Search Market Research Report

Microcrystalline Wax Market Size, Share Global Analysis Report, 2022 – 2028

Microcrystalline Wax Market Size, Share, Growth Analysis Report By Type (Flexible and Hard), By Application (Cosmetics and Personal Care, Candles, Adhesives, Packaging, Rubber, and Others), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2022 – 2028

Industry Insights

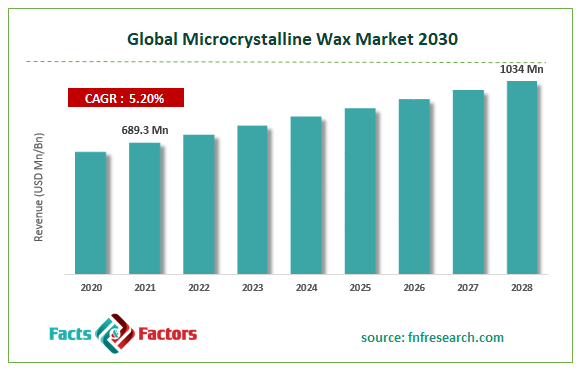

[239+ Pages Report] According to the report published by Facts & Factors, the global microcrystalline wax market size was worth around USD 689.3 million in 2021 and is predicted to grow to around USD 1034 million by 2028 with a compound annual growth rate (CAGR) of roughly 5.2% between 2022 and 2028. The report analyzes the global microcrystalline wax market’s drivers, restraints/challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the microcrystalline wax market.

Market Overview

Market Overview

A refined mixture of solid, saturated aliphatic hydrocarbons known as microcrystalline wax (or amorphous wax) is produced by de-oiling specific fractions of the petroleum refining process. The product appears to be opaque, odorless, white to colored, and malleable. Commercially, it can be obtained in the form of granules, pellets, slabs, or liquid bulk. Microcrystalline wax has a higher melting point, a more branched molecular structure, and longer hydrocarbon chains than paraffin wax (higher molecular weight). Numerous industries, including those that deal with caulking, castings, rubber, food cartons, electroplating, and cosmetics, use microcrystalline wax. They serve as natural bases in lipstick, cold creams, and ointments, which are utilized in the personal care and pharmaceutical industries to harden, lubricate, carry pigments & medications, and protect against moisture. Dental floss contains them as well.

Key Insights

Key Insights

- As per the analysis shared by our research analyst, the global microcrystalline wax market is estimated to grow annually at a CAGR of around 5.2% over the forecast period (2022-2028).

- In terms of revenue, the global microcrystalline wax market size was valued at around USD 689.3 million in 2021 and is projected to reach USD 1034 million, by 2028. Due to a variety of driving factors, the market is predicted to rise at a significant rate.

- Based on application, the cosmetics & personal care segment held the largest market share in 2021

- Based on region, Asia Pacific held the largest revenue share in 2021

Covid-19 Impact

Covid-19 Impact

COVID-19 had a negative impact on the global microcrystalline wax market in 2020. In addition to being utilized as polymer additives for lubricating, microcrystalline wax is also employed in coatings, paints, and adhesives. Construction activities were halted during the lockdown on account of the pandemic scenario, which reduced the need for microcrystalline wax, which is utilized in products like adhesives and others in the construction industry. This harmed the market during the market study. However, the food and e-commerce sectors have seen a surge in demand for microcrystalline wax used in paper packaging. Microcrystalline wax is additionally utilized in soaps and other personal care items as an antifoaming ingredient. Due to the growing awareness of personal hygiene, there is a significant market demand for soaps and other personal care items, which in turn drives the market demand for microcrystalline wax. For instance, In June 2020, global retail e-commerce traffic stood at a record 22 billion monthly visits, with demand being exceptionally high for everyday items such as groceries, clothing, but also retail tech items. Therefore, these facts supported the market growth in the COVID-19 era.

Growth Drivers

Growth Drivers

- Applications of microcrystalline wax in medicines and cosmetics products to drive the market

The growing applications of microcrystalline wax in medicine and cosmetics product is expected to drive global microcrystalline wax market growth during the forecast period. Researchers have discovered new applications for microcrystalline wax as a result of developments in medical research. Studying the characteristics of various wax types has also become increasingly important as a vital factor in market expansion. Crystalline wax is used to make a wide range of gels and creams, which are in high demand. Petroleum jelly is incredibly good at reducing excessive irritation and moisture on the skin. Therefore, the incorporation of microcrystalline wax into petroleum jellies will usher in a period of market expansion. The dominance of microcrystalline wax over paraffin wax has also fueled the market's expansion.

Restraints

Restraints

- Volatility in the raw material prices might be hampering the market

One of the main factors limiting the growth of the microcrystalline wax industry is the volatility of crude oil prices. The majority of the raw materials used to make microcrystalline wax are petroleum-based and thus susceptible to changes in the price of crude oil. The cost of the raw materials needed to make microcrystalline wax is directly impacted by changes in crude oil prices. Costly and unstable raw materials are a challenge for manufacturers, which lowers their profit margins. Due to this situation, market participants are now under pressure to increase their operations' productivity and efficiency to maintain growth and market share. Thus, volatility in the raw material prices might be hampering the global microcrystalline wax market growth during the forecast period.

Opportunities

Opportunities

- Increasing demand for microcrystalline wax from the e-commerce industry proliferates the market expansion

The increasing demand for microcrystalline wax from the e-commerce industry is expected to proliferate the market growth during the forecast period. The demand for microcrystalline wax, which is utilized in paper packaging, has increased in the e-commerce sector. Additionally, microcrystalline wax is used as an antifoaming component in soaps and other personal care products. In particular, during the COVID-19 period, there was a strong market demand for soaps and other personal care products due to the rising awareness of personal cleanliness, propelling the e-commerce sector. For instance, according to ECOMMERCEGUIDE.COM, Mobile users generated USD 3.56 trillion in retail e-commerce purchases in 2021. For years, e-commerce websites have been enhancing their mobile user experience to boost their online sales. Thus, the e-commerce industry provides a lucrative opportunity for market growth during the forecast period.

Segmentation Analysis

Segmentation Analysis

The global microcrystalline wax market is segmented based on type, application, and region

Based on the application, the global market is bifurcated into cosmetics & personal care, candles, adhesives, packaging, rubber, and others. The cosmetics and personal care segment held the largest market share in 2021 and is expected to grow significantly during the forecast period. The growth in the segment is attributable to the extensive use of microcrystalline wax in cosmetics and personal care products. Microcrystalline wax is used in cosmetics and personal care products as a viscosity agent, binder, and emollient to thicken the formulations. The demand for cosmetics and beauty products has significantly increased as a result of the proliferation of new cosmetics and concerns about appearance. According to L'oreal, the value of the global cosmetics business exceeded USD 216 billion in 2020, with skincare accounting for around 42% of that value. 2020 saw good market growth for skincare products, which also contributed significantly to the cosmetics market. Thus, proliferate the segment growth during the forecast period.

Recent Developments:

Recent Developments:

- In March 2022, AWAX Group, Europe's largest wax manufacturer, completed the acquisition of SASOL Wax GmbH, the wax division of the South African energy and chemical company Sasol Ltd. The transaction includes two plants in Hamburg, Germany, one in Linz, Austria, and one in Birkenhead, United Kingdom. The Group will broaden its wax product portfolio and strengthen its technological leadership in the wax market as a result of this acquisition.

- In January 2019, HollyFrontier Corporation announced that its subsidiaries have completed the previously announced acquisition of Sonneborn US Holdings Inc. and Sonneborn Co parties U.A. (collectively “Sonneborn”). With the acquisition of Sonneborn, HollyFrontier elevates itself to the position of a major international provider of specialist goods. Strong brand recognition and a wide range of products from Sonneborn enhance HollyFrontier's current operations. Through this transaction, HollyFrontier's downward integration strategy into specialist products is advanced, and the Rack Forward business segment is greatly expanded. By enhancing processing and blending capabilities in North America and Europe, as well as by growing the global sales organization and distribution network, Sonneborn improves HollyFrontier’s global presence.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 689.3 Million |

Projected Market Size in 2028 |

USD 1034 Million |

CAGR Growth Rate |

5.2% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

MOL Group, Sasol, The International Group Inc., Calumet Specialty Products Partners, L.P., Indian Oil Corporation Ltd, Sonneborn LLC, Kerax Limited, Koster Keunen, Nippon Seiro Co. Ltd., Asian Oil Company, CEPSA, Holly Frontier Refining & Marketing LLC, and Others |

Key Segment |

By Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Analysis

Regional Analysis

- The Asia Pacific dominates the market during the forecast period

The Asia Pacific accounted for the largest global microcrystalline wax market share of over 40% in 2021 and is expected to show its dominance during the forecast period. The growth in the region is attributed to the growing packaging and cosmetics industry, particularly in the countries like China, India, Japan, and South Korea. For instance, In March 2019, China's cosmetics retail sales were approximately USD 4.33 billion, reaching approximately USD 3.85 billion in March 2020. Mainly due to the impact of COVID-19, he had reduced consumption of microcrystalline wax with a rate of decline of about 11% in the domestic cosmetics segment. Furthermore, according to a report released by the Ministry of Economics and Industry, the Indian beauty and personal care (BPC) industry is expected to reach over USD 10 billion by 2021 with an estimated annual growth rate of 5% to 6%. The personal care and cosmetics sector in India is expected to continue growing due to increased shelf space in Indian retailers and boutiques. Thus, the aforementioned facts will support the market expansion during the forecast period.

Competitive Analysis

Competitive Analysis

- MOL Group

- Sasol

- The International Group Inc.

- Calumet Specialty Products Partners

- L.P.

- Indian Oil Corporation Ltd

- Sonneborn LLC

- Kerax Limited

- Koster Keunen

- Nippon Seiro Co. Ltd.

- Asian Oil Company

- CEPSA

- Holly Frontier Refining & Marketing LLC

The global microcrystalline wax market is segmented as follows:

By Type

By Type

- Flexible

- Hard

By Application

By Application

- Cosmetics and Personal Care

- Candles

- Adhesives

- Packaging

- Rubber

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- MOL Group

- Sasol

- The International Group Inc.

- Calumet Specialty Products Partners

- L.P.

- Indian Oil Corporation Ltd

- Sonneborn LLC

- Kerax Limited

- Koster Keunen

- Nippon Seiro Co. Ltd.

- Asian Oil Company

- CEPSA

- Holly Frontier Refining & Marketing LLC

Frequently Asked Questions

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors