Search Market Research Report

Animal Feed Additives Market Size, Share Global Analysis Report, 2023 – 2030

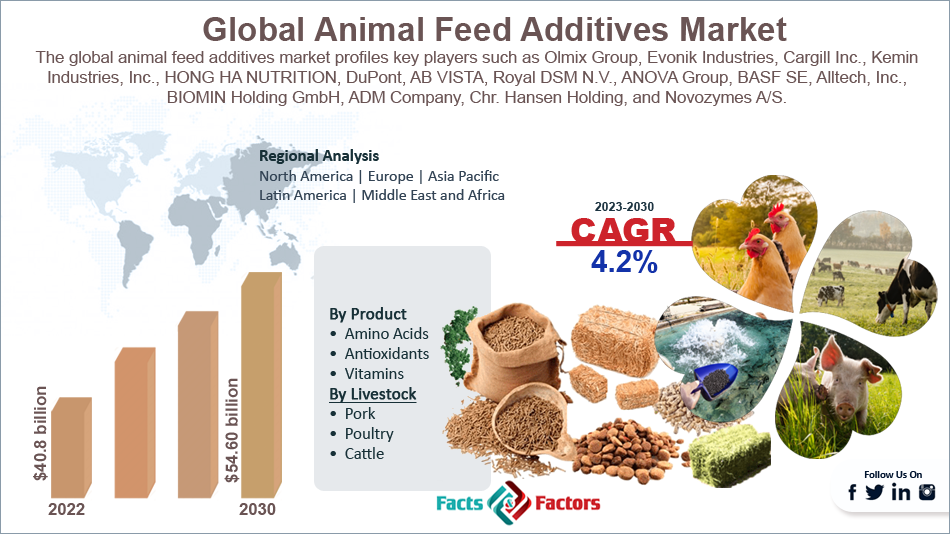

Animal Feed Additives Market Size, Share, Growth Analysis Report By Product(Amino Acids, Antioxidants, and Vitamins), By Livestock (Pork, Poultry, and Cattle), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

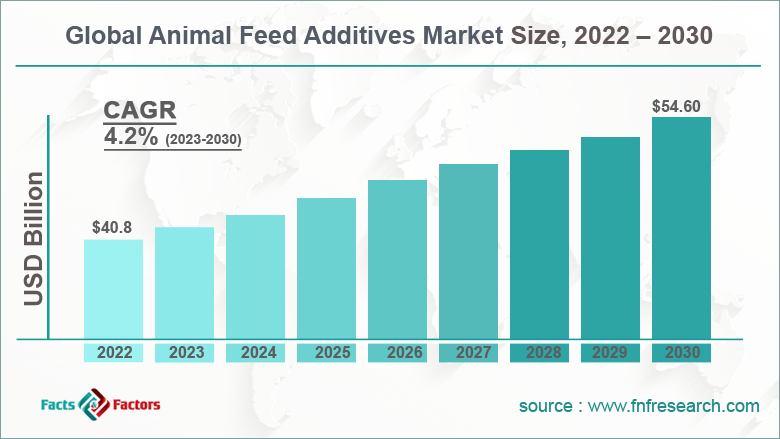

[228+ Pages Report] According to the report published by Facts & Factors, the global animal feed additives market size was evaluated at $40.8 billion in 2022 and is slated to hit $54.60 billion by the end of 2030 with a CAGR of nearly 4.2% between 2023 and 2030. The market report is an indispensable guide on growth factors, challenges, restraints, and opportunities in the global marketspace. The animal feed additives industry report covers the geographical market along with a comprehensive competitive landscape analysis. It also includes cash flow analysis, profit ratio analysis, market basket analysis, market attractiveness analysis, PESTEL analysis, SWOT analysis, Porter’s five force analysis, and value chain analysis. Additionally, the animal feed additives market report explores the investor and stakeholder space to help companies make data-driven decisions.

Market Overview

Market Overview

Animal feed additives are nutritive materials that are added to livestock feed. For the record, a few of the animal feed additives include minerals, antioxidants, amino acids, regulators, preservatives, emulsifiers, vitamins, and digestibility enhancers. Moreover, they are added to animal nutrition for achieving a favorable impact on animal feed and on the animal products that are derived after feeding them feed combined with additives.

Reportedly, animal feed additives help in improving animal feed flavor and enhance the performance & health of animals. According to EFSA (the European Food Safety Authority), additives have no hazardous effects on either animal or human health as well as on the environment.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global animal feed additives market is projected to expand annually at the annual growth rate of around 4.2% over the forecast timespan (2023-2030)

- In terms of revenue, the global animal feed additives market was evaluated at nearly $40.8 billion in 2022 and is expected to reach $54.60 billion by 2030.

- The global animal feed additives market is anticipated to record massive growth over the forecast period owing to growing awareness pertaining to benefits accrued due to the use of feed additives along with its use during the COVID-19 pandemic.

- Based on the product, the amino acids segment is predicted to contribute a majorly towards the market growth over the forecast timeline.

- In terms of livestock, the poultry segment is projected to account for a major share of the global market in 2023-2030.

- Region-wise, the European animal feed additives market is projected to register the highest CAGR during the assessment period.

Industry Growth Factors

Industry Growth Factors

- Need for improving quality of animal feed to boost the global market trends over 2023-2030

The surge in meat intake across the globe is likely to boost the global animal feed additives market trends. Growing awareness pertaining to benefits accrued due to the use of feed additives along with its use during the COVID-19 pandemic has paved the way for the growth of the global market. An increase in know-how about the spread of diseases in the livestock animals such as food & mouth disease, avian flu, mad cow disease, and swine flu has prompted concerns related to the safety & quality of meat, thereby increasing demand for animal feed additives.

Furthermore, animal feed additives play a major role in food intake, gastrointestinal health, reproduction, and metabolism as well as in poultry farming. This, in turn, has made animal feed additives more popular in animal husbandry, poultry, and fishing sectors.

A large number of animal feed additives producers are setting up local distribution networks that aid their business growth as well as protect them from trade risks. Such initiatives have created a strong base for the growth of the animal feed additives market across the globe. The rise in the consumption of seafood in the regular diet has further catapulted the growth of the global market.

Hindrances

Hindrances

- Rise in prices of raw materials adversely impact product demand across the globe

The surge in the costs of raw components including barley, maize, and wheat has impeded the growth of the global animal feed additives industry. Strict laws governing feed additive production can hamper the expansion of the global industry.

Opportunities

Opportunities

- Need for improving animal gut health to increase product penetration in the animal feed industry and open new market growth opportunities

Animal feed additives improve the efficacy of feed use, increase animal growth, help in feed preservation, and improve animal metabolism. Apart from this, animal feed additives find a spectrum of applications in animal farming for controlling pathogen colonization in the animal gut.

Reportedly, ingredients that are added to animal feed such as propionic and formic acids are directly provided to broiler birds for eliminating the pathogens from the intestines. All these aforementioned factors are likely to be the key market drivers and will open new growth opportunities for the global animal feed additives market.

Challenges

Challenges

- Strict laws regulating the use of antibiotics to be a big challenge for the industry growth globally

Restricting the use of antibiotics in some of the countries of Europe and North America can prove to be the biggest challenge in the growth path of the global animal additives industry. Apart from this, the easy availability of substitute products including amino acids, enzymes, and acidifiers can further create big hurdles in the expansion of the industry across the globe.

Segmentation Analysis

Segmentation Analysis

The global animal feed additives market is sectored into product, livestock, and region.

Based on the product, the global animal feed additives market is divided into amino acids, vitamins, and antioxidants segments. In addition to this, the amino acids segment, which contributed over 35% of the global market share in 2022, is predicted to maintain its segmental dominance even in the coming years.

The segmental growth in the next eight years can be ascribed to the need for improving the immunity and gut health of animals. Apart from this, the need for preventing skin disease in animals will steer the growth of the global market. In addition to this, amino acids play a pivotal role in halting cerebral dysfunction in animals.

In terms of livestock, the animal feed additives market across the globe is bifurcated into pork, cattle, and poultry. The poultry segment, which accounted for nearly 38% of the global market earnings in 2022, is predicted to establish a leading position in the global market in the coming years. The segmental surge over the next eight years can be subject to an increase in broiler production in various countries across the globe. Easy availability of various kinds of poultry additives such as vitamins, enzymes, antioxidants, and acidifiers can elevate the nutritional value of the animal feed, thereby expanding segmental growth.

Recent Breakthroughs

Recent Breakthroughs

- In the first quarter of 2023, Volac International Limited, a UK-based player in the dairy business, launched a new feed additive unit with the aim of aiding the global feed sector reach new heights of growth along with fulfilling net zero standards set by institutions such as EU and other regulatory bodies across the globe. Reportedly, the new unit is likely to focus on improving livestock production, minimizing GHG emissions, and enhancing rumen microbial fermentation.

- In November 2022, ADM Company, a U.S.-based food processing firm, launched two sweetening animal feed products under its SUCRAM product portfolio for livestock species. For the record, the animal feed additives are developed by ADM Company’s global feed additive division referred to as Pancosma. Moreover, the latter introduced SUCRAM M’I Sweet as well as SUCRAM Specifeek for improving the feed palatability for young animals such as piglets. Reportedly, these products increase food consumption in animals along with ensuring their good health.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 40.8 Billion |

Projected Market Size in 2030 |

USD 54.60 Billion |

CAGR Growth Rate |

4.2% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Olmix Group, Evonik Industries, Cargill Inc., Kemin Industries Inc., HONG HA NUTRITION, DuPont, AB VISTA, Royal DSM N.V., ANOVA Group, BASF SE, Alltech Inc., BIOMIN Holding GmbH, ADM Company, Chr. Hansen Holding, Novozymes A/S., and others. |

Key Segment |

By Product, Livestock, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Insights

Regional Insights

- Asia-Pacific Animal Feed Additives market to record noteworthy growth over 2023-2030

Asia-Pacific, which accounted for 40% of the overall share of the global animal feed additives market in 2022, is anticipated to lead the regional market growth in the forecast timespan. The regional market surge over 2023-2030 can be due to the presence of a massive livestock population in countries such as China, India, Bangladesh, Thailand, New Zealand, and Indonesia.

Apart from this, flourishing fishing and poultry sectors as well as a rise in cattle-rearing activities in the region will help the market achieve sustainable growth in the coming years. Presence of major product manufacturers is likely to attract foreign investments in the feed business and dairy sector across the Asia-pacific, thereby profiting the animal feed additive business of the sub-continent.

On the other hand, the animal feed additives industry in Europe is predicted to record the highest CAGR in the forthcoming years. The regional market expansion over the forecast timeline can be due to free trade agreements between the EU nations. Apart from this, the thriving swine industry in Spain will further add to the regional industry earnings.

Competitive Space

Competitive Space

- Olmix Group

- Evonik Industries

- Cargill Inc.

- Kemin Industries Inc.

- HONG HA NUTRITION

- DuPont

- AB VISTA

- Royal DSM N.V.

- ANOVA Group

- BASF SE

- Alltech Inc.

- BIOMIN Holding GmbH

- ADM Company

- Chr. Hansen Holding

- Novozymes A/S.

The global animal feed additives market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- Amino Acids

- Antioxidants

- Vitamins

By Livestock Segment Analysis

By Livestock Segment Analysis

- Pork

- Poultry

- Cattle

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Olmix Group

- Evonik Industries

- Cargill Inc.

- Kemin Industries Inc.

- HONG HA NUTRITION

- DuPont

- AB VISTA

- Royal DSM N.V.

- ANOVA Group

- BASF SE

- Alltech Inc.

- BIOMIN Holding GmbH

- ADM Company

- Chr. Hansen Holding

- Novozymes A/S.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors