Search Market Research Report

Biodegradable Packaging Market Size, Share Global Analysis Report, 2023 – 2030

Biodegradable Packaging Market Size, Share, Growth Analysis Report By End User (Food & Beverage, Personal Care & Cosmetics, Pharmaceuticals, Home Care, And Other Consumer Goods), By Packaging Format (Labels & Tapes, Films & Wraps, Pouches & Bags, Cups & Bowls, Trays & Clamshells, Cans, Boxes & Cartoons, Bottles & Jars, And Others), By Material (Paper & Paperboard, Bioplastics, And Bagasse), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2023 – 2030

Industry Insights

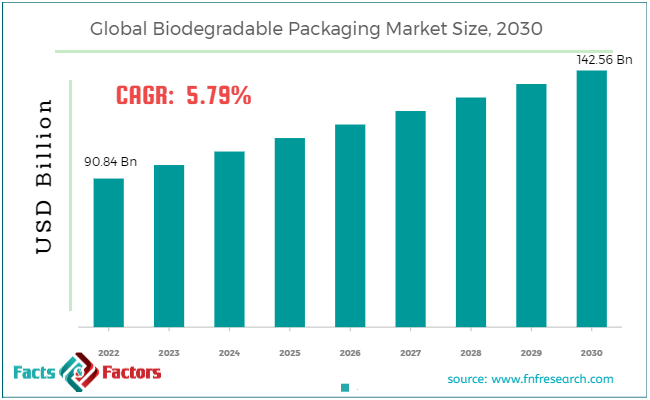

[219+ Pages Report] According to Facts and Factors, the global biodegradable packaging market size was valued at USD 90.84 billion in 2022 and is predicted to surpass USD 142.56 billion by the end of 2030. The biodegradable packaging industry is expected to grow by a CAGR of 5.79%.

Market Overview

Market Overview

Biodegradable packaging refers to the packaging formats and materials that can decompose and naturally break down in the environment. Biodegradable packaging lowers the impact of packaging waste on environmental health as compared to traditional non-degradable materials.

Additionally, these materials are manufactured to undergo microbial decomposition, thereby helping companies to convert them into natural substances like biomass, carbon dioxide, and water.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global biodegradable packaging market size is estimated to grow annually at a CAGR of around 5.79% over the forecast period (2023-2030).

- In terms of revenue, the global biodegradable packaging market size was valued at around USD 90.84 billion in 2022 and is projected to reach USD 142.56 billion by 2030.

- Growing consumer demand is driving the growth of the global biodegradable packaging market.

- Based on the end user, the food and beverage segment is growing at a high rate and is projected to dominate the global market.

- Based on the packaging format, the boxes & cartoon segment is projected to swipe the largest market share.

- Based on the material, the paper and paper segment is likely to swipe the larger share of the market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Growing consumer demand is likely to drive the growth of the global market.

The increasing environmental consciousness among consumers is likely to boost the demand for biodegradable and eco-friendly packing solutions in the market. The plastic solution has a long-lasting impact on the ecosystem, and therefore, the increasing environmental issues are further driving the need for sustainable solutions.

Also, the updated government policies and regulations on lowering the adoption of single-use plastic are promoting environmentally friendly practices. Furthermore, governments in many countries have banned the usage of certain plastic products and packaging materials.

Also, the government is incentivizing businesses to use sustainable packaging. Therefore, such a landscape is expected to propel the growth of the global biodegradable packaging market in the forthcoming years. For instance, Amcor Corp introduced AmFiberTM in January 2022 to redefine the functionality of traditional packaging materials. It offers a wide range of functional benefits to cater to the growing demands of consumers.

Restraints

Restraints

- Cost consideration is expected to hamper the growth of the global market.

The biodegradable packaging solutions are more expensive than conventional solutions. This high upfront cost is a huge barrier for small and medium-sized enterprises and start-ups. This scenario impacts the adoption rate of biodegradable alternatives and thereby hinders the growth of the biodegradable packaging industry.

Opportunities

Opportunities

- Introduction of bagasse packaging is expected to foster growth opportunities in the global market.

Bagasse is a fibrous, pulpy, and dry remnant of crust sugar cane. It is widely used in the manufacturing of serving elements and packaging materials. It is 100% biodegradable and offers no negative impact on environmental health. Also, the ongoing research on bagasse to make it an ideal material to withstand hot and cold food packing is also contributing to the growth of the global market.

Moreover, its carbon footprint is way less than that of plastic packaging. Therefore, such a landscape is expected to foster growth opportunities in the global biodegradable packaging market in the coming years. For instance, TIPA Corp grabbed a USD 70 million investment in January 2022 for innovating compostable packaging solutions. These solutions are eco-friendly and offer the same durability and barrier properties as traditional packing materials.

Challenges

Challenges

- Fragmented standards and certifications are big challenges in the global market.

There is no standardized definition and certification for biodegradable packaging in the market. Different regions and certification institutes have different criteria, making it more challenging for businesses to navigate through different parameters in different regions. Therefore, such a landscape is expected to slow down the growth of the biodegradable packaging industry.

Segmentation Analysis

Segmentation Analysis

The global biodegradable packaging market can be segmented into end user, packaging format, material, and region.

By end user, the market can be segmented into food & beverage, personal care & cosmetics, pharmaceuticals, home care, and other consumer goods. The food and beverage segment is expected to foster lucrative growth opportunities in the biodegradable packaging industry during the anticipated period. One of the major factors propelling the demand for biodegradable packaging in the industry is the growing inclination of consumers toward more sustainable and eco-friendly packaging solutions.

Also, this parameter of biodegradable packaging aligns with people's preferences and serves as a differentiating factor for brands. Polymers like polyhydroxybutyrate, starch, base, plastic, and polylactic acid offer high strength, are recyclable and have enhanced adaptability, which is ideal for companies in the food and beverage industry.

Also, recycling packaging materials like polycaprolactone offer excellent biocompatibility and biodegradable features. Moreover, the beverage industry market is expected to grow significantly in the coming years because of consumers' predisposition to high-quality drinking products.

By packaging format, the market can be segmented into labels & tapes, films & wraps, pouches & bags, cups & bowls, trays & clamshells, cans, boxes & cartoons, bottles & jars, and others. The boxes & cartoon segment is anticipated to witness huge developments during the predicted period. Boxes and cartoons are versatile packaging formats that are ideal for usage across different industries. These formats are widely used in pharmaceuticals, personal care items, food products, and other consumer goods industries.

Moreover, the boxes and cartons hold a positive perception in consumers' minds. These formats offer enough space for branding, creative design elements, and product information. Companies can easily leverage these formats in sustainable packaging to communicate their commitment to environmental responsibility along with differentiating their products in the market.

By material, the market can be segmented into paper & paperboard, bioplastics, and bagasse. The paper and paperboard segment is likely to swipe the larger share of the global biodegradable packaging market in the coming years. Paper and paper boards are sourced from renewable sources like wood pulp.

Also, these materials can decompose and biodegrade naturally without impacting environmental health and are eco-friendly when compared to the non-biodegradable alternatives. These are versatile in nature, thereby ideal for a large number of packing forms like wraps, labels, cartons, boxes, and many others.

Moreover, consumers perceive these formats as a natural and environmentally friendly choice. Paperboard packaging largely aligns with consumer preferences for sustainable options. Apart from being biodegradable, these materials are also recyclable. Therefore, it meets the criteria of the circular economy principle, where the materials are reused to minimize waste.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2022 |

USD 90.84 Billion |

Projected Market Size in 2030 |

USD 142.56 Billion |

CAGR Growth Rate |

5.79% CAGR |

Base Year |

2022 |

Forecast Years |

2023-2030 |

Key Market Players |

Karat Packaging Inc., Pactiv LLC, Kruger Inc., Georgia-Pacific LLC, Stora Enso Oyj, Tetra Pak International S.A, WestRock Company, Mondi Group, International Paper Company, Sealed Air Corporation, Smurfit Kappa Group, Amcor plc, Evergreen packaging, Huhtamaki Oyj, Swedbrand Groups, Berry Global Group, Winpak Ltd., and Others. |

Key Segment |

By End User, By Packaging Format, By Material, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is poised to experience a high growth rate in the global biodegradable packaging market in the coming years because of the domination of driving factors like high consumer demand for sustainable products, ideal regulatory initiatives, and growing environmental awareness. Consumers in the region are increasingly concerned regarding the growing plastic pollution and its harsh impact on the health of the environment.

However, it led to a shift in consumer preference towards biodegradable and eco-friendly packaging. Furthermore, the companies in the region, especially in the food and beverage sector, are implementing and executing their commitments on sustainable products and packaging solutions. However, it has induced the higher adoption of biodegradable packaging solutions as a part of larger corporate responsibility in the region.

Asia Pacific is also likely to witness notable growth in the coming years. An increasing demand for sustainable and eco-friendly packaging solutions in the region because of the growing environmental consciousness among consumers is driving the growth of the regional market.

Moreover, several countries in the region have implemented policies to curb the increasing plastic pollution and encourage the adoption of biodegradable solutions. These regulations are drafted to address the growing environmental challenges with sustainable solutions.

Also, the companies in the region are incorporating sustainability into their business strategies to swipe a large market area and reduce the environmental impact of increasing industrialization. The region is also witnessing innovations in biodegradable materials like plant-based packaging, compostable plastics, and bioplastic, which is further expected to foster a huge development in the market.

Therefore, such an emerging landscape in the region is likely to positively impact the growth trajectory of the regional market during the forecast period.

For instance, Amcor Rigid Packaging revealed the launch of PowerPostTM in May 2022. The PowerPost tech produces around 30% less carbon and one-third lighter bottles as compared to other 20oz bottles.

Competitive Analysis

Competitive Analysis

The key players in the global biodegradable packaging market include:

- Karat Packaging Inc.

- Pactiv LLC

- Kruger Inc.

- Georgia-Pacific LLC

- Stora Enso Oyj

- Tetra Pak International S.A

- WestRock Company

- Mondi Group

- International Paper Company

- Sealed Air Corporation

- Smurfit Kappa Group

- Amcor plc

- Evergreen packaging

- Huhtamaki Oyj

- Swedbrand Groups

- Berry Global Group

- Winpak Ltd.

For instance, SABIC launched a pilot project in collaboration with Schwarz Group in October 2020. The latter is the European retail store operator. The project is for the SABIC’s traditional film bags prepared for the certified circular polyethylene in vegetable packaging.

The global biodegradable packaging market is segmented as follows:

By End User Segment Analysis

By End User Segment Analysis

- Food & Beverage

- Personal Care & Cosmetics

- Pharmaceuticals

- Home Care

- Other Consumer Goods

By Packaging Format Segment Analysis

By Packaging Format Segment Analysis

- Labels & Tapes

- Films & Wraps

- Pouches & Bags

- Cups & Bowls

- Trays & Clamshells

- Cans

- Boxes & Cartoons

- Bottles & Jars

- Others

By Material Segment Analysis

By Material Segment Analysis

- Paper & Paperboard

- Bioplastics

- Bagasse

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Karat Packaging Inc.

- Pactiv LLC

- Kruger Inc.

- Georgia-Pacific LLC

- Stora Enso Oyj

- Tetra Pak International S.A

- WestRock Company

- Mondi Group

- International Paper Company

- Sealed Air Corporation

- Smurfit Kappa Group

- Amcor plc

- Evergreen packaging

- Huhtamaki Oyj

- Swedbrand Groups

- Berry Global Group

- Winpak Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors