Search Market Research Report

Aircraft Component Market Size, Share Global Analysis Report, 2025 – 2034

Aircraft Component Market Size, Share, Growth Analysis Report By End-Users (Military Aviation And Civil Aviation), By Service Provider Types (Military MRO Units, Third-Party MRO Providers, Airlines, OEMs, And Others), By Aircraft Types (Turbofan, Turbojet, Turboshaft, Turboprops, And Others), By Components (Fuel Systems, Pneumatic Systems, Hydraulic Systems, Electric Systems, Airframe Components, Landing Gear, Avionics, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

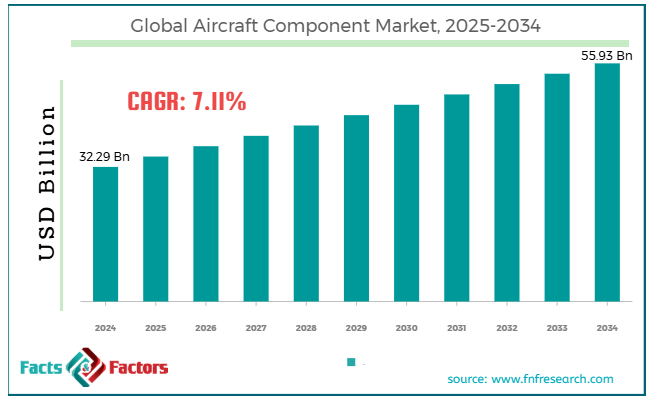

[215+ Pages Report] According to Facts & Factors, the global aircraft component market size was valued at USD 32.29 billion in 2024 and is predicted to surpass USD 55.93 billion by the end of 2034. The aircraft component industry is expected to grow by a CAGR of 7.11% between 2025 and 2034.

Market Overview

Market Overview

Aircraft components refer to the individual parts that help in manufacturing aircraft and enable its functioning. Such components are crucial for the safety and functionality of both commercial and military aircraft. There are various types of aircraft components available on the market, including airframes, electrical systems, hydraulic and pneumatic systems, cabin interiors, fuel systems, sensor systems, and many others. These aircraft can be customized with the required configuration for different end-users. Also, the increasing integration of AI and sensors is boosting the functionality of these aircraft.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global aircraft component market size is estimated to grow annually at a CAGR of around 7.11% over the forecast period (2025-2034).

- In terms of revenue, the global aircraft component market size was valued at around USD 32.29 billion in 2024 and is projected to reach USD 55.93 billion by 2034.

- Increasing passenger traffic is driving the growth of the global aircraft component market.

- Based on the end-users, the military aviation segment is growing at a high rate and is projected to dominate the global market.

- Based on service provider types, the OEM segment is anticipated to grow with the highest CAGR in the global market.

- Based on the aircraft types, the turbofan segment is projected to swipe the largest market share.

- Based on components, the engine segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Will increasing passenger traffic positively impact the growth of the global aircraft component market?

The global air passenger traffic is rising continuously, driving a huge demand for additional aircraft and associated components. Also, manufacturers are modernizing airlines with more fuel-efficient models. Additionally, the growth of urban air mobility is generating a substantial demand for lightweight and customized components. The rising demand for MRO services is likely to revolutionize the global aircraft component market. Critical parts, such as compressor engine blades, are more prone to wear and tear and, therefore, require periodic inspection and service.

Moreover, airlines are shifting toward AI-based predictive maintenance, which is expected to influence the industry's growth further positively. The boom in the aftermarket is also likely to boost the industry's development, as airlines are increasingly signing component pooling contracts. However, technological advancements in aircraft components are expected to reshape the future of the market.

For instance, advancements in smart avionics, such as the launch of advanced cockpit displays, autothrottle, and other AI-integrated systems, are expected to be a significant driver of the market. For instance, Honeywell revealed its 10-year deal with Saudia Technic in 2023. This agreement is expected to establish a full-service MRO for Boeing 777 APUs in the Middle East.

Restraints

Restraints

- How do high manufacturing costs restrain the growth of the global aircraft component market?

The high cost of manufacturing aircraft components presents a formidable challenge in the aircraft component industry. Moreover, the escalating burden of producing affordable, advanced tools with precise engineering is further limiting the industry's growth.

Opportunities

Opportunities

- Military modernization programs are likely to foster growth opportunities in the global market.

Governments of all the leading countries are investing heavily in military modernization programs, which are a key driver in the evolution of the global aircraft component market. For instance, manufacturers are using radar-absorbing materials, which are gaining immense traction among end users. Moreover, the emergence of next-generation engines with CMC turbine blades is also expected to intensify the market's growth. Airlines are demanding customized reconfiguration capabilities for their cabins, featuring lightweight interiors, which is expected to further prompt the development of the industry.

The emergence of regional aircraft is a pivotal trend that is likely to expand the market further. These aircraft are likely to drive massive demand for cost-effective and lightweight components. Many industrial policies are also positively responding to this trend by boosting domestic aerospace supply chains and local defense manufacturing. For instance, Air Serbia and Lufthansa Technik (LHT) agreed to a five-year contract with Sri Lankan Airlines for LEAP-1A engine MRO services in 2023.

Challenges

Challenges

- The complex regulatory landscape is a big challenge in the global market.

Components require certificates from official authorities, such as the DGCA, FAA, and EASA, for approval purposes. Additionally, the entire regulatory process is time-consuming, leading to delays in manufacturing and the launch of components. Moreover, varying military and defense projects in different economies are expected to impact growth. Therefore, such factors are likely to be a big challenge in the aircraft component industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 32.29 Billion |

Projected Market Size in 2034 |

USD 55.93 Billion |

CAGR Growth Rate |

7.11% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Bridgestone Corporation, Magellan Aerospace, Stelia Aerospace, Curtiss-Wright Corporation, Triumph Group, Daher Group, FACC AG, Premium AEROTECH GmbH, Chemetall GmbH, Parker-Hannifin Corporation, Dassault Systèmes SE, Zodiac Aerospace, Panasonic Avionics Corporation, Spirit Aerosystems Inc., DuCommun Incorporated, Hexcel Corporation, Liebherr International AG, Elektro-Metall Export GmbH, Diel Aviation Holding GmbH, Lufthansa Technik AG, Composite Technology Research Malaysia Sdn. Bhd., Mitsubishi Heavy Industries Ltd., Honeywell International Inc., Aero Engineering & Manufacturing Co., Engineered Propulsion System, CAMAR Aircraft Parts Company, and others. |

Key Segment |

By End-Users, By Service Provider Types, By Aircraft Types, By Components, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global aircraft component market can be segmented into end-users, service provider types, aircraft types, components, and regions.

Based on end-users, the market can be segmented into military aviation and civil aviation. Military aviation is expected to account for the largest share of the aircraft component industry during the forecast period. There is a significant spike in the programs for global military modernization. The US market is making a multi-million-dollar investment in advanced aircraft to upgrade its legacy. Europe is also driving demand for next-generation fighter components. Such programs from different regions are fostering massive demand for advanced and customized aircraft components, which is a major factor driving the growth of the global market. The rising trend to customize military components according to the requirements of aircraft and fleets is also expected to revolutionize the market. There is a significant demand for armored components and high-stress airframes. However, demand for such complex aircraft contributes to the higher sales revenue of the segment.

Based on service provider types, which segment will dominate the aircraft component market?

The market can be segmented into military MRO units, third-party MRO providers, airlines, OEMs, and others. The OEM segment is likely to dominate the global aircraft component market during the forecast period. Many aircraft OEMs are witnessing demands for backlogs, which is expected to transform the market. Such demand for backlogs, even beyond 2030, is expected to contribute to the high sales volume in the segment. OEMs offer next-generation aircraft development with high-performance components and customized design. Additionally, OEM revenue is higher due to the high initial manufacturing costs, integration, and supply of services for these parts.

Based on aircraft types, the market can be segmented into turbofan, turbojet, turboshaft, turboprop, and others. The turbofan segment is expected to experience significant developments during the forecast period. Turbofans have widespread applications in various aircraft, including military, business, and commercial jets, which is driving growth in the segment. However, technological advancements in turbofan design are also likely to revolutionize the market. Geared turbofans enhance fuel efficiency, and additive manufacturing facilitates the creation of lighter parts. Turbo fans are widely used in complex maintenance, thereby fostering demand for module and engine health monitoring systems.

On the component types, the market can be segmented into fuel systems, pneumatic systems, hydraulic systems, electric systems, airframe components, landing gear, avionics, and others. The engine component is the fastest-growing segment in the global aircraft component market during the forecast period. The engine plays a critical role in every aircraft. It has a direct impact on noise compliance, fuel efficiency, and thrust-to-weight ratio. However, the ongoing innovations are likely to further widen the scope of the segment during the forecast period. Engine components are more prone to heavy wear and tear, which further poses a demand for frequent maintenance, generating high revenue in the aftermarket.

Regional Analysis

Regional Analysis

- What factors help North America dominate the global aircraft component market?

North America is expected to lead the global aircraft component market during the forecast period. There is a significant influx of investments in engine components, such as ultra-high bypass engines and geared turbofans. Additionally, there is a growing demand for Parts Manufacturer Approval (PMA). North America is shifting more towards next-gen cockpit systems and other advanced technologies, which are further fostering significant growth opportunities in the market

However, the United States is likely to dominate the North American market due to its strong aftermarket. Leading companies in North America are expanding the scope of the regional market. The United States has a robust, world-class MRO ecosystem, which plays a crucial role in driving the market's growth. Canada is also likely to experience growth in the coming years due to the focus on engine components in both the manufacturing and MRO sectors. Additionally, Mexico is leading the North American market due to its rapidly growing aerospace sector.

The Asia-Pacific region is another major area likely to experience significant developments in the coming years. The rapid expansion of MROs, particularly in countries such as Australia, Singapore, and China, is a testament to the growth in the region. The surge in demand for engines, driven by rising passenger traffic, is also paving the way for a high-growth trajectory. China is the most significant market player in the APAC region due to its production of engines, AI-based sensors, and composites. Moreover, India is the fastest-growing country with major OEM partnerships.

Additionally, the country's rising domestic defense aircraft budget is also a transformative force in the market. For instance, HAECO collaborated with Emirates to offer specialized overhaul services in 2025. This service is for the Boeing 777 fleet airline.

Competitive Analysis

Competitive Analysis

The key players in the global aircraft component market include:

- Bridgestone Corporation

- Magellan Aerospace

- Stelia Aerospace

- Curtiss-Wright Corporation

- Triumph Group

- Daher Group

- FACC AG

- Premium AEROTECH GmbH

- Chemetall GmbH

- Parker-Hannifin Corporation

- Dassault Systèmes SE

- Zodiac Aerospace

- Panasonic Avionics Corporation

- Spirit Aerosystems Inc.

- DuCommun Incorporated

- Hexcel Corporation

- Liebherr International AG

- Elektro-Metall Export GmbH

- Diel Aviation Holding GmbH

- Lufthansa Technik AG

- Composite Technology Research Malaysia Sdn. Bhd.

- Mitsubishi Heavy Industries Ltd.

- Honeywell International Inc.

- Aero Engineering & Manufacturing Co.

- Engineered Propulsion System

- CAMAR Aircraft Parts Company

For instance, AAR successfully acquired the Triumph Group MRO business in 2024 for $725 million. Facilities in the USA and Thailand are expanding the company's global MRO footprint.

The global aircraft component market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Military Aviation

- Civil Aviation

By Service Provider Types Segment Analysis

By Service Provider Types Segment Analysis

- Military MRO Units

- Third-Party MRO Providers

- Airlines

- OEMs

- Others

By Aircraft Types Segment Analysis

By Aircraft Types Segment Analysis

- Turbofan

- Turbojet

- Turboshaft

- Turboprops

- Others

By Components Segment Analysis

By Components Segment Analysis

- Fuel Systems

- Pneumatic Systems

- Hydraulic Systems

- Electric Systems

- Airframe Components

- Landing Gear

- Avionics

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Bridgestone Corporation

- Magellan Aerospace

- Stelia Aerospace

- Curtiss-Wright Corporation

- Triumph Group

- Daher Group

- FACC AG

- Premium AEROTECH GmbH

- Chemetall GmbH

- Parker-Hannifin Corporation

- Dassault Systèmes SE

- Zodiac Aerospace

- Panasonic Avionics Corporation

- Spirit Aerosystems Inc.

- DuCommun Incorporated

- Hexcel Corporation

- Liebherr International AG

- Elektro-Metall Export GmbH

- Diel Aviation Holding GmbH

- Lufthansa Technik AG

- Composite Technology Research Malaysia Sdn. Bhd.

- Mitsubishi Heavy Industries Ltd.

- Honeywell International Inc.

- Aero Engineering & Manufacturing Co.

- Engineered Propulsion System

- CAMAR Aircraft Parts Company

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors