Search Market Research Report

Hot Fill Packaging Market Size, Share Global Analysis Report, 2024 – 2032

Hot Fill Packaging Market Size, Share, Growth Analysis Report By End-Users (Nectar, Dairy, Soups, Ready-To-Drink Beverages, Flavored Water, Mayonnaise, Jams, Vegetable Juices, Fruit Juices, Sauces & Spreads, And Others), By Machine Type (Automatic And Manual), By Capacity (Above 64 Oz, 33 Oz- 64 Oz, 13 Oz- 32 Oz, and up to 12 Oz), By Packaging Layer (Tertiary, Secondary, And Primary), By Material (Polypropylene, Glass, Plastic, And Others), By Product (Caps & Closures, Cans, Pouches, Containers, Jars, Bottles, And Others), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

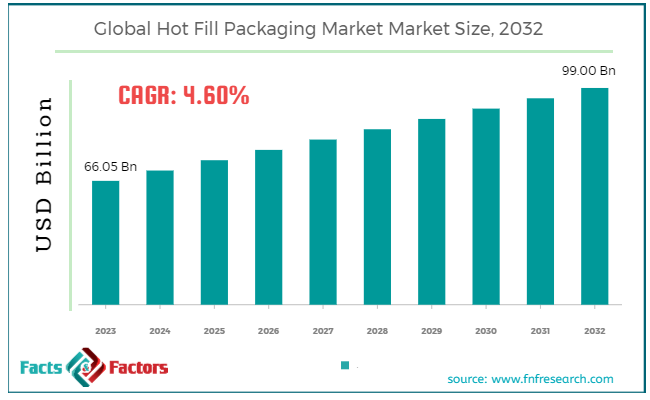

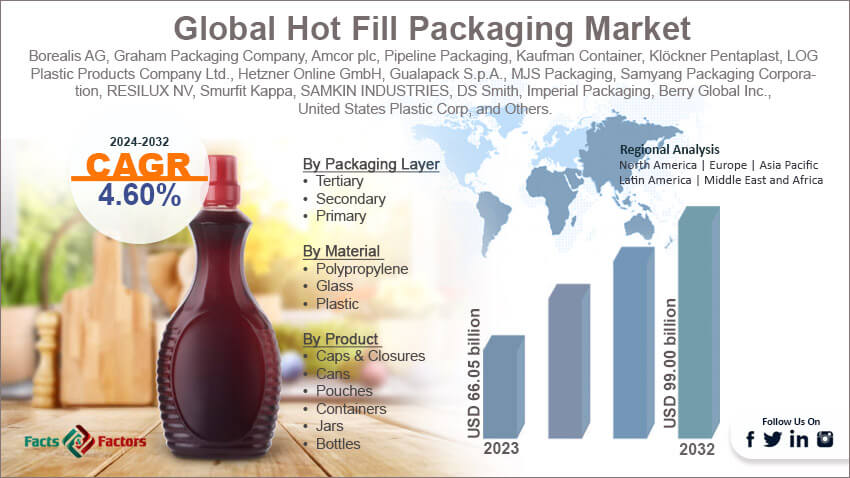

[217+ Pages Report] According to Facts and Factors, the global hot fill packaging market size was valued at USD 66.05 billion in 2023 and is predicted to surpass USD 99.00 billion by the end of 2032. The hot fill packaging industry is expected to grow by a CAGR of 4.60% between 2024 and 2032.

Market Overview

Market Overview

Hot fill packaging is used to pack specific kinds of food and beverages that are temperature-sensitive. Hot-fill packaging keeps the containers at elevated temperatures, followed by sealing and cooling to ensure the product's stability and safety. Hot-fill packaging preserves the product's freshness, flavor, and nutritional value by ensuring the high temperature. It also prevents the growth of microorganisms and enzymes that can destroy the product content. Also, it is a cost-effective solution as compared to other available options in the market.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global hot fill packaging market size is estimated to grow annually at a CAGR of around 4.60% over the forecast period (2024-2032).

- In terms of revenue, the global hot fill packaging market size was valued at around USD 66.05 billion in 2023 and is projected to reach USD 99.00 billion by 2032.

- Growing demand for convenience products is driving the growth of the global hot fill packaging market.

- Based on the end-users, the ready-to-drink beverages segment is growing at a high rate and is projected to dominate the global market.

- Based on the machine type, the automatic machine segment is projected to swipe the largest market share.

- Based on the capacity, the 13 Oz - 32 Oz segment is expected to dominate the global market.

- Based on the packaging layers, the tertiary segment is expected to dominate the global market.

- Based on the material, the plastic material segment is projected to witness huge growth in the global market.

- Based on the product, the bottles segment is likely to see developments in the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing demand for convenience products is driving the growth of the global market.

The hectic lifestyle of the people is posing a huge requirement for convenience products in the global hot fill packaging market. People are looking forward to on-the-go food and beverage options which fit their lifestyle and consumption habits.

Also, with the changing consumption patterns and dietary lifestyles, people nowadays are more inclined toward beverage products like sports drinks, functional beverages, and many others. Also, there is an increasing focus of people on sustainability in the packaging industry.

Therefore, hot food packaging is more in demand as it is made from recyclable materials and aligns with the goal of environmentally friendly packaging solutions. For instance, Berry Global introduced a hot line of sauce bottles in May 2022. The product is named Nova Bottle, and they come in packaging of sizes 250 ml and 500 ml. The design of the product is consumer-centric and focuses on offering convenience to consumers.

Restraints

Restraints

- High initial investment is expected to hamper the growth of the global market.

Hot fill packaging systems require specialized packaging technology and infrastructure, which incurs a huge initial investment. Therefore, it is expected to hamper the growth of the global hot fill packaging market.

Also, high upfront costs act as a barrier for entry-level businesses, therefore limiting their adoption rate. Additionally, the packaging design limitations with hot fill packaging processes are further likely to limit the growth of the industry.

Opportunities

Opportunities

- Rising concerns about product safety and extended shelf life are expected to foster growth opportunities in the global market.

Hot fill packaging preserves the quality and freshness of packed products by maintaining the required high temperature. These packaging solutions also extend the shelf life of the product by avoiding the growth of microorganisms and bacteria in the product's content.

Technological advancements are expected to further strengthen the industry in the coming years. Innovation of advanced materials and packaging designs are further expected to improve the performance and efficiency of the packaging solution. Increasing research and development activities are a major factor expected to revolutionize the marketplace.

The changing retail landscape is also likely to positively impact the growth of the hot fill packaging industry. The emergence of e-commerce, online grocery platforms, and convenience stores is expected to propel the demand for hot-fill packaging solutions. For instance, Amcor Rigid Packaging came up with PowerPost in May 2022. It is a groundbreaking technology starting the production of light bottles manufactured from recycled materials.

Challenges

Challenges

- Competition from alternate packaging technologies is a big challenge in the global market.

Hot fill packaging solutions are facing intense competition from alternative packaging technologies like aseptic packaging. Alternative technologies have their own unique advantage and are therefore posing a huge challenge in the hot fill packaging industry.

Segmentation Analysis

Segmentation Analysis

The global hot fill packaging market can be segmented into end-users, machine type, capacity, packaging layer, material, product, and others.

By End-Users Insights

By End-Users Insights

On the basis of end-users, the market can be segmented into nectar, dairy, soups, ready-to-drink beverages, flavored water, mayonnaise, jams, vegetable juices, fruit juices, sauces & spreads, and others. The ready-to-drink beverages segment accounts for the largest share of the hot fill packaging industry. Ready-to-drink beverages are more popular among consumers because of their convenience.

These beverages help people enjoy their schedule without the hassle of preparing the drink. Hot fill packaging is widely used in these beverages because of their safety parameters and efficient packaging. These packaging are stable at high temperatures, thereby helping manufacturers maintain the freshness and quality of the drink.

Also, another major reason for the high growth rate of the segment is its wide product range. Ready-to-drink beverages include energy drinks, sports drinks, fruit juices, tea, coffee, and many other functional beverages. The versatility of hot-fill packaging allows manufacturers to work with all of their products.

By Machine Type Insights

By Machine Type Insights

Based on machine type, the market can be segmented into automatic and manual. The automatic machine type is the fastest-growing segment in the global hot fill packaging market. Automatic hot-fill packaging is widely adopted by manufacturers because of its productivity and efficiency. It helps companies save labor and increase output. Also, the consistency and accuracy of automatic machines attract consumers.

By Capacity Insights

By Capacity Insights

In terms of capacity, the market can be segmented into above 64 Oz, 33 Oz- 64 Oz, 13 Oz- 32 Oz, and up to 12 Oz. The 13 Oz - 32 Oz segment is likely to dominate the hot fill packaging industry in the forthcoming years. The growing demand for beverages in this capacity range is one of the major factors propelling the growth of the segment. The packaging size is convenient and easy to carry. It is ideal for on-the-go consumption, household use, and other daily work.

By Packaging Layer Insights

By Packaging Layer Insights

On the basis of the packaging layer, the market can be segmented into tertiary, secondary, and primary. Tertiary packaging layers are gaining high popularity in the hot fill packaging industry. This packaging is highly used by people because of its ability to handle transportation hassles. It lowers the chances of product damage and transportation costs. Also, tertiary packaging helps manufacturers with enough brand visibility in the marketing content space.

By Material Insights

By Material Insights

In terms of material, the market can be segmented into polypropylene, glass, plastic, and others. The plastic material segment is projected to witness significant developments in the global hot fill packaging market during the forecast period. Plastic materials are versatile in nature. They are ideal for packaging design, shape, size, and functionality.

Also, these are light in weight which reduces the transportation cost and handling hassles. It is durable and resistant to breakage, which makes it an ideal material for hot-fill packaging.

By Product Insights

By Product Insights

Based on product, the market can be segmented into caps & closures, cans, pouches, containers, jars, bottles, and others. Bottle segment is expected to swipe the largest sales volume in the hot fill packaging industry. Bottles are widely used in packaging formats because of the consumer's preferences. It is a user-friendly format which is easy to use. It is one of the most consumer’s trusted and recognized packaging formats, which is available in different shapes and sizes.

Also, it is highly used across different industries like personal care, cosmetic products, food & beverage, and pharmaceutical products. Additionally, bottles offer extended shelf life and product protection. It protects the content from oxygen, moisture, light and other contaminants, thereby preserving products for a long time.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 66.05 Billion |

Projected Market Size in 2032 |

USD 99.00 Billion |

CAGR Growth Rate |

4.60% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Borealis AG, Graham Packaging Company, Amcor plc, Pipeline Packaging, Kaufman Container, Klöckner Pentaplast, LOG Plastic Products Company Ltd., Hetzner Online GmbH, Gualapack S.p.A., MJS Packaging, Samyang Packaging Corporation, RESILUX NV, Smurfit Kappa, SAMKIN INDUSTRIES, DS Smith, Imperial Packaging, Berry Global Inc., United States Plastic Corp, and Others. |

Key Segment |

By End-Users, By Machine Type, By Capacity, By Packaging Layer, By Material, By Product, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market

North America accounts for the largest share of the global hot fill packaging market during the forecast period. Its high growth rate is due to its economy and high population base. People in the region demand hot-fill packaging solutions as there is a high consumption of products like soups, ready-to-drink beverages, soups, sauces, juices and others. People in the region are looking forward to go-on-the-go beverages because of their hectic lifestyles. Hot-fill packaging helps manufacturers align with the consumer's demand for product freshness, portability, and convenience.

Additionally, the rising trend of single serve, soups, and drinks is further driving the demand for these packaging. Companies in the region are investing heavily in research and development activities to come up with innovative and unique products. Companies are working on customized packaging designs to stand out in the competitive landscape. Moreover, companies are focusing on unique features like ergonomic shapes, resealable closures, and enough graphic space to swipe a large market area in the region.

Asia-Pacific is another leading region in the hot fill packaging industry. The region is likely to see huge developments in the coming years because of the increasing urbanization in the region. The changing lifestyles of people, along with their growing disposable income, are further expected to pose a huge demand for ready-to-drink food and beverages in the market. For instance, Amcor Plc came up with a new tech hub in China in August 2022 to innovate advanced eco-friendly packaging technology. The major goal with the setup is expanding their operations in Asia Pacific.

Competitive Analysis

Competitive Analysis

The key players in the global hot fill packaging market include:

- Borealis AG

- Graham Packaging Company

- Amcor plc

- Pipeline Packaging

- Kaufman Container

- Klöckner Pentaplast

- LOG Plastic Products Company Ltd.

- Hetzner Online GmbH

- Gualapack S.p.A.

- MJS Packaging

- Samyang Packaging Corporation

- RESILUX NV

- Smurfit Kappa

- SAMKIN INDUSTRIES

- DS Smith

- Imperial Packaging

- Berry Global Inc.

- United States Plastic Corp

For instance, Asahi Beverages opened its new manufacturing facility in Southeast Queensland in June 2022. The facility is named Upgraded Wulkuraka, with an investment of 55 million from the company.

The global hot fill packaging market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Nectar

- Dairy

- Soups

- Ready-To-Drink Beverages

- Flavored Water

- Mayonnaise

- Jams

- Vegetable Juices

- Fruit Juices

- Sauces & Spreads

- Others

By Machine Type Segment Analysis

By Machine Type Segment Analysis

- Automatic

- Manual

By Capacity Segment Analysis

By Capacity Segment Analysis

- Above 64 Oz

- 33 Oz- 64 Oz

- 13 Oz- 32 Oz

- up to 12 Oz

By Packaging Layer Segment Analysis

By Packaging Layer Segment Analysis

- Tertiary

- Secondary

- Primary

By Material Segment Analysis

By Material Segment Analysis

- Polypropylene

- Glass

- Plastic

- Others

By Product Segment Analysis

By Product Segment Analysis

- Caps & Closures

- Cans

- Pouches

- Containers

- Jars

- Bottles

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Borealis AG

- Graham Packaging Company

- Amcor plc

- Pipeline Packaging

- Kaufman Container

- Klöckner Pentaplast

- LOG Plastic Products Company Ltd.

- Hetzner Online GmbH

- Gualapack S.p.A.

- MJS Packaging

- Samyang Packaging Corporation

- RESILUX NV

- Smurfit Kappa

- SAMKIN INDUSTRIES

- DS Smith

- Imperial Packaging

- Berry Global Inc.

- United States Plastic Corp

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors