Search Market Research Report

Anticoagulant Drugs Market Size, Share Global Analysis Report, 2022 – 2028

Anticoagulant Drugs Market Size, Share, Growth Analysis Report By Drug Class (Heparins, Factor Xa Inhibitor, Warfarin, Direct Thrombin Inhibitor, and Others), By Route of Administration (Oral and Injectable), By Application (Atrial Fibrillation/Flutter, Venous Thromboembolism, Coronary Heart Disease, and Others), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, and Online Pharmacies), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

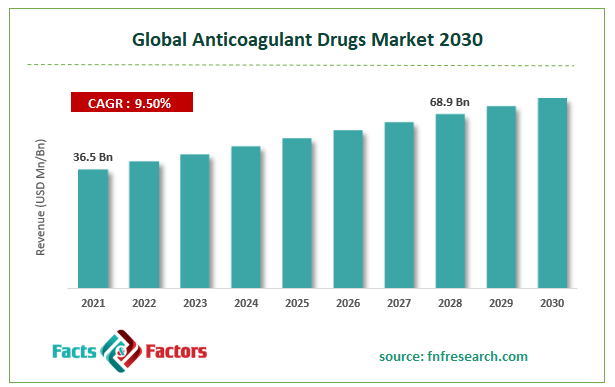

[224+ Pages Report] According to the report published by Facts Factors, the global Anticoagulant Drugs market size was worth around USD 36.5 billion in 2021 and is predicted to grow to around USD 68.9 billion by 2028 with a compound annual growth rate (CAGR) of roughly 9.5% between 2022 and 2028. The report analyzes the global Anticoagulant Drugs market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Anticoagulant Drugs market.

Market Overview

Market Overview

Anticoagulants are medications that reduce the risk of blood clots in the body. Platelets stick together and proteins in the blood bind together to form a solid mass, which is how blood clots form. Blood clots, in general, play an important role in stopping external bleeding caused by any skin injury. Blood clots, on the other hand, can be dangerous because they can block blood circulation. Clots in the arteries or the heart can obstruct blood flow and result in a heart attack. Clots in blood vessels in the brain can result in a stroke. Anticoagulants prevent platelets from adhering to one another and clotting proteins from interacting with one another. These are commonly used to treat deep vein thrombosis (DVT), pulmonary embolism, and atrial fibrillation, and to manage the high and moderate risk of stroke.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global anticoagulant drugs market is estimated to grow annually at a CAGR of around 9.5% over the forecast period (2022-2028).

- In terms of revenue, the global anticoagulant drugs market size was valued at around USD 36.5 billion in 2021 and is projected to reach USD 68.9 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on drug class, the heparins segment held the largest market share in 2021.

- Based on the route of administration, the oral segment is expected to dominate the market during the forecast period.

- Based on application, the atrial fibrillation/flutter segment was dominated in 2021.

- Based on end users, the hospital pharmacies segment accounted for the major market share in 2021 and is expected to show its dominance during the forecast period.

- Based on region, North America is projected to dominate the market during the forecast period.

Covid-19 Impact

Covid-19 Impact

COVID-19 infection is expected to have a significant impact on the anticoagulant industry due to the rapid pace of research. There are currently more than ten clinical trials evaluating the potential of anticoagulants in COVID-19 patients, according to a study published in the American Journal of Cardiovascular Drugs in 2020. Furthermore, studies are being conducted on parenteral administration techniques for these medications in critically ill COVID-19 patients. As a result, the COVID-19 pandemic is expected to have an indirect and direct impact on the market in question. Furthermore, according to the World Health Organization Update from January 2021, patients with COVID-19, both confirmed and suspected, should have access to follow-up care with low-dose anticoagulants. Thus, the COVID-19 pandemic positively influenced the market growth of anticoagulant drugs.

Growth Drivers

Growth Drivers

- Increasing cardiovascular disease to drive the market growth

The rising prevalence of cardiovascular diseases will be a major driver of the global anticoagulants drugs market over the forecast period. Cardiovascular diseases (CVDs) are a type of heart and blood vessel problem. Cardiovascular diseases are the leading cause of death worldwide, accounting for three-quarters of CVD deaths in low- and middle-income countries. Direct oral anticoagulants, a type of anticoagulation pharmacotherapy, are used to reduce thrombosis in a variety of cardiovascular situations. For instance, according to the World Health Organization report published in 2021, cardiovascular diseases killed 17.9 million people worldwide in 2019, accounting for 32% of all deaths. 85% of these deaths were caused by heart attacks or strokes. As a result, the growing prevalence of cardiovascular diseases drives the growth of the anticoagulants drugs market.

Restraints

Restraints

- The possible side effect associated with anticoagulant drugs hamper the market growth

During the forecast period, the global anticoagulant drugs market may be hampered by potential adverse effects from anticoagulants or blood thinners. The main negative side effect of taking these medications is excessive bleeding. Warfarin, a common example, carries an increased risk of other side effects such as skin necrosis, blue or purple toes, congenital impairments, and miscarriages. Anticoagulants are typically not recommended to prevent problems in people with AFib, high blood pressure, or other conditions.

Opportunities

Opportunities

- Technological advancements in anticoagulants drugs provide a lucrative opportunity for the market expansion

Technological advancements in the development of oral anticoagulant products, as well as approvals, are significant factors that provide an attractive opportunity for market expansion. For instance, in June 2021, the US Food and Drug Administration approved Boehringer Ingelheim's dabigatran etexilate (Pradaxa) anticoagulant oral pellets as the first oral anticoagulant to treat children aged 3 months to less than 12 years old with venous thromboembolism after at least five days of treatment with an injection-based blood thinner.

Segmentation Analysis

Segmentation Analysis

The global anticoagulant drugs market is segmented based on drug class, route of administration, application, distribution channel, and region

Based on the drug class, the global market is bifurcated into heparins, factor Xa inhibitor, warfarin, direct thrombin inhibitor, and others. The heparins segment held the largest market share in 2021 and is expected to show its dominance during the forecast period. Heparin is a medication primarily used to stop blood clots from forming in a variety of individuals. This blood thinner is used by cardiac surgeons to treat several medical disorders, including deep vein thrombosis, acute coronary syndrome, atrial fibrillation, pulmonary embolism, and unstable angina. On the other hand, the warfarin segment is expected to grow at the highest CAGR during the forecast period. Warfarin is an oral anticoagulant that is commonly used to treat and prevent blood clots. Warfarin has multiple FDA-approved and off-label clinical uses such as Prophylaxis and treatment of venous thrombosis and arising pulmonary embolisms, Prophylaxis and treatment of thromboembolic complications from atrial fibrillation or cardiac valve replacement, reduction in the risk of death, recurrent myocardial infarction, thromboembolic events (e.g., stroke, systemic embolization) after myocardial infarction, and secondary prevention of recurrent stroke and transient ischemic attacks.

Based on the route of indication, the market is segmented into oral and injectable. The oral segment is expected to dominate the market during the forecast period. One of the most popular methods of administration is through the oral route of medication. Direct oral anticoagulants (DOACs) offer less medication interaction and better absorption. They are unaffected by outside factors like food and alcohol. The prevalence of stroke and systemic embolism among people with atrial fibrillation is increasing, which will increase the demand for oral anticoagulants.

Based on the application, the global anticoagulants drugs market is segmented into atrial fibrillation/flutter, venous thromboembolism, coronary heart disease, and others. The atrial fibrillation/flutter segment was dominated in 2021 with over 30% market share and is expected to show this pattern during the forecast period. AFib prevalence is rising alarmingly quickly. Worldwide, public and private healthcare organizations are making an effort to raise awareness of various cardiac problems. Atrial fibrillation affects more than a million people in the UK, according to the Stroke Association. Anticoagulants are widely employed to treat this condition.

Based on distribution channels, the global market is divided into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment accounted for the largest market share in 2021 and is expected to dominate over the forecast period. Hospital pharmacies offer several advantages, including better access to medications. A significant share of CVD patients visits hospital outpatient departments (OPDs) to receive treatment and medication prescriptions since these departments have more sophisticated infrastructure and medical staff. Anticoagulant sales across in-house pharmacies will increase at a large rate as more patients choose to receive their treatments at hospitals to receive high-quality care.

Recent Developments:

Recent Developments:

- In July 2020, Portola Pharmaceuticals Inc. was acquired by US-based biopharmaceutical business Alexion Pharmaceuticals Inc. The commercial portfolio of Alexion Pharmaceuticals Inc. now includes Andexxa, a factor Xa inhibitor reversal drug sold as Ondexxya in Europe. A US-based clinical-stage biopharmaceutical business called Portola Pharmaceuticals Inc. has the blood thinner Bevyxxa in its product line.

- In February 2022, the Food and Drug Administration of the United States granted fast-track status to Bayer's oral Xia inhibitor Asundexian. This drug was in the second round of testing and might be safer than other medications already available.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 36.5 Billion |

Projected Market Size in 2028 |

USD 68.9 Billion |

CAGR Growth Rate |

9.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Johnson & Johnson, Bayer AG, Boehringer Ingelheim GmbH, Bristol-Myers Squibb Company, Daiichi Sankyo Company, Abbott Laboratories, Aspen Holdings, Sanofi, Pfizer Inc, Alexion Pharmaceuticals Inc., Leo Pharma AS, Dr. Reddy’s Laboratories, and others. |

Key Segment |

By Drug Class, Route of Administration, Application, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America is expected to dominate the market during the forecast period

North America accounted for nearly half of the global anticoagulant drugs market during the forecast period and is expected to maintain its dominance throughout the analysis period. Increased demand for novel therapies, the presence of major stakeholders, early diagnosis, improved healthcare infrastructure, the presence of qualified medical experts, and a larger target population was attributed to this. The United States accounted for the highest proportion of anticoagulants in the region, owing to growing knowledge about the therapeutic benefits of anticoagulants in disease management and the country's rising obesity rate. It also has the highest obesity rate in the world. As a result, the regional market is being driven.

Competitive Analysis

Competitive Analysis

- Johnson & Johnson

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Abbott Laboratories

- Aspen Holdings

- Sanofi

- PfizerInc

- Alexion Pharmaceuticals Inc.

- Leo Pharma AS

- Dr. Reddy’s Laboratories

The global anticoagulant drugs market is segmented as follows:

By Drug Class

By Drug Class

- Heparins

- Factor Xa Inhibitor

- Warfarin

- Direct Thrombin Inhibitor

- Others

By Route of Administration

By Route of Administration

- Oral

- Injectable

By Application

By Application

- Atrial Fibrillation/Flutter

- Venous Thromboembolism

- Coronary Heart Disease

- Others

By Distribution Channel

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Johnson & Johnson

- Bayer AG

- Boehringer Ingelheim GmbH

- Bristol-Myers Squibb Company

- Daiichi Sankyo Company

- Abbott Laboratories

- Aspen Holdings

- Sanofi

- PfizerInc

- Alexion Pharmaceuticals Inc.

- Leo Pharma AS

- Dr. Reddy’s Laboratories

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors