Search Market Research Report

North America Frozen Bakery Products Market Size, Share Global Analysis Report, 2024 – 2032

North America Frozen Bakery Products Market Size, Share, Growth Analysis Report By Form (Gluten-free, Sugar-free, Organic, Others), By Product Type (Cakes & Pastries, Biscuits & Cookies, Bread, Others), By Distribution Channel (Specialty Stores, Convenience Stores, Supermarket/Hypermarket, Others), and By Country - Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

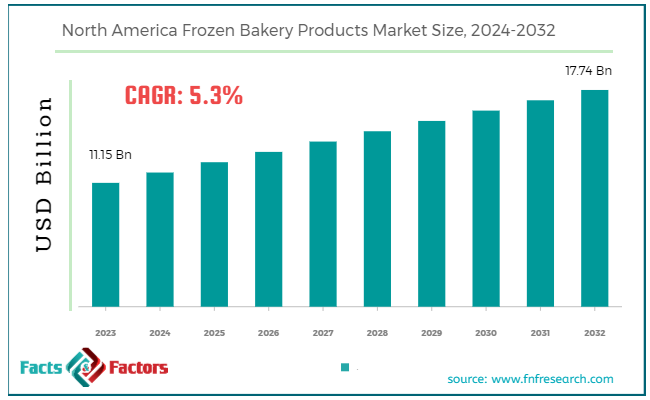

[213+ Pages Report] According to Facts & Factors, the North America frozen bakery products market size in terms of revenue was valued at around USD 11.15 billion in 2023 and is expected to reach a value of USD 17.74 billion by 2032, growing at a CAGR of roughly 5.3% from 2024 to 2032. The North America frozen bakery products market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

North America frozen bakery products include a wide range of bakery items such as bread, pastries, cakes, cookies, and doughs that are preserved by freezing to extend their shelf life. These products are popular for their convenience, quality, and long-lasting freshness. They cater to various segments, including retail consumers, food service providers, and institutional buyers.

The market for frozen bakery products in North America is experiencing significant growth, driven by changing consumer lifestyles, increasing demand for convenience foods, and advancements in freezing technologies. The market includes a diverse array of products such as frozen bread, cakes, pastries, cookies, and pizza crusts, which are widely available through supermarkets, hypermarkets, convenience stores, and online retail platforms.

Key Highlights

Key Highlights

- The north america frozen bakery products market has registered a CAGR of 5.3% during the forecast period.

- In terms of revenue, the north america frozen bakery products market was estimated at roughly USD 11.15 billion in 2023 and is predicted to attain a value of USD 17.74 billion by 2032.

- The North American frozen bakery products market is poised for continued growth, driven by the demand for convenience, technological advancements, and expanding retail channels.

- Based on the product type, the bread segment is growing at a high rate and is projected to dominate the market.

- Based on the distribution channel, the convenience stores segment is projected to swipe the largest market share.

- By region, United States dominates the North American market due to high consumer demand for convenience foods and the presence of major market players.

Key Growth Drivers:

Key Growth Drivers:

- Convenience: Frozen bakery products offer a high level of convenience, providing consumers with ready-to-bake or ready-to-eat options that save time and effort.

- Extended Shelf Life: Frozen products offer a longer shelf life compared to fresh alternatives, reducing food waste and appealing to consumers who value practicality.

- Variety and Innovation: Manufacturers are constantly introducing new and innovative frozen bakery products, catering to diverse consumer preferences and dietary needs (e.g., gluten-free).

- Rising Disposable Income: With increasing disposable income in some segments, consumers are willing to spend more on convenient and premium frozen bakery products.

Restraints:

Restraints:

- Perception of Quality: A lingering perception that frozen products are inferior to fresh-baked goods can hinder market growth.

- Health Concerns: Concerns about sugar content, preservatives, and overall nutritional value of frozen bakery products can deter some health-conscious consumers.

Opportunities:

Opportunities:

- Focus on Healthier Options: Developing frozen bakery products with lower sugar content, whole grains, and natural ingredients caters to the growing demand for healthier choices.

- Targeted Marketing: Targeted marketing campaigns can address consumer concerns about quality and highlight the convenience and variety offered by frozen bakery products.

- E-commerce Expansion: Expanding online sales channels can make frozen bakery products more accessible to a wider range of consumers.

Challenges:

Challenges:

- Fluctuating Ingredient Costs: Rising costs of ingredients like flour and sugar can squeeze profit margins for manufacturers.

- Competition: Intense competition within the frozen food industry requires continuous innovation and effective marketing strategies.

- Maintaining Product Quality: Ensuring consistent quality and taste throughout the frozen bakery product's shelf life remains a challenge.

Segmentation Analysis Analysis

Segmentation Analysis Analysis

The north america frozen bakery products market is segmented based on form, product type, distribution channel, and others.

By Form Insights

By Form Insights

Based on Form, the north america frozen bakery products market is divided into gluten-free, sugar-free, organic, and others. The gluten-free segment of the North America frozen bakery products market caters to consumers with gluten intolerance or celiac disease, as well as those who prefer gluten-free diets for health reasons. This segment includes products such as bread, cookies, cakes, and pastries made from gluten-free ingredients like rice flour, almond flour, and quinoa. The increasing awareness of gluten intolerance and the growing trend of gluten-free diets are driving the demand for gluten-free frozen bakery products. These products are perceived as healthier alternatives and are gaining popularity among health-conscious consumers. The gluten-free frozen bakery products segment is projected to grow at a robust CAGR due to the rising prevalence of gluten intolerance and the increasing demand for healthier food options.

The sugar-free segment targets consumers looking to reduce their sugar intake for health reasons, such as managing diabetes or following low-sugar diets. This segment includes sugar-free versions of popular bakery items like cookies, cakes, and pastries. The growing health concerns related to high sugar consumption, such as diabetes and obesity, are driving the demand for sugar-free frozen bakery products. Consumers are increasingly seeking alternatives that allow them to enjoy baked goods without the negative health impacts of sugar. Manufacturers are using sugar substitutes like stevia, erythritol, and monk fruit to create sugar-free products that still offer great taste and texture. The sugar-free frozen bakery products segment is expected to grow steadily.

The organic segment includes frozen bakery products made from organically sourced ingredients, free from synthetic pesticides, fertilizers, and GMOs. This segment caters to consumers who prioritize organic food for its perceived health benefits and environmental sustainability. The demand for organic frozen bakery products is driven by the growing consumer preference for organic foods and the increasing awareness of the health and environmental benefits of organic farming. Organic products are seen as healthier and more natural, appealing to a broad range of health-conscious consumers.

By Product Type Insights

By Product Type Insights

On the basis of Product Type, the north america frozen bakery products market is bifurcated into cakes & pastries, biscuits & cookies, bread, pizza crusts, and others. The cakes and pastries segment includes a variety of sweet baked goods such as cakes, muffins, croissants, and Danish pastries. These products are popular for their convenience and indulgence, often purchased for special occasions and everyday treats. The demand for frozen cakes and pastries is driven by the increasing consumer preference for ready-to-eat and easy-to-prepare bakery products. The convenience offered by frozen cakes and pastries, which can be stored for longer periods and quickly prepared, is a significant factor boosting their popularity. Manufacturers are focusing on product innovation, introducing new flavors and healthier options to cater to diverse consumer preferences. The cakes and pastries segment is expected to grow at a steady pace??.

The biscuits and cookies segment encompasses a wide range of baked goods, including plain biscuits, flavored cookies, and filled cookies. These products are favored for their taste, convenience, and versatility as snacks. The frozen biscuits and cookies market is driven by the demand for convenient, tasty snacks that can be quickly baked or thawed. The trend towards healthier snacking options has led manufacturers to introduce products with reduced sugar, whole grains, and other nutritious ingredients. Additionally, the increasing preference for on-the-go snacks is fueling the growth of this segment. The availability of a wide variety of flavors and formats also appeals to a broad consumer base.

The bread segment includes various types of frozen bread, such as white bread, whole wheat bread, multigrain bread, and specialty bread. Bread is a staple food product with high consumption rates across North America. The demand for frozen bread is driven by its convenience and extended shelf life, making it a practical choice for consumers. The increasing interest in health and wellness has led to a growing demand for whole grain and multigrain bread. Moreover, the trend of home baking and the popularity of artisan bread are contributing to the segment's growth. Retailers and foodservice providers are also expanding their frozen bread offerings to cater to the diverse preferences of consumers.

The pizza crusts segment includes various types of frozen pizza bases, from thin crusts to thick and stuffed crusts. Pizza is a popular food item in North America, enjoyed by people of all ages. The popularity of pizza and the convenience of frozen pizza crusts are key drivers for this segment. Consumers appreciate the ability to quickly prepare pizzas at home with their preferred toppings. The growing trend of customization and the increasing demand for gourmet and healthier pizza options, such as gluten-free and whole wheat crusts, are further driving the segment's growth. Foodservice providers and retail chains are also expanding their frozen pizza crust offerings to meet consumer demand.

By Distribution Channel Insights

By Distribution Channel Insights

Based on Distribution Channel, the north america frozen bakery products market is categorized into online retail, convenience stores, supermarket/hypermarket, and others. The online retail segment includes e-commerce platforms and online grocery stores where consumers can purchase frozen bakery products. This channel has gained significant traction due to the convenience of shopping from home and the increasing penetration of the internet and smartphones. The growth of online retail for frozen bakery products is driven by several factors, including the convenience of home delivery, the ability to compare products and prices easily, and the increasing availability of a wide range of products online. The COVID-19 pandemic has further accelerated the shift towards online shopping, as consumers have become more accustomed to purchasing groceries and other essentials online. Retailers are investing in robust online platforms and partnering with delivery services to enhance the customer experience and meet the growing demand.

Convenience stores segment are small retail outlets that offer a limited range of groceries and everyday items, including frozen bakery products. These stores are typically located in residential areas and are known for their accessibility and convenience. Convenience stores play a crucial role in the distribution of frozen bakery products due to their strategic locations and the convenience they offer to consumers. The growing demand for ready-to-eat and quick-preparation foods has led to an increase in the availability of frozen bakery products in convenience stores. However, the limited shelf space in these stores can be a constraint, leading to a selective range of products being stocked.

Supermarkets and hypermarkets are large retail stores offering a wide variety of food and non-food products, including an extensive range of frozen bakery items. These stores are often located in urban and suburban areas and serve as major distribution points for groceries. The supermarket and hypermarket segment dominates the frozen bakery products market due to its extensive reach, variety of products, and ability to offer competitive pricing. Consumers prefer shopping at these stores for their one-stop shopping experience and the wide selection of products available. The presence of large retail chains like Walmart and Costco, which stock a diverse range of frozen bakery products, further strengthens this distribution channel. Additionally, supermarkets and hypermarkets often have in-store bakeries that attract customers seeking freshly baked and frozen bakery items.

Recent Developments:

Recent Developments:

Bakery Bites: Innovation on the Rise

- In January 2023: Bimbo Bakeries' Sara Lee brand is upping their bread game with a new option - white bread made with vegetables! Each loaf boasts a full cup of veggies and added vitamins A, D, and E, catering to health-conscious consumers who don't want to sacrifice convenience.

- In April 2022: Walker's Shortbread has partnered with Dufry to launch a new Global Travel Retailer range. This means you can indulge in their classic shortbread and potentially other treats at over 55 travel retail locations worldwide. Perfect for satisfying your sweet tooth on the go or grabbing a souvenir with a delicious twist.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 11.15 Billion |

Projected Market Size in 2032 |

USD 17.74 Billion |

CAGR Growth Rate |

5.3% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Aryzta AG, Barilla Holding S.p.A., Britannia Industries Limited, Canada Bread Company Ltd., Cole's Quality Foods Inc., Dawn Food Products Inc, Dunkin' Donuts LLC, General Mills Inc., Grupo Bimbo S.A.B. de C.V., T. Marzetti Company, United Biscuits, and Others. |

Key Segment |

By Form, By Product Type, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- United States dominates the market during the forecast period

The North America frozen bakery products market is segmented into the United States, Canada, and Mexico. Among these, the United States dominates the market, primarily due to its large consumer base, higher disposable income, and rapid urbanization. The U.S. market is driven by the increasing demand for frozen bread and other bakery products. Additionally, the expansion of restaurant chains and the trend of eating on-the-go are significant factors contributing to the market's growth in the U.S.

Canada holds the largest share at a CAGR of 6.2% during the forecast period. Canada is another key player in the regional market, expected to experience a slightly higher growth rate compared to the U.S. The Canadian market benefits from a growing trend towards healthy eating and the increasing popularity of frozen bakery items that cater to health-conscious consumers. The market in Mexico also shows promise, with manufacturers introducing innovative products to meet changing consumer preferences and the growing food industry.

The North America frozen bakery products market is poised for significant growth, driven by factors such as the increasing demand for convenience foods, advancements in food processing technologies, and the growing trend of healthy eating. The market includes a wide range of products such as bread, pizza crusts, cakes, pastries, waffles, donuts, and cookies, catering to various consumer preferences and dietary needs.

Consumers in North America have shown a strong preference for convenient, ready-to-eat bakery products due to their busy lifestyles. This demand is further bolstered by the nutritional value and extended shelf life of frozen bakery items. The rising awareness and demand for specialty frozen baked goods, such as gluten-free, dairy-free, and low-sugar options, also contribute to market growth. Innovations in food processing, storage, and packaging are enhancing the quality and appeal of these products, driving their adoption across different consumer segments.

List of Key Players

List of Key Players

Some of the main competitors dominating the north america frozen bakery products market include;

- Aryzta AG

- Barilla Holding S.p.A.

- Britannia Industries Limited

- Canada Bread Company Ltd.

- Cole's Quality Foods Inc.

- Dawn Food Products Inc

- Dunkin' Donuts LLC

- General Mills Inc.

- Grupo Bimbo S.A.B. de C.V.

- T. Marzetti Company

- United Biscuits

The north america frozen bakery products market is segmented as follows:

By Form Segment Analysis

By Form Segment Analysis

- Gluten-free

- Sugar-free

- Organic

- Others

By Product Type Segment Analysis

By Product Type Segment Analysis

- Cakes & Pastries

- Biscuits & Cookies

- Bread

- Pizza Crusts

- Others

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Online Retail

- Convenience Stores

- Supermarket/Hypermarket

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Aryzta AG

- Barilla Holding S.p.A.

- Britannia Industries Limited

- Canada Bread Company Ltd.

- Cole's Quality Foods Inc.

- Dawn Food Products Inc

- Dunkin' Donuts LLC

- General Mills Inc.

- Grupo Bimbo S.A.B. de C.V.

- T. Marzetti Company

- United Biscuits

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors