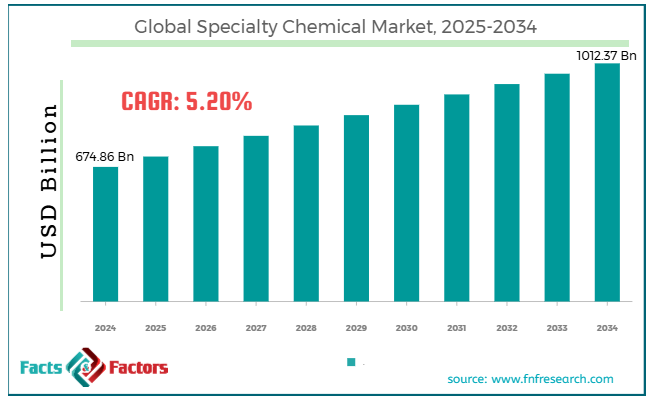

[221+ Pages Report] According to Facts & Factors, the global specialty chemical market size was worth around USD 674.86 billion in 2024 and is predicted to grow to around USD 1012.37 billion by 2034, with a compound annual growth rate (CAGR) of roughly 5.20% between 2025 and 2034.

Market Overview

Market Overview

Specialty chemicals are high-value, performance-based products that enhance the functionality, quality, or processing of final products across various industries. Unlike commodity chemicals, specialty chemicals are prepared in limited volumes and are modified for specific applications, such as construction chemicals, agrochemicals, adhesives, electronic chemicals, polymers, fragrances and flavors, and surfactants. The global specialty chemical market is expected to experience significant growth over the coming years, driven by increasing demand from various end-use industries, advancements in product customization, and the implementation of environmental regulations and sustainability initiatives.

Specialty chemicals play a vital role in the electronics, construction, automotive, and personal care industries. These chemicals improve durability, aesthetics, and performance. The growing industrial output worldwide is driving consumption in these industries.

Additionally, manufacturers are producing modified chemical solutions for certain applications. This customization is emerging as a significant competitive differentiator. Moreover, stringent global rules are propelling industries towards biodegradable and eco-friendly chemicals. This fuels the demand for water-based coatings, green solvents, and bio-based polymers. Compliance is motivating modernization in sustainable chemistry.

Nevertheless, the worldwide market is hindered by a strict regulatory framework and fluctuations in raw material prices. Governments are enforcing environmental and safety regulations for specialty chemicals. Compliance usually comprises reformulation, expensive testing, and documentation. This may hinder the market entry and increase operating costs.

Furthermore, the production of specialty chemicals relies on rare elements and petrochemicals. Disturbances in the supply chain or fluctuations in crude oil prices significantly impact margins. These worries complicate cost planning for manufacturers.

Yet, the global specialty chemical industry is anticipated to progress considerably over the estimated period due to smart manufacturing and digital transformation, the rise in electric vehicles, and the development of improved materials for renewable energy. The incorporation of automation, IoT, and AI in chemical production and formulation enables real-time customization, improving efficiency.

Moreover, electric vehicle batteries, thermal management materials, adhesives, and lightweight composites demand specialty chemicals, offering novel product niches. Additionally, solar panels, energy storage systems, and wind turbines utilize a wide range of specialty resins, polymers, and coatings that are expected to advance in conjunction with increasing investment in clean energy.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global specialty chemical market is estimated to grow annually at a CAGR of around 5.20% over the forecast period (2025-2034)

- In terms of revenue, the global specialty chemical market size was valued at around USD 674.86 billion in 2024 and is projected to reach USD 1012.37 billion by 2034.

- The specialty chemical market is projected to grow significantly due to increasing demand from end-use industries, growth in semiconductor and electronics manufacturing, and advancements in agrochemicals.

- Based on type, the agrochemicals segment is expected to lead the market, while the flavors, fragrances & personal care active ingredients segment is expected to grow considerably.

- Based on the source, the crude oil segment is expected to lead the market compared to the naphtha, ethane, & propane segment.

- Based on region, Asia Pacific is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Sustainability and green chemistry drive the market growth

The global push for reducing carbon footprints and a shift towards circular economies has increased the importance of sustainability in the global specialty chemical market. Leading companies are actively adopting renewable solvents and bio-based feedstocks to comply with regulations such as REACH and the EU Green Deal. According to Deloitte, in 2024, nearly 72% of specialty chemicals firms in Europe are heavily investing in green chemistry programs.

Remarkable product introductions include carbon-neutral polymers by DSM and bio-based surfactants by Croda, which align with customer sustainability objectives. With the growing ESG scrutiny, the demand for environmentally friendly specialty chemicals is expected to increase rapidly over the next 5 years.

- Technological improvements and product modernization considerably fuel the market growth

Specialty chemical manufacturers are heavily investing in research and development to produce high-performing, environmentally friendly formulations with applications in high-tech sectors. Companies are actively innovating, such as with biodegradable surfactants and nano-based coatings, to meet stringent performance and ecological criteria.

Clariant announced a €70 million investment in its Innovation Center in Frankfurt for 2024. This spending aims to speed up the development of green chemicals.

Technologies such as green synthesis pathways and AI-based molecular design are transforming the production of specialty chemicals, improving product yield and customization.

For example, IBM and Solvay's quantum computing collaboration is focused on mimicking molecular structures to accelerate research and development. These modernizations are increasing the competitiveness of specialty chemicals in precision-demanding industries such as semiconductors and aerospace.

Restraints

Restraints

- Skill gaps and labor shortages in advanced chemical manufacturing unfavorably impact market progress

There is a growing scarcity of technically proficient labor in the industry, particularly in areas such as regulatory compliance, research and development, and proven engineering. These labor obstacles negatively impact innovation schedules and operational efficiency.

The problem is exacerbated by declining enrollment and an aging workforce in chemical engineering and materials science initiatives on a global scale. In the European Union, for instance, the total number of chemical engineering graduates decreased by 12% between 2019 and 2024. This talent gap restricts capacity expansion, disrupts project schedules, and increases labor costs, especially in the high-tech production of chemicals.

Opportunities

Opportunities

- Escalating demand for agrochemicals to boost crop yields contributes to the market growth

Climate change and population growth are driving agriculture to produce more food with limited resources, thereby fueling the demand for high-performing agrochemicals, such as fungicides, herbicides, and specialty fertilizers. The worldwide agrochemical industry surpassed USD 265 billion in 2024, with specialty chemicals comprising a growing share, backed by their targeted efficacy.

Specialty solutions, such as biopesticides, controlled-release fertilizers, and micronutrient enhancers, are gaining prominence, mainly in regions with weakening soil quality. In 2024, Bayer CropScience and UPL introduced novel digital farming and bio-solutions platforms that comply with precision agriculture trends. With rising concerns about food security and arable land stress, the specialty chemical industry presents strong expansion opportunities for specialty chemical companies.

Challenges

Challenges

- Raw material scarcity and dependency on petrochemical feedstock restrict the market growth

A heavy dependency on non-renewable petrochemical feedstock, such as benzene, naphtha, and toluene, offers higher risks in the supply chain of specialty chemicals. With the increasing volatility of crude oil supply due to war risks, climate restrictions, and OPEC+ policies, access to such inputs becomes unpredictable. These issues are further complicated by tight sustainability regulations and the pressure for carbon neutrality, which imprisons the production of fossil fuels.

Companies are compelled to either face declining regulatory compliance or invest in green feedstock, increasing the cost pressure. The restricted scalability of bio-based substitutes also limits the speed of substitution, leaving farms in a vulnerable transition stage.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 674.86 Billion |

Projected Market Size in 2034 |

USD 1012.37 Billion |

CAGR Growth Rate |

5.20% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

BASF SE, Dow Inc., DuPont de Nemours Inc., Solvay S.A., Evonik Industries AG, Clariant AG, LANXESS AG, Huntsman Corporation, Croda International Plc, Ashland Global Holdings Inc., Albemarle Corporation, Eastman Chemical Company, Arkema S.A., Cabot Corporation, Aditya Birla Chemicals, and others. |

Key Segment |

By Type, By Source, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global specialty chemical market is segmented based on type, source, and region.

Based on type, the global specialty chemical industry is divided into agrochemicals, flavors, fragrances & personal care active ingredients, dyes & pigments, water treatment, bio-based, construction & textile chemicals, surfactants & polymer additives, and others. The agrochemicals segment registered the largest market share, driven by growing demand to increase agricultural productivity. With surging global food demand and deteriorating arable land, the use of herbicides, fertilizers, pesticides, and plant growth regulators has increased. According to the latest updates and estimations, the total agrochemical category registers for over 20% of the global industry share.

Based on source, the global specialty chemical market is segmented into crude oil, naphtha, ethane & propane, butane & wood, and others. The crude oil segment led the global market in the past year and is expected to lead over the forecast period. It is the primary source of specialty chemicals, serving as the feedstock for numerous petrochemical derivatives. A majority of specialty chemicals, such as surfactants, polymers, and solvents, are synthesized from the fractions of crude oil. Owing to its established infrastructure and versatility, crude oil inputs account for over 40 percent of the total production of specialty chemicals.

Regional Analysis

Regional Analysis

- Asia Pacific to witness significant growth over the forecast period

The Asia Pacific region holds a leadership position in the specialty chemical market, driven by industrialization, a strong manufacturing base, surging demand from end-use industries, and low-cost manufacturing and export-focused production. Asia Pacific has progressed as the leading manufacturing hub, propelled by countries such as Japan, India, South Korea, and China. These countries aid large-scale production in textiles, construction, and electronics, which are majorly dependent on specialty chemicals.

The region accounts for over 45% of the global specialty chemicals market as of 2024. The region's growing middle-class population is surging the demand for food processing, personal care, and home care products. For example, India's personal care sector is growing at a 10% compound annual growth rate (CAGR), while China's construction industry leads the way, among others. These industries altogether drive the consumption of adhesives, surfactants, coatings, and flavors.

Furthermore, the APAC region benefits from cost-effective labor costs, economies of scale, and access to raw materials, thereby increasing its prominence as a key exporter of specialty chemicals. China contributes to 40% of global agrochemical exports, while specialty chemicals exports from India are projected to reach $ 65 billion by 2025. Furthermore, outsourcing from Western nations contributes to this growth.

Europe is expected to experience significant growth in the specialty chemical industry, driven by a well-developed industrial base and innovation centers, a heightened focus on green chemistry and sustainability, as well as increasing demand from the aerospace and automotive sectors. Europe boasts a mature market of chemical industries in France, Germany, and the United Kingdom, which are prominent for their quality specialty chemicals production. High research and development infrastructure fuels innovation in key segments like cosmetics, advanced materials, and pharmaceuticals. The region registers for approximately 25% of the global market as of 2024.

Moreover, European regulations are highly focused on sustainability and environmental safety, driving the development of eco-friendly and bio-based specialty chemicals. The European Union's Green Deal is dedicated to making the chemical sector climate-neutral by 2050, driving demand for biodegradable polymers and green solvents. This fosters new product development and emphasizes attracting investment.

Additionally, the region's advanced aerospace and automotive industries create stable demand for adhesives, specialty coatings, and composites. These sectors require high-performance chemicals for enhanced fuel efficiency and lightweighting. For instance, Germany's automotive industry contributes to over 15 percent of the region's specialty chemical consumption.

Competitive Analysis

Competitive Analysis

The leading players in the global specialty chemical market are:

- BASF SE

- Dow Inc.

- DuPont de Nemours Inc.

- Solvay S.A.

- Evonik Industries AG

- Clariant AG

- LANXESS AG

- Huntsman Corporation

- Croda International Plc

- Ashland Global Holdings Inc.

- Albemarle Corporation

- Eastman Chemical Company

- Arkema S.A.

- Cabot Corporation

- Aditya Birla Chemicals

Key Market Trends

Key Market Trends

- Growth in specialty chemicals for EVs:

The growth of the electric vehicle industry is driving the demand for specialty adhesives, battery chemicals, coatings, and thermal management materials. These chemicals improve battery life, vehicle performance, and safety. With government programs encouraging the adoption of electric vehicles, the segment is emerging as a key driver of growth.

- Mounting demand for specialty chemicals in healthcare and personal care:

Health-conscious users are expanding the demand for specialty ingredients in pharmaceuticals, wellness products, and cosmetics. Organic and natural additives, along with advanced delivery systems, are gaining traction. The industry's progress is driven by the increasing spending power of consumers and global shifts in lifestyle.

The global specialty chemical market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Agrochemicals

- Flavors, Fragrances & Personal Care Active Ingredients,

- Dyes & Pigments

- Water Treatment, Bio-Based, Construction & Textile Chemicals

- Surfactants & Polymer Additives

- Others

By Source Segment Analysis

By Source Segment Analysis

- Crude Oil

- Naphtha, Ethane & Propane

- Butane & Wood

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- BASF SE

- Dow Inc.

- DuPont de Nemours Inc.

- Solvay S.A.

- Evonik Industries AG

- Clariant AG

- LANXESS AG

- Huntsman Corporation

- Croda International Plc

- Ashland Global Holdings Inc.

- Albemarle Corporation

- Eastman Chemical Company

- Arkema S.A.

- Cabot Corporation

- Aditya Birla Chemicals

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors