Search Market Research Report

Power Transmission Line Inspection Robot Market Size, Share Global Analysis Report, 2025 – 2034

Power Transmission Line Inspection Robot Market Size, Share, Growth Analysis Report By End-Users (Industrial Sector, Government Agencies, And Utility Companies), By Technologies (Laser Scanning, Ultrasonic Testing, Thermal Imaging, And Visual Inspection), By Types (Climbing Robots, Aerial Robots, And Ground-Based Robots), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 – 2034

Industry Insights

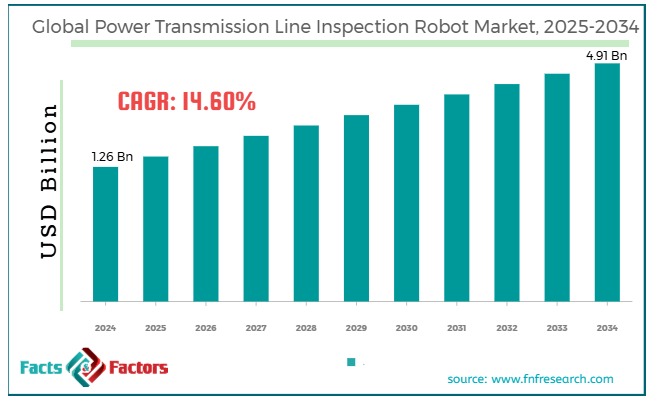

[221+ Pages Report] According to Facts & Factors, the global power transmission line inspection robot market size was valued at USD 1.26 billion in 2024 and is predicted to surpass USD 4.91 billion by the end of 2034. The power transmission line inspection robot industry is expected to grow by a CAGR of 14.60% between 2025 and 2034.

Market Overview

Market Overview

A power transmission line inspection robot is a special robotic system that helps utilities inspect and monitor the transmission lines and other power grid networks. These robots help improve the accuracy, efficiency, and safety of power grids.

However, there are different kinds of inspection robots available in the market, such as climbing robots, aerial robots, ground-based robots, and many others.

AI and machine learning are making these robots more effective and accurate. These robots help in visual inspection, 3-D mapping, post-disaster assessment, and many other areas, which benefit end-users.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global power transmission line inspection robot market size is estimated to grow annually at a CAGR of around 14.60% over the forecast period (2025-2034).

- In terms of revenue, the global power transmission line inspection robot market size was valued at around USD 1.26 billion in 2024 and is projected to reach USD 4.91 billion by 2034.

- Aging power infrastructure is driving the growth of the global power transmission line inspection robot market.

- Based on the end-users, the utility companies segment is growing at a high rate and is projected to dominate the global market.

- Based on technologies, the visual inspection segment is anticipated to grow with the highest CAGR in the global market.

- Based on the types, the aerial robots segment is projected to swipe the largest market share.

- Based on region, North America is expected to dominate the global market during the forecast period.

Growth Drivers

Growth Drivers

- Aging power infrastructure is driving the growth of the global market.

Countries all across the globe have outdated transmission networks that are being modernized by governments, which is one of the major reasons for the high growth rate of the global power transmission line inspection robot market. There is a requirement for precise inspection robots in hard-to-reach areas to help revamp the whole power distribution network efficiently.

Also, the high demand for continuous and reliable power supply in urban and suburban areas is increasing the demand for inspection robots. The growing industrial activities and changing lifestyles of people demand an uninterrupted power supply, which is further boosting the demand for inspection robots to prevent power outages and facilitate predictive maintenance.

Robotic inspections do not require any personnel staff for operation, which also helps utilities lower their operational cost and eliminate any chances of human risks.

However, there is high adoption of aerial and autonomous robots for faster inspections over long distances in challenging terrains like forests and mountains, which is another emerging reason for the high sales revenue of the industry.

For instance, Climbing Robot for High-Altitude Inspections launched all new climbing robots in 2024 for better maneuverability and stabilization while inspecting transmission.

Restraints

Restraints

- High initial investment is expected to hinder the growth of the global market.

Power line inspection robots are quite expensive and require high upfront capital, which hinders the growth of the power transmission line inspection robot industry.

Utility companies with small budgets further limit the adoption rate of inspection robots. The complexity of integrating these robots with existing grid infrastructure is also likely to slow down the industry's growth trajectory in the coming years.

Opportunities

Opportunities

- Technological advancements are expected to foster growth opportunities in the global market.

Manufacturers are increasingly integrating their robots with advanced technologies like machine learning and AI to improve the functionalities of these robots.

Furthermore, the installation of GPS, thermal imaging, and IoT systems in robots is likely to revolutionize the market. These technologies help robots easily collect data and do predictive analytics.

Also, the strict regulations by authorities like NERC and CEA are mandating the requirement of periodic audits on the maintenance and inspection of power transmission lines, which is also expected to widen the scope of the global power transmission line inspection robot market. These robots help utilities easily audit their framework and provide accurate reports to the organizations.

However, the fast expansion of power transmission networks globally, because of cross-border interconnectivity projects, is also supporting the significant rise of the market.

For instance, EPRI is coming up with a transmission line inspection robot in 2024 with advanced capabilities to traverse 80 miles of the lines twice a year.

Challenges

Challenges

- Lack of skilled workforce is a big challenge in the global market.

The shortage of staff, like operators and technicians, to handle these inspection robots and analyze the data generated by them, is a big challenge in the power transmission line inspection robot industry.

Also, regulatory challenges like stringent compliance standards are further expected to slow down the trajectory. However, the limited battery life and payload capacity are other emerging factors expected to negatively impact the growth of the industry.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.26 Billion |

Projected Market Size in 2034 |

USD 4.91 Billion |

CAGR Growth Rate |

14.60% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Phoenix Robotics, Airobotics, Drone Volt, Sensonics, UAV Factory, Robotic Systems Lab, SkySpecs, Nexxis, Elistair, SwellPro, Cyberhawk Innovations, Robotic Skies, Inspector, Flyability, Terra Drone Corporation, and others. |

Key Segment |

By End-Users, By Technologies, By Types, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global power transmission line inspection robot market can be segmented into end-users, technologies, types, and regions.

On the basis of end-users, the market can be segmented into the industrial sector, government agencies, and utility companies. The utility companies segment is projected to account for the largest share of the power transmission line inspection robot industry during the forecast period.

Utility companies have a crucial role in generating, transmitting, and distributing electricity, and therefore, they need advanced inspection technologies to manage their infrastructures. One of the major reasons for the high growth rate of the segment is that the companies have large-scale power grids spanning over a large area.

Managing such a large area is time-consuming and costly; consequently, robot inspection is a more affordable and economical solution. Also, there are many safety concerns because of the high-tension power lines and challenging environment. Humans cannot inspect the areas with difficult terrains like mountains and extreme weather.

Therefore, robots help organizations perform inspections autonomously. Robotic inspection significantly reduced downtime by enabling early predictive maintenance, faster fault detection, and emergency shutdowns.

On the basis of technologies, the market can be segmented into laser scanning, ultrasonic testing, thermal imaging, and visual inspection. Visual inspection is the leading segment in the global power transmission line inspection robot market. Visual inspection is the first step in the diagnostic process, which helps users detect defects like wear & tear, corrosion, etc.

Also, external interferences like fallen trees and debris easily get covered with visual inspection. Visual inspection is a versatile and non-invasive way to check all the transmission line networks in every area.

In addition, the advancements in imaging technology, like the innovation of high-definition cameras, multispectral sensors, etc., are also responsible for the high growth rate of the segment. Moreover, AI-powered systems can detect anomalies very easily, further driving the segment's growth.

Also, visual inspection can easily be facilitated in harsh environments without requiring any personnel or components, thereby making it an ideal solution for diverse geographies and high-voltage segments. Visual inspection solutions can easily be integrated with robotic systems, which can easily navigate through the inspection path.

On the basis of types, the market can be segmented into climbing robots, aerial robots, and ground-based robots. The aerial robot segment is expected to dominate the global power transmission line inspection robot market during the forecast period. Aerial robots can easily access the power distribution network in extreme geographic terrains like mountains or densely forested areas.

Moreover, they are more efficient and can cover a larger area quickly, making them attractive among organizations. It helps these organizations detect the defects early, eliminating any possible downtimes.

Moreover, integrating high-resolution cameras and thermal imaging sensors with aerial robots is further expected to revolutionize the market. Many other associated advanced diagnostic tools are improving the effectiveness of these robots, which further helps detect potential faults, like corrosion, wear & tear, etc.

Regional Analysis

Regional Analysis

- North America to dominate the global market.

North America is likely to account for the largest share of the global power transmission line inspection robot market during the forecast period. The region is focusing on modernizing its existing power infrastructure, which is one of the major reasons driving the extensive growth of the market.

Also, the government's efforts to integrate smart grid technology as a proactive approach to improve the operational efficiency of the entire framework are another crucial reason for fostering developments in the market.

The North American market is all set to see substantial growth in the coming years because of the increasingly aging infrastructure that demands modern solutions like power transmission robots.

The US is a leading market in North America because of its innovative solutions to inspect power lines in order to strengthen grid reliability.

Canada is also likely to dominate the market in the coming years because of its contribution to the rising trend of modernizing their power infrastructure to build a robust power transmission network in the country. Also, the regulatory standards in North America are likely to support the industry's growth trajectory.

Asia-Pacific is anticipated to witness such developments in the coming years. The rural electrification program is emerging as the major reason fueling the growth of the APAC market. Also, the rising demand from residential, commercial, and industrial sectors is also supporting the industry's growth.

Countries like India, China, and Southeast Asia are posing a high demand for electricity because of rapid industrialization and urbanization.

China is leading the market in APAC because of the strong government support and growing interest of domestic robotics players in developing robots for inspecting power transmission lines and networks.

Also, India has a vast potential to capture a larger market because of the high adoption rate of drones by public and private utility organizations. Japan is increasingly integrating AI-powered robot inspection in power transmission works to modernize its power infrastructure, which is also likely to support the market's growth.

Competitive Analysis

Competitive Analysis

The key players in the global power transmission line inspection robot market include:

- Phoenix Robotics

- Airobotics

- Drone Volt

- Sensonics

- UAV Factory

- Robotic Systems Lab

- SkySpecs

- Nexxis

- Elistair

- SwellPro

- Cyberhawk Innovations

- Robotic Skies

- Inspector

- Flyability

- Terra Drone Corporation

For instance, RIGSA came up with Unitree B2 in 2025 in Panama. It is a quadruped robot that aims to help with robotic inspection technology for deploying robots at Fortuna Hydroelectric Power Plant for the inspection of transmission tunnels.

The global power transmission line inspection robot market is segmented as follows:

By End-Users Segment Analysis

By End-Users Segment Analysis

- Industrial Sector

- Government Agencies

- Utility Companies

By Technologies Segment Analysis

By Technologies Segment Analysis

- Laser Scanning

- Ultrasonic Testing

- Thermal Imaging

- Visual Inspection

By Types Segment Analysis

By Types Segment Analysis

- Climbing Robots

- Aerial Robots

- Ground-Based Robots

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Phoenix Robotics

- Airobotics

- Drone Volt

- Sensonics

- UAV Factory

- Robotic Systems Lab

- SkySpecs

- Nexxis

- Elistair

- SwellPro

- Cyberhawk Innovations

- Robotic Skies

- Inspector

- Flyability

- Terra Drone Corporation

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors