Search Market Research Report

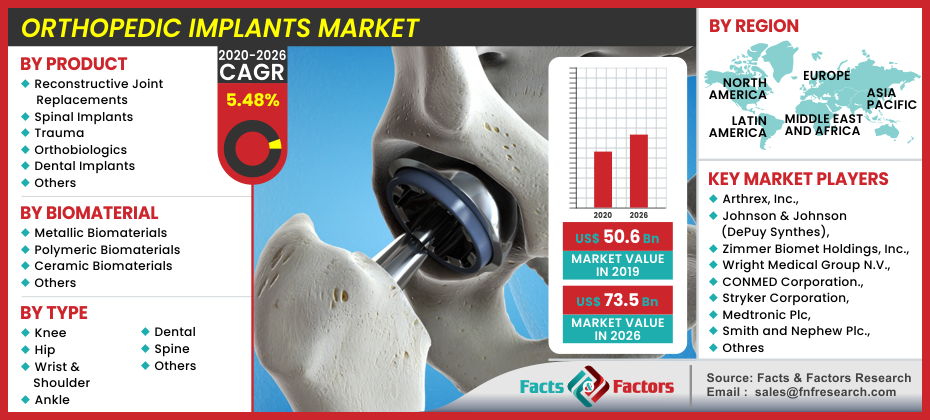

Orthopedic Implants Market Size, Share Global Analysis Report, Implants Market by Product Type (Reconstructive Joint Replacements, Spinal Implants, Trauma, Orthobiologics, Dental Implants, and Others) By Biomaterial (Metallic Biomaterials, Polymeric Biomaterials, Ceramic Biomaterials, and Others), By Type (Knee, Hip, Wrist & Shoulder, Ankle, Dental, Spine, and Others) and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Orthopedic Implants Market by Product Type (Reconstructive Joint Replacements, Spinal Implants, Trauma, Orthobiologics, Dental Implants, and Others) By Biomaterial (Metallic Biomaterials, Polymeric Biomaterials, Ceramic Biomaterials, and Others), By Type (Knee, Hip, Wrist & Shoulder, Ankle, Dental, Spine, and Others) and By Region: Global Industry Perspective, Comprehensive Analysis, and Forecast, 2020 – 2026

Industry Insights

[197+ Pages Report] Facts and Factors has recently published the report titled “Orthopedic Implants Market” which illustrates that the global demand and consumption for the orthopedic implants market was estimated at around USD 50.6 Billion in 2019, and it is expected to provide revenue of about USD 73.5 Billion by end of 2026, developing at a CAGR of around 5.48% between 2020 and 2026.

Market Overview

Market Overview

An orthopedic implant is a medical device that is designed to replace or sustain a missing joint or bone. The medical implant is primarily made of stainless steel and titanium alloys, with a plastic coating that serves as artificial cartilage. Internal fixation is an orthopedic procedure that entails the surgical placement of implants for the purpose of bone repair. Pins, rods, screws, and plates used to anchor broken bones as they heal are among the most common forms of medical implants.

Industry Growth Factors

Industry Growth Factors

The demand is largely driven by the growing geriatric population, as people over the age of 65 are at a higher risk of developing degenerative disc disease, low bone density, and osteoarthritis. Furthermore, the rising number of sports-related injuries, as well as the growing phenomenon of road accidents, is driving up the number of trauma cases, boosting demand for orthopedic implants.

Embedded sensors in modern orthopedic implants provide surgeons with real-time data, allowing them to enhance post-operative assessment and implant positioning. Smart-sensor-powered technology is expected to gain traction in the orthopedic implants industry, as it has a lot of promise in terms of preventing periprosthetic infection. In the orthopedic implants industry, robotic devices are gaining traction because they enable surgeons to perform surgeries with more repeatable precision and smaller incisions. The high cost of these devices, on the other hand, could discourage their use in the orthopedic implant market.

Segmentation Analysis

Segmentation Analysis

The global orthopedic implants market is segregated based on product type, biomaterial, type, and regions.

Reconstructive joint replacements, spinal implants, trauma, orthobiologics, dental implants and others are the bifurcation of product type segment. Moreover, based on biomaterial the market is classified into metallic biomaterials, polymeric biomaterials, ceramic biomaterials, and others. Due to the cost-effectiveness of these products, the metallic biomaterials segment accounted for the largest share in 2019. When compared to other materials, metallic biomaterials are more effective at promoting bone healing. These are used to make orthopedic implants including screws, plates, and VCF (vertebral compression fracture) products, among other things. Other biomaterials, on the other hand, are expected to develop at the fastest rate during the forecast era. This is due to an increase in demand for these products, which have many advantages over synthetic biomaterials, including biocompatibility, lack of toxicity, and the ability to bear complex protein binding sites and other biochemical signals that can aid in the healing or incorporation of tissues. Besides, the global orthopedic implants market report is also classified based on type segment into the knee, hip, wrist & shoulder, ankle, dental, spine, and others

Regional Analysis

Regional Analysis

North America continues to dominate the orthopedic implant market. Increased healthcare spending by local governments and well-established healthcare infrastructure in the United States and Canada are driving the market growth. More specifically, North America's aging population would fuel growth over the projected period. Due to increasing awareness of the use of various orthopedic devices, nascent consumer needs, and improving healthcare infrastructure, the market is expected to witness boost in sales.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 50.6 Billion |

Projected Market Size in 2026 |

USD 73.5 Billion |

CAGR Growth Rate |

5.48% |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

Arthrex, Inc., Johnson & Johnson (DePuy Synthes), Zimmer Biomet Holdings, Inc., Wright Medical Group N.V., CONMED Corporation., Stryker Corporation, Medtronic Plc, Smith and Nephew Plc., DJO Finance LLC, and Globus Medical Inc., amongst others. |

Key Segment |

by Product Type, By Biomaterial, By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

During the forecast era, China, India, and Brazil are expected to rise at the fastest rates. The increasing patient knowledge levels related to the commercial availability of orthopedic implants, booming medical tourism, and constantly improving healthcare infrastructure are all factors contributing to the market's substantial growth in these countries. As a result, from 2019 to 2026, the Asia Pacific and Latin America are expected to expand significantly.

Competitive Players

Competitive Players

Some main participants of the global orthopedic implants market are

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings Inc.

- Wright Medical Group N.V.

- CONMED Corporation.

- Globus Medical Inc.

- Stryker Corporation

- Medtronic Plc

- Smith and Nephew Plc.

- DJO Finance LLC

- Arthrex Inc.

Product Segment Analysis

Product Segment Analysis

- Reconstructive Joint Replacements

- Spinal Implants

- Trauma

- Orthobiologics

- Dental Implants

- Others

Biomaterial Segment Analysis

Biomaterial Segment Analysis

- Metallic Biomaterials

- Polymeric Biomaterials

- Ceramic Biomaterials

- Others

Type Segment Analysis

Type Segment Analysis

- Knee

- Hip

- Wrist & Shoulder

- Ankle

- Dental

- Spine

- Others

Regional Segment Analysis

Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

- GCC Countries

- South Africa

- Rest of MEA

Table of Content

Industry Major Market Players

- Johnson & Johnson (DePuy Synthes)

- Zimmer Biomet Holdings Inc.

- Wright Medical Group N.V.

- CONMED Corporation.

- Globus Medical Inc.

- Stryker Corporation

- Medtronic Plc

- Smith and Nephew Plc.

- DJO Finance LLC

- Arthrex Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors