Search Market Research Report

Microbial Fermentation Technology Market Size, Share Global Analysis Report, 2022 – 2030

Microbial Fermentation Technology Market Size, Share, Growth Analysis Report By End-User (Academic Research Institutes, Bio-Pharmaceutical Industries, Food & Feed Industry, Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs)), By Product (Industrial, Medical, Food & Feed Products, and Alcohol Beverages), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2030

Industry Insights

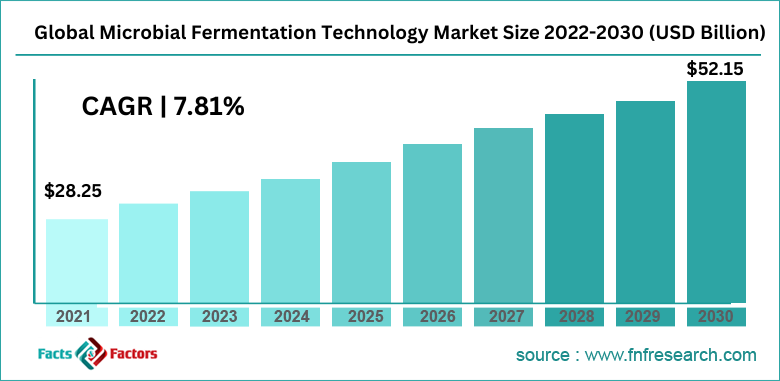

[221+ Pages Report] According to the report published by Facts and Factors, the global microbial fermentation technology market size was worth around USD 28.25 billion in 2021 and is predicted to grow to around USD 52.15 billion by 2030 with a compound annual growth rate (CAGR) of roughly 7.81% between 2022 and 2030. The report analyzes the global microbial fermentation technology market drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the microbial fermentation technology industry.

Market Overview

Market Overview

Microbial fermentation technology refers to the use of several types of microorganisms like fungi, bacteria, or yeast to change the biochemical or nutritional quality of ingredients that are used at the initial stages of product manufacturing in industries like pharmaceuticals, food & beverages (F&B), and chemicals. The global industry is a rapidly growing segment due to several factors. Microbial fermentation technology defines a sustainable and natural way of production & manufacturing and is extremely popular owing to its ability to produce high-grade and large-scale end-products within a limited duration. Fermentation involves the breakdown of large organic molecules with the aid of microorganisms giving rise to simpler molecules. This activity leads to the product of fermented food which showcases changed biochemical activities that meet the desired expectations of the producer.

Furthermore, it remains the most significantly used method in almost all end-user verticals including the pharmaceutical market where it is used to produce antibiotics, insulin, and therapeutic enzymes. The use of fermenting microorganisms provides an enhanced state of probiotic properties, antioxidants, and peptide production in the end products leading to its growing popularity.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global microbial fermentation technology market is estimated to grow annually at a CAGR of around 7.81% over the forecast period (2022-2030)

- In terms of revenue, the global microbial fermentation technology market size was valued at around USD 28.25 billion in 2021 and is projected to reach USD 52.15 billion, by 2030.

- The microbial fermentation technology industry is projected to grow at a significant rate due to the growing demand for fermented food products

- Based on end-user segmentation, the food & feed industry was predicted to show maximum market share in the year 2021

- Based on product segmentation, food & feed products were the leading products in 2021

- On the basis of region, Asia-Pacific was the leading revenue generator in 2021

Growth Drivers

Growth Drivers

- Growing demand for fermented food products to propel market demand

The global microbial fermentation technology is expected to grow owing to the rising demand for fermented food products like yogurt, kombucha, and other edible items or drinks. These products undergo biochemical changes during the manufacturing process with the aid of controlled microbial growth and pose several health benefits which is one of the major reasons why the growing population giving higher importance to health is more inclined toward the consumption of fermented food items. Studies have indicated that regular and controlled consumption of fermented food can help improve the overall health of the consumer. They are excellent antimicrobial agents along with being exceptional anti-oxidants.

In addition to this, the anti-diabetic, anti-inflammatory, and anti-atherosclerotic activities have helped them become a favorite amongst the population. Fermented products are easier to digest since most of the natural starches or sugars in the food products have already undergone the breaking down process. They also showcase excellent health potential which refers to the assistance food products make in providing the availability of nutrients like vitamins to the body. Fermented food products are also claimed to improve the behavioral aspect and general mood of consumers. All of these benefits combined with the growing awareness are expected to propel global market growth.

Restraints

Restraints

- High and fluctuating costs of raw materials and equipment to restrict market expansion

One of the key growth restraints that the microbial fermentation technology industry is likely to face during the projection period is the high cost of raw materials and equipment along with constant price fluctuation influenced by several political, economical, and social factors The price of raw materials in the global market industry is highly sensitive to the trade relations that are currently impacting the price of the fuel reflecting on the transportation sector.

Opportunities

Opportunities

Untapped potential in new markets to provide growth opportunities

The global microbial fermentation technology market players can expect higher sales volume and can expand into new markets especially developing economies that are currently witnessing a surge in all types of end-products including healthcare and F&B items. Furthermore, these countries are also registering a high influx of international player entries given the immense growth potential they hold. Other factors like increasing strategic collaborations between domestic and foreign players in the pharmaceutical and food sector could open more growth opportunities.

Challenges

Challenges

- Product consistency and scaling up to pose as an industry challenge

The commercialization of the global microbial fermentation technology market may be limited owing to the lack of resources to maintain product consistency, which is key to maintaining a high brand value over the years. Furthermore, the microbial fermentation technology industry may face challenges in terms of scaling up the production process in due time as the demand is increasing at an exponential rate giving market players limited time to deliver the final goods.

Segmentation Analysis

Segmentation Analysis

The global microbial fermentation technology market is segmented based on end-user, product, and region.

Based on end-user, the global market is divided into academic research institutes, bio-pharmaceutical industries, food & feed industry, contract manufacturing organizations (CMOs), and contract research organizations (CROs).

- The global market was led by the food & feed industry due to the growing applications of the fermentation mechanics

- It is used extensively to produce every day consumed items like cheese, yogurt, beer, bread, and wine. All of the items sell in large quantities worldwide

- The growing research on higher adoption of the technology in this segment could propel its further growth during the projection period

- The US per capita consumption of yogurt in is around 14.29 pounds per person

Based on product, the global market is divided into industrial, medical, food & feed products, and alcohol beverages

- The global market registered the highest growth in the alcohol beverages and food & feed products segments

- The technology makes use of yeast to convert added sugars into carbon dioxide and alcohol. It is one of the most widely used processes to manufacture whiskey, rum, wine, beer, and vodka which are some of the highest-selling alcohol products commercially

- As per reports, the wine-drinking population in 2019 in the US was around 77.1 million

Recent Developments:

Recent Developments:

- In November 2022, BIOVECTRA, a leading pharmaceutical and biotech Contract Development, and Manufacturing Organization (CDMO) company announced the inauguration of a new single-use biologic fermentation site which is located in Windsor, Canada. The suite is equipped with a single-use fermenter working at a capacity of 100 liters to 1,000 liters. It is expected to help the company improve its production lines and capacity thus cementing the company’s hold

- In July 2022, WuXi Biologics, a leading CDMO, announced the launch of a new facility in Hangzhou province in China. The unit will assist in the production of current good manufacturing practice (cGMP) manufacturing based on microbial products. The facility is an extension of the company’s Integrated Innovation Centre

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 28.25 Billion |

Projected Market Size in 2030 |

USD 52.15 Billion |

CAGR Growth Rate |

7.81% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2030 |

Key Market Players |

Koninklijke DSM NV, Amyris Inc., F. Hoffmann-La Roche AG, Novozymes A/S, Biocon Ltd., TerraVia Holdings Inc., Danone U.K., United Breweries Ltd., Lonza Group AG, Ajinomoto Company Incorporation, BASF, Amano Enzyme Inc., The Dow Chemical Company, Archer Daniels Midland Company, AB Enzymes, Cargill Inc., Du Pont Danisco A/S, Evonik Industries AG, BioVectra Inc., and others. |

Key Segment |

By End-User, Product, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- Asia-Pacific to dominate the industry growth during the projection period

The global microbial fermentation technology market is anticipated to witness the highest growth in the Asia-Pacific region during the forecast period. The rising demand in the F&B sector during the rise in population, an increasing number of players, rising disposable income, and other factors could assist in the regional market growth. The technology is registering growing investments in the region as fermentation technology holds high potential in the food & beverages sector.

Furthermore, favorable government policies supporting the growth of the food & feed sector in the countries of China, India, Japan, and other regions could also act as regional industry propellers. A rising focus on food safety in the Middle East is expected to help the region garner a high CAGR. These countries are witnessing tremendous demand for nutritional food products that are also high-quality.

Competitive Analysis

Competitive Analysis

- Koninklijke DSM NV

- Amyris Inc.

- F. Hoffmann-La Roche AG

- Novozymes A/S

- Biocon Ltd.

- TerraVia Holdings Inc.

- Danone U.K.

- United Breweries Ltd.

- Lonza Group AG

- Ajinomoto Company Incorporation

- BASF

- Amano Enzyme Inc.

- The Dow Chemical Company

- Archer Daniels Midland Company

- AB Enzymes

- Cargill Inc.

- Du Pont Danisco A/S

- Evonik Industries AG

- BioVectra Inc.

The global microbial fermentation technology market is segmented as follows:

By End-User Segment Analysis

By End-User Segment Analysis

- Academic Research Institutes

- Bio-Pharmaceutical Industries

- Food & Feed Industry

- Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs)

By Product Segment Analysis

By Product Segment Analysis

- Industrial

- Medical

- Food & Feed Products

- Alcohol Beverages

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Koninklijke DSM NV

- Amyris Inc.

- F. Hoffmann-La Roche AG

- Novozymes A/S

- Biocon Ltd.

- TerraVia Holdings Inc.

- Danone U.K.

- United Breweries Ltd.

- Lonza Group AG

- Ajinomoto Company Incorporation

- BASF

- Amano Enzyme Inc.

- The Dow Chemical Company

- Archer Daniels Midland Company

- AB Enzymes

- Cargill Inc.

- Du Pont Danisco A/S

- Evonik Industries AG

- BioVectra Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors