Search Market Research Report

Carbon Capture and Storage (CCS) Market Size, Share Global Analysis Report, 2024 – 2032

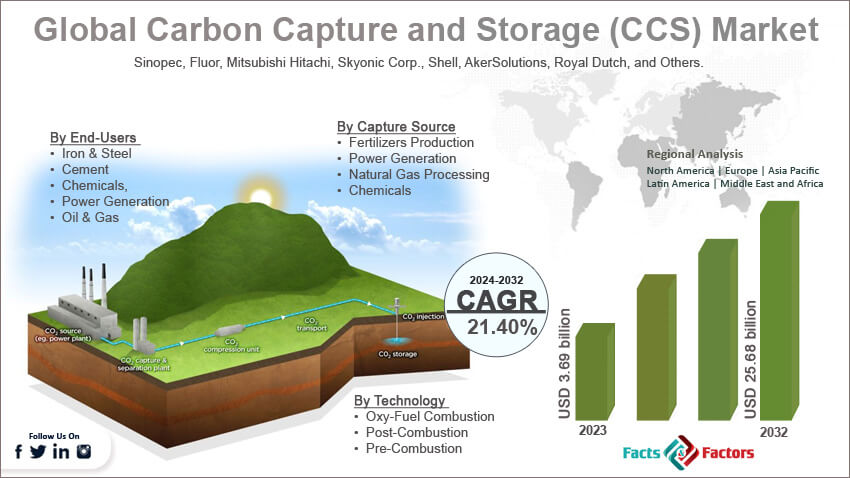

Carbon Capture and Storage (CCS) Market Size, Share, Growth Analysis Report By End-Users (Iron & Steel, Cement, Chemicals & Chemicals, Power Generation, Oil & Gas, And Others), By Technology (Oxy-Fuel Combustion, Post-Combustion, Pre-Combustion, And Others), By Capture Source (Fertilizers Production, Power Generation, Natural Gas Processing, Chemicals, And Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

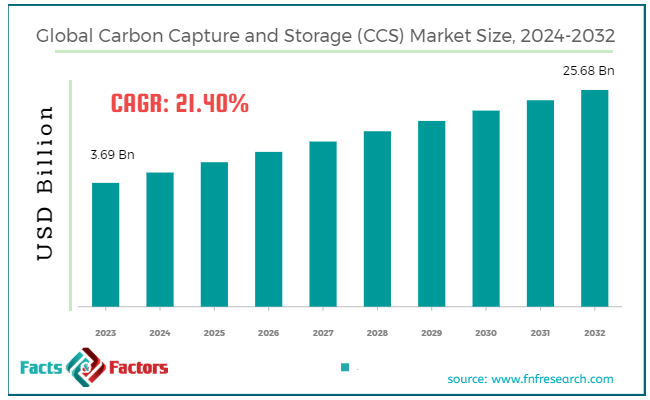

[230+ Pages Report] According to Facts & Factors, the global carbon capture and storage (CCS) market size was valued at USD 3.69 billion in 2023 and is predicted to surpass USD 25.68 billion by the end of 2032. The carbon capture and storage (CCS) industry is expected to grow by a CAGR of 21.40% between 2024 and 2032.

Market Overview

Market Overview

Carbon capture and storage is a technology to capture the carbon dioxide and lower the industrial emissions. Three major steps are involved in the process, including capturing CO2, transporting it, and storing it underground. It is a widely used technology to deal with climate change and net zero emission targets. CCS significantly lowers the emissions from power plants and other industry sources, thereby helping to control the rising global warming levels.

Also, it can be used in different industries like chemical production, steel, and cement, where the CO2 emissions are challenging. Additionally, the deployment of CCS is likely to create more jobs in the marketplace and also strengthen the economic rate growth in the construction research and engineering sector.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global carbon capture and storage (CCS) market size is estimated to grow annually at a CAGR of around 21.40% over the forecast period (2024-2032).

- In terms of revenue, the global carbon capture and storage (CCS) market size was valued at around USD 3.69 billion in 2023 and is projected to reach USD 25.68 billion by 2032.

- Regulatory framework is driving the growth of the global carbon capture and storage (CCS) market.

- Based on the end-users, the oil & gas segment is growing at a high rate and is projected to dominate the global market.

- Based on the technology, the pre-combustion segment is projected to swipe the largest market share.

- Based on capture sources, the natural gas processing segment is expected to dominate the global market.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Regulatory framework is driving the growth of the global market.

Governments all across the globe are issuing policies like emission trading systems, carbon pricing, and direct regulations mandating CO2 reductions to lower carbon emissions, which is likely to drive the growth of the global carbon capture and storage (CCS) market during the forecast period. These policies are likely to favor the mass deployment of CCS technology. The commitments under international agreements like the Paris Agreement further boost the adoption rate of CCS technology.

Additionally, financial incentives like tax credits and subsidies are also likely to offer financial benefits, thereby making these projects more economically viable. CCS technology is highly in use in industries where carbon emissions are prominent like chemical production, steel, and cement. These industries are increasingly adopting CCS technology to meet sustainability goals and regulatory requirements.

Moreover, the rising concerns regarding climate change are also pressurizing industries to adopt CCS technologies in order to reduce greenhouse emissions. For instance, Carbon Engineering Ltd got significant investment from Air Canada and Airbus in 2022. These investments are aimed at boosting the development of scalable and cost-effective decarbonization solutions.

Restraints

Restraints

- High costs are likely to hinder the growth of the global market.

High upfront cost in deploying CCS technologies is a major factor hindering the growth of the carbon capture and storage (CCS) industry. Also, the operational expenses to capture and maintain the storage facilities. However, the uncertainty regarding carbon credits affects CCS projects.

Opportunities

Opportunities

- Technological advancements are likely to foster growth opportunities in the global market.

Advancements in capturing technologies like membrane separation, physical absorption, chemical solvents, and many others are likely to further boost the growth of the global carbon capture and storage (CCS) market during the forecast period. Developments in techniques like storage site selection and CO2 injections help in monitoring the effectiveness of long-term CO2 storage. The ongoing partnerships between government and private companies are also likely to accelerate the progress of CCS technology. International collaborations and knowledge sharing help in adopting best practices in CCS technology.

All these factors are contributing to the growth of the industry. For instance, ExxonMobil entered into an agreement with Nucor Corporation in 2023. However, this marked their third carbon capture accord. This sequence reveals the company's positive outlook across different industries.

Challenges

Challenges

- Social acceptance is a big challenge in the global market.

The public perception of CCS technology, like the risk of leakage of CO2, impacts the local ecosystem and communities. Therefore, there is resistance to the adoption of CCS technology. Additionally, the lack of community engagement during the project planning and development stages further delays these projects.

Segmentation Analysis

Segmentation Analysis

The global carbon capture and storage (CCS) market can be segmented into end-users, technology, capture source, and region.

On the basis of end-users, the market can be segmented into iron & steel, cement, chemicals & chemicals, power generation, oil & gas, and others. The oil & gas segment accounts for the largest share of the carbon capture and storage industry. Rising applications in enhanced oil recovery applications are one of the major factors for the high growth rate of the segment. There is a high need to capture CO2 in the oil and gas sector as it is injected into the oil fields to increase the amount of crude oil.

However, CCS helps in storing huge amounts of CO2 pumped into the fields. However, the government offers incentives to companies investing in CCS technologies. Also, the oil and gas sector has extensive infrastructure like storage and pipeline facilities, and therefore, it is easier to store and transport CO2.

Also, it lowers the requirement for investments in any new equipment or infrastructure. Regulatory compliance plays a major role in the growth of the segment. There are strict regulations for the oil and gas companies to adopt CCS technologies in order to align with the mandates and avoid penalties. However, many companies are adopting CCS as a part of their corporate social responsibility.

On the basis of technology, the market can be segmented into oxy-fuel combustion, post-combustion, pre-combustion, and others. The pre-combustion segment is likely to dominate the global carbon capture and storage market. Capturing CO2 before the combustion process is referred to as the pre-combustion process. Pre-combustion capture is known to be more efficient than other methods because it makes the process simple and less energy-intensive by extracting out concentrated steam of CO2.

However, the concentration of CO2 is quite high at this stage. Therefore, it helps in lowering the overall cost in order to capture and compress the gas. The production of hydrogen includes the process called gasification, and there is a requirement for extraction of CCS technology. The pre-combustion method works well at this stage, which further appeals to end-users.

Nowadays, the growing scope of pre-combustion technology and hydrogen production is driving the need for CCS technology to support a significant transition to a low-carbon economy. Pre-combustion has a number of applications in industrial processes and, therefore, is widely used in chemical and fertilizer industries where CO2 is a byproduct. For instance, in ammonia production, CCS technology works best and makes the whole process easy. Additionally, natural gas processing plants and refineries also use pre-combustion technology to lower their overall carbon footprint.

On the basis of capture source, the carbon capture and storage industry can be segmented into fertilizers production, power generation, natural gas processing, chemicals, and others. The natural gas processing segment is expected to witness significant growth during the forecast period. Rising demand for cleaner energy is the primary reason for the high growth rate of this segment. Natural gas is said to have lower carbon emissions as compared to traditional fossil fuels. Also, CCS in natural gas processing can help in lowering methane emissions, which is, however, a more dangerous gas than CO2.

Moreover, development and capture techniques are also expected to positively impact the growth of the segment. Membrane separation, physical absorption, chemical solvent, and other developments are likely to make the capturing process more cost-effective and easy.

Additionally, the integration with existing infrastructure is expected to help in transporting, storing, and capturing processes. Government and international bodies are implementing regulations to lower the emission of CO2. However, these mandates are encouraging people to adopt natural gas processing facilities and CCS technologies.

Also, the financial incentives and grants further attract end-users. Additionally, eliminating impurities like CO2 from natural gas ultimately enhances the quality and market value of the natural gas, which is another crucial reason positively impacting the growth trajectory of the segment.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 3.69 Billion |

Projected Market Size in 2032 |

USD 25.68 Billion |

CAGR Growth Rate |

21.40% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Sinopec, Fluor, Mitsubishi Hitachi, Skyonic Corp., Shell, AkerSolutions, Royal Dutch, and Others. |

Key Segment |

By End-Users, By Technology, By Capture Source, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America will account for a large share of the global carbon capture and storage market during the forecast period. Petra Nova in Texas is the largest post-combustion CCS project, which is contributing significantly towards the high growth rate of the regional market.

Moreover, the Illinois Industrial CCS Project is another major undertaking in North America, which is likely to expand the industry further. This project captures CO2 from ethanol production facilities and ultimately stores it in deep saline formations.

Also, there is one major project in Canada named Boundary Dam, where CCS is used to capture CO2 from coal-fired power plants. Increasing private and public funding is further driving CCS project development in North America. Also, collaborative projects between public and private agencies are expected to foster innovation. All these factors are likely to positively influence the growth trajectory of the regional market.

Asia Pacific is another major region likely to witness significant developments in the carbon capture and storage industry in the coming years. Japan and South Korea are making significant developments in the market. Tomakomai CCS Demonstration Project in Japan uses CCS technology to capture and store CO2 in an offshore saline aquifer.

Also, South Korea's CCS initiatives to invest in research and pilot projects to lower the overall carbon emissions are anticipated to support the growth trajectory. China is also expected to witness significant developments in the regional market. The country's commitment to carbon neutrality is driving huge investments in CCS research and development projects.

Additionally, Australia’s significant geological storage capacity and strong government support are expected to further positively impact the growth of the regional market. For instance, Equinor entered into an agreement with Linde as a Front-End Engineering Design contract for the H2H Saltend project in 2023. The project gave the operation and maintenance tasks to BOC.

Competitive Analysis

Competitive Analysis

The key players in the global carbon capture and storage (CCS) market include:

- Sinopec

- Fluor

- Mitsubishi Hitachi

- Skyonic Corp.

- Shell

- AkerSolutions

- Royal Dutch

For instance, ADNOC came up with the Sequestered CO2 Injection project in 2023. It has started the deployment of a CO2 injection well, which is stored in Abu Dhabi's carbonate saline aquifer.

The global carbon capture and storage (CCS) market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Iron & Steel

- Cement

- Chemicals,

- Power Generation

- Oil & Gas

- Others

By Technology Segment Analysis

By Technology Segment Analysis

- Oxy-Fuel Combustion

- Post-Combustion

- Pre-Combustion

- Others

By Capture Source Segment Analysis

By Capture Source Segment Analysis

- Fertilizers Production

- Power Generation

- Natural Gas Processing

- Chemicals

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Sinopec

- Fluor

- Mitsubishi Hitachi

- Skyonic Corp.

- Shell

- AkerSolutions

- Royal Dutch

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors