Search Market Research Report

Luxury Packaging Market Size, Share Global Analysis Report, 2024 – 2032

Luxury Packaging Market Size, Share, Growth Analysis Report By End-Users (Consumer Electronics, Consumer Goods, Food & Beverages, And Fashion Accessories & Apparel), By Products (Cans, Bottles, Boxes & Cartons, Pouches & Bags, And Others), By Materials (Wood, Fabric, Glass, Metal, Paper & Paperboard, Plastic, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

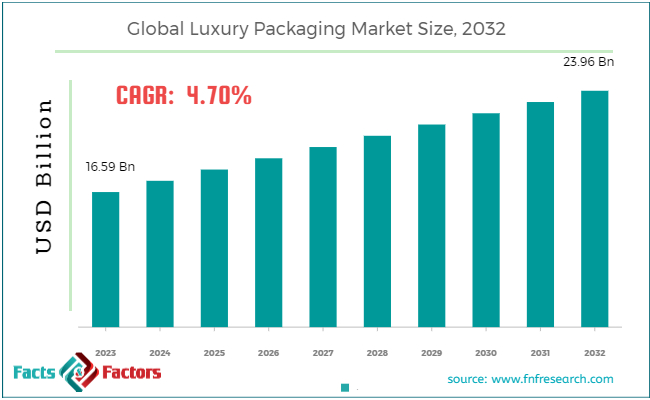

[214+ Pages Report] According to Facts and Factors, the global luxury packaging market size was valued at USD 16.59 billion in 2023 and is predicted to surpass USD 23.96 billion by the end of 2032. The luxury packaging industry is expected to grow by a CAGR of 4.70% between 2024 to 2032.

Market Overview

Market Overview

Luxury packaging is the designing and production of high-quality packing solutions. These packaging solutions are more functional and form an integral part of brand image in the market. Such packaging solutions include high-grade paper and materials in manufacturing.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global luxury packaging market size is estimated to grow annually at a CAGR of around 4.70% over the forecast period (2024-2032).

- In terms of revenue, the global luxury packaging market size was valued at around USD 16.59 billion in 2023 and is projected to reach USD 23.96 billion by 2032.

- Surge in e-commerce activities is driving the growth of the global luxury packaging market.

- Based on the end-user, the fashion accessories & apparel segment is growing at a high rate and is projected to dominate the global market.

- Based on the products, the boxes & carton segment is projected to swipe the largest market share.

- Based on the materials, the paper & paper board segment is projected to witness a high CAGR during the forecast period.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Surge in e-commerce activities is driving the growth of the global market.

Growth in e-commerce activities is a primary factor fuelling the growth of the global luxury packaging market. Brands are investing in high-end packaging solutions to meet the emerging demands of online retail. However, there is an equal requirement to maintain a secure unboxing experience, which in turn is another major factor accentuating the need for high and luxurious packaging solutions in the market.

Also, the growing awareness among people regarding sustainability issues is further leading companies to opt for sustainable and luxurious packaging solutions.

Additionally, the fast expansion of the consumer base into different emerging markets is expected to positively influence the growth of the market. Moreover, the integration of digital technologies into the packaging processes to enhance consumer engagement will also support the growth of the market. For instance, Delta Global got a Gold Award from EcoVadis in August 2022. This award category rates the sustainability of businesses.

Restraints

Restraints

- High cost is likely to hamper the growth of the global market.

The high cost associated with high-quality materials and intricate designs is likely to hinder the growth of the global luxury packaging market during the forecast period. High costs deter the price-sensitive consumers. Also, the supply chain disturbances and geo-political issues further slow down the growth trajectory of the market.

Opportunities

Opportunities

- Personalization is expected to foster growth opportunities in the global market.

The growing need for personalization is expected to widen the scope of the luxury packaging industry. Brands are posing high demand to customize the packaging options in order to improve brand loyalty, brand visibility, and product appeal. The rising trend of collaboration with designers, artists, and luxury brands is further driving the growth of the market.

For instance, Ardagh Metal Packaging collaborated with Au Vodka to produce gold-colored metal containers for Blue Raspberry vodka in July 2022.

Challenges

Challenges

- Counterfeiting is a big challenge in the global market.

Luxurious brands face challenges regarding counterfeiting, which has emerged as a big challenge in the luxury packaging industry. Also, if packaging designs are made intricate to avoid counterfeiting, it will increase the end cost, which will further negatively impact the market.

Segmentation Analysis

Segmentation Analysis

The global luxury packaging market can be segmented into end-users, products, materials, and regions.

By end-users, the market can be segmented into consumer electronics, consumer goods, food & beverages, and fashion accessories & apparel. The fashion accessories & apparel segment is poised to witness heavy growth during the forecast period.

The emerging fashion trends and innovations are a primary factor fuelling the growth of the segment. The rapid changes in the global fashion world are driving people's interest in purchasing apparel and accessories more frequently than before. Also, many companies are coming up with innovations in style, material, and designs to attract consumers and swipe a large market area.

Also, the improving economic conditions all across the globe, particularly in developing and underdeveloped areas, are positively influencing the segment's growth. The increasing middle-class population, along with the disposable income, is diverting consumer sentiments toward spending on luxurious fashion items.

By product, the global luxury packaging market is categorized into composite cans, bottles, boxes & cartons, pouches & bags, and others. The boxes & carton segment is expected to dominate the global market during the forecast timeframe. The rise in e-commerce platforms and online shopping is a major reason behind the high demand for packaging solutions in the market. Consumers now demand durable and more secure packaging that can handle the shipment and transit challenges.

Boxes and cartons are main packaging formats used in the food and beverage sector. The high usage of these formats can be attributed to the versatility of boxes and cartons, thereby making them ideal for packing a wide range of products, from cereals to beverages. The retail sector also poses a high demand for these packaging formats in the market.

By material, the market can be segmented into wood, fabric, glass, metal, paper & paperboard, plastic, and others. The paper & paper board segment is expected to grow with a whopping CAGR in the coming years. The high growth rate of the segment can be attributed to the surge in awareness among people regarding environmental health. People are now demanding packaging materials that are biodegradable and renewable, thereby posing less damage to the environment.

The surge in e-commerce activities further accentuates the demand for packaging material in the market. End users are posing a high demand for corrugated boxes, which are ideal for transiting and shipping activities. The government is playing a crucial role in encouraging the growth of the segment. Strict regulations imposed by the government to reduce plastic usage are also helping the industry to flourish. The government is even incentivizing companies to use sustainable and renewal solutions.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 16.59 Billion |

Projected Market Size in 2032 |

USD 23.96 Billion |

CAGR Growth Rate |

4.70% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Stolzle Glass, Ardagh Group, Dahlinger GmbH, BC Boncar srl, MW Creative Ltd., Eurobox Packaging, GPA Global, Fleet Luxury Packaging, Delta Global, Luxpac Ltd., McLaren Packaging, WestRock Company, Progress Packaging, Keenpac, Ekol Ofset, Pendragon Presentation Packaging, Lucas Luxury Packaging, DS Smith plc, HH Deluxe Packaging, Design Packaging Inc., and Others. |

Key Segment |

By End-Users, By Products, By Materials, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America accounts for a large share of the global luxury packaging market. Brands are posing high demand for the market because packaging plays an important role in attracting consumers and conveying the brand image. Therefore, luxury packaging is viewed as an extension of brand image in the region. E-commerce is highly influencing the regional market.

Many brands in the region are coming up with innovative and unique packaging solutions to deliver a premium feel to their product. Also, packaging companies are investing heavily in research and development activities to come up with unique brand experiences by tweaking the quality of material, shape, size, and designs.

Moreover, the region is a hub for technological innovation, which, in turn, is also likely to support the growth trajectory of the regional market during the forecast period. Also, people in the region are promoting sustainable and eco-friendly packaging solutions, which are expected to foster developments in the regional market.

Asia Pacific is anticipated to see notable developments in the luxury packaging industry in the coming years. The developing economies in the region are posing a high demand for luxurious packaging solutions in the market. Also, the surge in people's disposable income is encouraging premium packaging solutions.

Asian countries like China and India are witnessing surging demands because of the growing Western influence on the people. The people in the region associate high-quality packaging with product excellence, which is also likely to support the growth trajectory of the regional market.

However, surging e-commerce activities will also boost the growth of the regional market. Strategic market entry by many international and local brands has also heightened the emphasis on luxurious packaging solutions to appeal to the preferences of consumers in the region. For instance, Fedrigoni took over Guarro Casas in October 2022 to improve the choice of specialty papers for high-end printing applications.

Competitive Analysis

Competitive Analysis

The key players in the global luxury packaging market include:

- Stolzle Glass

- Ardagh Group

- Dahlinger GmbH

- BC Boncar srl

- MW Creative Ltd.

- Eurobox Packaging

- GPA Global

- Fleet Luxury Packaging

- Delta Global

- Luxpac Ltd.

- McLaren Packaging

- WestRock Company

- Progress Packaging

- Keenpac

- Ekol Ofset

- Pendragon Presentation Packaging

- Lucas Luxury Packaging

- DS Smith plc

- HH Deluxe Packaging

- Design Packaging Inc.

For instance, GPA Global collaborated with Ontario Teachers in October 2022 to help businesses with expansion goals. The latter is a significant global investor with a net asset of USD 242.5 billion.

The global luxury packaging market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Consumer Electronics

- Consumer Goods

- Food & Beverages

- Fashion Accessories & Apparel

By Products Segment Analysis

By Products Segment Analysis

- Cans

- Bottles

- Boxes & Cartons

- Pouches & Bags

- Others

By Materials Segment Analysis

By Materials Segment Analysis

- Wood

- Fabric

- Glass

- Metal

- Paper & Paperboard

- Plastic

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Stolzle Glass

- Ardagh Group

- Dahlinger GmbH

- BC Boncar srl

- MW Creative Ltd.

- Eurobox Packaging

- GPA Global

- Fleet Luxury Packaging

- Delta Global

- Luxpac Ltd.

- McLaren Packaging

- WestRock Company

- Progress Packaging

- Keenpac

- Ekol Ofset

- Pendragon Presentation Packaging

- Lucas Luxury Packaging

- DS Smith plc

- HH Deluxe Packaging

- Design Packaging Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors