Search Market Research Report

Pneumatic Equipment Market Size, Share Global Analysis Report, 2025 – 2034

Pneumatic Equipment Market Size, Share, Growth Analysis Report By End-Users (Construction Sector, Automotive Sector, Manufacturing Sector, And Others), By Applications (Residential, Commercial, And Others), By Types (Continuous Flow Tools, Percussion Tools, Rotary Tools, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

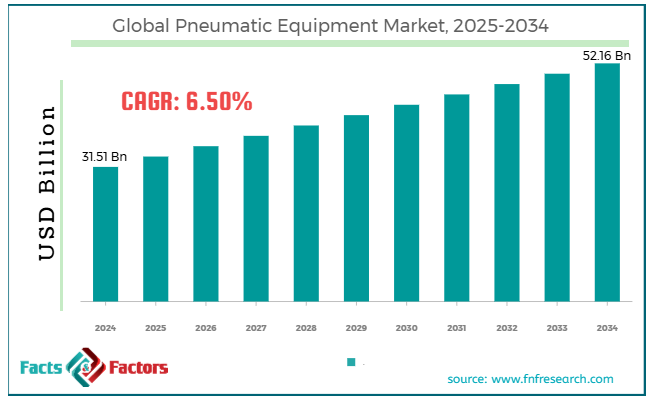

[221+ Pages Report] According to Facts & Factors, The global pneumatic equipment market size was valued at USD 31.51 billion in 2024 and is predicted to surpass USD 52.16 billion by the end of 2034. The pneumatic equipment industry is expected to grow by a CAGR of 6.50% between 2025 and 2034.

Market Overview

Market Overview

Pneumatic equipment comprises all devices, systems, and tools that function using compressed gas. It facilitates mechanical work. Some of the pneumatic equipment includes actuators, dampers, cylinders, air motors, conveyor belts, air brakes, robotic arms, air drills, grinders, and many others. Pneumatic tools are ideal for working in hazardous environments, as they eliminate the risk of electric sparks and other potential hazards. These are portable and lightweight, featuring a simple design and low maintenance.

Moreover, these are environmentally friendly and powerful tools. These pieces of equipment are used across all sectors, including healthcare, construction, automotive, manufacturing, food and beverage, and aerospace.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global pneumatic equipment market size is estimated to grow annually at a CAGR of around 6.50% over the forecast period (2025-2034).

- In terms of revenue, the global pneumatic equipment market size was valued at around USD 31.51 billion in 2024 and is projected to reach USD 52.16 billion by 2034.

- Rapid industrial automation is driving the growth of the global pneumatic equipment market.

- Based on the end-users, the manufacturing segment is growing at a high rate and is projected to dominate the global market.

- Based on applications, the residential segment is anticipated to grow with the highest CAGR in the global market.

- Based on the types, the rotary tool segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Rapid industrial automation is driving the growth of the global market.

Industries worldwide are adopting automation to enhance efficiency and minimize potential errors. Pneumatic equipment plays a critical role in industrial automation. Pneumatic equipment, such as cylinders and actuators, plays a crucial role in packaging and material handling.

Additionally, there is a high demand for pneumatic equipment in the semiconductor, electronics, and automotive sectors. Additionally, the rapidly expanding manufacturing base in countries such as Mexico, Vietnam, India, and China is emerging as a crucial factor in the industry's high growth rate. Government initiatives, such as China's Belt and Road and India's Make in India program, are likely to support the industry's growth in the coming years.

Additionally, pneumatic systems are more energy-efficient, which means they consume less energy, making them more attractive to end-users. Industries are adopting eco-friendly business practices to curb increasing carbon emissions. Consequently, they are adopting pneumatic equipment to achieve their goals. The rising trend of integrating smart technologies with pneumatic systems is likely to further widen the scope of the global pneumatic equipment market. Performance optimization, remote diagnostics, and real-time monitoring are among the key advantages offered by smart pneumatics.

For instance, KSB Group introduced pneumatic 90-degree quarter-turn actuators in 2023. The double- and single-acting pneumatic Actair Evo and Dynactair Evo actuators.

Restraints

Restraints

- Inefficiency is expected to hinder the growth of the global market.

Pneumatic systems are less efficient than other available options in the market because they lose around 90% of the energy in the process. Moreover, some other issues lead to performance drops, such as air leaks. Intense competition from electric and hydraulic alternatives is also anticipated to negatively impact the pneumatic equipment industry's growth.

Opportunities

Opportunities

- Fast-expanding construction sector is likely to foster growth opportunities in the global market.

The increasing number of transport infrastructure, real estate, and urbanization projects boosts the requirement for pneumatic equipment, such as jackhammers, material lifting equipment, and many others. Moreover, the growing trend of adopting DIY practices for home improvement is expected to further revolutionize the global pneumatic equipment market. Pneumatic equipment is gaining significant traction among users due to its ease of use, low maintenance requirements, and affordability.

Additionally, this equipment has a wide range of applications in the healthcare and food industries. Pneumatic equipment works best in sterile and sensitive environments, and therefore, it is widely used in hospitals and food and beverage applications.

Nowadays, there is ongoing upgradation and renovation of legacy systems, which is expected to significantly contribute to the market's significant rise. The outdated mechanical systems are actively being replaced with pneumatic equipment. For instance, ElGi introduced the LD series of reciprocating air compressors in 2022. It is ideal for manufacturing, food and beverage, metal, and pharmaceutical sectors.

Challenges

Challenges

- Limited precision is a big challenge in the global market.

Pneumatic equipment lacks precision position control, and therefore, it finds fewer applications in advanced processes. Additionally, sectors such as aerospace, robotics, and semiconductors require micron-level precision, which is not feasible with pneumatic equipment.

Additionally, the lack of standardization is another significant factor that is likely to slow down the pneumatic equipment industry's growth.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 31.51 Billion |

Projected Market Size in 2034 |

USD 52.16 Billion |

CAGR Growth Rate |

6.50% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

SMC Corporation, Siemens AG, Rotex Automation Ltd., Parker Hannifin Corporation, Norman Equipment Company, Janatics India Pvt Ltd., Festo Vertrieb GmbH & Co. KG., Emerson Electric Company, Eaton Corporation PLC, DL Pneumatics, CKD Corporation, Chicago Pneumatic Tool Company Inc., Bonesi Pneumatik Srl, Bimba Manufacturing Company, AirTAC International Group, and others. |

Key Segment |

By End-Users, By Applications, By Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global pneumatic equipment market can be segmented into end-users, applications, types, and regions.

On the basis of end-users, the market can be segmented into the construction sector, automotive sector, manufacturing sector, and others. The manufacturing sector is likely to dominate the pneumatic equipment industry during the forecast period. Pneumatic equipment plays a crucial role in the manufacturing sector, serving a diverse range of applications. Pneumatic equipment, such as conveyors and ADAS, is in high demand due to the pick-and-place tasks that are crucial in manufacturing units. It thereby widens demand in the assembly lines to improve precision and speed. The widespread adoption of smart manufacturing, such as Industry 4.0 and automation, is also driving demand for these systems.

Manufacturers are offering well-integrated pneumatic systems with IoT modules, sensors, and AI for remote monitoring, predictive maintenance, and process optimization. Pneumatic tools offer modular and flexible production setups, which are of high importance in the automotive, consumer, electronics, and FMCG sectors. It reduces downtime, thereby enabling manufacturers to continue their production process.

On the basis of application, the market can be segmented into residential, commercial, and others. The residential segment is anticipated to account for the largest share of the global pneumatic equipment market during the forecast period. High demand for homes. Automation is driving the growth of pneumatic tools in the residential segment. People nowadays are showing a growing demand for security systems, such as pneumatic smart beds and automated window door systems, among others, which is fostering growth in the segment.

Moreover, the rise in demand for pneumatic tools for DIY purposes further widens the scope of this segment. Some of the significant benefits of these are that they are lightweight, cost-effective, and easy to maintain, which further makes them popular among Home users. Pneumatic systems, such as actuators and controllers, can be integrated with building management systems to provide occupants with greater comfort and convenience. Rapid urbanization is a crucial factor fueling the growth of the segment.

On the basis of types, the market can be segmented into continuous flow tools, percussion tools, rotary tools, and others. The rotary tool segment is expected to be the fastest-growing in the pneumatic equipment industry during the predicted period. Pneumatic rotary tools are used for a wide range of applications, including cutting, polishing, grinding, drilling, and deburring.

Additionally, they are in high demand due to their versatility. For instance, one individual tool can perform multiple functions. Pneumatic rotary tools are more durable than other types of tools available on the market. Moreover, they offer lower downtime and long duty cycles. An increasing number of DIYers, artisans, and makers are strengthening demand in the market. Furthermore, these tools are available at a lower cost with higher RPM and precision, which in turn is expected to further foster growth opportunities in the segment.

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is likely to account for the largest share of the global pneumatic equipment market during the forecast period. The United States is the fastest-growing region in the North American market, driven by the rapid growth of the aerospace and automotive sectors.

Moreover, the government is making efforts to promote domestic manufacturing, which is another significant factor supporting the development of the regional market. Additionally, there is a growing focus on companies enhancing process efficiency and boosting automation, which is expected to further widen the market's scope.

Canada is also projected to experience significant growth during the predicted period, driven by ongoing technological innovations. The government in Canada is developing programs such as the Advanced Manufacturing Partnership and Automate Canada, which are also expected to positively influence the growth of the regional market.

Asia-Pacific is also expected to dominate the pneumatic equipment industry in the coming years. China is a leading country in the APAC region, with a majority of its market share driven mainly by strong demand for pneumatic tools in the area. India is also expected to experience significant growth in the coming years due to its expanding economy. The country is witnessing a high demand for pneumatic tools, particularly in infrastructural projects. Automation is growing rapidly in the APAC region across various industries, emerging as a significant factor driving the growth of the regional market.

Pneumatic systems have huge applications in the automotive sector, particularly in component manufacturing and assembly lines. Therefore, the fast-growing construction and automotive industry in APAC is posing a strong demand for pneumatic equipment in the global market. For instance, Chicago Pneumatic introduced a ½-inch cordless impact wrench in 2022. It is termed as the lightest and most compact tool in its range.

Competitive Analysis

Competitive Analysis

The key players in the global pneumatic equipment market include:

- SMC Corporation

- Siemens AG

- Rotex Automation Ltd.

- Parker Hannifin Corporation

- Norman Equipment Company

- Janatics India Pvt Ltd.

- Festo Vertrieb GmbH & Co. KG.

- Emerson Electric Company

- Eaton Corporation PLC

- DL Pneumatics

- CKD Corporation

- Chicago Pneumatic Tool Company Inc.

- Bonesi Pneumatik Srl

- Bimba Manufacturing Company

- AirTAC International Group

For instance, Researchers at the Shenzhen Institute of Advanced Technology (SIAT) developed a reprogrammable bistable soft gripper in 2023 for enhanced human-machine interaction. It includes a bistable frame and soft pneumatic actuator.

The global pneumatic equipment market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Construction Sector

- Automotive Sector

- Manufacturing Sector

- Others

By Applications Segment Analysis

By Applications Segment Analysis

- Residential

- Commercial

- Others

By Types Segment Analysis

By Types Segment Analysis

- Continuous Flow Tools

- Percussion Tools

- Rotary Tools

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- SMC Corporation

- Siemens AG

- Rotex Automation Ltd.

- Parker Hannifin Corporation

- Norman Equipment Company

- Janatics India Pvt Ltd.

- Festo Vertrieb GmbH & Co. KG.

- Emerson Electric Company

- Eaton Corporation PLC

- DL Pneumatics

- CKD Corporation

- Chicago Pneumatic Tool Company Inc.

- Bonesi Pneumatik Srl

- Bimba Manufacturing Company

- AirTAC International Group

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors