03-Mar-2020 | Facts and Factors

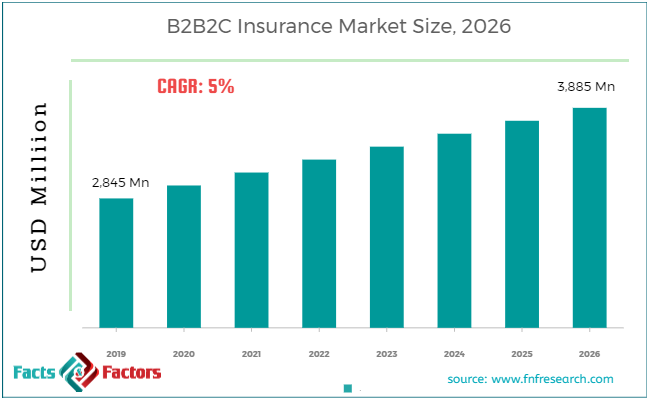

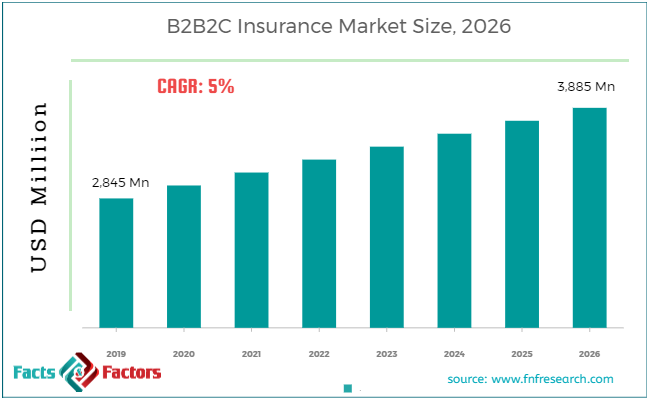

Findings from Facts and Factors report “B2B2C Insurance Market By Type (Vehicle Insurance, Home Insurance, Personal Insurance, Travel Insurance, Mobile Insurance & Warranty Extension, Employee Assistance Programs, and Others), By Distribution Channel (Channel Sales and Online Platform), and By Application (Individuals and Corporate): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecasts, 2020–2026” states that the global B2B2C Insurance market in 2019 was approximately USD 2,845 Million. The market is expected to grow at a CAGR of 5% and is anticipated to reach around USD 3,885 Million by 2026.

B2B2C insurance is the sale of life, non-life, and health insurance products through non-insurance intermediaries. These include vehicle insurance, home insurance, personal insurance, travel insurance, mobile insurance & warranty extension, employee assistance programs, etc. B2b2c insurance could be distributed both ways, online as well as offline. Individuals or the corporate sector could be benefitted from this insurance.

Browse the full “B2B2C Insurance Market By Type (Vehicle Insurance, Home Insurance, Personal Insurance, Travel Insurance, Mobile Insurance & Warranty Extension, Employee Assistance Programs, and Others), By Distribution Channel (Channel Sales and Online Platform), and By Application (Individuals and Corporate): Global Industry Outlook, Market Size, Business Intelligence, Consumer Preferences, Statistical Surveys, Comprehensive Analysis, Historical Developments, Current Trends, and Forecasts, 2020–2026" report at https://www.fnfresearch.com/b2b2c-insurance-market-by-type-vehicle-insurance-home

The rising use of digitalization is leveraging the digital platforms and ecosystem. It influences expectations and customer behavior. This factor is propelling the target market growth. In addition, increasing interest in financial product distribution has been augmenting the target market growth as well. However, the lack of affordability for low and middle-income countries is expected to hamper the target market growth over the forecast period.

Nevertheless, digital technology industries coupled with user experience through mobile banking, online shopping, and other digitally-enabled services have changed the customer’s expectations. This may create lucrative opportunities for the target market.

Segmental Overview:

In terms of type, the target market is categorized as vehicle insurance, home insurance, personal insurance, travel insurance, mobile insurance & warranty extension, employee assistance programs, and others. Among these, the personal insurance category is the leading one. Personal Insurance provides financial security to an individual’s family as well as himself for serious illness or injuries, permanent disablement, loss of ability to earn, or even death.

In terms of the distribution channels, the target market is categorized as channel sales and online platforms. Among these, the channel sales category is the dominating one. It is the process of distribution of a product through segmenting sales operations.

In terms of application, the target market is categorized as individuals and corporate. Among these, the corporate category is leading. Corporate sectors such as from banks to car manufacturers, insurance corporations, utility providers, telecom companies, e-commerce, retailers, and other digital players are involved in this category.

Regional Overview:

In terms of region, the target market is segmented as North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Among these, Asia Pacific is expected to dominate the target market over the forecast period owing to the increasing interest of individuals in financial product distribution in the region.

Report Scope

Report Attribute |

Details |

Market Size in 2019 |

USD 2,845 Million |

Projected Market Size in 2026 |

USD 3,885 Million |

CAGR Growth Rate |

5% CAGR |

Base Year |

2019 |

Forecast Years |

2020-2026 |

Key Market Players |

AssicurazioniGeneraliS.p.A., Allianz, AXA Equitable Life Insurance Company, BNP Paribas Cardif, insurance GmbH, China Life Insurance, Japan Post Holding Co., Ltd., Munich Re, PORTO SEGURO, Prudential Financial, Inc., Swiss Re, United HealthCare Services, Inc., Zurich Insurance Group, and others. |

Key Segment |

By Type, Distribution Channel, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Competitive Landscape:

Some of the key players operating in the target market are AssicurazioniGeneraliS.p.A., Allianz, AXA Equitable Life Insurance Company, BNP Paribas Cardif, bsurance GmbH, China Life Insurance, Japan Post Holding Co., Ltd., Munich Re, PORTO SEGURO, Prudential Financial, Inc., Swiss Re, United HealthCare Services, Inc., Zurich Insurance Group, and others.

This report segments the B2B2C Insurance market as follows:

Global B2B2C Insurance Market: By Type Segmentation

- Vehicle Insurance

- Home Insurance

- Personal Insurance

- Travel Insurance

- Mobile Insurance & Warranty Extension

- Employee Assistance Programs

- Others

Global B2B2C Insurance Market: By Distribution Channel

- Channel Sales

- Online Platform

Global B2B2C Insurance Market: By Application

Global B2B2C Insurance Market: Region

- North America

- Europe

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Southeast Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of the Middle East & Africa

About Us:

Facts & Factors is a leading market research organization offering industry expertise and scrupulous consulting services to clients for their business development. The reports and services offered by Facts and Factors are used by prestigious academic institutions, start-ups, and companies globally to measure and understand the changing international and regional business backgrounds. Our client’s/customer’s conviction on our solutions and services has pushed us in delivering always the best. Our advanced research solutions have helped them in appropriate decision-making and guidance for strategies to expand their business.

Contact Us:

Facts & Factors

A - 2108, Sargam,

Nanded City,

Sinhagad Road,

Pune 411041, India

USA: +1-347-989-3985

Email: [email protected]

Web: https://www.fnfresearch.com