Search Market Research Report

Automotive Tires Market Size, Share Global Analysis Report, 2025 - 2034

Automotive Tires Market Size, Share, Growth Analysis Report By Season (Summer, Winter, and All Seasons), By Rim Size (Less than 15, Between 15 & 20, More than 20), By Vehicle Type (Passenger Vehicle, Commercial Vehicle, and Electric Vehicle), By Distribution Channel (Aftermarket and Original Equipment Manufacturer (OEM), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

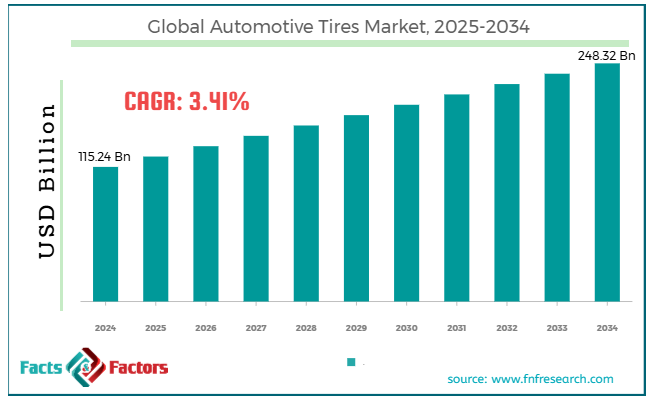

[222+ Pages Report] According to Facts & Factors, the global automotive tires market size was worth around USD 115.24 billion in 2024 and is predicted to grow to around USD 248.32 billion by 2034, with a compound annual growth rate (CAGR) of roughly 3.41% between 2025 and 2034.

Market Overview

Market Overview

Automotive tires are ring-shaped components of a vehicle. They are installed around the wheel’s rim. The main purpose of automotive tires is to transfer an automotive’s load from the axle through the wheel to the ground. Furthermore, they are essential for transferring traction to the areas where the wheel moves. Automotive tires are designed to absorb shock while rolling over the surface and elevate passenger comfort. The most common materials used in the production of automotive tires include natural rubber, synthetic rubber, wire, fabric, carbon black, and additional chemical compounds. The demand for automotive tires is expected to witness a significant growth rate during the projection period. The rising demand for efficient automotives in the logistics and e-commerce segment, along with technological advancements reported in tire production processes, will help the industry thrive in the coming years.

In addition to this, the surging vehicle ownership rate in emerging and developed economies, along with rising demand for electric vehicles (EVs), may work in favor of the industry players. A major growth inhibitor for industry players may emerge in the form of raw material supply chain volatility and intense competition within the industry.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global automotive tires market is estimated to grow annually at a CAGR of around 3.41% over the forecast period (2025-2034)

- In terms of revenue, the global automotive tires market size was valued at around USD 115.24 billion in 2024 and is projected to reach USD 248.32 billion by 2034.

- The automotive tires market is projected to grow at a significant rate due to the rising demand for automotives in fleet-based applications.

- Based on the rim size, the 15 & 20-inch rim size segment is growing at a high rate and will continue to dominate the global market as per industry projections

- Based on the distribution channel, the aftermarket segment is anticipated to command the largest market share

- Based on region, the Asia-Pacific is projected to dominate the global market during the forecast period

Growth Drivers

Growth Drivers

- How will increasing fleet-driven demand influence the automotive tires market growth rate?

The global automotive tires market is projected to be driven by the rising demand for automotives in fleet-based applications. The modern e-commerce and logistics industries rely heavily on a large number of commercial-grade vehicles to ensure the timely delivery of products to end consumers. The globalization of the e-commerce and logistics sectors has further propelled demand for fuel and energy-efficient automobiles, subsequently driving the use of automotive tires.

For instance, in January 2025, Amazon, one of the world’s largest e-commerce companies, announced that it had ordered around 200 Mercedes-Benz fully electric eActros 600 heavy goods vehicles from Daimler. The company is expected to use the vehicles to serve consumers in the UK and German markets.

In December 2025, Uber, a ride-hailing service provider, announced its entry into the Indian business-to-business (B2B) market with the launch of Uber Direct. The company is expected to compete with other regional players in providing white‑label delivery service. Similarly, other leading transportation and e-commerce service providers across the globe are investing heavily in building a robust fleet infrastructure as consumer demands continue to rise.

- Thriving aftermarket demand for automotive tires is expected to further add revenue in the industry

The increasing sales of modern tires through aftermarket channels have witnessed steady growth in the past few years. Automotive tires are susceptible to damage after regular use. In addition, frequently changing tires on automobiles can help extend the vehicle's service life. The cost-effectiveness of after-market sales channels further adds to the growing demand in the global automotive tires market.

Moreover, most aftermarket tire companies offer excellent customization options that may not be available with original equipment manufacturers. The rapid expansion of tire-related service providers across the globe is expected to work in favor of the industry leaders during the projection period.

Restraints

Restraints

- What will be the impact of intense industry competition on the growth of the automotive tire market?

The global automotive tires industry is expected to be restricted due to the high competitiveness within the industry. According to industry analysis, the automotive tire market is characterized by a growing number of players. It includes OEMs and aftermarket service providers. However, excessive competition can impact profit margins for industry players and can also become overwhelming for consumers.

Opportunities

Opportunities

- Will the expansion of the electric & hybrid vehicle sector and self-driving cars generate growth opportunities for the automotive tires industry?

The global automotive tires market is expected to generate growth opportunities due to the rising expansion of electric & hybrid vehicles. In addition to this, the introduction and rising adoption of self-driving cars will further facilitate increased innovations in the automotive tires sector. These vehicles require advanced, specialized, low-rolling-resistance tires that can withstand arresting forces.

In February 2025, Yokohama Rubber Co., Ltd. announced that it had officially begun the supply of its ADVAN Sport EV tires as OEM for the new Lynk & Co Z10 sedan launched by Lynk & Co. The latter is a joint venture between Volvo Car Group from Sweden and China’s Geely Auto Group.

According to official reports, the ADVAN Sport EV tires are designed to meet the needs of premium electric vehicles. It uses a novel compound that assists in reducing tire rolling resistance, along with a tread pattern that increases drainage. In August 2025, NEXEN TIRE launched N'FERA Supreme EV ROOT. The new range is a high-performance tire suitable for use in both conventional and electric vehicles. The tires consist of an Artificial Intelligence (AI) driven performance prediction system that analyzes attributes such as fuel efficiency and noise.

Challenges

Challenges

- How will concerns about the sale of counterfeit products affect the growth of the automotive tire market?

The global industry for automotive tires is projected to be challenged by the rising concerns over the sale of counterfeit products. These tires are linked to safety issues and environmental damage.

In addition, counterfeit products tend to reduce a vehicle's fuel efficiency and lead to increased vibration and noise. Brand perception may be hampered due to the poor performance of poor-grade tires, thus affecting overall market revenue.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 115.24 Billion |

Projected Market Size in 2034 |

USD 248.32 Billion |

CAGR Growth Rate |

3.41% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Sumitomo Rubber Industries, Michelin, Goodyear, Yokohama Rubber, Kumho Tire, Continental, Apollo Tyres, Cooper Tire & Rubber, Bridgestone, Nokian Tyres, Pirelli, Toyo Tires, Hankook Tire, MRF, Maxxis, and others. |

Key Segment |

By Seasone, By Rim Size, By Vehicle Type, By Distribution Channel, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global automotive tires market is segmented based on season, rim size, vehicle type, distribution channel, and region.

Based on season, the global market segments are summer, winter, and all seasons.

- Why will the 15 to 20 rim size segment dominate the automotive tires market?

Based on rim size, the global automotive tires industry is divided into less than 15, between 15 & 20, and more than 20. In 2024, the highest growth was listed in the range of 15 to 20 rim sizes. These tires offer higher cost and performance efficiency as compared with other competing alternatives. Industry analysis suggests that rim sizes between 15 & 20 provide greater comfort and compatibility across a wider range of vehicles on the market.

Based on vehicle type, the global market segments are passenger vehicles, commercial vehicles, and electric vehicles.

- Will the aftermarket segment emerge as the leading segment in the automotive tires industry?

Based on the distribution channel, the global market is divided into. In 2024, the highest demand was observed in the aftermarket segment. The increasing demand for tire replacement in the heavy commercial vehicle segment is one of the largest segmental growth drivers. Furthermore, the growing trend of vehicle customization and personalization has further amplified demand in the aftermarket segment.

Regional Analysis

Regional Analysis

- Why will growth in Asia-Pacific continue to dominate the automotive tires market?

The global automotive tires market is projected to be led by Asia-Pacific during the forecast period. In 2024, it accounted for nearly 41.01% of the global revenue and is expected to deliver a CAGR of 5.01% in the coming years. Growth in the Asia-Pacific region is driven by a robust automotive sector, which propels demand for efficient tire solutions.

Furthermore, low-cost manufacturing facilities across major Asian countries, along with rapidly evolving standards of living and consumer buying behavior, have further influenced greater revenue in the regional market. The aftermarket sales segment is one of the largest contributors to growth in Asia-Pacific, and it will follow similar trends in the future.

- What position will North America hold in the automotive tires industry?

North America is the second-highest revenue generator, accounting for nearly 26.05% of the global market share in 2024. The regional CAGR will reach over 4.5% during the projection duration. The US is expected to lead growth in North America, driven by higher use of automotives across the country. Additionally, the continued growth of the used-car market and the presence of strict regulatory safety standards governing the automotive sector will further contribute to the region's revenue.

Competitive Analysis

Competitive Analysis

The global automotive tires market is led by players like:

- Sumitomo Rubber Industries

- Michelin

- Goodyear

- Yokohama Rubber

- Kumho Tire

- Continental

- Apollo Tyres

- Cooper Tire & Rubber

- Bridgestone

- Nokian Tyres

- Pirelli

- Toyo Tires

- Hankook Tire

- MRF

- Maxxis

What are the key trends in the Automotive Tires Market?

What are the key trends in the Automotive Tires Market?

- Use of advanced production technologies

A promising trend in the automotive tire industry is the growing use of new production technologies for manufacturing tires. These technologies include automation & robotics, additive manufacturing (3D printing), and advanced materials.

- Promotion of sustainability

The automotive tire sector is witnessing increasing adoption of sustainable practices, including the use of eco-friendly materials and tire recycling. Furthermore, the integration of smart systems into modern tires may enable sustained growth in the industry over the projection period.

The global automotive tires market is segmented as follows:

By Season

By Season

- Summer

- Winter

- All Seasons

By Rim Size

By Rim Size

- Less than 15

- Between 15 & 20

- More than 20

By Vehicle Type

By Vehicle Type

- Passenger Vehicle

- Commercial Vehicle

- Electric Vehicle

By Distribution Channel

By Distribution Channel

- Aftermarket

- Original Equipment Manufacturer (OEM)

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Sumitomo Rubber Industries

- Michelin

- Goodyear

- Yokohama Rubber

- Kumho Tire

- Continental

- Apollo Tyres

- Cooper Tire & Rubber

- Bridgestone

- Nokian Tyres

- Pirelli

- Toyo Tires

- Hankook Tire

- MRF

- Maxxis

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors