Search Market Research Report

Drug Discovery Outsourcing Services Market Size, Share Global Analysis Report, 2025 - 2034

Drug Discovery Outsourcing Services Market Size, Share, Growth Analysis Report By Service Type (Chemistry Services, Biological Services), By Drug Type (Small-Molecule Drugs, Large-Molecule Drugs), By Therapeutic Area (Oncology, Infectious Disease, Respiratory Disease, Cardiovascular, Gastrointestinal, and Others), By End-User (Contract Research Organizations, Pharmaceutical & Biotechnology Companies, Academic Institutes, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

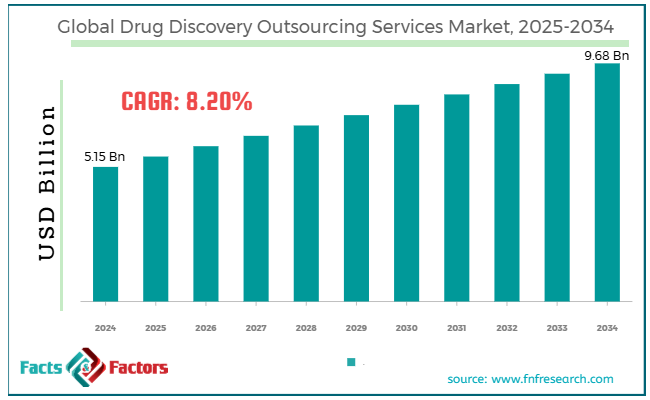

[215+ Pages Report] According to Facts & Factors, the global drug discovery outsourcing services market size was worth around USD 5.15 billion in 2024 and is predicted to grow to around USD 9.68 billion by 2034, with a compound annual growth rate (CAGR) of roughly 8.20% between 2025 and 2034.

Market Overview

Market Overview

Drug discovery outsourcing services include biotech and pharmaceutical companies associating with external groups like CROs to perform different stages of drug discovery procedures. These services involve hit discovery, target identification, preclinical testing, and lead optimization. Outsourcing services significantly reduces costs, simplifies access to specialized technologies and expertise, concentrates on core competencies, and quickens timelines. The worldwide drug discovery outsourcing services market is anticipated to grow substantially in the coming years, owing to technological improvements, resource optimization, cost efficiency, and emphasis on orphan and rare diseases. Integrating machine learning, artificial intelligence, and high-throughput screening solutions has transformed drug discovery. Outsourcing allows companies to access these modernized platforms without high investments.

Moreover, pharmaceutical companies actively outsource drug discovery to minimize research and development costs and enhance resources. This approach enables them to utilize professional third-party services, primarily in regions with lower costs, without compromising research quality.

Also, outsourcing facilities are specialized researchers in the areas of orphan and rare diseases, which may not be viable for firms to perform autonomously.

Nevertheless, the global market faces barriers due to regulatory compliance intricacies, restricted control of processes, and quality assurance issues. Fluctuating global regulatory principles may delay drug approvals and complicate the outsourcing procedure. Outsourcing may also result in strict control over drug discovery and lessen oversight procedures, thus adversely impacting outcomes.

Furthermore, promising reliable quality in outsourcing services may be complex, mainly when dealing with numerous partners. However, the market will gain remarkable growth over the estimated period owing to opportunities from integrating remote and virtual trials, emphasis on biosimilars and biologics, and inclination towards personalized medicine. Adopting remote and virtual clinical trials, strengthened by the recent COVID-19, offers prospects for outsourcing data collection and trial management services.

In addition, the rising demand for biosimilars and biologics is propelling the need for professional outsourcing services in these domains. Also, the inclination towards tailored medicine fuels the demand for drug discovery services, offering growth opportunities for outsourcing providers.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global drug discovery outsourcing services market is estimated to grow annually at a CAGR of around 8.20% over the forecast period (2025-2034)

- In terms of revenue, the global drug discovery outsourcing services market size was valued at around USD 5.15 billion in 2024 and is projected to reach USD 9.68 billion by 2034.

- The drug discovery outsourcing services market is projected to grow significantly owing to the increasing cases of chronic illnesses globally, mounting demand for outsourcing novel therapeutics and drugs, and rising expenses by biotechnology and pharmaceutical companies.

- Based on service type, the chemistry services segment is expected to lead the market, while the biological services segment is expected to grow considerably.

- Based on drug type, the large-molecule drugs segment is leading the market, while the small-molecule drugs segment will grow sizably.

- Based on the therapeutic area, the oncology segment is the dominating segment among others, while the respiratory disease segment is projected to witness sizeable revenue over the forecast period.

- Based on end-user, the pharmaceutical & biotechnology companies segment is expected to lead the market as compared to the academic institutes segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by the Asia Pacific.

Growth Drivers

Growth Drivers

- Will the mounting demand for safe & effective drugs spur the drug discovery outsourcing services market growth?

The rising incidences of chronic illnesses and the growing elderly population fuel the demand for novel and effective treatments, thus impacting the global drug discovery outsourcing services market. This rising demand requires effective drug discovery procedures, triggering companies to outsource diverse stages of drug development to meet industry demands.

Iktos declared the closing of its Series A round, worth €15.5 million, in March 2023 to grow its AI-driven drug discovery solutions. This funding will allow Iktos to develop its drug discovery and AI potential and extend its offerings, including introducing Iktos Robotics. It is a high-end drug discovery platform that mixes clinical synthesis and AI automation to boost drug discovery timelines significantly.

- Technological improvements that streamline manufacturing processes fuel market growth

The growth of digital solutions like big data analytics, artificial intelligence, and automation is transforming the pharmaceutical and biotechnology outsourcing outlook. These solutions improve drug manufacturing procedures. As companies embrace these modernizations, outsourcing partners with superior technologies become more valuable.

In May 2023, Google Cloud declared two novel AI-based life sciences technologies to boost precision medicine and drug discovery for pharmaceutical companies, biotech firms, and public sector organizations.

Restraints

Restraints

- Does the loss of control over research processes negatively impact the drug discovery outsourcing services market progress?

Outsourcing important R&D segments can create a disconnect between the CRO and the sponsor, primarily resulting in communication breakdowns and misaligned research protocols, goals, and timelines. It also delays iteration cycles in lead optimization stages and hit-to-lead phases.

A 2023 audit of a leading CRO based in Singapore disclosed unreliable SOP adherence for 4 United States biotechnology companies, stalling clinical translation of assured immunotherapies.

Opportunities

Opportunities

- How will the amplified investment in research & development positively impact market growth

Their research and development budgets majorly drive the biotechnology and pharmaceutical sectors to satisfy the mounting demand for novel drugs and therapies, personalized medicines, and biologics. This higher investment has offered a favorable environment for subcontracting drug discovery, mainly to specialized biotech companies and CROs.

The IFPMA reported approximately USD 182 billion in spending on biopharmaceutical research and development in 2021, with estimates reaching USD 213 billion by 2026. This spending positively impacted the progress of the drug discovery outsourcing services industry.

Challenges

Challenges

- Ethical considerations in animal testing limit the growth of market

Strict protocols governing animal testing in drug discovery, fueled by ethical considerations, primarily increase production costs. These protocols may offer key challenges to the smooth operation of drug discovery research.

Different legislations that promise product quality, like GMP (Good Manufacturing Practices), usually raise manufacturing costs.

Concerns over the ethical use of animals in research have prompted governments to enact legislation governing animal use and safety, presenting significant challenges to the seamless operation of drug discovery research.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 5.15 Billion |

Projected Market Size in 2034 |

USD 9.68 Billion |

CAGR Growth Rate |

8.20% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Charles River Laboratories, Eurofins Scientific, Thermo Fisher Scientific (Patheon), Labcorp Drug Development (formerly Covance), Evotec SE, Syngene International Ltd., Medpace, ICON plc, Pharmaceutical Product Development LLC (PPD), BioDuro-Sundia, GVK Biosciences, Selvita, Aurigene Discovery Technologies, ChemPartner, Frontage Laboratories, and others. |

Key Segment |

By Service Type, By Drug Type, By Therapeutic Area, By End User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global drug discovery outsourcing services market is segmented based on service type, drug type, therapeutic area, end-user, and region.

Based on service type, the global drug discovery outsourcing services industry is divided into chemistry services and biological services. The chemistry services segment registered a maximum market share in the past year and will continue to dominate. These services entail compound library synthesis, medicinal chemistry, and lead optimization. These services are vital in making small-molecule drugs, which are prevalent in the pharma sector. In 2024, these services registered notable market share due to the broad use of small molecules in the early stages of drug development and the rising intricacy of drug discovery processes.

Based on the therapeutic area, the global drug discovery outsourcing services market is segmented into oncology, infectious disease, respiratory disease, cardiovascular, gastrointestinal, and others. The oncology segment held a notable market share due to complex biology needing specialized expertise, high cancer incidences on a global scale, and mounting demand for immune and targeted therapies. Also, pharma companies heavily invest in oncology research and development due to its commercial potential, the growth of precision medicine, and fast regulatory pathways, all of which accelerate innovation and reduce costs.

Based on end-user, the global drug discovery outsourcing services industry is segmented into contract research organizations, pharmaceutical & biotechnology companies, academic institutes, and others. The pharmaceutical & biotechnology companies segment led the global market in the previous years due to high R&D investment, specialized expertise, and emphasis on core competencies. Biotechnology and pharmaceutical companies distribute massive budgets to research and development. They outsource discovery jobs like lead optimization, target identification, and toxicity screening to improve this investment. Outsourcing streamlines access to superior technologies like genomics, AI, bioinformatics, and highly specialized experts, which may be expensive for in-house maintenance. By outsourcing discovery stages, firms can focus more on key areas such as regulatory approval, marketing, and commercialization.

Regional Analysis

Regional Analysis

- Will North America witness significant growth in the drug discovery outsourcing services market over the forecast period?

North America led the global drug discovery outsourcing services market in 2024 and will continue its dominance over the estimated period. The key factors contributing to growth include a well-developed pharmaceutical industry, intense research and development investments, and sophisticated technological capabilities and infrastructure. North America is home to prominent biotechnology and pharmaceutical companies like Gilead Sciences, Eli Lilly, and Merck, which are key contributors to the industry. These companies seek specialized drug discovery services to improve their research and development capabilities. The region invests in research and development, nurturing advancements and introducing novel therapies. This investment supports the progress of CMOs and CROs, which provide vital services in drug discovery.

Moreover, the region boasts about its improved technologies and modernized research facilities that simplify efficient drug discovery procedures. Associations between service providers and pharmaceutical companies are actively using these technologies to speed up development timelines.

Asia Pacific is expected to progress as the second-leading region in the global drug discovery outsourcing services industry. The region is expected to grow considerably due to cost-efficiency, skilled labor, strong government support, and technological improvements. Nations like China, South Korea, and India offer low operational and labor costs, making them appealing regions for outsourcing drug discovery services. Asia Pacific brags about its massive pool of expert professionals in pharmaceutical and biotechnology, aiding the development of CDMOs and CROs.

Moreover, nations like China and Japan have imposed subsidy programs and regulatory reforms to improve local manufacturing capabilities and simplify drug approval procedures. Adopting high-throughput screening technologies and artificial intelligence is boosting drug discovery in the Asia Pacific.

Competitive Analysis

Competitive Analysis

The global drug discovery outsourcing services market is led by players like:

- Charles River Laboratories

- Eurofins Scientific

- Thermo Fisher Scientific (Patheon)

- Labcorp Drug Development (formerly Covance)

- Evotec SE

- Syngene International Ltd.

- Medpace

- ICON plc

- Pharmaceutical Product Development LLC (PPD)

- BioDuro-Sundia

- GVK Biosciences

- Selvita

- Aurigene Discovery Technologies

- ChemPartner

- Frontage Laboratories

Key Market Trends

Key Market Trends

- AI-based drug discovery:

Biotechnology and pharmaceutical companies actively use machine learning and artificial intelligence to boost early-stage drug discovery. These technologies facilitate the virtual screening of compounds, predict drug-target interactions, and minimize costs and time in identifying viable drug candidates.

- Long-term collaborations and strategic associations:

Pharmaceutical companies are forming multi-year associations with academic institutes and CROs. These partnerships enhance access to specialized expertise, share research, develop cost-effective solutions and mitigate risks, and accelerate innovations through joint research efforts.

The global drug discovery outsourcing services market is segmented as follows:

By Service Type Segment Analysis

By Service Type Segment Analysis

- Chemistry Services

- Biological Services

By Drug Type Segment Analysis

By Drug Type Segment Analysis

- Small-Molecule Drugs

- Large-Molecule Drugs

By Therapeutic Area Segment Analysis

By Therapeutic Area Segment Analysis

- Oncology

- Infectious Disease

- Respiratory Disease

- Cardiovascular

- Gastrointestinal

- Others

By End User Segment Analysis

By End User Segment Analysis

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

- Academic Institutes

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Charles River Laboratories

- Eurofins Scientific

- Thermo Fisher Scientific (Patheon)

- Labcorp Drug Development (formerly Covance)

- Evotec SE

- Syngene International Ltd.

- Medpace

- ICON plc

- Pharmaceutical Product Development LLC (PPD)

- BioDuro-Sundia

- GVK Biosciences

- Selvita

- Aurigene Discovery Technologies

- ChemPartner

- Frontage Laboratories

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors