Search Market Research Report

Medical Device Packaging Market Size, Share Global Analysis Report, 2022 – 2028

Medical Device Packaging Market Size, Share, Growth Analysis Report By Material Type (Plastic, Paper & Paperboard, Aluminum, and Other Material Types), By Product Type (Pouches, Bags, Trays, Boxes, Clam Shells, and Other Product Types), By Application (Sterile Packaging and Non-sterile Packaging), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

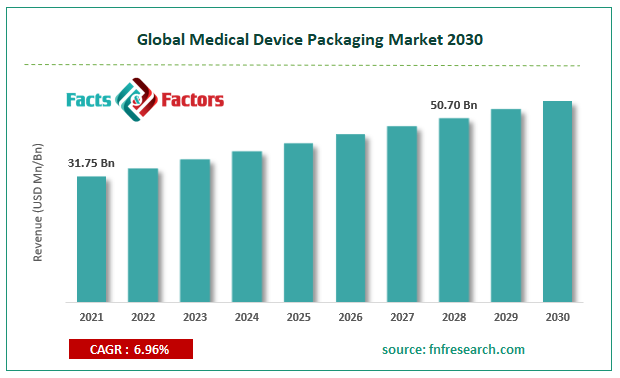

[207+ Pages Report] According to the report published by Facts Factors, the global medical device packaging market size was worth around USD 31.75 billion in 2021 and is predicted to grow to around USD 50.70 billion by 2028 with a compound annual growth rate (CAGR) of roughly 6.96% between 2022 and 2028. The report analyzes the global medical device packaging market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the medical device packaging market.

Market Overview

Market Overview

Medical device packaging applications employ various materials and methods. The packaging material which remains in direct contact with the healthcare devices is called primary packing material and the material which protects the primary packaging is called secondary packing materials. Some of the key secondary packaging materials used are paper or cardboard boxes. Tertiary packing systems such as a carton box are generally used for bulk storage and transportation application of the medical device. The medical packaging material must be compatible with the sterilization process, i.e., these medical packaging shall retain the sterile condition, till the pack is broken. Furthermore, packaging systems for non-sterile devices should maintain their cleanliness and integrity.

Some of the key types of medical devices include overwraps, bags, pouches, trays, and clamshells comprising various materials. These materials are flexible as well as rigid. Paper is being increasingly used in medical device packaging. Further, to offer clean peal performance, these packaging papers are being impregnated with polymer and latex. Meanwhile, plastics are used as film (flexible) and sheets (semi-rigid and rigid) for medical device packaging. Furthermore, aluminum is also used as foil or vacuum-deposited on film which acts as a barrier for oxygen, light, and moisture. These materials are used for shipping and storing various medical devices such as syringes, incubators, dialysis machines, elastic bandages, gloves, catheters, pacemakers, dental lasers, valves, and others. Considering the growing demand for medical devices in the healthcare sector, the demand for medical device packaging is likely to rise, in the coming years.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global medical device packaging market is estimated to grow annually at a CAGR of around 6.96% over the forecast period (2022-2028).

- In terms of revenue, the global medical device packaging market size was valued at around USD 31.75 billion in 2021 and is projected to reach USD 50.70 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on material type segmentation, plastic was predicted to show maximum market share in the year 2021

- Based on application segmentation, sterile packaging was the leading revenue-generating application in 2021.

- On the basis of region, North America was the leading revenue generator in 2021.

Covid-19 Impact

Covid-19 Impact

Medical device packaging demand increased during the COVID-19 pandemic in 2020, considering the enhanced demand for medical devices across the globe. Several industries’ trade has been stopped temporarily across various regions and countries in 2020. However, the supply related to the healthcare industry was not affected significantly from one country to another, thereby, the pandemic boosted the demand for medical device packaging in 2020. During the pandemic, the demand for various medical devices increased, including, oximeters, gloves, infusion and suction pumps, sterilizers, patient monitors, ultrasound, and ventilators, among others. Furthermore, the industry has also registered a positive trend in 2021 and is also likely to rise with a high growth rate, during the forecast period. For instance, according to MedTech Europe, the European medical technology market is estimated to be around EUR 150 billion in 2021. Furthermore, the European medical device market registered a growth rate of 6.6% in 2020 and 2.9% in 2021. Meanwhile, the European in vitro diagnostic (IVD) industry accounted for EUR 13,971 million in 2020, registering a growth rate of 25%, compared to the previous year.

Growth Drivers

Growth Drivers

- Technological development in the medical device sector to drive market growth during the forecast period.

The global medical device packaging market cap may grow owing to the rising technological development in the healthcare devices sector. The involvement of artificial intelligence (AI) in medical devices is creating a new era in the healthcare industry. In the medical industry, AI-based medical devices can automate tasks, analyze data from multiple sources, demonstrate trends, process & gather information from wearable sensors, identify various diseases, predict risks for existing diseases and complications, and also support R&D related to the medical field. The need for medical assistance is rising at a significant rate, across the globe, considering the growing demand from a growing population, rising chronic diseases, increasing per capita income across various countries, rising health consciousness, and population aging. These factors are increasing the demand for AI-based medical devices, which will further favor the demand for the medical device packaging market.

Restraints

Restraints

- Fluctuations in the raw material prices are likely to hinder the market demand

Some of the key raw materials for medical device packaging are plastics, paper, aluminum, and others. Specifically, plastics comprise various raw materials, including, polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), polyvinyl chloride (PVC), and others. All these materials are based on the prices of crude oil, which remain fluctuating. The price of plastics is not only dependent on the price of raw materials, it is also related to other market conditions, such as rising demand for plastic resin from various end-user industries products, such as building and construction, and others. Considering the fluctuating raw material prices, manufacturers face challenges in keeping the final price for their end-products, such that to compete with their competitors efficiently.

Opportunities

Opportunities

- Growing demand for sustainable packaging solutions to provide growth opportunities

Considering various environmental impacts and government regulations, the demand for sustainable packaging for the medical device industry is likely to rise in the coming years. The production of plastic resins results in different environmental emissions, which are not eco-friendly to nature. Various harmful gases, such as NOx, SOx, and CO2, among others. Furthermore, these plastic packaging products will turn into landfills after end-use applications. Some of them can be pyrolyzed at high temperatures to avoid landfill, however, they produce greenhouse and other harmful gases to the environment. Manufacturers are planning to use recycled PET for medical device packaging applications. As of June 2021, DuPont is actively working to advance sustainability across the value chain of medical packaging products.

Challenges

Challenges

- Regulatory standards related to medical packaging to challenge market cap growth

Various standards are required for medical device packaging, which acts as a challenge for manufacturers, such that to remain in the market and compete with other providers. Some of the key EU/FDA medical device packaging standards are EN ISO 11607-1 (Addressing medical device packaging materials, sterile barrier system), EN ISO 11607-2 (Addressing validation of medical device packaging processes), BS EN 868-2 (Packaging for terminally sterilized medical devices. Sterilization wrap. Requirements and test methods), ASTM D3330 (Package Strength Testing by Peel Adhesion Testing), ASTM F88 Package (Strength Testing by Seal Peel Testing), ASTM F1140 (Package Strength Testing by Burst Testing), and others. However, these standards can be fulfilled by the manufacturers and providers, which will further support the demand for the studied market.

Segmentation Analysis

Segmentation Analysis

The global medical device packaging market is segmented based on material type, product type, application, and region.

Based on material type, the global market segments are plastic, paper & paperboard, aluminum, and other material types. Currently, the global market is dominated by plastic-based medical device packaging products. Plastics include polyethylene (PE), polyethylene terephthalate (PET), polypropylene (PP), polystyrene (PS), polyvinyl chloride (PVC), and others.

Based on product type, the global market is segmented into pouches, bags, trays, boxes, clam shells, and other product types. Pouches accounted for a major share in the studied market in 2021.

The demand for medical pouches is rising considering the rising demand for various one-time usable medical devices such as medical test kit packaging, and syringe packaging, among others.

Based on application, the global market segments are sterile packaging and non-sterile packaging. Currently, the global market is dominated by sterile packaging. Considering the advantages of sterile packaging and the wide range of technology available for sterilization is expected to favor the growth of the studied market. Some of the key sterilization methods are ethylene oxide (EtO) gas sterilization, heat sterilization, gamma radiation sterilization, electron beam radiation sterilization, and other sterilization methods.

Recent Developments:

Recent Developments:

- In April 2022, Amcor plc announced an investment to build a new thermoforming capability for medical packaging in its medical facility based in Sligo, Ireland. The company’s Sligo site will comprise Class 7 cleanroom manufacturing environments and thermoforming operations, which are fully certified to ISO 13485 standards and meet required regulatory policies.

- In October 2021, Amcor plc has launched a multi-chamber pouch packaging for drug-device combination products in the Europe region. The company’s dual chamber pouch (DCP) has already been successfully tested and commercialized in the United States market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 31.75 Billion |

Projected Market Size in 2028 |

USD 50.70 Billion |

CAGR Growth Rate |

6.96% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

3M, Amcor plc, AR Packaging, Berry Global Inc., Constantia Flexibles, DuPont, Klöckner Pentaplast, Mitsubishi Chemical Corporation, Sonoco Products Company, West Pharmaceutical Services Inc., and others. |

Key Segment |

By Material Type, Product Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to lead owing to its well-established healthcare sector during the forecast period

The global medical device packaging market growth is expected to be driven by North America. The major share of medical device packaging comes from the United States, considering its huge market for medical devices. As per MedTech Europe, the United States accounted for the largest share (43.5%) of the global medical device market.

Medical devices produced or sold in the United States are regulated by the U.S. Food and Drug Administration (FDA). Specifically, within the U.S. Food and Drug Administration, the center for devices and radiological health (CDRH) is responsible for drafting the speci?c requirements for the design, manufacturing, and packaging of medical devices. The regulating body takes care of the distribution, handling, and storage of the medical device, and checks its integrity (microbial and physical) and strength such as burst, tensile, and others.

The United States has added various medical equipment and devices, recently, owing to the increasing demand from healthcare centers and hospitals. According to the WHO, as of May 2022, the country has 13,275 magnetic resonance imaging devices, 14,750 computerized tomography scanners, and 16,010 gamma cameras or nuclear medicine, among others. Some of the key medical device manufacturers in the United States are Johnson & Johnson, Abbott, Medtronic, Baxter, and Danaher, among others. All the above-mentioned factors are expected to propel the demand for medical device packaging from various healthcare devices segment.

Europe is expected to generate significant revenues owing to the increasing demand for efficient medical devices for its healthcare institutions. According to MedTech Europe, in 2021, Europe occupied the second position, with a share of 27.3%, in the global medical device market, after the United States. The top five markets in Europe are Germany, France, the United Kingdom, Italy, and Spain. In the coming years, these countries are likely to create huge demand for medical device packaging.

Competitive Analysis

Competitive Analysis

- 3M

- Amcor plc

- AR Packaging

- Berry Global Inc.

- Constantia Flexibles

- DuPont

- Klöckner Pentaplast

- Mitsubishi Chemical Corporation

- Sonoco Products Company

- West Pharmaceutical Services Inc.

The global medical device packaging market is segmented as follows:

By Material Type

By Material Type

- Plastic

- Paper and Paperboard

- Aluminum

- Other Material Types

By Product Type

By Product Type

- Pouches

- Bags

- Trays

- Boxes

- Clam Shells

- Other Product Types

By Application

By Application

- Sterile Packaging

- Non-sterile Packaging

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- 3M

- Amcor plc

- AR Packaging

- Berry Global Inc.

- Constantia Flexibles

- DuPont

- Klöckner Pentaplast

- Mitsubishi Chemical Corporation

- Sonoco Products Company

- West Pharmaceutical Services Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors