Search Market Research Report

Oxygen Concentrators Market Size, Share Global Analysis Report, 2022 – 2028

Oxygen Concentrators Market Size, Share, Growth Analysis Report By Delivery System (Pulse Flow and Continuous Flow), By Application (Chronic Obstructive Pulmonary Disease (COPD), Asthma, Respiratory Distress Syndrome and Others), By End User (Hospital, Homecare Settings, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

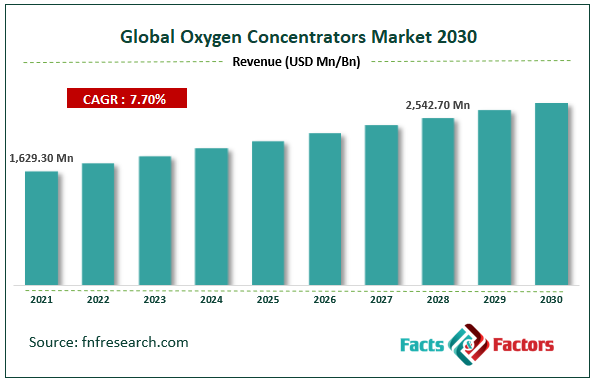

[206+ Pages Report] According to Facts and Factors, the global oxygen concentrators market size was worth USD 1,629.30 million in 2021 and is estimated to grow to USD 2,542.70 million by 2028, with a compound annual growth rate (CAGR) of approximately 7.70% over the forecast period. The report analyzes the portable oxygen concentrator market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the portable oxygen concentrator market.

Market Overview

Market Overview

A portable oxygen concentrators (POC) is a medical device that gives people with respiratory illnesses access to oxygen. The concentrator separates nitrogen and oxygen from ambient air, discards the nitrogen, and gives patients access to 95% pure oxygen via a mask. A portable oxygen concentrator (POC) is a type of medical equipment that provides oxygen to people with respiratory illnesses. The gadget separates nitrogen and oxygen from the ambient air to give the patient pure oxygen. POCs come with a plug-in power supply, a knob to change the flow rate, an alarm indication, and an oxygen outlet for a nasal cannula. They have two delivery modes: pulse dosage and continuous flow. Modern POCs can be used by mountaineers and hikers in areas with low oxygen levels since they are more mobile and compact than the stationary concentrators that were once the norm.

COVID-19 Impact:

COVID-19 Impact:

Three key ways that COVID-19 can affect the economy are directly altering supply and demand, disrupting distribution networks, and having an economic impact on businesses and financial markets. Many nations, including China, India, Saudi Arabia, the United Arab Emirates, Egypt, and others, have difficulty moving pharmaceuticals from one location to another due to widespread lockdowns.

Medical oxygen concentrators are in greater demand due to the COVID-19 pandemic. In essence, COVID-19 is a respiratory condition that affects the lungs and, in difficult situations, lowers the oxygen level. The key characteristic of COVID-19 is bilateral pneumonia, which increases the need for supplementary oxygen. Among other tools, oxygen concentrators and liquid oxygen are used to raise the oxygen level. When liquid oxygen is scarce, oxygen concentrators are utilized for oxygen therapy instead of oxygen tanks because the latter can run continuously. But since there are more cases, there is a significant mismatch between supply and demand.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global oxygen concentrator market value to grow at a CAGR of 7.70% over the forecast period.

- In terms of revenue, the global oxygen concentrator market size was valued at around USD 1,629.30 million in 2021 and is projected to reach USD 2,542.70 million by 2028.

- The increasing prevalence of Chronic Obstructive Pulmonary Disease (COPD) and technological advancements across the globe are the major factors driving the market growth.

- By delivery system, the continuous flow category dominated the market in 2021.

- By end user, the homecare settings category dominated the market in 2021.

- North America dominated the global oxygen concentrator market in 2021.

Growth Drivers

Growth Drivers

- Increasing the geriatric population to drive market growth.

For the forecast period, the market growth is anticipated to be driven by a rising geriatric population. The diaphragm weakens with age, making it difficult to breathe fully and lowering the body's oxygen level. For instance, the World Health Organization predicts that the number of elderly people in Europe will rise from 894 million in 2019 to 910 million in 2021. By 2020, there will be 19 million persons in Europe who are 85 years or older, and by 2050, there will be 40 million.

Restraints

Restraints

- The high capital cost involved hindering the market growth

The global market for medical oxygen concentrators is anticipated to grow slowly due to the high capital costs associated with CO2 capture. There is a significant need for the system or product and strong demand for oxygen. CO2 capture is one of the many process cycles used in manufacturing, which is quite expensive. Furthermore, it is anticipated that the poor acceptability of non-portable and single-user equipment will restrain market expansion. The size of the oxygen systems is to blame for this.

Opportunity

Opportunity

- An increase in the number of people exposed to indoor air pollution presents market opportunities

A rise in the number of persons exposed to indoor air pollution and the number of current smokers contribute to the market's expansion. The market for portable oxygen concentrators will benefit from these opportunities. Additionally, throughout the projection period, increased acceptance rates of cutting-edge technologies and an increase in the number of emerging markets will create favorable possibilities for expanding the portable oxygen concentrators market.

Segmentation Analysis

Segmentation Analysis

The global oxygen concentrator market is segmented into a delivery system, application, and end user.

The market is segmented into pulse and continuous, depending on the distribution method. Revenue from the constant flow made up the vast majority. Medical oxygen concentrators are anticipated to increase due to the rapid development of new technologies. Additionally, it is projected that continued usage of respiratory equipment for oxygen therapy will accelerate category growth. The primary target populations for continuous flow oxygen concentrators are the elderly and those bedridden. The gadgets are also less expensive than pulse flow technology because they do not include any breath-sensing equipment.

Hospitals, home healthcare, and other categories are divided based on the end user. The medical oxygen concentrator and oxygen cylinder market for home care had the highest revenue. Over the forecast period, the segment will likely rise due to rising demand for home oxygen therapies, rising need for pure oxygen, and technological improvements, including the shrinking of this medical equipment. The primary drivers of the market are an improving standard of living and an increase in the use of home-based therapy, particularly in developed nations like North America and Europe. Additionally, a significant aging population in nations like Germany, Japan, Italy, Monaco, and Austria is anticipated to boost segment growth for the projected period.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,629.30 Million |

Projected Market Size in 2028 |

USD 2,542.70 Million |

CAGR Growth Rate |

7.70% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Koninklijke Philips N.V, Chart Industries, Inc., Invacare Corporation, Inogen, Inc., Drive Devilbiss Healthcare, O2 Concepts LLC, Nidek Medical, GCE Group, Caire Inc, and Others |

Key Segment |

By Delivery System, Application, End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Recent Developments

Recent Developments

- In May 2021, OxyGo LLC declared that it had purchased LIFE Corporation, a business that produced CPR and portable emergency oxygen equipment. The company's ability for growth was enhanced by this acquisition, which also offered opportunities for market-based commercial growth.

- NGK SPARK PLUG CO., LTD. announced in October 2018 that it had acquired the oxygen-related product businesses of CAIRE Inc. in the United States, Chart BioMedical (Chengdu) Co., Ltd. in China, and Chart BioMedical Limited in the United Kingdom. This was done to grow their business in the portable oxygen concentrators market. The product lineup offered by the company in the market has improved.

- On April 3, 2019, Inogen, Inc. unveiled the Inogen One G5, a portable oxygen concentrator that is small and easy to carry. This innovative portable caters to the needs of patients undergoing oxygen therapy.

- On October 15, 2019, Precision Medical released The Live Active Five, a new portable oxygen concentrator to help people with respiratory conditions, including COPD. With the help of the Li-ion battery, this Live Active Five is simple to use.

Regional Landscape

Regional Landscape

- North America dominated the market in 2021

In North America, the greatest revenue share was 32.4%. The elderly population in the area is one of the main forces behind the market expansion. According to statistics released by the UN, more than 70 million people in North America were expected to be over 60 in 2014. This population is particularly vulnerable to a range of respiratory infections because of their compromised immune systems and constrained capacity for oxygen intake. The regional market is also being boosted by government initiatives, including the Federal Aviation Administration's (FAA) authorization to use portable oxygen concentrators during air travel and the rise in the prevalence of severe chronic obstructive pulmonary disease brought on by unhealthy lifestyles.

The Asia Pacific is expected to be the most profitable market over the projected period. Major factors influencing the expansion of the regional market include the prevalence of lung diseases and the rapidly rising elderly population. One in four locals is anticipated to be older than 60 by 2050. Major improvements in living and health conditions have been seen in the region's more developed countries. It is projected that factors such as rising healthcare expenditures, longer life expectancies, and public awareness of new technologies will boost regional market expansion during the projection period.

Competitive Landscape

Competitive Landscape

Key players within the Global Oxygen Concentrators market include

- Koninklijke Philips N.V

- Chart Industries Inc.

- Invacare Corporation

- Inogen Inc.

- Drive Devilbiss Healthcare

- O2 Concepts LLC

- Nidek Medical

- GCE Group

- Caire Inc

The Global Oxygen Concentrators Market is segmented as follows:

By Delivery System:

By Delivery System:

- Continuous Flow

- Pulse Flow

By Application:

By Application:

- Chronic Obstructive Pulmonary Disease (COPD)

- Asthma

- Respiratory Distress Syndrome

- Others

By End User:

By End User:

- Hospitals

- Homecare Settings

- Others

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Koninklijke Philips N.V

- Chart Industries Inc.

- Invacare Corporation

- Inogen Inc.

- Drive Devilbiss Healthcare

- O2 Concepts LLC

- Nidek Medical

- GCE Group

- Caire Inc

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors