Search Market Research Report

Frozen Seafood Market Size, Share Global Analysis Report, 2024 – 2032

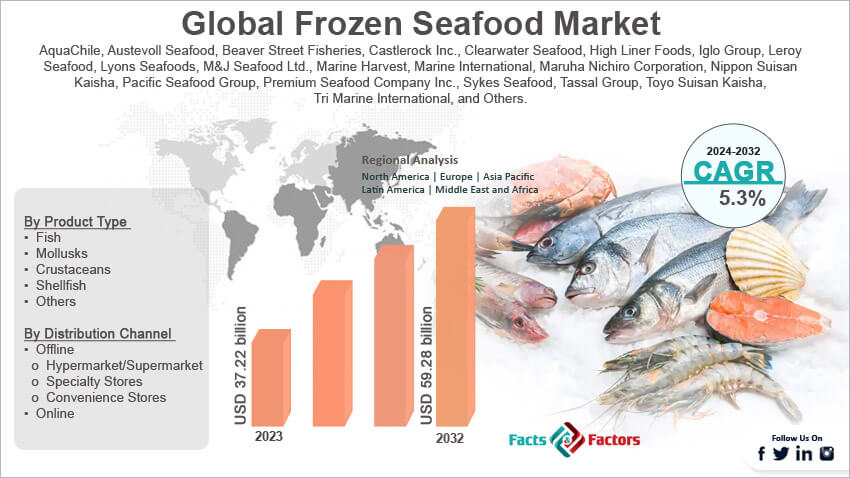

Frozen Seafood Market Size, Share, Growth Analysis Report By Form (Processed and Raw), By Product Type (Fish, Mollusks, Crustaceans, Shellfish, and Others), By Distribution Channel (Offline and Online), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

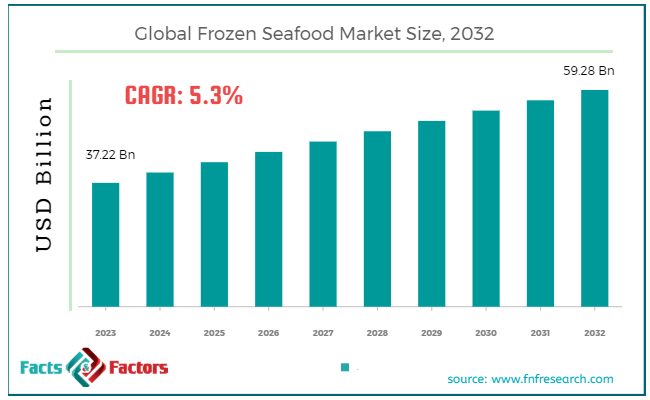

[215+ Pages Report] According to Facts & Factors, the global frozen seafood market size in terms of revenue was valued at around USD 37.22 billion in 2023 and is expected to reach a value of USD 59.28 billion by 2032, growing at a CAGR of roughly 5.3% from 2024 to 2032. The global frozen seafood market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Frozen seafood refers to a variety of seafood products that have been processed and preserved through freezing shortly after being harvested. This process helps to maintain the quality, nutritional value, and flavor of the seafood by preventing the growth of bacteria and enzymes that cause spoilage. Frozen seafood includes a wide range of products such as fish, shrimp, crab, squid, and other marine animals. It is available in various forms including fillets, whole fish, processed meals, and shellfish.

The frozen seafood market is experiencing significant growth, driven by increasing consumer demand for convenient and long-lasting food products. The market's expansion is fueled by advancements in freezing technologies, which enhance the quality and shelf life of seafood. Additionally, the global rise in disposable incomes and changing lifestyles have led to a higher preference for ready-to-eat and easy-to-prepare food options.

Key Highlights

Key Highlights

- The frozen seafood market has registered a CAGR of 5.3% during the forecast period.

- In terms of revenue, the global frozen seafood market was estimated at roughly USD 37.22 billion in 2023 and is predicted to attain a value of USD 59.28 billion by 2032.

- The frozen seafood market is poised for significant growth, driven by consumer demand for convenience, the health benefits of seafood, and advancements in freezing technology.

- On the basis of form, the processed segment is growing at a high rate and is projected to dominate the global market.

- Based on the product type, the fish segment holds the largest market share and is expected to continue growing at a significant CAGR.

- In terms of distribution channel, the offline segment remains dominant, driven by consumer trust and the convenience of physical stores.

- By region, Europe is expected to dominate the global market.

Key Growth Drivers

Key Growth Drivers

- Consumer Convenience: The demand for convenient food options has been rising, with frozen seafood being a key beneficiary. Consumers appreciate the ease of preparation and year-round availability of frozen seafood products, which fit well with busy lifestyles??.

- Nutritional Preservation: Freezing seafood shortly after harvest helps preserve its nutritional value, including essential proteins, omega-3 fatty acids, vitamins, and minerals. This makes frozen seafood a healthy alternative to fresh seafood, especially in regions where fresh options are not readily available?.

- Extended Shelf Life: The freezing process significantly extends the shelf life of seafood, reducing food waste and ensuring a stable supply. This is particularly beneficial for both consumers and retailers, offering a reliable food source that is less susceptible to spoilage??.

- Global Trade and Accessibility: Frozen seafood facilitates international trade, allowing consumers access to a diverse range of seafood products from around the world. Advanced cold chain logistics ensure the quality and freshness of products throughout the supply chain??.

Restraints

Restraints

- High Energy Costs: The freezing and storage of seafood require significant energy, leading to high operational costs. This can be a major restraint, particularly for small and medium-sized enterprises?.

- Perceived Quality Issues: Some consumers perceive frozen seafood as inferior to fresh seafood in terms of taste and texture. Overcoming this perception requires continuous education and marketing efforts??.

- Regulatory Challenges: The frozen seafood industry must comply with stringent food safety and quality regulations, which vary by region. Navigating these regulatory landscapes can be complex and costly for producers and exporters??.

Opportunities

Opportunities

- Technological Advancements: Innovations in freezing technologies, such as individual quick freezing (IQF), can improve product quality and expand the range of seafood items that can be frozen effectively. These advancements open new market opportunities?.

- Rising Health Consciousness: Increasing awareness of the health benefits of seafood, coupled with the growing popularity of high-protein and omega-3-rich diets, is driving demand for frozen seafood. Marketing these health benefits can attract more consumers??.

- Expansion into Emerging Markets: Emerging economies, particularly in Asia and Latin America, present significant growth opportunities due to rising disposable incomes and changing dietary preferences. Companies can capitalize on these trends by expanding their presence in these regions?.

Challenges

Challenges

- Maintaining Quality During Transport: Ensuring that frozen seafood maintains its quality during long-distance transport requires sophisticated and reliable cold chain logistics. Any break in the cold chain can lead to product spoilage and significant financial losses??.

- Competition from Fresh and Canned Seafood: Frozen seafood faces competition from both fresh and canned seafood, which can be perceived as more convenient or higher in quality. Differentiating frozen seafood through quality and convenience is crucial?.

- Environmental Concerns: The environmental impact of freezing, packaging, and transporting seafood is a growing concern among consumers and regulators. Companies need to adopt more sustainable practices to mitigate these concerns and appeal to eco-conscious consumers.

Frozen Seafood Market: Segmentation Analysis

Frozen Seafood Market: Segmentation Analysis

The global frozen seafood market is segmented based on form, product, distribution channel, and region.

By Form Insights

By Form Insights

Based on Form, the global frozen seafood market is divided into processed and raw. Processed frozen seafood includes products that have been pre-cooked, seasoned, breaded, or otherwise prepared before freezing. This category includes items like fish sticks, breaded shrimp, and pre-seasoned fillets. Processed frozen seafood offers high convenience to consumers, as these products require minimal preparation and cooking time. This is particularly appealing to busy households and foodservice providers. The processing adds value by enhancing flavor, texture, and variety, making these products more attractive to consumers who prefer ready-to-cook or ready-to-eat options?. The processed frozen seafood segment is expected to hold a significant market share and is projected to grow at a substantial CAGR due to the increasing demand for convenience foods and the broad variety of processed options available.

Raw frozen seafood includes products that are frozen shortly after harvesting without undergoing any significant processing. This category includes whole fish, raw shrimp, and unseasoned fillets. Freezing raw seafood immediately after harvest helps maintain its nutritional value and freshness, making it an appealing choice for consumers seeking high-quality, unprocessed products. Raw frozen seafood can be used in a wide range of culinary applications, providing flexibility for both home cooks and professional chefs to create various dishes according to their preferences??.

By Product Type Insights

By Product Type Insights

On the basis of Product Type, the global frozen seafood market is bifurcated into fish, mollusks, crustaceans, shellfish, and others. Fish is the largest segment in the frozen seafood market. This category includes a wide variety of species such as salmon, tuna, cod, haddock, and mackerel. Frozen fish is popular due to its versatility and nutritional benefits.

Fish is a rich source of protein, omega-3 fatty acids, and essential vitamins and minerals. The growing awareness of these health benefits drives consumer demand. A broad range of fish species is available year-round, making it a staple in many diets worldwide??. The fish segment holds the largest market share and is expected to continue growing at a significant CAGR due to rising health consciousness and increasing demand for protein-rich diets?.

Mollusks include products such as squid, octopus, and cuttlefish. This segment is known for its unique flavors and textures, which are popular in various culinary traditions. Mollusks are highly valued in gourmet and traditional cuisines, particularly in Mediterranean and Asian dishes. They are low in fat and high in protein, making them a healthy seafood option??.

Crustaceans include shrimp, crabs, lobsters, and crayfish. This segment is highly popular due to the rich flavor and variety of culinary uses. Crustaceans are in high demand globally, especially in North America, Europe, and Asia-Pacific regions, where they are considered delicacies. They are rich in protein and essential minerals like zinc and iodine?.

Shellfish include oysters, clams, scallops, and mussels. These products are known for their distinctive flavors and are often used in gourmet dishes. Shellfish are often associated with luxury and fine dining, which boosts their demand in upscale restaurants and culinary applications. Shellfish are rich in vitamins and minerals, contributing to their appeal as a healthy seafood option??. Others segment includes other types of frozen seafood such as sea cucumbers, sea urchins, and lesser-known fish species. These products cater to niche markets and specific culinary preferences.

By Distribution Channel Insights

By Distribution Channel Insights

Based on Distribution Channel, the global frozen seafood market is categorized into offline and online. The offline distribution channel includes traditional retail outlets such as supermarkets, hypermarkets, specialty seafood stores, and convenience stores. This channel remains the dominant distribution method for frozen seafood.

Many consumers prefer to purchase frozen seafood from physical stores where they can inspect the product quality directly. Physical stores benefit from impulse buying behavior, where consumers make unplanned purchases while shopping for other groceries?. Supermarkets and hypermarkets offer a wide variety of frozen seafood products, making it convenient for consumers to purchase all their groceries in one place. The offline distribution channel holds the largest market share in the frozen seafood market. It is expected to grow steadily, supported by strong consumer preferences and the extensive network of physical retail stores??.

The online distribution channel includes e-commerce platforms, direct-to-consumer websites, and online grocery delivery services. This channel is growing rapidly, driven by technological advancements and changing consumer behavior. Online shopping offers the convenience of purchasing frozen seafood from home, with delivery services bringing products directly to the consumer’s doorstep. E-commerce platforms often provide a wider variety of products, including specialty and exotic seafood items that may not be available in local stores??. The COVID-19 pandemic accelerated the shift towards online shopping, with more consumers opting for home delivery to avoid crowded places??. The online distribution channel is expected to grow at a higher CAGR compared to the offline channel. This growth is driven by increasing internet penetration, improvements in cold chain logistics, and the rising popularity of online grocery shopping.

Recent Developments:

Recent Developments:

- In November 2022, Beaver Street Fisheries, known for its Sea Best brand, launched new additions to their popular Sea Best Seafood Festival line. This convenient, one-pot seafood boil concept was first introduced in 2018.

- In May 2022, saw a shakeup in the salmon industry with the merging of SalMar ASA and Norway Royal Salmon ASA. SalMar emerged as the acquiring company in this strategic move.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 37.22 Billion |

Projected Market Size in 2032 |

USD 59.28 Billion |

CAGR Growth Rate |

5.3% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

AquaChile, Austevoll Seafood, Beaver Street Fisheries, Castlerock Inc., Clearwater Seafood, High Liner Foods, Iglo Group, Leroy Seafood, Lyons Seafoods, M&J Seafood Ltd., Marine Harvest, Marine International, Maruha Nichiro Corporation, Nippon Suisan Kaisha, Pacific Seafood Group, Premium Seafood Company Inc., Sykes Seafood, Tassal Group, Toyo Suisan Kaisha, Tri Marine International, and Others. |

Key Segment |

By Form, By Product Type, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Frozen Seafood Market: Regional Analysis

Frozen Seafood Market: Regional Analysis

- Europe is expected to dominate the global market during the forecast period.

Europe will lead with the largest share during the forecast period (2024-2032). Europe is a mature market for frozen seafood, with significant consumption in countries like Spain, France, and the UK. The market is characterized by a strong preference for locally sourced and sustainably fished products, driven by environmental awareness and high standards of food quality. European consumers are increasingly demanding premium products, which has led to a surge in the availability of high-end frozen seafood options. Key drivers in this market include sustainability concerns, a growing demand for premium products, and the local sourcing of seafood.

The North American frozen seafood market is significant, driven primarily by the United States and Canada. High consumption rates are supported by increasing health consciousness and the demand for convenient food options. Consumers in North America are showing a marked preference for high-quality, sustainably sourced, and organic products, reflecting a broader trend towards healthier lifestyles. Key drivers include the perceived health benefits of seafood, the convenience it offers, and busy modern lifestyles.

The Asia-Pacific region holds the largest share of the global frozen seafood market, driven by rapid urbanization, rising disposable incomes, and diverse seafood preferences. China being the dominant country and projected to swipe the largest market share. This region's growth is fueled by increasing urban populations and a rising middle class with greater purchasing power. Consumers in Asia-Pacific exhibit a high demand for a variety of seafood products, both traditional and exotic, with a significant focus on convenience and price.

The frozen seafood market in Latin America is growing, particularly in Brazil, Mexico, and Argentina. This region's market is expanding due to an increasing middle-class population, urbanization, and rising awareness of seafood's health benefits. Consumers in Latin America prefer a mix of local and imported seafood, with a higher sensitivity to price compared to other regions. The growth in this market is supported by improved supply chain logistics and the availability of a variety of seafood products.

The frozen seafood market in the Middle East and Africa is relatively small but expanding. The market growth is driven by increasing urbanization and the westernization of diets. Consumers in this region show a growing preference for ready-to-eat seafood products, aligning with global trends towards convenience. South Africa is a notable market within this region. The key drivers include urbanization, westernized dietary habits, and the increasing availability of convenient seafood products.

Frozen Seafood Market: List of Key Players

Frozen Seafood Market: List of Key Players

Some of the main competitors dominating the global frozen seafood market include;

- AquaChile

- Austevoll Seafood

- Beaver Street Fisheries

- Castlerock Inc.

- Clearwater Seafood

- High Liner Foods

- Iglo Group

- Leroy Seafood

- Lyons Seafoods

- M&J Seafood Ltd.

- Marine Harvest

- Marine International

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha

- Pacific Seafood Group

- Premium Seafood Company Inc.

- Sykes Seafood

- Tassal Group

- Toyo Suisan Kaisha

- Tri Marine International

The global frozen seafood market is segmented as follows:

By Form Segment Analysis

By Form Segment Analysis

- Processed

- Raw

By Product Type Segment Analysis

By Product Type Segment Analysis

- Fish

- Mollusks

- Crustaceans

- Shellfish

- Others

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Offline

- Hypermarket/Supermarket

- Specialty Stores

- Convenience Stores

- Online

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- AquaChile

- Austevoll Seafood

- Beaver Street Fisheries

- Castlerock Inc.

- Clearwater Seafood

- High Liner Foods

- Iglo Group

- Leroy Seafood

- Lyons Seafoods

- M&J Seafood Ltd.

- Marine Harvest

- Marine International

- Maruha Nichiro Corporation

- Nippon Suisan Kaisha

- Pacific Seafood Group

- Premium Seafood Company Inc.

- Sykes Seafood

- Tassal Group

- Toyo Suisan Kaisha

- Tri Marine International

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors