Search Market Research Report

Real-time Payment Market Size, Share Global Analysis Report, 2023 – 2030

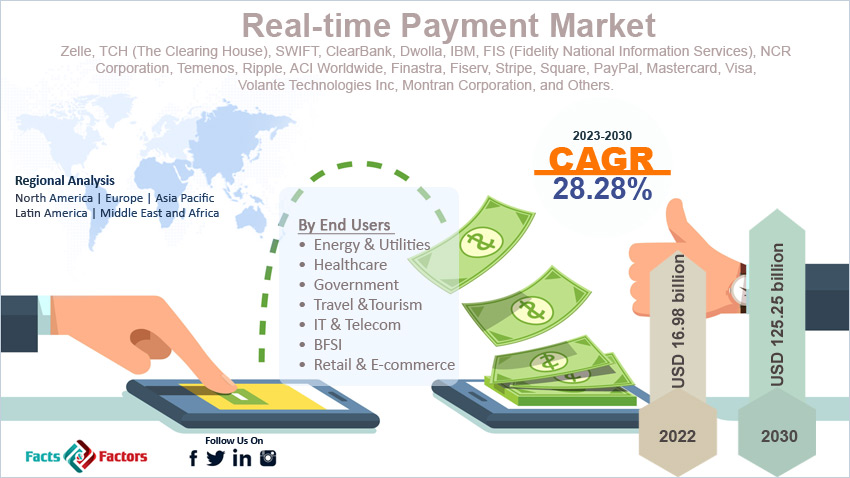

Real-time Payment Market Size, Share, Growth Analysis Report By End Users (Energy & Utilities, Healthcare, Government, Travel &Tourism, IT & Telecom, BFSI, Retail & Ecommerce, And Others), By Enterprise Size (Small & Medium Enterprises And Large Enterprises), By Deployment (On-Premise And Cloud Services), By Component (Services And Solutions), By Payment Type (Person-To-Person (P2P), Business-To-Person (B2P), Person-To-B1usiness (P2B), and Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

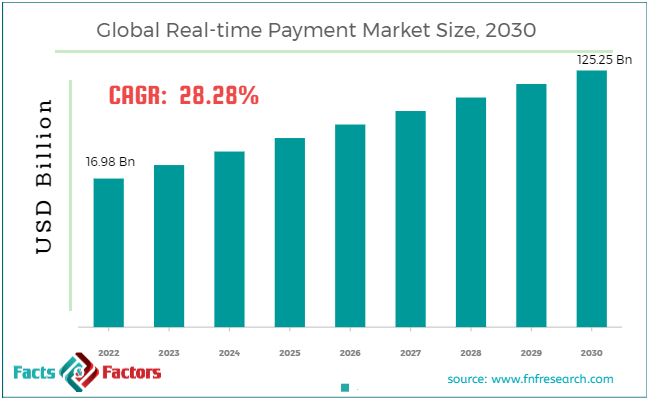

[206+ Pages Report] According to Facts and Factors, the global real-time payment market size was around USD 16.98 billion in 2022 and is anticipated to reach USD 125.25 billion by the end of 2030. The real-time payment industry is expected to grow with a CAGR of 28.28% between 2023-2030.

Market Overview

Market Overview

Real-time payments are electronic payment transactions that are facilitated immediately. These payments are done within seconds and are helpful in transferring funds from one account to another on an immediate basis. Real-time payments are faster than any other available options, which makes them ideal for almost all commercial transactions.

Also, these payment solutions are operatable 24×7 and 365 days a year, which further attracts consumers and companies. Almost all the real-time payment solutions are facilitated via digital channels, which are operated through mobile.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global real-time payment market size is estimated to grow annually at a CAGR of around 28.28% over the forecast period (2023-2030).

- In terms of revenue, the global real-time payment market size was valued at around USD 16.98 billion in 2022 and is projected to reach USD 125.25 billion by 2030.

- Consumer demand for speed and convenience is driving the growth of the global real-time payment market.

- Based on the end-users, the retail and e-commerce segment is growing at a high rate and is projected to dominate the global market.

- Based on the enterprise size, the large enterprise segment is projected to swipe the largest market share.

- Based on the deployment, the cloud-based segment is the fastest-growing segment in the global market.

- Based on the component, the solution segment is anticipated to grow with a high CAGR in the global market.

- Based on the payment type, the person-to-business (P2B) is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Consumer demand for speed and convenience is likely to drive the growth of the global market.

The growing digitalization has led consumers to expect immediate access to funds, payments, and transfers at any time of the day, which is a major reason for the growth of the global real-time payment market. This growing demand for unparalleled convenience and speed is expected to foster developments in the real-time payment market.

Moreover, the growing digital transformation across different sectors has further initiated the real-time payment system in order to modernize the legacy payment framework.

For instance, ACI revealed its innovative mobile engagement platform that assists merchants in catering to their inventory of goods and services and thereby helps users enhance the on-the-go shopping experience using locations, voice, and image recognition technology.

Restraints

Restraints

- Infrastructure and connectivity challenges are likely to hamper the growth of the global market.

Advanced technological infrastructure and network connectivity are needed to integrate the real-time payment system, which is a big challenge in the real-time payment industry, particularly in developing countries. Furthermore, expanding these systems to some remote areas is more complex, which is likely to limit the market's growth in the coming years.

Opportunities

Opportunities

- Integration with other services is likely to foster growth opportunities in the global market.

The rising trend of integrating the real-time payment system with other financial services like expense management, accounting software, and customer relationship management systems is revolutionizing the global real-time payment market. It is expected to benefit the companies by improving their capabilities.

For instance, Visa collaborated with Venmo and PayPal to pilot Visa+ in April 2023. The major goal of the partnership is to help people transfer money securely and quickly.

Challenges

Challenges

- Interoperability issues are a big challenge in the global market.

The lack of standardization between the various real-time payment systems creates friction in cross-border transactions. Interoperability is a huge challenge that is likely to limit its adoption in the market.

Segmentation Analysis

Segmentation Analysis

The global real-time payment market can be segmented into end users, enterprise size, deployment, component, payment type, and region.

By end users, the market can be segmented into energy & utilities, healthcare, government, travel & tourism, IT & telecom, BFSI, retail & e-commerce, and others. The retail and e-commerce segment is likely to dominate the real-time payment industry with more than 35% of the market share in the forthcoming years. This growth projection reflects the increasing requirement for real-time payment solutions in the e-commerce and retail sectors.

The e-commerce sector is on the rise because an increasing number of people are shifting to online shopping. Real-time payment methods offer consumers and merchants a convenient way to initiate purchases and improve the overall consumer shopping experience.

Moreover, there is high demand from consumers for faster and more convenient payment options. Therefore, in order to align with these expectations, companies are coming up with seamless transaction processes, which are further expected to boost the growth of the segment in the forthcoming years.

By enterprise size, the market can be segmented into small & medium enterprises and large enterprises. The large enterprise segment is projected to register the largest market share in the coming years. Large enterprises require an efficient payment system.

The real-time payment system helps these enterprises streamline their financial operations and improve overall efficiency. Also, large enterprises can reduce their overall cost with the help of accurate and fast processing payment systems by eliminating the time-consuming manual payment processes.

Moreover, real-time payments facilitate fine and consistent supply chain management for large enterprises by helping them in the fast settlement of invoices and payments to suppliers.

By deployment type, the market can be segmented into on-premise and cloud services. The cloud-based segment accounts for the largest share of the global real-time payment market. The cloud-based segment is gaining popularity among companies because of its scalability and cost-effectiveness.

The cloud-based solutions help businesses meet their requirements easily. These solutions eliminate the requirement for expensive hardware infrastructure, which helps organizations save huge amounts of money. The cloud-based systems are useful because they can be accessed from anywhere all across the globe with an internet connection, thereby making it accessible for all employees, including remote workers.

By component, the market can be segmented into services and solutions. The solution segment is anticipated to grow with a high CAGR during the predicted period. The solution segment can further be bifurcated into manage services, integration & implementation, services, advisory services, security & fraud management, payment processing, and payment gateway.

An increasing number of businesses and financial institutes are realizing the need for real-time payment solutions, which is a primary reason for the growth of the solution segment. Furthermore, consumers are also seeking a convenient and faster mode of payment, which is also expected to foster the developments in the segment.

The organizations are revolutionizing by aligning with digital transformation initiatives. These organizations are increasingly adopting real-time payment solutions to their financial infrastructure. The fast expansion of e-commerce and mobile commerce is further accentuating the demand for real-time payment solutions.

By payment type, the market can be segmented into person-to-person (P2P), business-to-person (B2P), person-to-business (P2B), and others. The person-to-business (P2B) is the fastest-growing segment in the global real-time payment market. The person-to-business transaction involves individuals making payments to businesses, bills, services, products, and more.

The growing online shopping activities are making B2B transactions more relevant. Real-time payment solutions are crucial for e-commerce platforms to help consumers make instant payments. Additionally, the integration of digital wallet services with real-time payments is further likely to contribute towards the growth of the segment. Customers are now using their digital wallets to make payments to the business directly.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 16.98 Billion |

Projected Market Size in 2030 |

USD 125.25 Billion |

CAGR Growth Rate |

28.28% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Zelle, TCH (The Clearing House), SWIFT, ClearBank, Dwolla, IBM, FIS (Fidelity National Information Services), NCR Corporation, Temenos, Ripple, ACI Worldwide, Finastra, Fiserv, Stripe, Square, PayPal, Mastercard, Visa, Volante Technologies Inc, Montran Corporation, and Others. |

Key Segment |

By End Users, By Enterprise Size, By Deployment, By Component, By Payment Type, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market during the projected period.

North America is expected to be the fastest-growing region in the real-time payment industry during the forecast period. A real-time payment solution aligns with the requirement of people for faster and more convenient payment options in the region.

Moreover, security is a big issue in the region, and therefore, companies in North America are prioritizing real-time payment systems with strong authentication and data protection measures to ensure safe transactions. Also, the fintech companies and financial institutions are collaborating with each other to enhance the real payment infrastructure, which in turn is also likely to expand the scope of the regional market.

Asia Pacific is also likely to grow steadily in the forthcoming years because of the high penetration of mobile apps and smartphones, along with the easy availability of high-speed data. Moreover, the increasing adoption of QR code-based payment systems is further expected to accentuate the growth of the regional market.

Competitive Analysis

Competitive Analysis

The leading players in the global real-time payment market include:

- Zelle

- TCH (The Clearing House)

- SWIFT

- ClearBank

- Dwolla

- IBM

- FIS (Fidelity National Information Services)

- NCR Corporation

- Temenos

- Ripple

- ACI Worldwide

- Finastra

- Fiserv

- Stripe

- Square

- PayPal

- Mastercard

- Visa

- Volante Technologies Inc

- Montran Corporation

For instance, Fiserv came up with the App market in April 2022. It is for financial institutions that require a set of fintech solutions to assist them in operating more efficiently and expanding to new customers.

The global real-time payment market is segmented as follows:

By End Users Segment Analysis

By End Users Segment Analysis

- Energy & Utilities

- Healthcare

- Government

- Travel &Tourism

- IT & Telecom

- BFSI

- Retail & E-commerce

- Others

By Enterprise Size Segment Analysis

By Enterprise Size Segment Analysis

- Small & Medium Enterprises

- Large Enterprises

By Deployment Segment Analysis

By Deployment Segment Analysis

- On-Premise

- Cloud Services

By Component Segment Analysis

By Component Segment Analysis

- Services

- Solutions

By Payment Type Segment Analysis

By Payment Type Segment Analysis

- Person-To-Person (P2P)

- Business-To-Person (B2P)

- Person-To-B1usiness (P2B)

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Zelle

- TCH (The Clearing House)

- SWIFT

- ClearBank

- Dwolla

- IBM

- FIS (Fidelity National Information Services)

- NCR Corporation

- Temenos

- Ripple

- ACI Worldwide

- Finastra

- Fiserv

- Stripe

- Square

- PayPal

- Mastercard

- Visa

- Volante Technologies Inc

- Montran Corporation

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors