Search Market Research Report

Ethyleneamines Market Size, Share Global Analysis Report, 2022 – 2028

Ethyleneamines Market Size, Share, Growth Analysis Report By Type (Ethylenediamine and Heavy Ethyleneamines), By Industry Vertical (Personal Care, Pulp & Paper, Adhesives, Paints & Coatings, Agro Chemicals, Automotive, Pharmaceutical, Oil & Gas, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

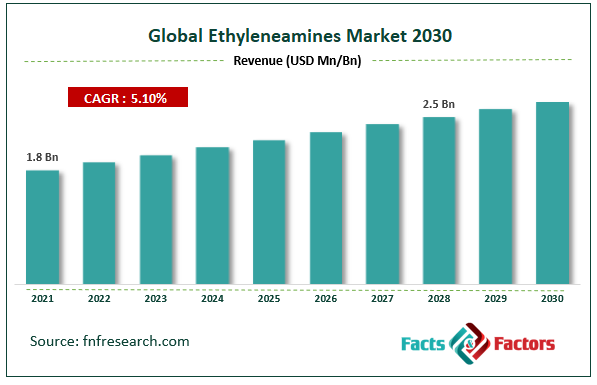

[210+ Pages Report] According to Facts and Factors, the global ethyleneamines market size was worth around USD 1.8 billion in 2021 and is predicted to grow to around USD 2.5 billion by 2028 with a compound annual growth rate (CAGR) of roughly 5.1% between 2022 and 2028. The report analyzes the global Ethyleneamines market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the Ethyleneamines market.

Market Overview

Market Overview

Ethyleneamines are amine compounds in which the amine groups are connected by ethylene bonds. The ethylene amines have various characteristics. For instance, they have a nasty amine smell and are dull, low-consistency fluids. Because of their exceptional mixture of reactivity, basicity, and surface action, ethyleneamines are utilized in a variety of applications. Paper, paints, cement, cleansers, cosmetics, medications, and paintings can all be made with ethyleneamines.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global ethyleneamines market is estimated to grow annually at a CAGR of around 5.1% over the forecast period (2022-2028).

- In terms of revenue, the global ethyleneamines market size was valued at around USD 1.8 billion in 2021 and is projected to reach USD 2.5 billion, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on type, ethylenediamine was predicted to dominate the market in the year 2021

- Based on industry vertical, the adhesives, paints, and coatings segment held the largest market share in 2021

- Based on region, Asia Pacific held the largest revenue share in 2021

Covid-19 Impact

Covid-19 Impact

The COVID-19 pandemic adversely impacted the market for ethyleneamines because of its dependency on the textile, automotive, and chemical industries. The COVID-19 pandemic had a significant impact on worldwide auto manufacturing in 2020, with a 16% decrease in output due to lockdowns and factory closures, according to the International Organization of Motor Vehicle Manufacturers. The risk of infections among employees in locations where ethyleneamines generate lubricants has led to the closure or reduction of operations at several automobile companies. It temporarily reduced the demand for ethyleneamines during the COVID-19 period.

Growth Drivers

Growth Drivers

- Growing agriculture sector augmented to drive the market

The growing agriculture sector across the globe is projected to drive the global ethyleneamines market growth over the forecast period. An organic substance called ethylenediamine serves as a basic ingredient in the production of agricultural chemicals including pesticides and fertilizers. Governments spend a lot of money on agricultural programs and investments since it is one of the best methods to increase environmental sustainability and agricultural productivity. The Agriculture and Food Research Initiative (AFRI), a project of the United States Department of Agriculture, aims to improve human nutrition, assure food security, and prepare the next generation of agricultural workers. For instance, NABARD announced an investment of USD 100 million in a venture capital fund in May 2019 for equity investments in start-ups in India that focus on agriculture and the rural sector. Moreover, the Canadian government gave the Canadian Federation of Agriculture (CFA) a total of USD 560,000 in 2020 to help them create the Canadian Agri-Food Sustainability Initiative. Therefore, the growing agriculture sector coupled with increasing government initiatives influence the market growth during the analysis period.

Restraints

Restraints

- Health risks associated with ethyleneamines might hamper the market growth

Humans with acute inhalation exposure to ethyleneamines have severe inflammation and irritation of the respiratory tract. Acute inhalation exposure symptoms in people include eye burning & tearing, sore throat, nasal discharge, bronchitis, shortness of breath, and emphysema of the lungs. Ethyleneamines are a powerful blistering agent that can burn the skin chemically to the third degree. Additionally, it is corrosive to eye tissue and may result in conjunctival scarring and persistent corneal opacity. Ethyleneamines may also contain solvents, which increase the risk of fire and explosion. Drums containing ethyleneamines may leak during a fire and greatly increase the fire's intensity. As a result, it is projected that the toxicity hazards connected with ethyleneamines will restrain the market's expansion.

Opportunities

Opportunities

- Increasing demand from the automotive industry provides an opportunity for market expansion

The increasing demand for ethyleneamines from the automotive industry is projected to provide a lucrative opportunity for global ethyleneamines market expansion during the forecast period. Etyleneamines are primarily employed as an additive for ash-less emissions in fuels and lubricants in automotive applications. It is primarily included in lubricants to reduce the formation of sludge and deliquesce deposits in IC engines. Moreover, the increasing demand for automobiles across the globe is also flourishing the market growth. For instance, according to the India Brand Equity Foundation (IBEF), the Indian passenger car market was valued at USD 32.70 billion in 2021, and it is expected to reach a value of USD 54.84 billion by 2027 while registering a CAGR of over 9% between 2022-27. Thus, these factors supported the market expansion for ethyleneamines.

Segmentation Analysis

Segmentation Analysis

The global ethyleneamines market is segmented based on type, industry vertical, and region.

Based on the type, the global market is bifurcated into ethylenediamine and heavy ethyleneamines. The ethylenediamine segment had the largest market share in 2021 and is expected to show this pattern over the forecast period due to the growing need for ethylenediamine in a variety of end-use sectors for uses including chelating agents, corrosion inhibitors, ethylene urea resins, ion exchange resins, thermoplastic resin lubricants, petroleum additives, polyamide resins, rubber chemicals, surface-active agents, and more. It is the lowest molecular weight ethyleneamine produced, and it is a single-component clear and colorless substance. Additionally, ethylenediamine is utilized as an intermediary in the synthesis of tetra acetyl ethylenediamine (TAED), a bleaching activator found in detergents and additives for dishwashing and laundry. As a result, it is predicted that throughout the projection period, demand for ethylenediamine will rise significantly due to the increased demand from various applications.

Based on the industry vertical, the global ethyleneamines market is categorized into personal care, pulp & paper, adhesives, paints & coatings, agrochemicals, automotive, pharmaceutical, oil & gas, and others. The adhesives, paints, and coatings are growing at a substantial rate during the forecast period. The growing demand for ethyleneamines from the paints, coatings, and adhesives industries for the production of epoxy resins. Epoxy resins, which are essential in the paints and adhesives industries, are produced using ethylene amines. In the coating zone, it stops the corrosion of steel and marine frameworks. It can stick to a variety of surfaces in the adhesive area, including metal, wood, glass, and plastic. One of the most crucial engineering resins for automobiles, aircraft, and wind turbine blades, these resins can also be found in the field of composite materials. The epoxy resin performs as intended once it has dried. This critical phase makes use of ethylene amine. Thus, the extensive demand for ethyleneamines to manufacture epoxy resins is anticipated to propel the ethyleneamines market during the forecast period.

Recent Developments:

Recent Developments:

- In August 2021, to increase the production of propionic acid, propionic aldehyde, ethyleneamines, ethanolamines, refined ethylene oxide, and tert-butyl acrylate, BASF SE and SINOPEC announced plans to further expand the Verbund facility in Nanjing, China. In 2023, the upgraded and new plants are anticipated to start operating.

- In September 2021, Dow Chemical Company increased the prices of the following ethyleneamine products in North America, like aminoethylethanolamine (AEEA) USD 0.15, diethylenetriamine (DETA) USD 0.30, ethylenediamine (EDA) USD 0.15, and piperazine 68% USD 0.10.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1.8 Billion |

Projected Market Size in 2028 |

USD 2.5 Billion |

CAGR Growth Rate |

5.1% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

BASF SE, Delamine BV, Arabian Amines Company, Diamines and Chemicals Ltd., Dow, Fisher Chemical, Huntsman International LLC, Nouryon, Oriental Union Chemical Corporation, Sadara Chemical Company, Saudi Basic Industries Corporation (SABIC), Tosoh Corporation., and Others |

Key Segment |

By Type, Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific dominates the market during the forecast period

The Asia Pacific accounted for the largest revenue share of more than 35% in 2021 and is expected to dominate over the forecast period. The growth in the region is attributable to the increasing demand for products in the automotive and agrochemical industry. China is the region's main producer of ethyleneamines, and China and India account for the majority of the market for these chemicals. Personal care, textiles, adhesives & paints, automotive, and several other industries in China all utilize ethyleneamines. For instance, according to the International Council of Chemical Associations (ICCA), in 2019, the chemical industry contributes USD 5.7 trillion to the global GDP and supports 120 million jobs. In which, Asia Pacific is the largest contributor to GDP and jobs, generating 45% of the industry's total annual economic value and supporting 69% of jobs. Moreover, after the government implemented new rules and laws for the automobile industry, the demand for ethyleneamines in India will rise. Because it is necessary to use ethyleneamines as a gasoline additive, this is anticipated to increase demand for them. Thus, these factors support the market growth in the region over the forecast period.

Competitive Analysis

Competitive Analysis

- BASF SE

- Delamine BV

- Arabian Amines Company

- Diamines and Chemicals Ltd.

- Dow

- Fisher Chemical

- Huntsman International LLC

- Nouryon

- Oriental Union Chemical Corporation

- Sadara Chemical Company

- Saudi Basic Industries Corporation (SABIC)

- Tosoh Corporation

The global ethyleneamines market is segmented as follows:

By Type

By Type

- Ethylenediamine

- Heavy Ethyleneamines

By Industry Vertical

By Industry Vertical

- Personal Care

- Pulp and Paper

- Adhesives, Paints, and Coatings

- Agro Chemicals

- Automotive

- Pharmaceutical

- Oil and Gas

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- BASF SE

- Delamine BV

- Arabian Amines Company

- Diamines and Chemicals Ltd.

- Dow

- Fisher Chemical

- Huntsman International LLC

- Nouryon

- Oriental Union Chemical Corporation

- Sadara Chemical Company

- Saudi Basic Industries Corporation (SABIC)

- Tosoh Corporation

Copyright © 2024 - 2025, All Rights Reserved, Facts and Factors