Search Market Research Report

Caps and Closures Market Size, Share Global Analysis Report, 2021–2026

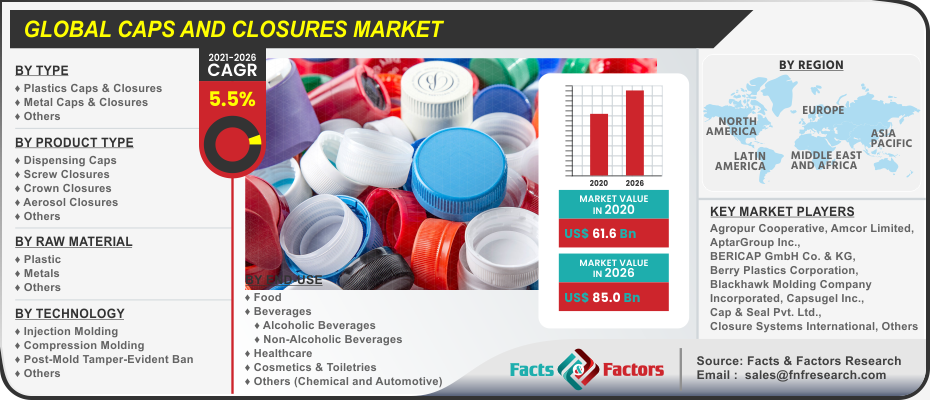

Caps and Closures Market Size, Share & Trends Analysis Report By Type (Plastics Caps & Closures, Metal Caps & Closures, Others), By Product Type (Dispensing Caps, Screw Closures, Crown Closures, Aerosol Closures, Others), By Raw Material (Plastic, Metals, Others), By Technology (Injection Molding, Compression Molding, Post-Mold Tamper-Evident Ban, Others), By End-use Industry (Food, Beverages, Healthcare, Cosmetics & Toiletries, Others), By Region, And Segment Forecast 2021–2026

Industry Insights

According to facts and factors, the worldwide demand for the global caps and closures market was valued at approximately USD 61.6 billion in 2020 and is predicted to create revenue of roughly USD 85.0 billion by the end of 2026, with a CAGR of approximately 5.5% between 2021 and 2026.

Market Overview

Market Overview

Caps and closures made from metal, plastic, and other materials are closing systems used in containers, cartons, bottles, jars, and other packaging formats for packaging and sealing applications. The growing production output from various end-use industries, coupled with design enhancement in caps and closures are driving its sales in the market. The final components of the packaging process are the Caps and closures. They also represent one of the most vital parts of the entire process on which the product integrity depends upon. Plastic caps and closures are important components in product packaging and play a key role in enhancing the functionality and aesthetics of the products. They are currently used across a number of different industries such as household goods, food and beverages, pharmaceuticals, cosmetic products, etc.

Meanwhile, sales of caps and closures are largely driven by marketing activities such as partnerships, product maximization, investments, acquisitions, and others. Furthermore, production, recyclability, and the introduction of sustainable and recyclable caps and closures are building lucrative opportunities for key manufacturers. Basically, manufacturers are focusing on circular packaging with the incorporation of caps and closures, which are made up from post-consumer resin (PCR) and other recyclable materials. With this, caps and closures manufacturers are upgrading their recycling initiatives, attracting eco-conscious customers, and achieving sustainability targets in the market. This turn is propelling sales of caps and closures, and the trend is projected to continue over the forecast period.

Industry Growth Factors

Industry Growth Factors

In recent years, there has been a significant rise in demand for child resistant packaging over safety concerns and regulations. Owing to increasing mandatory safety regulations for child resistant packaging, caps and closures manufacturers are producing child-resistant (CR) caps and closures on a large scale. The increase in demand for demographic trends, easy-to-open and sustainable packs and rapid urbanization contribute to the demand and adoption rate of caps & closures. These are widely utilized in the food & beverage industry for various applications, such as carbonated drinks, ketchup, mayonnaise, bottled water, and alcoholic beverages. Caps & closures help the extend shelf life of products, balance the oxygen content of the packed product and provide a barrier to dirt and moisture. Export & import of caps & closures has been attaining importance with its increasing demand.

Covid-19 Analysis

Covid-19 Analysis

The COVID-19 pandemic harmed the market growth, particularly caps and closures of productions. Caps & closures are used in pharmaceuticals, food & beverages, cosmetic products, household goods, and others. They are the final components of packaging and are accountable for maintaining the integrity of the packing of the product. Caps & closures use polypropylene, polyethylene, steel, and aluminum as the primary raw materials for manufacturing

On the other hand, the industry includes companies working in processing raw food materials distribution and packaging, which include already prepared foods and packaged foods, along with alcoholic and non-alcoholic beverages. The rise in the number of on-the-go consumers and increased adoption of ready-to-eat food are the primary factors for the growth of the food & beverage industry before the COVID-19 pandemic. Steadily population increase and changing lifestyle also per capita income were other drivers of the food & beverage industry. However, some factors affecting the food & beverage industry include shutdowns of restaurants and other seating areas.

Segmentation Analysis

Segmentation Analysis

The caps and closures market is segmented based on type, product type, raw material, technology, and end-use industry:

As per type caps and closures, the market is segmented into (plastics caps & closures, metal caps & closures, others), by product type (dispensing caps, screw closures, crown closures, aerosol closures, others), by raw material (plastic, metals, others), by technology (injection molding, compression molding, post-mold tamper-evident ban, others) and by end-use industry (food, beverages, healthcare, cosmetics & toiletries, others). The plastic segment held the highest market share of over 54% in 2020, in terms of revenue, and is estimated to expand further at the fastest CAGR over the forecast period. Plastic material poses environmental concerns due to lower degradability as well as CO2 emissions taking place during its production.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 61.6 Billion |

Projected Market Size in 2026 |

USD 85.0 Billion |

CAGR Growth Rate |

5.5% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2026 |

Key Market Players |

Agropur Cooperative, Amcor Limited, AptarGroup Inc., BERICAP GmbH Co. & KG, Berry Plastics Corporation, Blackhawk Molding Company Incorporated, Capsugel Inc., Cap & Seal Pvt. Ltd., Closure Systems International, Crown Holdings Incorporation, Guala Closures Group, Oriental Containers, Pact Group Holdings, Phoenix Closures, Pelliconi, Plastics Corporation, Plastic Closures Limited, Premier Vinyl Solution, Rexam PLC, Reynolds Group Holdings Limited, etc. and among others. |

Key Segment |

By Type, By Product Type, By Raw Material, By Technology, By End-use Industry, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

In the global market, Asia Pacific held the largest share. The Asia Pacific led the global caps & closures market. The Asia Pacific includes two high-growth economies like India and China. The standard of living is improving in this region, which is accelerating the per-capita spending on the packaging. Nowadays, hectic lifestyles result in the demand for packaged products for on-the-go consumption. This consequently leads to the demand for closures that are easy to open can be re-sealed, and keep the products fresh & new for a longer period. An economy such as Singapore, Indonesia, and Malaysia offers significant opportunities for the caps & closures market.

Competitive Players

Competitive Players

Some of the essential players operating in the caps and closures market are :

- Agropur Cooperative

- Amcor Limited

- AptarGroup Inc.

- BERICAP GmbH Co. & KG

- Berry Plastics Corporation

- Blackhawk Molding Company Incorporated

- Capsugel Inc.

- Cap & Seal Pvt. Ltd.

- Closure Systems International

- Crown Holdings Incorporation

- Guala Closures Group

- Oriental Containers

- Pact Group Holdings

- Phoenix Closures

- Pelliconi

- Plastics Corporation

- Plastic Closures Limited

- Premier Vinyl Solution

- Rexam PLC

- Reynolds Group Holdings Limited

Companies are also focusing on procuring recycled materials for caps manufacturing. Post-Consumer Recycled aluminum, steel, and plastic are being explored, which can be processed further and used as raw materials. For instance, in October 2020, Closure Systems International launched a beverage closure made from 30% PCR content in partnership with Coca-Cola to increase product sustainability.

By Type Segment Analysis

By Type Segment Analysis

- Plastics Caps & Closures

- Metal Caps & Closures

- Others

By Product Type Segment Analysis

By Product Type Segment Analysis

- Dispensing Caps

- Screw Closures

- Crown Closures

- Aerosol Closures

- Others

By Raw Material Segment Analysis

By Raw Material Segment Analysis

- Plastic

- Metals

- Others

By Technology Segment Analysis

By Technology Segment Analysis

- Injection Molding

- Compression Molding

- Post-Mold Tamper-Evident Ban

- Others

By End-use Industry Segment Analysis

By End-use Industry Segment Analysis

- Food

- Beverages

- Alcoholic Beverages

- Non-Alcoholic Beverages

- Healthcare

- Cosmetics & Toiletries

- Others (Chemical and Automotive)

Regional Segment Analysis

Regional Segment Analysis

- North America

- U.S.

- Canada

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- The Middle-East and Africa

- GCC Countries

- South Africa

- Rest of Middle-East Africa

Table of Content

Industry Major Market Players

- Agropur Cooperative

- Amcor Limited

- AptarGroup Inc.

- BERICAP GmbH Co. & KG

- Berry Plastics Corporation

- Blackhawk Molding Company Incorporated

- Capsugel Inc.

- Cap & Seal Pvt. Ltd.

- Closure Systems International

- Crown Holdings Incorporation

- Guala Closures Group

- Oriental Containers

- Pact Group Holdings

- Phoenix Closures

- Pelliconi

- Plastics Corporation

- Plastic Closures Limited

- Premier Vinyl Solution

- Rexam PLC

- Reynolds Group Holdings Limited

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors