Search Market Research Report

Carbon Credits Market Size, Share Global Analysis Report, 2025 – 2034

Carbon Credits Market Size, Share, Growth Analysis Report By Distribution Channels (Direct Purchases, Carbon Exchanges, Brokers, And Others), By Credit Types (Carbon Renewal Credits And Emission Reduction Credits), By End-Users (Agricultural & Forestry, Technology & Telecom, Transportation, Manufacturing, Energy & Power, Retail & Consumer Goods, And Others), By Project Types (Technology-Based Solutions, Nature-Based Solutions, And Many Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

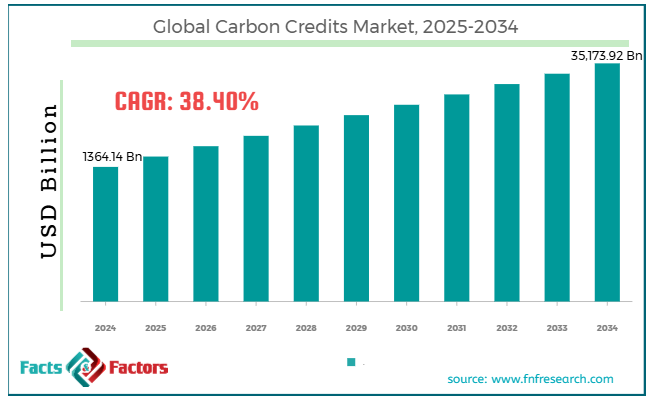

[221+ Pages Report] According to Facts & Factors, the global carbon credits market size was valued at USD 1364.14 billion in 2024 and is predicted to surpass USD 35,173.92 billion by the end of 2034. The carbon credits industry is expected to grow by a CAGR of 38.40% between 2025 and 2034.

Market Overview

Market Overview

Carbon credit refers to the certificate representing the right to emit one metric ton of CO2. It is a market-based system built to lower the global greenhouse gas emissions. The major goal of these credits is to help prevent climate change. These credits are important to promote cleaner technologies.

Also, it increases investments in renewable energy projects. It is a kind of financial incentive for companies trying to lower their overall carbon emissions. It will also help companies achieve net-zero goals faster.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global carbon credits market size is estimated to grow annually at a CAGR of around 38.40% over the forecast period (2025-2034).

- In terms of revenue, the global carbon credits market size was valued at around USD 1364.14 billion in 2024 and is projected to reach USD 35,173.92 billion by 2034.

- Global push for net-zero emissions is driving the growth of the global carbon credits market.

- Based on the distribution channels, the carbon exchange segment is growing at a high rate and is projected to dominate the global market.

- Based on credit types, the carbon removal credit segment is anticipated to grow with the highest CAGR in the global market.

- Based on the end-users, the technology & telecom segment is projected to swipe the largest market share.

- Based on project types, the nature-based solutions segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Global push for net-zero emissions is driving the growth of the global market during the forecast period.

The leading organizations worldwide are pledging to achieve next-zero carbon emissions by 2050, which will be a big reason for the high growth rate of the global carbon credits market during the forecast period.

Also, the growing corporate sustainability initiatives to build brand reputation and attract big investments are likely to support the market's growth.

In recent years, Fortune 500 companies have set up their science-based targets to offset these emissions, which is also expected to boost the demand for high-quality carbon credits in the market. Government regulations are likely to play a crucial role in developing the market.

Canada's carbon pricing, China's national carbon market, and the European Union’s emission trading systems are some of the major drivers of the industry. There is a recent surge in trading volumes in the market, which is expected to positively influence the industry's growth.

The voluntary carbon markets are quite flexible and cover areas like forest-based, renewable energy-based, and many others, which are also likely to contribute to the growth of the industry.

For instance, Amazon entered into an agreement with giant carbon credit providers in 2024 to buy verified emission reduction credits. Also, the company has invested in many forest-based projects.

Restraints

Restraints

- Lack of standardization is likely to hinder the growth of the global market.

There are different ways to verify the issue of carbon credits in different regions, which is emerging as a major factor restraining the growth of the carbon credits industry.

However, the rising concerns over greenwashing undermine people's trust in carbon offsets. Sometimes, companies buy carbon credits for the purpose of carbon neutrality without actually reducing their carbon emission levels.

Opportunities

Opportunities

- Advancements in CCUS are anticipated to foster growth opportunities in the global market.

The ongoing advancements in carbon capture, utilization, and storage technology are a major factor expected to foster new growth opportunities in the global carbon credits market.

Sectors like oil, steel, and cement are investing in carbon capture projects, which are emerging as a significant reason for the growth of the industry. Nature-based solutions like forest conservation and reforestation are good ways to sequester carbon. These kinds of solutions and credits offer co-benefits, which are further expected to uplift the growth of the industry.

Many financial institutions are establishing carbon funds, which are expected to expand the market in the coming years. The growing public awareness is also a crucial factor that is expected to increase demand in the market.

Consequently, consumers are showing interest in the brands investing in carbon credits and climate-positive initiatives, which in turn is encouraging companies to buy carbon offsets.

However, the voluntary nature of the market attracts investors, particularly for tech-based and nature-based credit. For instance, Shell will increase its investment in carbon credits in 2024. It is both the buyer and seller of carbon credits. It has pledged to become carbon neutral by 2050.

Challenges

Challenges

- Limited supply of high-quality credit is a big challenge in the global market.

There are only a few high-quality carbon removal projects, which is a big challenge in the carbon credits industry.

Although there are numerous low-quality projects in the market, big companies are still not interested in investing in these projects. The low payback period also deters private investments, which negatively influences the growth of the market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1364.14 Billion |

Projected Market Size in 2034 |

USD 35,173.92 Billion |

CAGR Growth Rate |

38.40% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

CarbonCure Technologies, Climeworks, Carbon Clean Solutions, The Nature Conservancy, Gold Standard, Schneider Electric, Goldman Sachs, Microsoft Corporation, Natural Capital Partners, Cheniere Energy, South Pole Group, and others. |

Key Segment |

By Distribution Channels, By Credit Types, By End-Users, By Project Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global carbon credits market can be segmented into distribution channels, credit types, end-users, project types, and regions.

On the basis of distribution channels, the market can be segmented into direct purchases, carbon exchanges, brokers, and others. The carbon exchange segment will account for the largest share of the carbon credits industry during the forecast period.

One of the major factors behind the high growth rate of the segment is the transparency and standardization of carbon exchanges. These exchanges offer clear data on pricing, project verification status, transaction records, and many others that eliminate trust caps between the users.

Also, the high liquidity nature of these exchanges attracts end-users. These exchanges are excellent platforms where carbon credits are traded instantly instead of waiting to negotiate bilateral contracts. Moreover, these exchanges also have low transactional costs, further attracting end-users.

On the basis of credit types, the market can be segmented into carbon renewal credits and emission reduction credits. The carbon removal credit segment is likely to dominate the global carbon credits market during the forecast period. Public and private companies are taking net-zero pledges, which is a significant reason for the growth of the segment.

Also, carbon removal is important to reduce the residual emissions. Giant companies are purchasing carbon removal credits to future-proof their sustainability goals. Removal credits are more affordable than avoidance credits, which attract investors and developers.

Government funding and policy support are also likely to revolutionize the market. Many government policies offer attractive subsidies for carbon removal, particularly in Canada, the US, and Europe, which are also expected to foster developments in the segment. The growing public-private partnerships are coming up with de-risked carbon technologies, which are expected to widen the scope of the segment.

On the basis of end-users, the market can be segmented into agricultural & forestry, technology & telecom, transportation, manufacturing, energy & power, retail & consumer goods, and others.

Technology & telecom is expected to lead the carbon credits industry during the anticipated period. Leading companies have aggressive sustainability goals like net-zero carbonization and carbon neutrality, which are strengthening the demand for carbon credits in the technology and telecom sectors. There is a growing carbon emission because of the growth of data centers and AI, which is further skyrocketing the demand for carbon credits in the market.

Technology companies are investing heavily in purchasing high-quality credits to secure long-term supplies and start new project development.

Also, the tech sector is leading the innovation in blockchain, AI, and satellite-based monitoring, which is further fostering the demand for carbon credits.

On the basis of project types, the market can be segmented into methane reduction projects, energy efficiency projects, renewable energy projects, technology-based solutions, nature-based solutions, and many others.

Nature-based projects like water security, soil restoration, and carbon sequencing are some of the major projects that can help eliminate CO2 right away.

Also, nature-based credits are more affordable than any tech-based removal methods, which makes them more accessible to buyers. NBS helps in community development and biodiversity conservation, which allows organizations to align with broader ESG goals.

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is likely to account for the largest share of the global carbon credits market during the forecast period. The United States is expected to record the highest growth in the region because of the major active states like New York, Washington, and California.

The strong government support is expected to positively influence the growth of the market. Canada is also emerging as a major country in the market because of the strong federal and provincial initiatives.

Major regulatory moves in North America, like CFTC guidelines, are also expected to revolutionize the regional market. The major aim of these regulatory guidelines is to boost transparency in the market.

Many companies in the region are pledging to become carbon-negative by 2030, which is also likely to widen the scope of the regional market.

Asia Pacific is also anticipated to witness substantial growth in the coming period. China is leading the market as its national emission trading scheme is among the world's largest, covering around 2000 power plants.

Moreover, India is likely to contribute immensely towards the regional market's growth because of the ongoing corporate commitments to lower their overall carbon emissions.

Singapore is also leading the market because of its growth in the carbon exchange market. It is becoming a global hub for carbon trading, which is a major reason for the high growth rate of the regional market.

The leading companies in the energy, power, technology, and finance sectors are actively participating in the market to meet their emissions reduction targets in APAC. Therefore, all these factors are likely to positively influence the regional market's growth.

For instance, Stripe increased its investment in carbon credits in 2024 to reduce its operational emissions. Stripe also came up with Stripe Climate as a part of the CSR initiative.

Competitive Analysis

Competitive Analysis

The key players in the global carbon credits market include:

- CarbonCure Technologies

- Climeworks

- Carbon Clean Solutions

- The Nature Conservancy

- Gold Standard

- Schneider Electric

- Goldman Sachs

- Microsoft Corporation

- Natural Capital Partners

- Cheniere Energy

- South Pole Group

For instance, Microsoft integrated blockchain technology in 2024 to get precise information on the usage of carbon credit transactions. The company aims to reach carbon neutrality by 2030. Also, the company is investing heavily in carbon removal initiatives like forest restoration.

The global carbon credits market is segmented as follows:

By Distribution Channels Segment Analysis

By Distribution Channels Segment Analysis

- Direct Purchases

- Carbon Exchanges

- Brokers

- Others

By Credit Types Segment Analysis

By Credit Types Segment Analysis

- Carbon Renewal Credits

- Emission Reduction Credits

By End-Users Segment Analysis

By End-Users Segment Analysis

- Agricultural & Forestry

- Technology & Telecom

- Transportation

- Manufacturing

- Energy & Power

- Retail & Consumer Goods

- Others

By Project Types Segment Analysis

By Project Types Segment Analysis

- Technology-Based Solutions

- Nature-Based Solutions

- Many Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- CarbonCure Technologies

- Climeworks

- Carbon Clean Solutions

- The Nature Conservancy

- Gold Standard

- Schneider Electric

- Goldman Sachs

- Microsoft Corporation

- Natural Capital Partners

- Cheniere Energy

- South Pole Group

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors