Search Market Research Report

Vegan Tuna Market Size, Share Global Analysis Report, 2024 – 2032

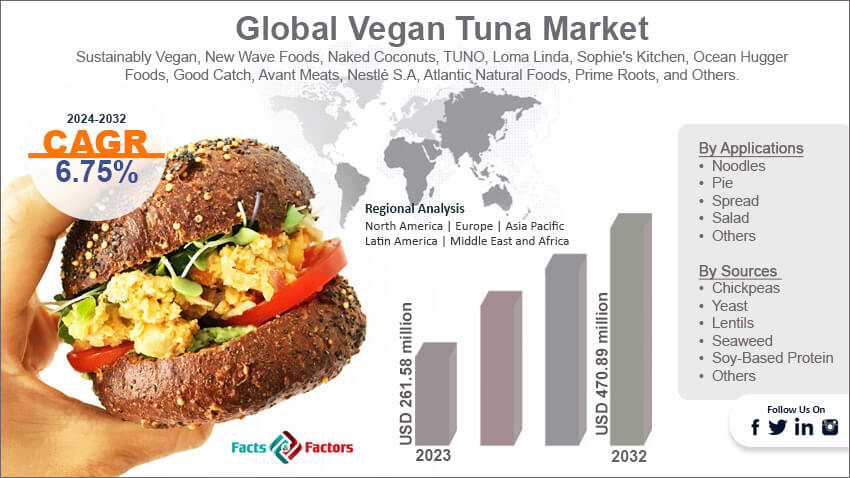

Vegan Tuna Market Size, Share, Growth Analysis Report By Distribution Channels (Specialty Food Stores, Supermarkets, Convenience Stores, Online Retailers, and Others), By Applications (Noodles, Pie, Spread, Salad, and Others), By Sources (Chickpeas, Yeast, Lentils, Seaweed, Soy-Based Protein, and Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

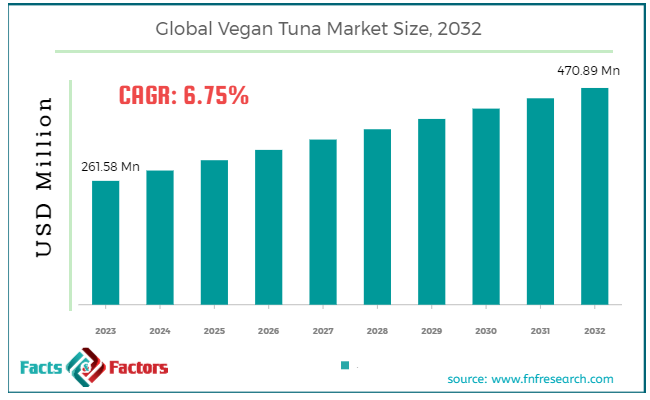

[210+ Pages Report] According to Facts and Factors, the global vegan tuna market size was valued at USD 261.58 million in 2023 and is predicted to surpass USD 470.89 million by the end of 2032. The vegan tuna industry is expected to grow by a CAGR of 6.75% between 2024 and 2032.

Market Overview

Market Overview

The increasing concern about damaging marine sources is a major reason for the high growth rate of the global vegan tuna market. Vegan tuna attracts people because it lowers the dependency on fish stocks which further lowers the negative impact on marine ecosystems.

Additionally, the growing interest of people in maintaining their health and wellness is also driving their interest in plant-based options like vegan tuna. It is a high-quality source of protein which further attracts consumers. For instance, Nestle came up with Sensational Vuna in 2023. It is a vegan tuna alternative, which is likely to mark the company’s giant step plant-based seafood sector.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global vegan tuna market size is estimated to grow annually at a CAGR of around 6.75% over the forecast period (2024-2032).

- In terms of revenue, the global vegan tuna market size was valued at around USD 261.58 million in 2023 and is projected to reach USD 470.89 million by 2032.

- Growing awareness regarding sustainability is driving the growth of the global vegan tuna market.

- Based on the distribution channels, the supermarket segment is growing at a high rate and is projected to dominate the global market.

- Based on the applications, the noodles segment is projected to swipe the largest market share.

- Based on the sources, the soy-based protein segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing awareness regarding sustainability is driving the growth of the global market.

The increasing concerns on damaging of marine sources is a major reason for the high growth rate of the global vegan tuna market. Vegan tuna is attracting people because it lowers the dependency on fish stocks which further lower negative impact on marine ecosystems.

Additionally, the growing interest of people on maintaining their health and wellness is also driving their interest in plants-based options like vegan tuna. It is a high-quality source of protein which further attracts consumers. For instance, Nestle came up with Sensational Vuna in 2023. It is a vegan tuna alternative, which is likely to mark the company’s giant step plant-based seafood sector.

Restraints

Restraints

- High prices are likely to hamper the growth of the global market.

Vegan tuna is priced higher than traditional animal-based products which is a major reason expected to slow down the growth trajectory of the vegan tuna industry during the forecast period. These products are priced high because they are manufactured from high-quality plant-based ingredients. Still, the premium pricing deters price-sensitive consumers from buying these products on a regular basis.

Opportunities

Opportunities

- Foodservice expansion is expected to foster growth opportunities in the global market.

The partnerships between mainstream retailers and food companies are likely to widen the scope of the global vegan tuna market in the forthcoming years. These collaborations are expanding the availability of these products in restaurants, online platforms, and supermarkets, which will increase their accessibility among consumers and thereby increase their adoption rates.

Additionally, endorsements from influencers, celebrities, and public figures are also playing a major role in raising awareness among people regarding the health benefits of vegan products like tuna.

Challenges

Challenges

- Supply chain disruptions are a big challenge in the global market.

The inconsistent supply of raw materials is likely to restrain the growth of the vegan tuna industry. Sourcing these key ingredients like seaweed extracts and other specialized plant proteins on a regular basis is a big challenge in front of food companies in the industry. Also, the limited availability of products across the channels is expected to restrain the market growth in the coming years.

Segmentation Analysis

Segmentation Analysis

The global vegan tuna market can be segmented into distribution channels, applications, sources, and regions.

On the basis of distribution channels, the market can be segmented into specialty food stores, supermarkets, convenience stores, online retailers, and others. The supermarket segment accounts for the largest share of the vegan tuna industry during the forecast period. Supermarkets offer a wider customer reach and have extensive distribution networks. Supermarkets offer convenience to people by offering a wide range of products under one roof.

Also, it is easier for consumers to shop for such products alongside their regular grocery shopping. Moreover, supermarkets offer high product visibility by allocating a good amount of shelf space to plant-based alternatives. This increase in visibility is one of the major reasons for the high trial purchase of these products.

Additionally, supermarkets include many promotional and marketing activities by highlighting trending products. Vegan products like tuna are high in popularity, and therefore, supermarkets are adding such products to drive their sales and increase market share. Also, the growing preference of people towards plant-based diets because of ethical, environmental, and health reasons is leading food companies to come up with innovative vegan alternatives in the market.

On the basis of application, the market can be segmented into noodles, pie, spread, salad, and others. The noodles segment is likely to dominate the global vegan tuna market in the coming years. Noodles are a popular and versatile food item that is gaining high popularity in the market. Noodles are cooked in different ways like boiled, stirred, fry, and soups.

Therefore, complimenting the vegan tuna with noodle dishes makes them an attractive option for people looking for yummy plant-based meals. Noodles improve their flavor and nutritional profile, which is a major reason for their high demand in the market.

Noodle is a staple in many regions which pose a strong cultural significance and acceptance in the society. Food companies are investing heavily in boosting their research activities in order to come up with innovations to align with the emerging requirements of consumers.

Furthermore, consumers are becoming more health conscious which is driving them to plant-based alternatives to traditional seafood and meat products. Vegan tuna is a good source of protein and essential nutrients. Also, it does not increase cholesterol in the human body. Also, noodles are highly accessible to consumers across the globe.

On the basis of source, the market can be segmented into chickpeas, yeast, lentils, seaweed, soy-based protein, and others. Soy-based protein is the fastest-growing segment in the vegan tuna industry. Soy is viewed as a complete protein meal because it contains all important amino acids, vitamins, fiber, and minerals. The soy-based protein is processed into different forms like temp, tofu, texture, vegetable protein, and many others. However, this versatility helps manufacturers come up with a variety of innovative products like sausages, burgers, and others, thereby catering to a large culinary application.

Furthermore, soy production is considered to be more environmentally friendly because it needs fewer sources to process a complete product. Startups and many food companies are investing in research and development activities to come up with new products that can mimic the taste and texture of animal-derived foods. The emerging demand for delicious plant-based foods is driving the demand for soy-based products. All these factors are contributing to the growing demand for plant-based foods in the global market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 261.58 Million |

Projected Market Size in 2032 |

USD 470.89 Million |

CAGR Growth Rate |

6.75% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Sustainably Vegan, New Wave Foods, Naked Coconuts, TUNO, Loma Linda, Sophie's Kitchen, Ocean Hugger Foods, Good Catch, Avant Meats, Nestlé S.A, Atlantic Natural Foods, Prime Roots, and Others. |

Key Segment |

By Distribution Channels, By Applications, By Sources, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is the fastest growing region in the global vegan tuna market during the forecast period. There is a growing demand for plant-based alternatives in the region because of many factors like environmental sustainability, mercury contamination, and overfishing. A growing number of people in the region are transitioning to a plant-based diet which is a major reason for the high growth rate of the market.

Also, the food manufacturers in the region are innovating with raw materials and other ingredients to come up with unique vegan tuna cuisines that capture a large market area. People in the region are demanding plant-based tuna made from seaweed, extracts, con pea protein, soy protein, and others.

Asia Pacific is also likely to dominate the vegan tuna industry during the forecast period. The region has diverse culinary traditions and dietary preferences which is a major reason for the positive influence of the market in the region. Also, the region has a strong preference for seafood. Still, due to the growing awareness among people regarding sustainability and animal welfare issues, there is a growing demand for plant-based alternatives in the region.

Moreover, the growing middle-class population and urbanization rate in the region are significantly widening the scope of plant-based diets like vegan tuna in the region. The growing health concerns among people, like diabetes, heart disease, and obesity, are further accentuating the demand for healthier food options among consumers. The region is home to the world's largest fishing industry, and therefore, it is creating concerns among people in the region regarding habitat destruction, overfishing, and pollution, which in turn is transitioning people from traditional seafood products to sustainable plant-based alternatives.

Competitive Analysis

Competitive Analysis

The key players in the global vegan tuna market include:

- Sustainably Vegan

- New Wave Foods

- Naked Coconuts

- TUNO

- Loma Linda

- Sophie's Kitchen

- Ocean Hugger Foods

- Good Catch

- Avant Meats

- Nestlé S.A

- Atlantic Natural Foods

- Prime Roots

For instance, Atlantic Natural Foods came up with an innovative product in 2022, which is a blend of texture and flavor. It is the result of the company's intense research activities along with growing investments.

The global vegan tuna market is segmented as follows:

By Distribution Channels Segment Analysis

By Distribution Channels Segment Analysis

- Specialty Food Stores

- Supermarkets

- Convenience Stores

- Online Retailers

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Noodles

- Pie

- Spread

- Salad

- Others

By Sources Segment Analysis

By Sources Segment Analysis

- Chickpeas

- Yeast

- Lentils

- Seaweed

- Soy-Based Protein

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Sustainably Vegan

- New Wave Foods

- Naked Coconuts

- TUNO

- Loma Linda

- Sophie's Kitchen

- Ocean Hugger Foods

- Good Catch

- Avant Meats

- Nestlé S.A

- Atlantic Natural Foods

- Prime Roots

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors