Search Market Research Report

Tilt Rotor Aircraft Market Size, Share Global Analysis Report, 2025 - 2034

Tilt Rotor Aircraft Market Size, Share, Growth Analysis Report By Type (Manned and Unmanned), By Rotor Type (Twin Rotors, Quad Rotors and Others), By End-Use (Commercial and Government and Military), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

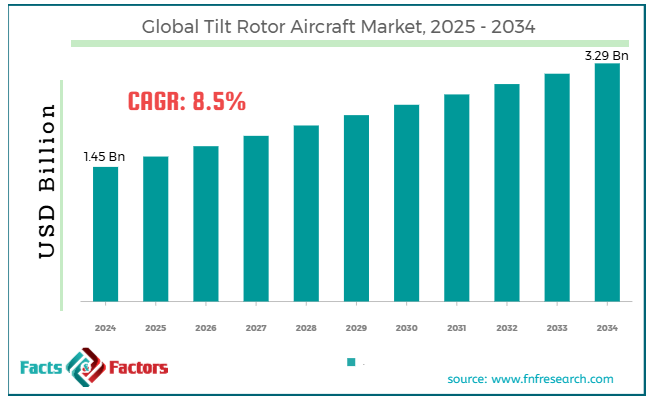

[230+ Pages Report] According to Facts & Factors, the global tilt rotor aircraft market size was worth around USD 1.45 billion in 2024 and is predicted to grow to around USD 3.29 billion by 2034 with a compound annual growth rate (CAGR) of roughly 8.5% between 2025 and 2034.

Market Overview

Market Overview

A tilt rotor aircraft is propelled forward by the push and lifting force produced by one or more rotors attached to a rotating engine cover or basket. When their rotors are oriented vertically, tiltrotors may ascend vertically. It has the same speed and range as a fixed wing aircraft when its rotors are in a horizontal position. For the intended movement direction, the rotors can alternatively be utilized at an angle.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global tilt rotor aircraft market is estimated to grow annually at a CAGR of around 8.5% over the forecast period (2025-2034).

- In terms of revenue, the global tilt rotor aircraft market size was valued at around USD 1.45 billion in 2024 and is projected to reach USD 3.29 billion, by 2034.

- The growing defense expenditure is expected to drive market growth over the forecast period.

- Based on the type, the manned segment is expected to dominate the market during the forecast period.

- Based on the rotor type, the twin rotors segment is expected to capture the largest market share over the forecast period.

- Based on the end-use, the government and military segment are expected to hold a prominent market share during the forecast period.

- Based on region, North America is expected to dominate the market during the forecast period.

Growth Drivers

Growth Drivers

- Rising sustainability initiative drives market growth

The growing focus on sustainability, especially on electric power systems, is one of the most recent developments in the tilt rotor aircraft sector. Aerospace firms are spending money on R&D to build electric tilt rotor aircraft as environmental effects and climate change worries grow. When compared to conventional fuel-powered models, these aircraft are meant to produce less noise pollution, carbon emissions, and operating costs. Electric tilt rotor aircraft are becoming increasingly practical thanks to developments in battery science and electric propulsion systems, which could result in longer flying times and more efficiency.

Governments and regulatory agencies are also encouraging the use of electric aircraft by enacting pollution rules and funding initiatives. Because of this, electric tilt rotor aircraft have a lot of potentials to be important in the future of sustainable aviation, serving both the military and the commercial sector and aiding in the fight against climate change on a worldwide scale.

Restraints

Restraints

- Regulatory challenges and lengthy certification procedures hinder market growth

One major impediment is the strict regulatory requirements and certification procedures for tilt rotor aircraft. New aircraft configuration development and certification entail stringent testing, adherence to safety regulations, and securing regulatory permissions from aviation authorities. The release of new tilt rotor models to the market may be delayed by these procedures, which can be expensive and time-consuming.

Regulatory bodies also face difficulties in developing suitable certification requirements due to the special operating features of tilt rotor aircraft, such as their ability to do vertical takeoff and landing (VTOL) and their ability to switch between vertical and horizontal flight. To assure safety and promote innovation in tilt rotor technology, industry players and regulatory organizations must work closely together to address these regulatory obstacles.

Opportunities

Opportunities

- Increasing collaboration offers a lucrative opportunity for market growth

Increasing collaboration is expected to offer an attractive opportunity for the digital ATC tower market over the projected timeframe. For instance, in March 2024, a Memorandum of Understanding (MOU) was signed by Bell Textron Inc., a Textron Inc. firm, and Leonardo S.p.A. to assess potential areas of cooperation in the tiltrotor technology domain. Bell and Leonardo have a long history of industrial cooperation on both traditional helicopters and tiltrotor technology. They are both global leaders in the design, manufacture, and service of rotorcraft for both commercial and military purposes.

With Bell's backing, Leonardo will lead the development of a tiltrotor design concept for the NATO Next Generation Rotorcraft Capability (NGRC) Concept Study, marking the official start of the collaborative effort.

Challenges

Challenges

- Limited range and payload pose a major challenge to market expansion

When it comes to payload capacity and endurance, tiltrotor aircraft are nevertheless constrained, especially while operating in vertical flight mode, even though they have greater speed and range than helicopters. For long-range missions or high lift applications in particular, finding the ideal balance between payload, range, and endurance continues to be difficult.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.45 Billion |

Projected Market Size in 2034 |

USD 3.29 Billion |

CAGR Growth Rate |

8.5% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Honeywell International Inc., Rostec, Israel Aerospace Industries Ltd, Leonardo S.p.A, Aviation Industry Corporation of China Ltd., Northrop Grumman Corporation, Lockheed Martin Corporation, Bell Textron Inc., BAE Systems plc, Boeing, and others. |

Key Segment |

By Type, By Rotor Type, By End-Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global tilt rotor aircraft industry is segmented based on type, rotor type, end-use and region.

Based on the type, the global tilt rotor aircraft market is bifurcated into manned and unmanned. The manned segment is expected to dominate the market during the forecast period. Several factors, including military requirements, commercial opportunities, technology breakthroughs, and changing operational needs, are driving expansion in the manned tiltrotor aircraft market. With the growing need for adaptable vertical lift solutions, manned tiltrotor aircraft will be essential in meeting a variety of mission needs in the military and commercial domains.

Based on the rotor type, the global tilt rotor aircraft industry is segmented into twin rotors, quad rotors and others. The twin rotors segment is expected to capture the largest market share over the forecast period. The payload capacity of twin rotor designs is generally higher than those of single rotor versions. These aircraft can carry greater payloads, such as passengers, freight, equipment, and mission-specific payloads because the lift is divided across two rotors. Twin-rotor tiltrotor aircraft can now serve a wider range of missions because of their greater payload capacity, which is boosting demand from both military and commercial operators.

Based on the end-use, the global tilt rotor aircraft market is segmented into commercial government and military. The government and military segment are expected to hold a prominent market share during the forecast period. Tilt rotor aircraft are highly suitable for a variety of military missions due to their unique characteristics. Rapid deployment, long-range transportation, aerial refueling, and surveillance are just a few of the operational scenarios they can adapt to because of their high-speed forward flight, hover efficiency, and ability to undertake vertical takeoff and landing (VTOL) missions. Due to their adaptability, tilt rotor aircraft are significant assets for military operations in the air, sea, and land. Thereby, driving the market growth.

Regional Analysis

Regional Analysis

- North America is expected to dominate the market during the forecast period

North America is expected to dominate the market over the forecast period. The primary factors behind this dominance include the existence of significant aerospace firms that are leading the way in the development of tilt rotor technology, like Bell, Boeing, and Lockheed Martin.

Furthermore, the market for tilt rotor aircraft is largely driven by the United States due to its strong military and commercial aviation sectors. Tilt rotor systems, like the Bell Boeing V-22 Osprey, which has been widely used in numerous operations across the globe, have found a significant market, particularly with the U.S. military. North America's superiority in the tilt rotor aircraft market is also largely due to its developed infrastructure, progressive regulatory framework, and significant expenditure in aerospace R&D.

On the other hand, the Asia Pacific is expected to grow at the highest CAGR during the forecast period. The regional expansion of the market is attributed to its increasing defense spending. China, India, Japan, South Korea, Australia, and other nations in the Asia-Pacific region are among those boosting their defense budgets to modernize and strengthen their armed forces.

Manufacturers of tilt-rotor aircraft now have an opportunity to deliver cutting-edge aerial platforms for a range of military uses, such as troop transport, special operations support, marine surveillance, and disaster relief, due to the increase in defense expenditure.

For instance, SIPRI data shows that since 1992, China's military spending has surged by about nine hundred percent. Compared to the Russians, who spent about $72 billion, the Chinese spent a substantial $300 billion in 2022.

Competitive Analysis

Competitive Analysis

The global tilt rotor aircraft market is dominated by players like:

- Honeywell International Inc.

- Rostec

- Israel Aerospace Industries Ltd

- Leonardo S.p.A

- Aviation Industry Corporation of China Ltd.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Bell Textron Inc.

- BAE Systems plc

- Boeing

The global tilt rotor aircraft market is segmented as follows:

By Type

By Type

- Manned

- Unmanned

By Rotor Type

By Rotor Type

- Twin Rotors

- Quad Rotors

- Others

By End-Use

By End-Use

- Commercial

- Government and Military

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Honeywell International Inc.

- Rostec

- Israel Aerospace Industries Ltd

- Leonardo S.p.A

- Aviation Industry Corporation of China Ltd.

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Bell Textron Inc.

- BAE Systems plc

- Boeing

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors