Search Market Research Report

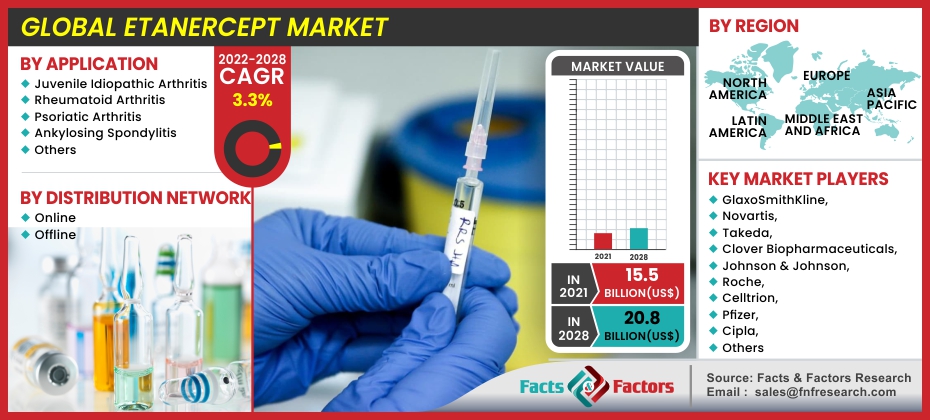

Etanercept Market Size, Share Global Analysis Report, 2022-2028

Etanercept Market By Application (Juvenile Idiopathic Arthritis, Rheumatoid Arthritis, Psoriatic Arthritis, Ankylosing Spondylitis, and Others), By Distribution Network (Online and Offline), and By Region-Global and Regional Industry Trends, Competitive Intelligence, Analysis of Data, Statistical Data, and Forecast 2022-2028

Industry Insights

[221+ Pages Report] According to Facts and Factors, during the forecast period of 2022 to 2028, the global etanercept market is estimated to develop at a compound annual growth rate (CAGR) of 3.3%. The global etanercept market was worth USD 15.5 billion in 2021, and it is anticipated to exceed USD 20.8 billion by 2028. The study investigates several elements and their consequences for the growth of the global etanercept market.

Market Overview

Market Overview

Etanercept is an injectable medication used to treat autoimmune diseases like arthritis and spondylitis. TNF alpha (Tumor necrosis factor-alpha) is a protein that is produced during inflammation, which is the body's response to injury. TNF alpha protein promotes inflammation and its associated symptoms, including swelling and tenderness. Etanercept is a protein created by humans that binds to the TNF cascade and prevents TNF alpha from enhancing inflammatory factors.

Etanercept was approved by the United States Food and Drug Administration in November 1998. According to research findings, problems with the immune system, blood, heart failure, and seizures are some of the adverse events associated with the use of etanercept. These side effects, however, differ between individuals.

COVID-19 Impact

COVID-19 Impact

Over the last 18 months, almost every industry in the world has suffered a setback. This is due to significant disruptions in their corresponding production and supply-chain operations as a consequence of multiple precautionary lockdowns and other restrictions imposed by governing authorities around the world. The same holds true for the global etanercept market.

Furthermore, consumer demand has subsequently decreased as people are now more focused on removing non-essential costs from their corresponding expenditures as the overall economic status of most people has been severely impacted by this outbreak. These factors are expected to weigh on the global market's revenue trajectory over the forecast period. However, as the respective governing officials begin to lift these imposed lockdowns, the global market is likely to recover.

Growth Drivers

Growth Drivers

- The link between the geriatric population and rheumatoid arthritis has been a significant market driver

Rheumatoid arthritis is a type of arthritis that primarily affects the elderly, causing swelling, pain, stiffness, and even joint damage. Furthermore, the following type of arthritis affects the fingers & wrists and is more common in women than in men. According to the CDC, the chance of having serious rheumatoid arthritis increases in one's 60s. According to various studies and reports, the general population is only getting older.

Fertility rates in middle and low-income countries, for example, have fallen from 2.5 children per woman to 2 children per woman. Furthermore, as a result of robust medical infrastructure, such regions' life expectancies have increased by up to 5 years. Because of these factors, the use of etanercept has grown and will continue to grow.

- The market has been pushed by lifestyle-related health risks, which act as a key driver

Sedentary lifestyles and urbanization-related factors have contributed to an increase in lifestyle-related health risks. As a result, obesity has become a major cause of disease in the world's population. Obesity rates in the United States approached 41.8 percent in 2018, up from 31.1 percent in 2000, according to the Center for Disease Control and Prevention.

Obesity has also been linked to an increased risk of ankylosing spondylitis. Numerous researchers have been looking for a link, and it turns out that one exists. According to independent research, the majority of spondylitis patients are overweight. Furthermore, etanercept has been actively recommended to such patients, expanding its utilization and adaptability.

Restraints

Restraints

- The cohort side-effects of etanercept use have hampered market growth

Etanercept has a profound effect on one's immune system, making it vulnerable to foreign infections. Furthermore, the body loses its strength to attack foreign invasions and thus surrenders quickly, increasing the risk of death from common flu-like symptoms. Furthermore, healthcare providers are advised to test the potential patient for tuberculosis (TB) before and during medication administration. Furthermore, a negative TB test is required before starting the medication. As a result, COVID-19 has weakened market participation even further, as there is a strong link between rising fatalities and impaired immune functionality.

According to the WHO's November 30th, 2021 report, there were approximately 256 million cases of the Sars-Cov-19 virus globally. Furthermore, having taken the following medications increases the risk of lymphoma by a factor of ten. As a result of such factors, the global etanercept market's growth has slowed.

Segmentation Analysis

Segmentation Analysis

The global etanercept market is segregated on the basis of application, distribution network, and region.

By application, the market is divided into juvenile idiopathic arthritis, rheumatoid arthritis, psoriatic arthritis, ankylosing spondylitis, and others. In the year 2021, rheumatoid arthritis held a commanding market share. It is due to the high prevalence of osteoarthritis in different regions around the world. The following condition affects 72 people out of every 100,000 people in the United States. Furthermore, the region has approximately 2 million documented cases of the following condition. The disease wreaks havoc on the synovial tissues of the joints. It is also a systemic disease with the possibility of invading the entire body and causing serious swelling or inflammation of the lungs, heart, or any other vital organ.

Etanercept, as a salt, is a tumor necrosis factor inhibitor that prevents the progression of inflammation. Furthermore, rheumatoid arthritis is expected to grow at the fastest rate, with a CAGR of 4.4 percent between 2022 and 2028. It is due to the condition's common triggers and their increasing prevalence. Growing age, obesity, and a larger female population are among the common causes that are only increasing, thereby supplementing the segment's growth and demand.

By distribution network, the market is divided into online and offline. In 2021, the offline segment held a commanding market share. It is due to reimbursement policies and the increasing adoption of AI as a supplement to a simple purchase. Furthermore, it is a prescription medication. As a result, offline retailers ship the aforementioned medication to the afflicted patient's home once a month. The online segment, on the other hand, is expected to grow the fastest, with a CAGR of 4.5 percent between 2022 and 2028. It is due to the strategies used by online retailers, such as cash-backs, discounts, and other similar ones.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 15.5 Billion |

Projected Market Size in 2028 |

USD 20.8 Billion |

CAGR Growth Rate |

3.3% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

GlaxoSmithKline, Novartis, Takeda, Clover Biopharmaceuticals, Johnson & Johnson, Roche, Celltrion, Pfizer, Cipla, and Samsung Bioepis. |

Key Segment |

By Application, Distribution Network, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- North America holds the largest market share

In 2021, North America's etanercept market held a 33 percent share when compared to other regions. It is due to the presence of leading pharma conglomerates in the region. Furthermore, the US government's budget allocated for medical R & D has been a major factor in the market's overall growth. Each year, approximately USD 175 billion is attributed to medical R & D advancement. Furthermore, private players have played an important role in the progress and are aggressively seeking new & focused medicines.

However, Asia Pacific is predicted to provide marketers with lucrative growth opportunities between 2022 and 2028. It's due to a rise in the frequency of aging populations, and it's linked to a variety of disease applications. Furthermore, CROs have been expanding, which will allow the region to grow further.

Recent Development

Recent Development

- December 2019: Clover Biopharma has begun Phase III studies in China for the Etanercept Biosimilar Candidate SCB-808. The first patient was given an injection of the biosimilar being developed in the preloaded syringe composition for the treatment of rheumatic diseases such as ankylosing spondylitis and rheumatoid arthritis, according to the company. The purpose of this study is to compare the efficacy, safety, and pharmacokinetics of SCB-808 and the originator drug Enbrel® in patients with ankylosing spondylitis after subcutaneous administration.

- November 2019: Samsung Bioepis and Biogen have announced a major commercialization agreement for two biosimilar applicants. The agreement gives Biogen the option to renew the commercialization term for Samsung Bioepis' three anti-TNF biosimilars – BENEPALI (etanercept), IMRALDI (adalimumab), and FLIXAB (infliximab) – in Europe for an additional five years, bringing the original ten-year agreement to a total of fifteen years. In Germany, France, Spain, Italy, and the United Kingdom, BENEPALI is the most commonly prescribed etanercept (UK). In Europe, IMRALDI is the leading adalimumab biosimilar. The agreement also gives Biogen the option of getting commercialization rights to BENEPALITM, FLIXABITM, and IMRALDITM in China in exchange for market royalties.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the global etanercept market are :

- GlaxoSmithKline

- Novartis

- Takeda

- Clover Biopharmaceuticals

- Johnson & Johnson

- Roche

- Celltrion

- Pfizer

- Cipla

- Samsung Bioepis

The global etanercept market is segmented as follows:

By Application Segment Analysis

By Application Segment Analysis

- Juvenile Idiopathic Arthritis

- Rheumatoid Arthritis

- Psoriatic Arthritis

- Ankylosing Spondylitis

- Others

By Distribution Network Segment Analysis

By Distribution Network Segment Analysis

- Online

- Offline

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- GlaxoSmithKline

- Novartis

- Takeda

- Clover Biopharmaceuticals

- Johnson & Johnson

- Roche

- Celltrion

- Pfizer

- Cipla

- Samsung Bioepis

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors