Search Market Research Report

Microalgae Market Size, Share Global Analysis Report, 2022-2028

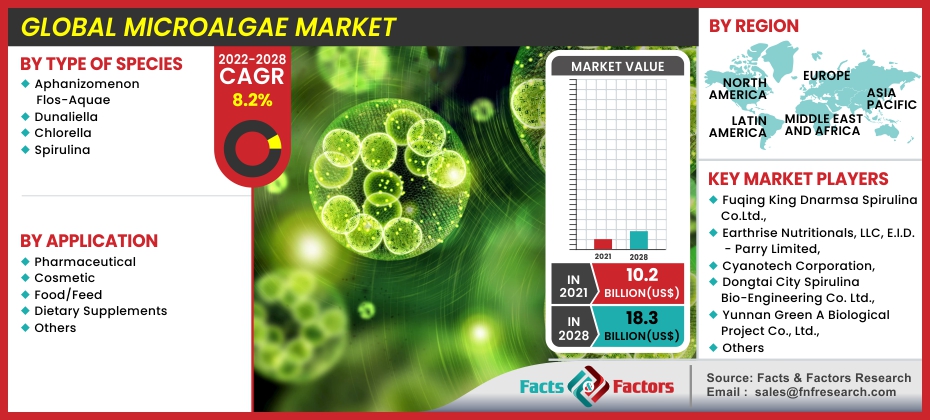

Microalgae Market By Type of Species (Aphanizomenon Flos-Aquae, Dunaliella, Chlorella, and Spirulina), By Application (Pharmaceutical, Cosmetic, Food/Feed, Dietary Supplements, and Others), and By Region-Global and Regional Industry Trends, Competitive Intelligence, Analysis of Data, Statistical Data, and Forecast 2022-2028

Industry Insights

[207+ Pages Report] According to Facts and Factors, during the forecast period of 2022 to 2028, the global microalgae market is estimated to develop at a compound annual growth rate (CAGR) of 8.2%. The global microalgae market was worth USD 10.2 billion in 2021, and it is anticipated to exceed USD 18.3 billion by 2028. The study investigates several elements and their consequences on the growth of the global microalgae market.

Market Overview

Market Overview

Microalgae is a microscopic algae that is normally found in marine water and fresh water. Microalgae are a rich source of minerals and nutrients like vitamin A, B1, B2, C, E, protein, iron, and magnesium. Because of these properties, microalgae are being used commercially in a variety of industries, including dietary supplements, food & feed, pharmaceuticals, cosmetics, and biofuels. The use of microalgae product lines in these industries raises customer awareness of the benefits of microalgae products.

The global microalgae market is expected to grow steadily in the coming years. The market's expansion can be attributed to the increasing use of algal protein in dietary supplements and the food industry. Furthermore, because algal protein is not recognized as an animal protein source, it is ideal for vegan consumption. Furthermore, microalgae have a wide range of applications, including cosmetics and the feed industry.

COVID-19 Impact

COVID-19 Impact

The COVID-19 pandemic had a negative impact on many markets around the world. Many industries have been negatively impacted by government measures to combat the COVID-19 pandemic, such as nationwide lockdowns and quarantines. The pandemic has taken its toll on the majority of food and beverage manufacturers. Many establishments in countries around the world were forced to close due to self-isolation, social distancing, and city-wide lockdowns.

Due to decreased usage and disrupted supply chains, the pandemic has put a strain on consumer food & beverage product manufacturers. Because of the lockdowns imposed in various countries, the food & beverage sector experienced a minor decline. This scenario has also had a negative impact on the confectionery industry, as people are only purchasing necessities.

Furthermore, government agencies have enacted a slew of rules and regulations governing the purchase of essential goods. According to trade organizations in the nutritional products sector, there has been a major effect on the global supply chain for functional foods and supplements, which has lowered end-user consumption of microalgal biomass, affecting the market growth.

Growth Drivers

Growth Drivers

- The growing nutraceuticals industry drives global microalgae market growth

The aging population, rising consumer understanding of preventative healthcare, the rise of the self-directed consumer (self-diagnosis over health practitioner diagnosis), channel proliferation (various marketing techniques & E-Commerce), and the transition from ingredient-focused messaging to broader brand positioning (grouping of supplements together solely to form a healthy benefits package) are the key factors driving the supplement industry's growth. Globally, the value and revenues of vitamins, minerals, nutritional, and herbal products are increasing steadily.

The total global market for nutraceuticals is expected to grow from approximately USD 372 billion in 2025, according to the Association for Packaging and Processing Technologies. This increase is primarily due to the growing popularity of natural nutraceuticals, which has resulted in the significant growth of botanical dietary supplements such as chlorella. Low cost in comparison to prescription drugs, as well as easy availability, are factors that are expected to boost demand over the next years.

Furthermore, chlorella is a scientifically researched algae with numerous publications from research institutes, medical institutions, and universities. It is Japan's best-selling health food supplement, with over 30% of the population using it as one of their primary health supplements. Chlorella has also been shown to strengthen the immune system, reduce the severity of several chronic health problems, and minimize medication side effects. Its nourishing, detoxifying, and rejuvenating properties help the body's natural defense and repair systems work more effectively. As a result, the growing nutraceutical characteristics and nutritional supplements of chlorella are driving the global microalgae market.

Restraints

Restraints

- Technical challenges in harvesting microalgae may limit the market growth

The technical challenges of harvesting microalgae on a large scale for feed and food will limit the market growth. Microalgae that have been commercially produced are often used in nutritional supplements and nutritional products for animals and humans. Microalgae has enormous potential for use in food/feed supplements, production of biofuel, electricity generation, and other applications.

However, there are a number of issues that need to be addressed before algal biomass production systems can be widely adopted. Several species are already commercially used in raceways, but they are not produced in sufficient amounts or in a cost-effective manner to meet the demand for fuel and feed.

While global demand for algae biomass continues to rise, producers require technological advancements that push cost reduction while maintaining and improving product quality. Furthermore, efficient, low-cost, and scalable harvesting methods necessitate technological advancements to drive downstream processing cost reduction and, ultimately, biofuel production. As a result, technical challenges in harvesting seaweed may stymie market growth in the coming years.

Opportunities

Opportunities

- An increasing number of research programs open new opportunities for microalgae companies

Many top microalgae businesses are building in the UK algae sector to accelerate their carbon footprint reduction and renewable energy generation strategies. In 2022, the Western European microalgae market is expected to account for nearly 3.2 percent of the total market share.

For example, the Biotechnology and Biological Sciences Research Council established Algae-UK in December 2021, a comprehensive network promoting the community of scientists and engineers interested in or collaborating with industrial biotechnology applications of algae, such as microalgae, macroalgae, and cyanobacteria. As a result, the ongoing development of similar schemes to undertake in-depth research in this field is expected to drive the market in the United Kingdom.

Challenges

Challenges

- Commercialization is a key challenge for microalgae-based products

A key challenge limiting market growth is the lack of commercialization of microalgae-based products. The high operating costs, infrastructure, and maintenance, as well as the choice of algal strains with protein-rich contents, dewatering, and commercial-scale harvesting, appear to be major challenges for microalgae-based product manufacturers.

Maximizing the production and commercialization of microalgae products is dependent on a variety of factors, including market and financial conditions. There is a scarcity of authentic and trustworthy statistics and data on microalgae growth markets, making it difficult to identify their true potential.

Long-term research is required to develop systems for producing reliable algal-based products, as sustainable development is a major concern, particularly for food, feed, and fuel. The limited or small-scale output of seaweed-based products, as well as the difficulties encountered in large-scale cultivation, make it commercially unfeasible.

Segmentation Analysis

Segmentation Analysis

The global microalgae market is segregated on the basis of the type of species, application, and region.

By type of species, the market is divided into Aphanizomenon flos-aquae, Dunaliella, chlorella, and spirulina. The most significant contributor to market growth is spirulina. Its ability to produce nutritional supplements with functional properties such as anti-oxidants, phycocyanins, phenolics, and anti-inflammation has contributed to its growth. Because of these properties, spirulina is an excellent ingredient for the production of nutritional supplements and edibles.

By application, the market is divided into pharmaceutical, cosmetic, food/feed, dietary supplements, and others. Dietary supplements have the largest share of these applications. This is due to the microalgae's high nutritional value, which includes protein, vitamins, and minerals. Because of the existence of these nutrients, microalgae are perfect for the production of pills, powders, and capsules. Furthermore, as a result of these factors, microalgae products have gained traction in the healthcare and nutrition industries.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 10.2 Billion |

Projected Market Size in 2028 |

USD 18.3 Billion |

CAGR Growth Rate |

8.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Fuqing King Dnarmsa Spirulina Co.Ltd., Earthrise Nutritionals, LLC, E.I.D. - Parry Limited, Cyanotech Corporation, Dongtai City Spirulina Bio-Engineering Co. Ltd., Yunnan Green A Biological Project Co., Ltd., Jiangshan Comp Spirulina Co., Ltd., Inner Mongolia Rejuve Biotech Co., Ltd., Zhejiang Binmei Biotechnology Co., Ltd., Bluetec Naturals Co., Ltd., Taiwan Chlorella Manufacturing Company (TCMC), Sun Chlorella Corporation, Far East Microalgae Industries, Co., Ltd., Roquette Klötze GmbH & Co. KG, Gong Bih Enterprise Co., Ltd., Yaeyama Shokusan Co., Ltd., Vedan Biotechnology Corporation, AlgoSource, Tianjin Norland Biotech Co., Ltd, Phycom BV, Allmicroalgae Natural Products S.A., Duplaco B.V., Taiwan Wilson Enterprise Inc., Daesang Corporation, Algalimento S.L, Seagrass Tech Private Limited, Plankton Australia Pty Limited, Hangzhou OuQi Food Co., Ltd., and Shaanxi Rebecca Bio-Tech Co., Ltd., among others |

Key Segment |

By Type of Species, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

In 2020, Europe dominated the global microalgae market. The region has unique structural, economic, and logistical assets that help it excel in microalgae research and applications. In Europe, microalgae are being marketed as a new source of useful nutrients for animal and human consumption. Microalgae-based products are used in specialized fields such as life sciences. DSM, a chemical company based in the Netherlands, has a strong presence in the life sciences sector. Pharmaceutical products derived from microalgae are expected to witness high growth in the near future.

European countries sourced 12% of their transportation energy from renewable sources, primarily biofuels, in 2020. Because of the high demand for luxury vehicles, motorcycles, and commercial trucks, the region consumes a significant amount of fuel. As a result, demand for microalgae-based products is expected to rise in countries such as Switzerland, Germany, and the Netherlands.

Through its policies, the European Union encourages the use of renewable energy. It is presently a notable region for renewable energy, and it is expected to remain so in the coming years. Investment opportunities by renewable energy players located in Europe account for approximately 28% of all renewable energy investments worldwide. This is expected to drive regional demand for microalgae-based products.

Recent Development

Recent Development

- January 2022: Yemoja Ltd., a startup company that develops advanced microalgae ingredients, announced plans to develop red microalgae for plant-based burgers and steaks. Ounje, the company's new brand, resembles the red juices of animal meat without using artificial colors. Apart from providing the preliminary red pigment to plant-based meats, the patented microalgal heme replaces congeals and browns like real meat juices when cooked.

- January 2022: Bharathidasan University in Tamil Nadu has signed agreements with ZIGMA Global Environ Solutions to launch a joint project worth Rs. 8 lakh on "microalgae-based bioremediation of municipal solid waste leachate." This project will use extremophilic microalgae to recover municipal solid waste leachate that otherwise seeps deep underground, contaminating groundwater and soil.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the global microalgae market are

- Fuqing King Dnarmsa Spirulina Co. Ltd.

- Earthrise Nutritionals LLC

- E.I.D. Parry Limited

- Cyanotech Corporation

- Dongtai City Spirulina Bio-Engineering Co. Ltd.

- Yunnan Green A Biological Project Co. Ltd.

- Jiangshan Comp Spirulina Co. Ltd.

- Inner Mongolia Rejuve Biotech Co. Ltd.

- Zhejiang Binmei Biotechnology Co. Ltd.

- Bluetec Naturals Co. Ltd.

- Taiwan Chlorella Manufacturing Company (TCMC)

- Sun Chlorella Corporation

- Far East Microalgae Industries Co. Ltd.

- Roquette Klötze GmbH & Co. KG

- Gong Bih Enterprise Co. Ltd.

- Yaeyama Shokusan Co. Ltd.

- Vedan Biotechnology Corporation

- AlgoSource

- Tianjin Norland Biotech Co. Ltd

- Phycom BV

- Allmicroalgae Natural Products S.A.

- Duplaco B.V.

- Taiwan Wilson Enterprise Inc.

- Daesang Corporation

- Algalimento S.L

- Seagrass Tech Private Limited

- Plankton Australia Pty Limited

- Hangzhou OuQi Food Co. Ltd.

- Shaanxi Rebecca Bio-Tech Co. Ltd.

The global microalgae market is segmented as follows:

By Type of Species Segment Analysis

By Type of Species Segment Analysis

- Aphanizomenon Flos-Aquae

- Dunaliella

- Chlorella

- Spirulina

By Application Segment Analysis

By Application Segment Analysis

- Pharmaceutical

- Cosmetic

- Food/Feed

- Dietary Supplements

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Fuqing King Dnarmsa Spirulina Co. Ltd.

- Earthrise Nutritionals LLC

- E.I.D. Parry Limited

- Cyanotech Corporation

- Dongtai City Spirulina Bio-Engineering Co. Ltd.

- Yunnan Green A Biological Project Co. Ltd.

- Jiangshan Comp Spirulina Co. Ltd.

- Inner Mongolia Rejuve Biotech Co. Ltd.

- Zhejiang Binmei Biotechnology Co. Ltd.

- Bluetec Naturals Co. Ltd.

- Taiwan Chlorella Manufacturing Company (TCMC)

- Sun Chlorella Corporation

- Far East Microalgae Industries Co. Ltd.

- Roquette Klötze GmbH & Co. KG

- Gong Bih Enterprise Co. Ltd.

- Yaeyama Shokusan Co. Ltd.

- Vedan Biotechnology Corporation

- AlgoSource

- Tianjin Norland Biotech Co. Ltd

- Phycom BV

- Allmicroalgae Natural Products S.A.

- Duplaco B.V.

- Taiwan Wilson Enterprise Inc.

- Daesang Corporation

- Algalimento S.L

- Seagrass Tech Private Limited

- Plankton Australia Pty Limited

- Hangzhou OuQi Food Co. Ltd.

- Shaanxi Rebecca Bio-Tech Co. Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors