Search Market Research Report

Rigid Packaging Containers Market Size, Share Global Analysis Report, 2023 – 2030

Rigid Packaging Containers Market Size, Share, Growth Analysis Report By End Users (Building & Construction, Automotive, Industrial, Cosmetic & Personal Care, Healthcare, Food & Beverage, And Others), By Manufacturing Processes (Thermoforming, Blow Molding, Injection Molding, Extrusion, And Others), By Materials (Polyvinyl Chloride, Polystyrene & Expanded Polystyrene, Polypropylene, Polyethylene Terephthalate, And Polyethylene), By Products (Caps & Closures, Trays & Containers, Bottles & Jars, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

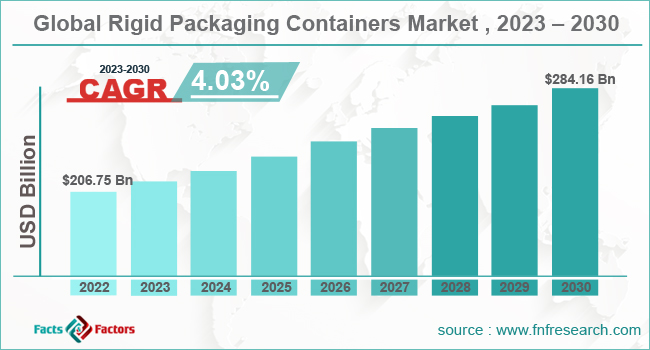

[222+ Pages Report] According to Facts and Factors, the global rigid packaging containers market size was USD 206.75 billion in 2022 and is anticipated to reach USD 284.16 billion by the end of 2030. The global rigid packaging containers market is likely to grow with a healthy CAGR of 4.03% during the anticipated period.

The market report offers detailed analytical insights into the top companies in the global industry. The rigid packaging containers industry report is a mix of both deep primary and secondary research dedicated to discovering the upcoming market trends, growth restraining factors, and opportunities.

Market Overview

Market Overview

Rigid packaging containers are solid packaging solutions made out of paper board, glass, metal, plastic, and others. These containers are manufactured in a way to protect the content during handling, transportation, and storage. They instill their shape to prevent packed items.

These packaging containers come in a large number of shapes, sizes, and forms, thereby catering to diverse products in different end-user sectors. These products are much in demand due to their product visibility, durability, and safety of the package goods.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global rigid packaging containers market size is estimated to grow annually at a CAGR of around 4.03% over the forecast period (2023-2030).

- In terms of revenue, the global rigid packaging containers market size was valued at around USD 206.75 billion in 2022 and is projected to reach USD 284.16 billion by 2030.

- Increase in online retail is expected to positively influence the growth of the global rigid packaging containers market.

- Based on the end-users, the food and beverage industry is likely to be the fastest-growing segment in the global market.

- Based on the manufacturing processes, the injection molding segment is a major contributor to the global market.

- Based on materials, Polyethylene is expected to dominate the global market.

- Based on the products, the bottles and jars account for the largest share of the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- An increase in online retail is expected to positively influence the growth of the global market.

The constant rise of e-commerce platforms is one of the major factors likely to expedite the growth of the global rigid packaging containers market exponentially in the forthcoming years. The increasing habit of people to shop online has significantly spurred the demand for efficient and protective packaging solutions that hold the capability to withstand the rigors of shipping and handling over longer distances.

For instance, Ingredients collaborated with Berry Global to create 100% recycled containers for hair care products. The company makes HDPE bottles at a factory located in Virginia.

Restraints

Restraints

- Substitution by flexible packaging is likely to restrain the growth of the global market.

Flexible packaging solutions like bags and pouches are increasingly gaining popularity owing to the advantages offered to them, like cost effectiveness, lower material consumption, lightweight, etc. Manufacturers are viewing them as ideal alternatives to rigid containers, which is likely to hamper the growth of the rigid packaging containers industry.

Opportunities

Opportunities

- Product innovation and differentiation are likely to offer lucrative opportunities in the global market.

Manufacturers are coming up with packaging innovations like advanced functionalities, eco-friendly materials, unique designs, etc., which help the end users stand out from the crowd and position their brand on store shelves to attract the consumer's attention.

Therefore, such a landscape is likely to offer lucrative growth opportunities in the global rigid packaging containers market. For instance, Amcor Rigid Packaging came up with a new product ClearCor in September 2022 to manufacture DairySeal for the containers of RTD dairy beverages. These bottles can be easily recycled by up to 80%.

Challenges

Challenges

- Environmental concerns are a big challenge in the global market.

The growing concerns regarding environmental health have significantly pushed people towards eco-friendly packaging solutions. Rigid packaging includes raw materials like glass and plastic, which contribute heavily to environmental pollution and increased carbon emissions. However, this particular shift in consumer preferences is a big challenge in the rigid packaging containers industry.

Segmentation Analysis

Segmentation Analysis

The global rigid packaging containers market can be segmented into end users, manufacturing processes, materials, products, and regions.

By end user, the market can be segmented into building & construction, automotive, industrial, cosmetic & personal care, healthcare, food & beverage, and others. The food and beverage industry is likely to be the fastest-growing segment in the global rigid packaging containers market because packaging plays an essential role in offering branding information and providing the safety of food products.

Advanced packaging solutions help preserve the quality of food and extend its shelf life. Rigid packaging containers like cartons, cans, jars, and bottles are some of the widely used packaging formats. Consumers are widely looking for food products that are portable, safe, and convenient to use.

Moreover, manufacturers are coming up with advanced packaging solutions that align with the growing requirement of people, like tampered evidence features, portion control, eco-friendly options, and several others, which in turn is also likely to foster developments in the segment.

By manufacturing process, the market can be segmented into thermoforming, blow molding, injection molding, extrusion, and others. The injection molding segment is a major contributor to the rigid packaging containers industry because of its wide usage in manufacturing processes, particularly in producing plastic packaging containers. It helps inject the molten plastic material into the specific mold to get the needed shape.

Also, its versatility in producing containers of different design, shapes, and sizes help manufacturers meet the increasing demand of their clients. Moreover, these molds are more cost-effective than other available options, particularly when the manufacturers are producing the container units in bulk.

By material, the market can be segmented into polyvinyl chloride, polystyrene & expanded polystyrene, polypropylene, polyethylene terephthalate, and polyethylene. Polyethylene is expected to dominate the rigid packaging containers industry because of its high versatility. Polyethylene can be converted into a large number of sizes and shapes, making it ideal for different packaging containers like jars, bottles, and more.

Additionally, they are more durable than others which makes them ideal to withstand storage and transportation handling processes. Moreover, they have higher resistance to solvents and chemicals, making them ideal for packaging liquids and chemicals. These are light in weight, which reduces transportation costs and energy consumption, thereby making them an ideal choice for customers in the industry.

By product, the market can be segmented into caps & closures, trays & containers, bottles & jars, and others. The bottles and jars account for the largest share of the global rigid packaging containers market because it aligns with the ongoing demand in the industry for consumer goods and appealing packaging solutions.

Additionally, the demand is highly driven by product innovation, consumer preferences, and regulatory requirements. These formats are highly used in household products, personal care, pharmaceutical, and food & beverage industry because they offer the advantage of branding opportunity, convenience, and product protection.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 203.75 Billion |

Projected Market Size in 2030 |

USD 284.16 Billion |

CAGR Growth Rate |

4.03% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Mondi, Crown Holdings, Amcor plc., Berry Global Group, RESILUX NV, Sealed Air, Coveris, Silgan Holdings Inc., MeadWestvaco Corporation, Berry Global Inc., Bemis Company Inc., BALL CORPORATION, Amcor plc, Dow, Ardagh Group S.A., Crown, Tetra Pak International S.A., Reynolds, PLASTIPAL HOLDINGS INC., Holmen, Georgia-Pacific, DS Smith, and Others. |

Key Segment |

By End Users, Manufacturing Processes, Materials, Products, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market during the forecast period.

North America accounts for the largest share of the global rigid packaging containers market. The region is highly influenced by various factors like industrial activity, consumption patterns, and increasing population. The market is expected to grow steadily in the forthcoming years because there is a significant rise in the demand for FMCG goods, and foods & beverages products.

However, the constantly growing end-user industries in the region, like pharmaceuticals, household, cosmetics, personal care, etc., are further driving the growth of the industry in the region.

Asia Pacific is also likely to grow rapidly in the forthcoming years because of the presence of growing economies like South Korea, Japan, India, China, and Southeast Asian nations. The market is highly driven by the increasing disposable income of people, increasing urbanization, population growth, and expansion of end-user sectors. However, the technological advancements in the region in material science, manufacturing processes, and design are further expected to promote the growth of the rigid packaging container industry.

Europe is growing as a mature and well-established market in the industry. The market is served by both international and local packaging manufacturers, which are striving hard to come up with product innovation and advanced packaging solutions to offer improved functionality, packaging design, and recycling capabilities.

Moreover, the growth of e-commerce in the region is another major reason for the growth of the global market. For instance, Alpha, in July 2022, successfully took over Apon, a Polish company. The major aim of the company is to reduce its footprint in Eastern and Central Europe.

Competitive Analysis

Competitive Analysis

The key players in the global rigid packaging containers market include:

- Mondi

- Crown Holdings

- Amcor plc.

- Berry Global Group

- RESILUX NV

- Sealed Air

- Coveris

- Silgan Holdings Inc.

- MeadWestvaco Corporation

- Berry Global Inc.

- Bemis Company Inc.

- BALL CORPORATION

- Amcor plc

- Dow

- Ardagh Group S.A.

- Crown

- Tetra Pak International S.A.

- Reynolds

- PLASTIPAL HOLDINGS INC.

- Holmen

- Georgia-Pacific

- DS Smith

For instance, Berry Global Group and Koa Corporation came up with cleaners and moisturizer containers that are manufactured from recycled materials.

The global rigid packaging containers market is segmented as follows:

By End Users Segment Analysis

By End Users Segment Analysis

- Building & Construction

- Automotive

- Industrial

- Cosmetic & Personal Care

- Healthcare

- Food & Beverage

- Others

By Manufacturing Processes Segment Analysis

By Manufacturing Processes Segment Analysis

- Thermoforming

- Blow Molding

- Injection Molding

- Extrusion

- Others

By Materials Segment Analysis

By Materials Segment Analysis

- Polyvinyl Chloride

- Polystyrene & Expanded Polystyrene

- Polypropylene

- Polyethylene Terephthalate

- Polyethylene

By Products Segment Analysis

By Products Segment Analysis

- Caps & Closures

- Trays & Containers

- Bottles & Jars

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Mondi

- Crown Holdings

- Amcor plc.

- Berry Global Group

- RESILUX NV

- Sealed Air

- Coveris

- Silgan Holdings Inc.

- MeadWestvaco Corporation

- Berry Global Inc.

- Bemis Company Inc.

- BALL CORPORATION

- Amcor plc

- Dow

- Ardagh Group S.A.

- Crown

- Tetra Pak International S.A.

- Reynolds

- PLASTIPAL HOLDINGS INC.

- Holmen

- Georgia-Pacific

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors