Search Market Research Report

Secure Microcontroller Market Size, Share Global Analysis Report, 2025 – 2034

Secure Microcontroller Market Size, Share, Growth Analysis Report By Product (8-Bit, 16-Bit, And 32-Bit), By Type (Embedded And Non-Embedded Types), By Industry Vertical (Automotive, Insurance, Consumer Goods, Media & Entertainment, Manufacturing, IT & Telecommunications, Government & Defense, Education, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

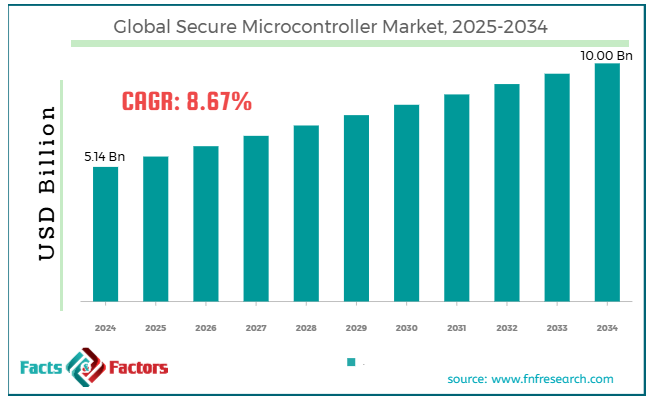

[222+ Pages Report] According to Facts & Factors, the global secure microcontroller market size valued at USD 5.14 billion in 2024 and is predicted to surpass USD 10.00 billion by the end of 2034. The secure microcontroller industry is expected to grow by a CAGR of 8.67% between 2025 and 2034.

Market Overview

Market Overview

A secure microcontroller refers to a unit integrated into hardware that helps protect sensitive data and enhances the system's security. These are quite different from standard microcontrollers, as secure MCUs are particularly built to avoid any unauthorized access, data breaches, and tampering. Secure microcontrollers offer cryptographic engines that facilitate robust data storage and communication. It facilitates hardware-based key storage, which stores all cryptographic keys in protected memory areas.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global secure microcontroller market size is estimated to grow annually at a CAGR of around 8.67% over the forecast period (2025-2034).

- In terms of revenue, the global secure microcontroller market size was valued at around USD 5.14 billion in 2024 and is projected to reach USD 10.00 billion by 2034.

- Fast expansion of connected devices is driving the growth of the global secure microcontroller market.

- Based on the product, the 32-bit segment is growing at a high rate and is projected to dominate the global market.

- Based on types, the embedded segment is anticipated to grow with the highest CAGR in the global market.

- Based on the industry vertical, the automotive segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Fast expansion of connected devices is likely to drive the growth of the global market.

The world is witnessing an increasing number of connected devices. Every smart device has a connected endpoint, which poses a significant security risk and, therefore, fosters a substantial need for secure microcontrollers. MCUs aid in identity protection and hardware authentication, thereby mitigating potential risks associated with the use of advanced devices.

Additionally, the automotive sector is the leading adopter of secure microcontrollers, which is expected to positively impact the global secure microcontroller market's growth. Additionally, a significant shift towards electric vehicles and autonomous driving is widening the scope of secure microcontrollers in the market. Infotainment systems, telematics, and ADAS are some of the advanced systems that necessitate secure MCUs to prevent hacking and ensure passenger safety.

urthermore, the rise of digital wallets and mobile payments is further strengthening the demand for secure microcontrollers in the market. Point-of-sale devices and smart cards need secure transaction processing, and therefore, tamperproof MCUs are critical. It is also playing an essential role in medical devices and healthcare applications. Many connected medical devices need protection to ensure the safety of patient data.

Therefore, many regulations, such as GDPR and HIPAA, encourage the use of secure microcontrollers to align with privacy laws. For instance, NXP Semiconductors introduced the MCUXpresso toolset in 2023. These developers focus on portability, usability, and scalability to facilitate the rapid development of embedded applications.

Restraints

Restraints

- Development costs are likely to restrict the growth of the global market.

Secure MCUs are quite expensive, which restricts the growth of the secure microcontroller industry. The cost is high due to the integration of cryptographic modules and secure memory in the microcontrollers, which helps prevent fraud or tampering activities.

Opportunities

Opportunities

- Industrial automation is likely to foster growth opportunities in the global market.

The rising trend of automation in logistics and manufacturing is likely to open numerous growth opportunities in the global secure microcontroller market. However, automation and modern operational technology are likely to increase the risk of unauthorized access and fraud. Therefore, there is a need for secure provisioning and device attestation to ensure the integrity of operational processes, leveraging secure microcontrollers.

Moreover, AI-based integrated MCUs are widely used in voice assistants, smart cameras, and other applications to ensure security. The use of biometrics and passwords in government ID cards and passports is also fostering numerous growth opportunities in the field of secure microcontrollers, as they help secure transactions using fingerprints and iris scans.

Another breakthrough in the market is that these microcontrollers reduce the overall footprint and power consumption. It also shortens the development cycle, which further attracts the end users. For instance, Renesas Electronics Corporation announced the successful manufacturing of MCUs in 2023. This advanced process is designed to reduce power consumption and enhance performance.

Challenges

Challenges

- Design complexity is a big challenge in the market.

Implementing security features such as cryptographic operations, key provisioning, and secure boot introduces complexity into the manufacturing process. Also, secure MCUs require certified environments, which further causes challenges in the secure microcontroller industry. Moreover, numerous compatibility and standardization issues exist in the market, which are expected to slow the industry's growth.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 5.14 Billion |

Projected Market Size in 2034 |

USD 10.00 Billion |

CAGR Growth Rate |

8.67% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Texas Instruments Incorporated, STMicroelectronics, Silicon Laboratories Inc., Renesas Electronics Corporation, NXP Semiconductors, Nuvoton Technology Corporation, Microchip Technology Inc., Infineon Technologies AG, Holtek Semiconductor Inc., Broadcom, Analog Devices Inc., Advanced Micro Devices Inc., and others. |

Key Segment |

By Product, By Type, By Industry Vertical, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global secure microcontroller market can be segmented by product, type, industry vertical, and region.

On the basis of products, the market can be segmented into 8-bit, 16-bit, and 32-bit. The 32-bit segment is likely to account for the largest share of the secure microcontroller industry during the forecast period. The 32-bit microcontrollers offer better functionality and performance. These are ideal for mid-to-highly complex applications. However, there are many 32-bit MCUs manufactured for use with low-power architectures, such as battery- or electric-powered devices.

Additionally, the 32-bit MCUs are experiencing a surge in demand in the automotive sector. These are used in electric vehicle control units, advanced driver assistance systems, and battery management systems, among others, for secure and real-time data processing. A significant shift toward connected and autonomous vehicles is further strengthening the demand for secure MCUs in the market.

Moreover, these MCUs help protect new firmware integrity and the communication interface. The increasing deployment of IoT devices in industrial automation, healthcare, smart cities, and other sectors is contributing to the growth of the segment. The wide adoption rate of AI-based architectures, which offer strong support from software libraries, is also expected to support the development of the segment.

On the basis of types, the market can be segmented into embedded and non-embedded types. The embedded segment is expected to register the highest CAGR growth during the predicted period. The widespread adoption of advanced driver assistance systems, such as blind spot monitoring and adaptive cruise control, is emerging as a crucial factor fueling the growth of the segment. Embedded MCUs are high-reliability, low-latency MCUs that incorporate cryptographic functionalities.

Furthermore, the rise in demand for electric and hybrid vehicles is contributing to the significant growth of the segment. Secure microcontrollers have emerged as a crucial component in charging infrastructure, battery management systems, motor control, and many other systems. The government regulations for the automotive sector are expected to be a transformative force in the global secure microcontroller market. Manufacturers are integrating secure boot features and hardware-based security microcontrollers to align with compliance.

On the basis of industry verticals, the market can be segmented into automotive, insurance, consumer goods, media & entertainment, manufacturing, IT & telecommunications, government & defense, education, and others. The automotive segment is anticipated to dominate the secure microcontroller industry during the forecast period. The high adoption rate of embedded systems in IoT devices is an emerging factor driving the growth of the segment. Secure microcontrollers (MCUs) are widely used in IoT architectures.

Devices such as medical wearables, industrial sensors, and home automation products often incorporate secure microcontrollers (MCUs). These MCUs can easily integrate security features like secure boot, encrypted memory, and secure key storage. Smart appliances, such as smart speakers, air conditioners, and TVs, always integrate these MCUs to prevent unauthorized access, protect user data, and facilitate secure firmware updates. Consumer concerns about privacy are prompting manufacturers to incorporate these secure microcontrollers into their devices.

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is anticipated to account for the largest share of the global secure microcontroller market during the forecast period. The automotive sector is the leading adopter of secure microcontrollers in North America, which is expected to drive the growth of the regional market. The region serves as a strong market for electric vehicles, which fosters a massive demand for secure microcontrollers in the regional market.

However, the US is a leading market in North America for several reasons, including the higher adoption rate of advanced driver assistance systems and electric vehicles in the region. The fast rollout of 5G networks in the United States is also expected to positively influence the growth of the regional market. Technological advancements are among the leading factors fostering growth in Canada. Additionally, the growing investments in the region in smart infrastructure are further supporting the market's growth.

Asia Pacific is another leading region expected to witness a fast-growing CAGR during the forecast period. China is a leading region in the market with a significant market share. The primary factor is its rapidly growing automotive sector, which drives demand for secure MCUs in the market. Japan is also a mature market with increasing industrial applications of secure MCUs. South Korea is expected to lead the market due to its rapidly expanding electronic manufacturing sector.

India is a growing market predicted to witness a rapidly expanding market due to increasing government initiatives, such as the Make in India scheme, aimed at boosting the domestic market. For instance, STMicroelectronics introduced the STM32CO series in 2023. This product is designed to offer enhanced performance, faster response times, and additional functionalities.

Competitive Analysis

Competitive Analysis

The key players in the global secure microcontroller market include:

- Texas Instruments Incorporated

- STMicroelectronics

- Silicon Laboratories Inc.

- Renesas Electronics Corporation

- NXP Semiconductors

- Nuvoton Technology Corporation

- Microchip Technology Inc.

- Infineon Technologies AG

- Holtek Semiconductor Inc.

- Broadcom

- Analog Devices Inc.

- Advanced Micro Devices Inc.

For instance, Infineon Technologies AG introduced the AURIX microcontroller AURIXTC4 series in 2022. The automotive sector is witnessing the emergence of e-mobility, cost-effective AI applications, and others.

The global secure microcontroller market is segmented as follows:

By Product Segment Analysis

By Product Segment Analysis

- 8-Bit

- 16-Bit

- 32-Bit

By Type Segment Analysis

By Type Segment Analysis

- Embedded

- Non-Embedded Types

By Industry Vertical Segment Analysis

By Industry Vertical Segment Analysis

- Automotive

- Insurance

- Consumer Goods

- Media & Entertainment

- Manufacturing

- IT & Telecommunications

- Government & Defense

- Education

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Texas Instruments Incorporated

- STMicroelectronics

- Silicon Laboratories Inc.

- Renesas Electronics Corporation

- NXP Semiconductors

- Nuvoton Technology Corporation

- Microchip Technology Inc.

- Infineon Technologies AG

- Holtek Semiconductor Inc.

- Broadcom

- Analog Devices Inc.

- Advanced Micro Devices Inc.

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors