Search Market Research Report

Tobacco Paper Market Size, Share Global Analysis Report, 2022 – 2028

Tobacco Paper Market Size, Share, Growth Analysis Report By Material (Hemp Wood, Pulp, Rice, Flax, Linen, and Sisal), By Weight (Up to 10.0 gsm, 10 gsm - 25 gsm, 25 gsm & Above), By Paper Grade (Cigarette Tissue, Tipping Base Paper, and Plug Wrap Paper), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

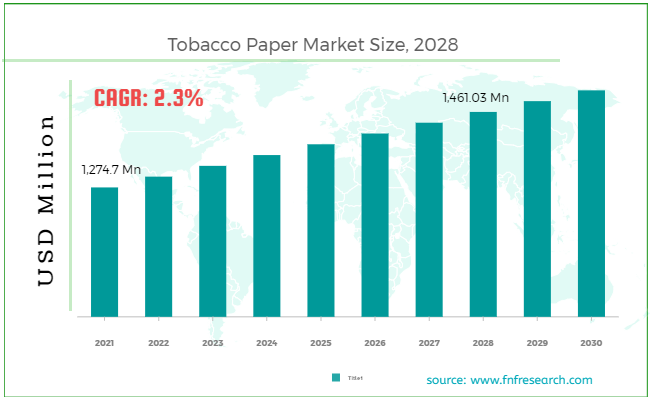

[237+ Pages Report] According to the report published by Facts & Factors, the global tobacco paper market size was worth USD 1,274.7 million in 2021 and is estimated to grow to USD 1,461.03 million by 2028, with a compound annual growth rate (CAGR) of approximately 2.3% during the forecast period. The report analyzes the tobacco paper market's drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the tobacco paper market.

Market Overview

Market Overview

The production of cigarettes requires the use of tobacco paper. Tobacco papers are used in the smoking of tobacco. It is a particularly thin paper with a specific coating that makes it possible to roll it into cigarettes without splitting or cracking. The tobacco paper market comprises the manufacturing, packaging, and general selling of tobacco. The need for environmentally friendly tobacco paper is increasing as people's awareness of the environment grows. Tobacco paper manufacturers are now emphasizing environmentally friendly tobacco papers. They now sell environmentally friendly goods, including filter tips and tobacco paper from non-tree sources. Manufacturers of tobacco papers are also developing new qualities like slow-burning, little smoke, and odor to draw in more customers. These attributes are driving the market for tobacco paper. Technological developments have resulted in tobacco paper rollers that take relatively little effort to roll paper, enhancing the rolling process's efficiency. Roll-your-own cigarettes are getting popular in both developed and underdeveloped countries. The market is being constrained by the rising demand for electronic cigarettes, although sales of these cigarettes are prohibited in many regions due to stringent government regulations. Moreover, rising health consciousness will challenge the industry in the forecast period.

COVID-19 Impact:

COVID-19 Impact:

The lockdown situation created by the COVID-19 epidemic has affected global tobacco paper market sales. Cigarette manufacturing enterprises forced to close due to the epidemic are the primary importers of tobacco paper. Moreover, lower demand and changing industrial production have harmed the market. However, industrial production is expected to return to pre-crisis levels by 2022 and tobacco paper consumption over the projection period.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global tobacco paper market value will grow at a CAGR of 2.3% over the forecast period.

- In terms of revenue, the global tobacco paper market size was valued at around USD 1,274.7 million in 2021 and is projected to reach USD 1,461.03 million by 2028.

- The growing variety of commercial cigarette brands, increased demand for treeless tobacco rolling papers, and the adoption of roll-your-own (RYO) cigarettes amongst the younger population are all driving the global market growth.

- By material, the pulp category dominated the market in 2021.

- By paper grade, the cigarette tissue category dominated the market in 2021.

- Asia Pacific dominated the global tobacco paper market in 2021.

Growth Drivers

Growth Drivers

- The growing popularity of roll-your-own (RYO) cigarettes drives the market growth

The rising preference for hand-rolled or handmade cigarettes, less expensive than factory-made (FM) cigarettes, is driving global demand for Roll-Your-Own (RYO) tobacco products. Rolling papers come in a variety of colors, textures, and flavors. These papers provide the appropriate ripping strength, thickness, air permeability, and burning speed control. The demand for roll-your-own cigarettes is very high, particularly among younger generations. This is due to the introduction of tobacco paper rollers, which allow consumers to roll cigarettes more effectively while exerting less effort. These developments are now propelling the global tobacco paper market's expansion. The rising popularity of eco-friendly tobacco papers will also enhance the tobacco paper industry's growth during the forecast period. Manufacturers are introducing environmentally friendly products such as treeless cigarette rolling papers, rolling tobacco papers produced from fruit and vegetable pulps, and cultivated cotton.

Restraints

Restraints

- Massive demand for electronic cigarettes among the young population hinders the market growth

The rising popularity of electronic cigarettes acts as a market restraint. Electronic cigarettes have grown in popularity and are actively promoted as safer cigarettes and smoking cessation aid. However, stringent government regulations limit the sale of electronic cigarettes in many regions. This has started shifting the electronic cigarette population to the roll-your-tobacco side. Rising health consciousness will also hinder the industry over the forecasting period. Though vendors are now concentrating on eco-friendly cigarette papers, tobacco paper manufacturers are developing a new strategy. High taxes and limited technological impact may further hinder the growth of the tobacco paper market.

Segmentation Analysis

Segmentation Analysis

The global tobacco paper market has been segmented into material, weight, paper grade, and region.

Based on material, the market is classified into hemp wood, pulp, rice, flax, linen, and sisal. Among these, the pulp segment led the market in 2021 and is expected to maintain its dominance throughout the forecast period. People are more concerned about the environment, and there is a high demand for environmentally friendly items. Tobacco paper manufacturers are now emphasizing environmentally friendly cigarette papers. The vendors are now focusing on producing cigarette paper from organic materials such as cultivated cotton and fruit & vegetable pulp. These elements dominate the wood pulp sector.

Based on weight, the market is classified into up to 10.0 gsm, 10 gsm - 25 gsm, 25 gsm & above. In 2021, the 10 - 25 gsm category dominated the global market owing to this weight range being utilized to make light and ultra-lightweight sheets for RYO cigarette rolling paper. Consumers widely prefer these papers for cannabis joints and hand-rolled cigarettes.

Based on paper grade, the market is classified into cigarette tissue, tipping base paper, and plug wrap paper. The cigarette tissue segment dominated the market in 2021 due to its widespread usage in preventing hazardous substance inhalation and lowering nicotine concentration. The tobacco is packaged in cigarette tissue paper.

Recent Developments

Recent Developments

- March 2021: Greenlane Holdings Inc., a provider of premium cannabis accouterments, child-resistant packaging, and specialist vaporization items, has announced the release of the VIBES collection of organic hemp rolling papers and cones. This new organic hemp range includes papers and cones created from 100% organic hemp fibers and manufactured using exclusively natural Arabic gum from the Acacia tree.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 1,274.7 Million |

Projected Market Size in 2028 |

USD 1,461.03 Million |

CAGR Growth Rate |

2.3% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

PT Bukit Muria Jaya, Schweitzer-Mauduit International Inc, Hangzhou Huafeng Paper Co. Ltd, Mudanjiang Hengfeng Paper Co. Ltd, Glatz Feinpapiere, Republic Technologies Ltd, Delfortgroup AG., and Others |

Key Segment |

By Material, Weight, Paper Grade, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Asia Pacific dominated the tobacco paper market in 2021

Due to being the largest tobacco producer and exporter, Asia Pacific dominates the global tobacco paper market. The region's large smoking population mainly drives the demand for tobacco paper. According to the World Health Organization, China is the world's largest producer and consumer of tobacco, with over 300 million active smokers, accounting for about one-third of all smokers worldwide. Increased population and rising disposable income also contribute to regional market expansion. China, Vietnam, the Philippines, Malaysia, India, Thailand, Indonesia, and Bangladesh are the region's largest markets. Furthermore, the rising popularity of tobacco products and cigarettes will drive the regional tobacco paper market growth throughout the forecast period.

Competitive Landscape

Competitive Landscape

- PT Bukit Muria Jaya

- Schweitzer-Mauduit International Inc

- Hangzhou Huafeng Paper Co. Ltd

- Mudanjiang Hengfeng Paper Co. Ltd

- Glatz Feinpapiere

- Republic Technologies Ltd

- Delfortgroup AG.

Global Tobacco Paper Market is segmented as follows:

By Material

By Material

- Hemp Wood

- Pulp

- Rice

- Flax

- Linen

- Sisal

By Weight

By Weight

- Up to 10.0 gsm

- 10 gsm - 25 gsm

- 25 gsm & above

By Paper Grade

By Paper Grade

- Cigarette Tissue

- Tipping Base Paper

- Plug Wrap Paper

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- PT Bukit Muria Jaya

- Schweitzer-Mauduit International Inc

- Hangzhou Huafeng Paper Co. Ltd

- Mudanjiang Hengfeng Paper Co. Ltd

- Glatz Feinpapiere

- Republic Technologies Ltd

- Delfortgroup AG

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors