Search Market Research Report

Construction Sealants Market Size, Share Global Analysis Report, 2022 – 2028

Construction Sealants Market By Resin Type (Silicone, Polyurethane, Polysulfide, Plastisol, Emulsion, Butyl-based, Others), By Application (Glazing, Flooring & Joining, Sanitary & Kitchen, Others), By End-Use Industry (Residential, Industrial, Commercial), By Technology (Water-Based, Solvent-Based, Reactive, Others), By Function (Bonding, Protection, Insulation, Soundproofing, Cable Management), and By Region - Global Industry Insights, Growth, Size, Share, Comparative Analysis, Trends and Forecast 2022 – 2028

Industry Insights

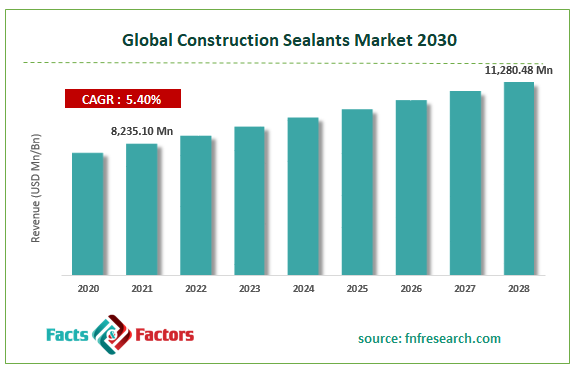

[210+ Pages Report] According to Facts and Factors, the global construction sealant market was valued at USD 8,235.10 million in 2021 and is predicted to increase at a CAGR of 5.40% to USD 11,280.48 million by 2028. The study examines the market in terms of revenue in each of the major regions, which are classified into countries.

Market Overview

Market Overview

Construction sealants have a wide range of applications. Glazing, flooring and joining, and sanitary and kitchen are just a few of the key applications for construction sealants. These applications are growing, which has propelled the building sealants market's expansion. The construction sealants market is being pushed by the rising use of sealants in newer applications in the construction industry, such as ductwork, anchoring, and structural glazing. Window framing, sanitary & kitchen, expansion joints, floor systems, walls, and panels all employ construction sealants. They provide stress-bearing capability and prevent cracking under changing atmospheric conditions. Increased investment in construction activities such as airports, bridges, dams, and metro stations is driving up demand for sealants for flooring, expansion joints, panels, and other applications.

The rising demand for permanent, non-slum housing in developing countries is being driven primarily by population growth, urbanization, and rising income. The construction sealants market is being driven by these countries' rapid growth in residential housing. The demand for green sealants or those with low VOCs is increasing as a result of a growing trend in various applications to use environmentally friendly or green products. Shifting to a more sustainable product portfolio has created significant growth opportunities for the industry. There is a growing trend in the construction market to use environmentally friendly or green buildings; thus, green and more sustainable sealant solutions have high growth potential. Sealant solutions are made from renewable, recycled, remanufactured, or biodegradable materials, which are also good for the occupants' health.

Impact of COVID – 19

Impact of COVID – 19

The global construction silicone sealants market is expected to slow in 2020-2021 as the construction industry is hit hard by the covid-19 pandemic. The pandemic has had an impact on both material and labor costs, as well as key cost components of construction projects. Countries such as China and Italy have slowed their manufacturing sectors, resulting in a significant decrease in the production of a wide range of materials ranging from steel to cement. Contractors who rely on Chinese goods and materials are likely to face higher costs, a shortage of construction materials, and a slower completion of projects. As a result, prices will rise and more projects will be canceled.

The complete research study looks at both the qualitative and quantitative aspects of the Construction Sealant market. Both the demand and supply sides of the market have been investigated. The demand side study examines market income in various regions before comparing it to all of the major countries. The supply-side research examines the industry's top rivals, as well as their regional and global presence and strategies. Each major country in North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America is thoroughly investigated.

Segmentation Analysis

Segmentation Analysis

The global Construction Sealant market is segregated based on resin type, application, end-use industry, technology and function.

Based on resin type, silicone construction sealants are expected to lead the construction sealants market during the forecast period. Silicone sealants are widely used in glazing, bathrooms, and kitchens. The growing use of silicone sealants in expansion joints for joining dissimilar materials provides weather protection to high-rise buildings as well as flexibility for airport runways and highways because these sealants remain pliable and do not crack in warm weather or become brittle and crack in cold weather, is driving their market.

Based on the application, the glazing segment is expected to grow at the fastest rate during the forecast period. Due to ongoing investments in infrastructure development, increasing urbanization, and rising living standards in emerging countries, the glazing construction sealants market is the fastest-growing in the world. The growing housing sector, ongoing urbanization, rising income levels, and favorable government policies drive the construction sealants market in the glazing application.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 8,235.10 Million |

Projected Market Size in 2028 |

USD 11,280.48 Million |

CAGR Growth Rate |

5.40% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

3M (U.S.), Bostik (France), Sika (Switzerland), H.B. Fuller (U.S.), Henkel (Germany), BASF (Germany), Dow (U.S.), Wacker (Germany), General Electric (U.S.), MAPEI (Italy), Asian Paints (India), ITW (U.S.), Soudal (Belgium), Konishi (Japan), DAP Products (U.S.), Pidilite (India), KCC (Korea), Yokohama Rubber (Japan), Franklin (U.S.), Selena (Poland), Kömmerling (Germany), PCI (Germany), Hodgson Sealants (U.K.), Pecora (U.S.), Euclid (U.S.) , and Others |

Key Segment |

By Resin Type, Application, End-Use Industry, Technology, Function, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

APAC has risen to become the world's leading consumer and producer of construction sealants. The growth of the Asia-Pacific construction sealants market is being driven by increased foreign investment due to low labor costs and the availability of raw materials.

Government proposals to improve manufacturing, as well as an increase in the construction of end-use industries such as steel manufacturing plants, helicopter manufacturing plants, new service centers, wind power plants, oil processing plants, high-speed rail lines, airport expansions, and thermal and nuclear power plants, are expected to drive the construction sealants market.

Competitive Landscape

Competitive Landscape

List of Key Players in the Global Construction Sealant Market:

- 3M (U.S.)

- Bostik (France)

- Sika (Switzerland)

- H.B. Fuller (U.S.)

- Henkel (Germany)

- BASF (Germany)

- Dow (U.S.)

- Wacker (Germany)

- General Electric (U.S.)

- MAPEI (Italy)

- Asian Paints (India)

- ITW (U.S.)

- Soudal (Belgium)

- Konishi (Japan)

- DAP Products (U.S.)

- Pidilite (India)

- KCC (Korea)

- Yokohama Rubber (Japan)

- Franklin (U.S.)

- Selena (Poland)

- Kömmerling (Germany)

- PCI (Germany)

- Hodgson Sealants (U.K.)

- Pecora (U.S.)

- Euclid (U.S.)

The global Construction Sealant market is segmented as follows;

By Resin Type Segment Analysis

By Resin Type Segment Analysis

- Silicone

- One-Component

- Two-Component

- Polyurethane

- One-Component

- Two-Component

- Polysulfide

- One-Component

- Two-Component

- Plastisol

- Emulsion

- Butyl-based

- Others (acrylic, epoxy, bitumen-based, and other hybrid sealants)

By Application Segment Analysis

By Application Segment Analysis

- Glazing

- Flooring & Joining

- Sanitary & Kitchen

- Others

By End-Use Industry Segment Analysis

By End-Use Industry Segment Analysis

- Residential

- Industrial

- Commercial

By Technology Segment Analysis

By Technology Segment Analysis

- Water-Based

- Solvent-Based

- Reactive

- Others

By Function Segment Analysis

By Function Segment Analysis

- Bonding

- Protection

- Insulation

- Soundproofing

- Cable Management

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- 3M (U.S.)

- Bostik (France)

- Sika (Switzerland)

- H.B. Fuller (U.S.)

- Henkel (Germany)

- BASF (Germany)

- Dow (U.S.)

- Wacker (Germany)

- General Electric (U.S.)

- MAPEI (Italy)

- Asian Paints (India)

- ITW (U.S.)

- Soudal (Belgium)

- Konishi (Japan)

- DAP Products (U.S.)

- Pidilite (India)

- KCC (Korea)

- Yokohama Rubber (Japan)

- Franklin (U.S.)

- Selena (Poland)

- Kömmerling (Germany)

- PCI (Germany)

- Hodgson Sealants (U.K.)

- Pecora (U.S.)

- Euclid (U.S.)

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors