Search Market Research Report

Blood Glucose Monitors Market Size, Share Global Analysis Report, 2022 – 2028

Blood Glucose Monitors Market Size, Share, Growth Analysis Report By Device Type (Continuous Glucose Monitoring (CGM) and System Self-Monitoring Blood Glucose (SMBG) System), By Modality (Wearable and Non-wearable), By Type (Non-invasive and Invasive), By Patient Type (Type 1 Diabetes and Type 2 Diabetes), By Distribution Channel (Institutional Sales and Retail Sales), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

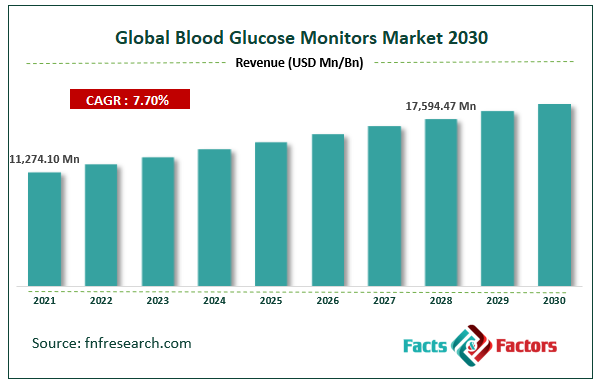

[224+ Pages Report] According to Facts and Factors, the Global Blood Glucose Monitors market size was worth around USD 11,274.10 million in 2021 and is estimated to grow to USD 17,594.47 million by 2028, with a compound annual growth rate (CAGR) of approximately 7.70% over the forecast period. The report analyzes the Blood Glucose Monitors market’s drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the Blood Glucose Monitors market.

Market Overview

Market Overview

Diabetes is a chronic disease that can lead to kidney damage, stroke, and even heart attack if blood sugar levels are not tested and analyzed regularly. Blood glucose monitors are diagnostic instruments used to evaluate and treat diabetic patients. It collects blood samples, but sensors are employed for continuous monitoring as technology advances. The increase in diabetic patients and the increasing demand for monitoring systems due to population expansion are the primary factors driving the blood glucose monitor market.

However, the fluctuating economic distribution in developing countries and the availability of low-cost alternative devices are projected to restrain the expansion of the blood glucose monitor market. In addition, the blood glucose monitor market is expected to be challenged by the implementation of demanding regulatory standards and decreased laboratory investment.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 outbreak has boosted the expansion of the blood glucose monitoring system market. As a result of the pandemic, several key players observed an increase in diabetes care revenue. In addition, with the increased risk of COVID-19 transmission among patients with diabetes, a greater emphasis is being placed on home usage monitoring devices to regulate blood glucose levels at home. Market growth for blood glucose monitors as a result of leading market manufacturers' fast response during the Covid-19 pandemic. This component helped them in efficiently treating COVID-19 patients.

Key Insights

Key Insights

- blood glucose Monitors market share value at a CAGR of 7.70% over the forecast period.

- The major market drivers are the rising prevalence of diabetes and the growing number of older people at risk for the disease.

- By device type, the Self-Monitoring Blood Glucose (SMBG) System segment dominates the market, accounting for more than 65% of global sales in 2021.

- By patient type, the type 2 diabetes segment dominates the market, accounting for more than 89.2% of global sales in 2021.

- North America dominates the Global Blood Glucose Monitors market and accounts for more than 35% of the global revenue in 2021.

Growth Drivers

Growth Drivers

- The rising prevalence of diabetes is likely to pave the way for global market growth

Growing diabetes prevalence is a key driver for the blood glucose monitor market. Diabetes patients are on the rise in developed countries. It is very prevalent among the elderly population. Visiting the hospital is often impossible for these individuals. Knowing precise glucose levels in the blood is simple with blood monitoring equipment. Preventive care awareness is generating demand. Diabetes identification at an early stage is predicted to save lives.

Restraints

Restraints

- Lack of awareness amongst people may hamper the global market growth

Diabetes is still unrecognized in many areas. Lower diagnosis is a barrier to growth in the blood glucose monitor market. The diagnostic rate is inferior in developing countries. Diabetes therapy is often delayed in India, China, and Brazil. Many people do not take diabetes to be a serious illness due to a lack of awareness. Delaying diagnosis and treatment might have disastrous health problems.

Opportunities

Opportunities

- Improving healthcare infrastructure to bring up several growth opportunities

Access to healthcare services will drive growth in the blood glucose monitor market. Health-care services are widely available in various areas. The ease of access to these testing devices will increase the market for blood glucose monitors. In addition, even underdeveloped countries are expanding their spending on infrastructures. All of these reasons will contribute to the growth of the blood glucose monitor market. Another important development component is government attempts to boost preventive care.

Challenges

Challenges

- The lack of reimbursement policies is likely to limit the global market growth

A challenge is the lack of reimbursement policies for blood glucose monitors. Patients are less likely to purchase a system due to low reimbursement policies. Many patients are unsure how to utilize blood glucose meters. As a result, the blood glucose monitors market's growth and expansion rates are slowing.

Segmentation Analysis

Segmentation Analysis

The global Blood Glucose Monitors market is segregated on the basis of device type, modality, type, patient type, distribution channel, and region.

By device type, the market is divided into Continuous Glucose Monitoring (CGM) System and Self-Monitoring Blood Glucose (SMBG) System. Among these, the Self-Monitoring Blood Glucose (SMBG) System segment dominates the market, accounting for more than 65% of global sales in 2021. The ease of usage and low cost are driving the growth. Every day, SMBG is regarded as a crucial component of diabetes therapy. Self-monitoring of blood sugar is a method in which people use a glucose meter to measure their blood sugar levels. Individuals use glucose meters to check their blood sugar levels when self-monitoring.

The market is classified into Type 1 Diabetes and Type 2 Diabetes by patient type. Among these, the type 2 diabetes segment dominates the market, accounting for more than 89.2% of global sales in 2021. In type 2 diabetes, a considerable amount of insulin is not utilized correctly. Living factors such as daily exercise and nutrition must be considered in order to properly manage type 2 diabetes. To maintain correct blood glucose levels, individuals with type 2 diabetes will require oral drugs and insulin. According to the National Library of Medicine, the global prevalence of type 2 diabetes is expected to climb to 7079 per 100,000 people by the end of 2030, with a sustained rise in all regions of the world.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 11,274.10 Million |

Projected Market Size in 2028 |

USD 17,594.47 Million |

CAGR Growth Rate |

7.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

B. Braun Melsungen AG (Germany), Dexcom Inc. (U.S.), F. Hoffmann-La Roche Ltd (Switzerland), Abbott (U.S.), Terumo Corporation (Japan), LifeScan IP Holdings, LLC (U.S.), Senseonics (U.S.), Ascensia Diabetes Care Holdings AG (Switzerland), Medtronic (Ireland), and Others |

Key Segment |

By Device Type, Modality, Type, Patient Type, Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In February 2020-In order to create a CGM device that can deliver enhanced CGM solutions, Abbott and Insulet have partnered to integrate autonomous insulin delivery and glucose sensor technology.

- February 2019 - Abbott joined forces with Novo Nordisk. The businesses would combine digital health tools compatible with Abbott's FreeStyle Libre system with insulin dose data from Novo Nordisk's pre-filled, linked pens.

Regional Landscape

Regional Landscape

- Growing Diabetes Population likely to help North America dominate the global market

North America dominates the Global Blood Glucose Monitors market and accounts for more than 35% of the global revenue in 2021. This dominance is due to the growing diabetes population in the region. It is mostly due to an increase in diabetes prevalence and the rates of obesity, lack of exercise, and a poor diet throughout North America. Increased use of technologically advanced glucose monitoring systems and stringent glucose monitoring product approval and launches in the region for better diabetes management contribute to the regional blood glucose monitoring systems market. The region's blood glucose monitoring market will grow as more blood glucose monitoring products are launched in the region.

Over the forecast period, Asia Pacific regional market is expected to be the fastest-growing region in the blood glucose monitors market in 2021. This is due to the growing senior population's increasing load of the region's targeted population. In addition, the ongoing efforts of the region's leading enterprises to provide continuous glucose monitoring will boost the blood glucose monitor market. The region's blood glucose monitoring systems market will benefit from improving healthcare infrastructure and rising disposable income. Innovations in medical centers and reimbursement policies in developing countries are significant drivers of this region's progress.

Competitive Landscape

Competitive Landscape

Key players within the global Blood Glucose Monitors market include

- B. Braun Melsungen AG (Germany)

- Dexcom Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Terumo Corporation (Japan)

- LifeScan IP Holdings

- LLC (U.S.)

- Senseonics (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Medtronic (Ireland)

The Global Blood Glucose Monitors market is segmented as follows:

By Device Type

By Device Type

- Continuous Glucose Monitoring (CGM)

- System Self-Monitoring Blood Glucose (SMBG) System

By Modality

By Modality

- Wearable

- Non-wearable

By Type

By Type

- Non-invasive

- Invasive

By Patient Type

By Patient Type

- Type 1 Diabetes

- Type 2 Diabetes

By Distribution Channel

By Distribution Channel

- Institutional Sales

- Retail Sales

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- B. Braun Melsungen AG (Germany)

- Dexcom Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Abbott (U.S.)

- Terumo Corporation (Japan)

- LifeScan IP Holdings

- LLC (U.S.)

- Senseonics (U.S.)

- Ascensia Diabetes Care Holdings AG (Switzerland)

- Medtronic (Ireland)

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors