Search Market Research Report

Hypersonic Technology Market Size, Share Global Analysis Report, 2022–2028

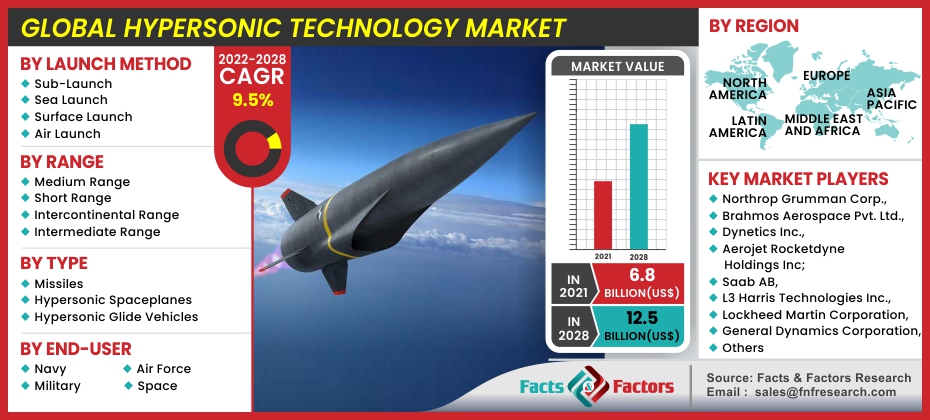

Hypersonic Technology Market By Launch Method (Sub-Launch, Sea launch, Surface Launch, and Air Launch), By Range (Medium Range, Short Range, Intercontinental Range, and Intermediate Range), By Type (Missiles, Hypersonic Spaceplanes, and Hypersonic Glide Vehicles), By End-User (Navy, Air Force, Military, and Space), and By Region-Global and Regional Industry Outline, Market Insights, Inclusive Analysis, Statistical Data, and Forecast 2022–2028

Industry Insights

[210+ Pages Report] According to Facts and Factors, during the forecast period of 2022 to 2028, the global hypersonic technology market is estimated to develop at a compound annual growth rate (CAGR) of 9.5%. The global hypersonic technology market was valued at USD 6.8 billion in 2021, and it is predicted to exceed USD 12.5 billion by 2028. The study investigates several elements and their consequences on the growth of the hypersonic technology market.

Market Overview

Market Overview

Hypersonic refers to speeds of Mach 5 or higher. Hypersonic travel is, clearly, supersonic travel on steroids. But, unlike "supersonic," which has a specific explanation of being faster than the speed of sound, "hypersonic" is a little more ambiguous. In general, hypersonic speeds are the point where the particles of air surrounding the aircraft begin to change by dissociating (breaking apart) and/or collecting the electrical charge. Because these things don't happen at a fixed speed, the term "hypersonic" refers to the point at which they begin to have an effect on the dynamics of flight, which is commonly acknowledged to be Mach 5, or 3,836.35 mph in circumstances of 20°C at sea level.

However, hypersonic research is not solely concerned with speed. It is also the technology's ability for accuracy, maneuverability, and ability to avoid detection that makes it so desirable.

COVID-19 Impact

COVID-19 Impact

The COVID-19 pandemic has had a negative impact on global business. It also had an impact on the development of difficult and expensive technologies such as hypersonic technologies. The development and testing processes were halted due to the government-imposed lockdown. As a result, it had an impact on the overall deployment.

Detrimental disruption and the economic downturn have put a halt to the adoption of technologies such as hypersonic and aircraft missiles. In 2020, the COVID-19 outbreak halted raw material imports and exports. As a result, the scarcity of raw materials hampered the production of ground defense equipment.

Growth Drivers

Growth Drivers

- Growing global R&D investments are expected to drive market growth

The effectiveness of hypersonic weapons is expected to be a major factor driving growth in the global hypersonic technology market. Furthermore, countries such as the United States, India, China, and Russia are making significant investments in hypersonic weapons research and development to strengthen their respective defense capabilities, which is expected to drive the growth of the global market.

Successful hypersonic missile test launches and deployments by countries such as China and Russia have urged other countries to focus on modernizing their corresponding missile systems. As a result, major corporations are increasingly required to develop strategies to meet growing demands for enhanced defense systems.

Increased investment by various countries, such as the United States, Russia, and China, is another key factor anticipated to spur market growth. Hypersonic weapons are deliberately developed to outperform modern ballistic missile defense systems. These weapons can deliver traditional or nuclear loads at super-duper velocities over long distances. The United States, Russia, and China are all actively developing hypersonic missiles. The United States is pursuing hypersonic weapons capable of delivering traditional payloads, while China and Russia are working to equip hypersonic missiles with both conventional and nuclear warheads. Other countries, such as Israel, Iran, and South Korea, have carried out research work on hypersonic airflow propulsion technology.

Restraints

Restraints

- Lack of advanced technologies is impeding the market’s growth

The difficulties in testing hypersonic airflows to approximate hypersonic flight velocity are a barrier to the development of hypersonic technologies. Even simulation tools are insufficient for predicting vehicle performance at high speeds. Another significant impediment to the growth of the global hypersonic technology market is the lack of advanced technologies that are extraordinarily powerful, ultra-light, and nonflammable, have a positive temperature coefficient and can be maintained at hypersonic speeds.

Opportunities

Opportunities

- Globally, there is an increase in the deployment of hypersonic technologies

The United States intends to deploy hypersonic weapons in the years ahead, despite increased efforts by both China and Russia to deploy markedly hypersonic technologies much faster than the United States. Russia declared its Avangard missile operational in 2019 and has upgraded Kh-32s to carry hypersonic missiles, whereas China has developed the DF-17, which could possibly strike the US mainland if launched from a naval vessel.

The United States maintains its investments, which earlier included major deals for the development of hypersonic weapons. The United States is also working on a popular missile body to be used by multiple military branches. The Institute for Defense and Government estimates that by 2027, a total of USD 128 billion will be expended on hypersonic weapons and equipment alone, with the Defense Department budget in the United States predicted to hit USD 2.4 billion in categorized hypersonic work by 2024. Boeing is working to develop its very own hypersonic transportation technology, and startups such as Hermeus are working on the development of a Mach 5 jet, which would cut travel time between New York and Paris to as little as 90 minutes. Such advancements are anticipated to fuel the global hypersonic technology market growth in the coming years.

Challenges

Challenges

- Thermal protection, communication, and maneuverability continue to be significant challenges in designing, building, and fielding a reliable hypersonic weapon

Friction and air resistance generate a tremendous amount of heat at hypersonic speeds, which must be managed with tough but small and light heat shields and thermal security devices. Instruments, such as sensing devices and electrical, must also be installed and shielded in order to withstand these harsh conditions. Managing intense temperatures and speeds necessitates the development and deployment of advanced materials, novel solutions, and composites that can sustain harsh environments. Hypersonic systems are operated in disputed environments and should be able to overcome a variety of defenses. Maneuverability at hypersonic speeds is a significant challenge that necessitates extensive calculation and advancement. During hypersonic flight, basic operations such as communications become important. Personnel must maintain constant interoperability with decision-makers and operators via communications networks and sensor systems capable of operating in these high-speed environments.

Segmentation Analysis

Segmentation Analysis

The global hypersonic technology market is segregated on the basis of launch method, range, type, end-user, and region.

By launch method, the market is classified into sub-launch, sea launch, surface launch, and air launch. Over the forecast period, the air-launch segment is estimated to have a significantly higher revenue share. Hypersonic speed is Mach 5 or higher, or 5 times the sound speed, and air launch allows for greater specificity and maneuvering.

By range, the market is divided into medium range, short range, intercontinental range, and intermediate range. During the forecast period, the intercontinental range is anticipated to lead the global market in terms of revenue contribution. Intercontinental missiles can travel longer distances in less time, carry multiple warheads, able of striking multiple objectives, and can be started from different platforms.

By type, the market is divided into missiles, hypersonic spaceplanes, and hypersonic glide vehicles. The missile segment is divided further into hypersonic cruise missiles and hypersonic ballistic missiles. Revenue from the hypersonic glide vehicle category is anticipated to grow at an accelerated CAGR due to an increased preference for better maneuverability, precision, and speed advantage over traditional ballistic missiles.

By end-user, the market is classified into the navy, air force, military, and space. During the forecast period, the military segment is estimated to account for the largest revenue share in the global market.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 6.8 Billion |

Projected Market Size in 2028 |

USD 12.5 Billion |

CAGR Growth Rate |

9.5% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Northrop Grumman Corporation, Brahmos Aerospace Pvt. Ltd., Dynetics Inc., Aerojet Rocketdyne Holdings Inc., Saab AB, L3 Harris Technologies Inc., Lockheed Martin Corporation, General Dynamics Corporation, Raytheon Company, SpaceX, The Boeing Company, and Thales Group. |

Key Segment |

By Launch Method, Range, Type, End-User, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- Revenue in Asia Pacific market is expected to grow at a rapid rate during the forecast period

Due to increased global political tension and soaring conflict between the US and China, revenue in the Asia Pacific market is expected to grow at an accelerated CAGR during the forecast period, driving increased investments to modern military capabilities. Likewise, regional conflicts in the region have resulted in countries such as India, China, and Japan making investments in hypersonic missile development, which is driving the market growth.

The Middle East and Africa markets are expected to grow at a significantly consistent rate during the forecast period, owing to conflicts and rising regional tensions, as well as Israel's efforts to develop hypersonic technologies.

Recent Developments

Recent Developments

- September 2021: The United States tested a hypersonic air-breathing weapon concept (HAWC). Raytheon Technologies built the missile, which was launched from an aircraft equipped with a scramjet engine developed by Northrop Grumman Corporation. The HAWC vehicle performs best in an oxygen-rich environment, and its speed and maneuverability make it difficult for air defense systems to detect. It can strike targets much faster than subsonic missiles and cause major damage even without the use of high explosives.

- August 2021: The US Air Force (USAF) and venture capital firms contributed USD 60 million to the development of the world's first reusable hypersonic passenger plane, which can travel five times faster than the speed of sound and significantly reduce travel time. The company has been asked to build three prototypes of the aircraft that will be tested, as well as reusable hypersonic propulsion systems.

Competitive Landscape

Competitive Landscape

Some of the main competitors dominating the global hypersonic technology market are :

- Northrop Grumman Corporation

- Brahmos Aerospace Pvt. Ltd.

- Dynetics Inc.

- Aerojet Rocketdyne Holdings Inc.

- Saab AB

- L3 Harris Technologies Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

- Raytheon Company

- SpaceX

- The Boeing Company

- Thales Group

The global hypersonic technology market is segmented as follows:

By Launch Method Segment Analysis

By Launch Method Segment Analysis

- Sub-Launch

- Sea Launch

- Surface Launch

- Air Launch

By Range Segment Analysis

By Range Segment Analysis

- Medium Range

- Short Range

- Intercontinental Range

- Intermediate Range

By Type Segment Analysis

By Type Segment Analysis

- Missiles

- Hypersonic Spaceplanes

- Hypersonic Glide Vehicles

By End-User Segment Analysis

By End-User Segment Analysis

- Navy

- Air Force

- Military

- Space

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Reunion

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Southeast Asia

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Northrop Grumman Corporation

- Brahmos Aerospace Pvt. Ltd.

- Dynetics Inc.

- Aerojet Rocketdyne Holdings Inc.

- Saab AB

- L3 Harris Technologies Inc.

- Lockheed Martin Corporation

- General Dynamics Corporation

- Raytheon Company

- SpaceX

- The Boeing Company

- Thales Group.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors