Search Market Research Report

Renewable Energy Certificate Market Size, Share Global Analysis Report, 2024 – 2032

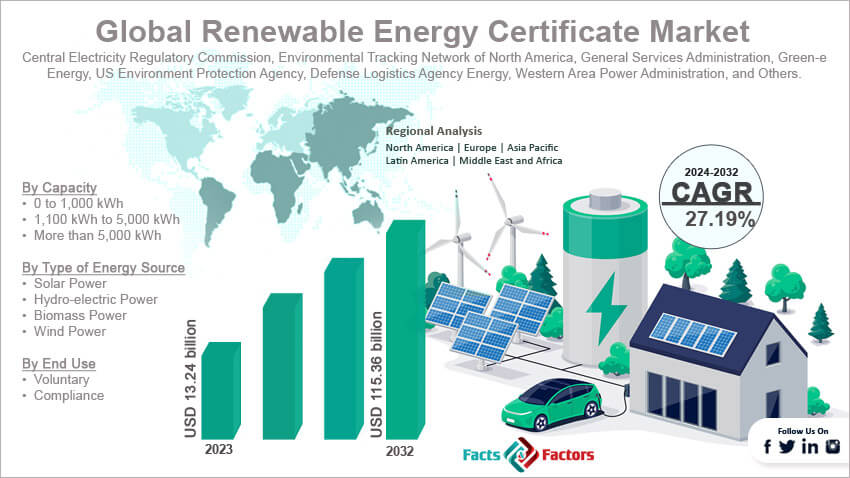

Renewable Energy Certificate Market Size, Share, Growth Analysis Report By Capacity (0 to 1000 kWh, 1100 kWh to 5000 kWh, and More than 5000 kWh), By Type of Energy Source (Solar Power, Hydro-electric Power, Biomass Power, and Wind Power), By End Use (Compliance and Voluntary), and By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

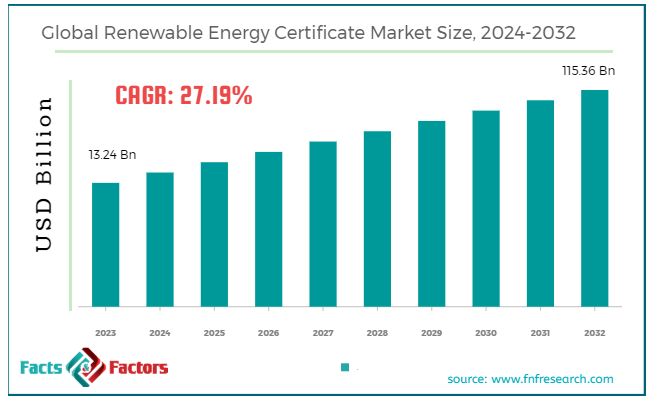

[221+ Pages Report] According to Facts & Factors, the global renewable energy certificate market size in terms of revenue was valued at around USD 13.24 billion in 2023 and is expected to reach a value of USD 115.36 billion by 2032, growing at a CAGR of roughly 27.19% from 2024 to 2032. The global renewable energy certificate market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

A Renewable Energy Certificate (REC), also known as a Green Certificate, Renewable Energy Credit, or Tradable Renewable Certificate, represents proof that one megawatt-hour (MWh) of electricity was generated from a renewable energy resource and fed into the grid. These certificates are tradable commodities in the energy market and serve as a mechanism to promote and track renewable energy generation and consumption.

The renewable energy certificate market facilitates the trade and management of renewable energy credits, enabling organizations and individuals to support renewable energy production. The market is growing due to increasing awareness and regulatory mandates for renewable energy adoption, technological advancements in renewable energy production, and the rising demand for sustainable energy sources.

Key Highlights

Key Highlights

- The renewable energy certificate market has registered a CAGR of 27.19% during the forecast period.

- In terms of revenue, the global renewable energy certificate market was estimated at roughly USD 13.24 billion in 2023 and is predicted to attain a value of USD 115.36 billion by 2032.

- The growth of the renewable energy certificate market is being propelled by regulatory mandates, corporate sustainability goals, and increasing renewable energy production.

- Based on the capacity, the more than 5,000 kWh segment is growing at a high rate and is projected to dominate the global market.

- On the basis of type of energy source, the solar power segment is projected to swipe the largest market share.

- By end use, the compliance segment is expected to dominate the global market.

- Geographically, North America dominates the renewable energy certificate market due to strong regulatory frameworks like the RPS in the U.S. and robust corporate demand for sustainable energy solutions.

Renewable Energy Certificate (REC) Market: Growth Drivers

Renewable Energy Certificate (REC) Market: Growth Drivers

- Rising Demand for Renewables: Governments and corporations are increasingly setting ambitious renewable energy targets, leading to a rise in renewable energy generation and, consequently, REC issuance.

- Compliance Needs: Many countries have implemented mandatory or voluntary renewable energy portfolio standards (RPS) that require utilities or businesses to source a certain amount of their electricity from renewables. RECs serve as a way to demonstrate compliance with these standards.

- Growing Corporate Sustainability Initiatives: Companies are increasingly focusing on environmental responsibility, and RECs allow them to offset their carbon footprint and demonstrate their commitment to sustainability.

- Technological Advancements: Blockchain and other emerging technologies are streamlining REC tracking and trading processes, making the market more transparent and efficient.

- Rising Energy Prices: Fluctuations in traditional energy prices can make renewable energy sources and RECs more attractive options.

Restraints:

Restraints:

- Market Fragmentation: REC markets can vary significantly in terms of regulations, pricing structures, and eligibility criteria across different regions. This fragmentation can create complexity for market participants.

- Limited Liquidity: In some regions, the REC market may lack sufficient liquidity, making it difficult for buyers and sellers to find each other and transact efficiently.

- Quality Concerns: There can be concerns about the environmental integrity of RECs, particularly if the underlying renewable energy generation is not demonstrably additional.

- Policy Uncertainty: Changes in government policies or regulations can create uncertainty and hinder market growth.

Opportunities:

Opportunities:

- Standardization and Harmonization: Efforts to standardize REC definitions and trading practices across different regions can enhance market transparency and facilitate cross-border trading.

- Development of New REC Products: Introducing new REC products with additional environmental attributes, such as location-based RECs or those tied to specific renewable technologies, can cater to diverse buyer preferences.

- Integration with Carbon Markets: Potential linkages between REC markets and carbon pricing schemes could create additional opportunities for RECs to play a role in emissions reduction strategies.

- Increased Investor Participation: Attracting more institutional investors to the REC market can provide greater liquidity and stability.

Challenges:

Challenges:

- Greenwashing Concerns: Ensuring transparency and preventing potential greenwashing practices associated with RECs remains an ongoing challenge.

- Grid Modernization: Inadequate grid infrastructure in some regions can limit the ability to integrate and utilize renewable energy effectively, impacting REC value.

- Cybersecurity Threats: As the REC market increasingly relies on digital platforms, robust cybersecurity measures are crucial to prevent fraud and ensure data integrity.

Renewable Energy Certificate Market: Segmentation Analysis

Renewable Energy Certificate Market: Segmentation Analysis

The global renewable energy certificate market is segmented based on capacity, type of energy source, end use, and region.

By Capacity Insights

By Capacity Insights

Based on Capacity, the global renewable energy certificate market is divided into 0 to 1000 kWh, 1100 kWh to 5000 kWh, and more than 5000 kWh. The 0 to 1,000 kWh segment of the renewable energy certificate market caters primarily to small-scale renewable energy producers, including residential solar panel systems and small community-based renewable projects. These producers generate a limited amount of renewable energy, contributing to local grids and individual energy needs. The growth in this segment is driven by increasing adoption of residential solar power systems and small-scale wind turbines. Government incentives and subsidies, net metering policies, and increasing awareness about renewable energy benefits are significant factors encouraging small-scale renewable energy generation.

The 1,100 kWh to 5,000 kWh segment is projected to grow significantly as more businesses and institutions invest in renewable energy solutions to meet their sustainability targets. 1,100 kWh to 5,000 kWh segment includes medium-scale renewable energy projects, often implemented by small businesses, schools, and larger residential setups. The demand in this segment is driven by businesses and institutions looking to reduce their carbon footprint and energy costs. Renewable energy systems in this capacity range are often used to power commercial buildings, educational institutions, and medium-sized industrial facilities.

The more than 5,000 kWh segment is expected to dominate the REC market with the highest growth rates. This growth is supported by substantial investments in large-scale renewable energy infrastructure and strong regulatory frameworks aimed at increasing the share of renewables in the energy mix. The more than 5,000 kWh segment includes large-scale renewable energy projects, such as utility-scale solar farms, wind farms, and large hydroelectric plants. These projects are major contributors to national and regional energy grids, often developed by large corporations, utilities, and government entities. This segment is driven by the need to meet national renewable energy targets and reduce greenhouse gas emissions. Large-scale projects benefit from economies of scale, making renewable energy more cost-competitive with traditional fossil fuels.

By Type of Energy Source Insights

By Type of Energy Source Insights

Based on Type of Energy Source, the global renewable energy certificate market is categorized into solar power, hydro-electric power, biomass power, and wind power. In 2023, the solar energy segment held the most revenue share in the market, driven by technological advancements and strong policy support. Solar power segment is a rapidly growing segment in the REC market due to the decreasing cost of solar panels and increasing adoption of solar energy across residential, commercial, and industrial sectors. The cost of solar photovoltaic (PV) technology has significantly decreased, making it more affordable and attractive for widespread use??. Increasing consumer awareness and demand for clean energy contribute to the growth of solar RECs??.

Hydro-electric power segment has been a long-standing and significant contributor to the REC market. It is one of the most established and reliable sources of renewable energy. Many countries have well-developed hydro-electric infrastructure, providing a stable supply of renewable energy??. Hydro-electric power produces no direct emissions, contributing to its role in reducing greenhouse gases?.

Biomass power segment involves converting organic materials into energy and plays a crucial role in the REC market by utilizing waste and other organic resources. Biomass energy provides an effective way to utilize agricultural, industrial, and municipal waste, contributing to waste management and energy production??. Biomass is considered a renewable resource, contributing to the sustainability goals of many regions?.

Wind power is one of the fastest-growing segments in the REC market, supported by significant technological advancements and decreasing costs. Innovations in wind turbine technology have improved efficiency and reduced costs, making wind power more competitive??. Wind power provides a high energy output, particularly in regions with favorable wind conditions, enhancing its contribution to the REC market??.

By End Use Insights

By End Use Insights

On the basis of End Use, the global renewable energy certificate market is bifurcated into compliance and voluntary. The voluntary segment involves businesses, organizations, and individuals purchasing RECs to offset their carbon footprint and support renewable energy production, even when not mandated by law. Growing consumer awareness and demand for environmentally responsible products and services encourage companies to invest in RECs as part of their corporate social responsibility (CSR) strategies?.

The compliance segment dominated the market with the largest revenue share in 2023. The compliance segment is driven by regulatory requirements that mandate a certain percentage of energy to come from renewable sources. This market is primarily influenced by government policies and regulatory frameworks. Many regions have implemented RPS or similar regulations that require utilities to source a specific percentage of their energy from renewable sources. This drives demand for renewable energy certificate to meet compliance targets??.

Recent Developments:

Recent Developments:

- (In March 2024): KBank joins forces with INNPOWER to launch a groundbreaking renewable energy certificate (REC) platform in Thailand. This initiative aims to streamline REC registration and sales, facilitating wider adoption of clean energy and potentially helping large businesses achieve net-zero goals.

- (In December 2023): The University of Oklahoma takes a step towards a greener future with a new program focused on renewable energy. This program equips business professionals with the knowledge and skills to navigate the growing renewable energy sector.

- (In December 2022): The high court of Delhi throws a temporary curveball at India's renewable energy market by suspending REC trading for existing certificates. This moves stems from a legal challenge to new regulations, highlighting the need for clear and consistent policies to ensure a smoothly functioning REC market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 13.24 Billion |

Projected Market Size in 2032 |

USD 115.36 Billion |

CAGR Growth Rate |

27.19% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Central Electricity Regulatory Commission, Environmental Tracking Network of North America, General Services Administration, Green-e Energy, US Environment Protection Agency, Defense Logistics Agency Energy, Western Area Power Administration, and Others. |

Key Segment |

By Capacity, By Type of Energy Source, By End Use, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Renewable Energy Certificate Market: Regional Analysis

Renewable Energy Certificate Market: Regional Analysis

- North America leads the global renewable energy certificate market

North America is the leading region in the global renewable energy certificate (REC) market. This region is accounted for 33.2% of the total revenue share in 2023. This dominance is primarily due to a favorable regulatory landscape, with many states in the U.S. implementing Renewable Portfolio Standards (RPS) that require utilities to generate a certain percentage of their energy from renewable sources. The presence of significant renewable energy capacity and the robust demand for RECs from both compliance and voluntary markets further bolster this region's market position. The presence of major corporations like Tesla, Microsoft, and Google purchasing RECs to meet their sustainability goals also boosts the market?.

Europe is another significant market for renewable energy certificates, characterized by stringent environmental regulations and strong governmental support for renewable energy projects. Countries such as Germany, the UK, and France are leading in renewable energy investments, promoting the use of green certificates to meet their ambitious carbon reduction goals. The European Union’s comprehensive policies on climate change and renewable energy are significant drivers, encouraging widespread adoption of RECs. These policies, combined with high public and corporate commitment to sustainability, result in a substantial market. Europe’s renewable energy certificate market is reflecting its healthy regulatory environment and continuous advancements in renewable technologies?.

The Asia-Pacific region is the fastest-growing market for RECs, driven by rapid industrialization and increasing energy demand, particularly in countries like China and India. These countries are implementing robust policies to promote renewable energy and reduce their reliance on fossil fuels. India’s Renewable Purchase Obligation (RPO) and China’s Green Certificate Trading Scheme are key regulatory measures driving the market. Significant investments in solar and wind energy projects, coupled with the region’s economic growth, contribute to this expansion. The Asia-Pacific renewable energy certificate market is expected to experience the highest growth rate during the forecast period.

Latin America is emerging as a significant player in the REC market, with countries like Brazil and Mexico leading the region through substantial investments in renewable energy projects. The expansion of solar and wind farms and supportive government policies aimed at increasing the share of renewables in the energy mix drive the market. As these countries develop their renewable infrastructure, the demand for RECs grows, reflecting a steady market expansion. The REC market in Latin America is expected to grow at a steady pace, driven by ongoing investments in renewable energy infrastructure and increasing environmental awareness??.

In the Middle East & Africa, the REC market is supported by efforts to diversify energy sources and reduce reliance on fossil fuels. Countries such as the UAE and South Africa are investing in renewable energy projects to meet growing energy demands sustainably. Government initiatives to support renewable energy development and adoption are significant growth drivers. Economic diversification and the need to ensure energy security are also contributing to the market’s expansion. The REC market in the Middle East & Africa is anticipated to grow steadily, supported by increasing investments in renewable energy and proactive government policies??.

Renewable Energy Certificate Market: List of Key Players

Renewable Energy Certificate Market: List of Key Players

Some of the main competitors dominating the global renewable energy certificate market include;

- Central Electricity Regulatory Commission

- Environmental Tracking Network of North America

- General Services Administration

- Green-e Energy

- US Environment Protection Agency

- Defense Logistics Agency Energy

- Western Area Power Administration

The global renewable energy certificate market is segmented as follows:

By Capacity Segment Analysis

By Capacity Segment Analysis

- 0 to 1,000 kWh

- 1,100 kWh to 5,000 kWh

- More than 5,000 kWh

By Type of Energy Source Segment Analysis

By Type of Energy Source Segment Analysis

- Solar Power

- Hydro-electric Power

- Biomass Power

- Wind Power

By End Use Segment Analysis

By End Use Segment Analysis

- Voluntary

- Compliance

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Central Electricity Regulatory Commission

- Environmental Tracking Network of North America

- General Services Administration

- Green-e Energy

- US Environment Protection Agency

- Defense Logistics Agency Energy

- Western Area Power Administration

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors