Search Market Research Report

Gene Therapy Market Size, Share Global Analysis Report, 2022 – 2028

Gene Therapy Market Size, Share, Growth Analysis Report By Vector Type (Viral Vector and Non-Viral Vector), By Therapy (In Vivo Therapy and Ex Vivo Therapy), By Gene Type (Antigen, Cytokine, Tumour Suppressor, Suicide, Deficiency, Growth Factors, Receptors, and Others), By Application (Oncological Disorders, Rare Diseases, Neurological Disorders, and Other Diseases), and By Region - Global and Regional Industry Overview, Market Intelligence, Comprehensive Analysis, Historical Data and Forecast 2022 – 2028

Industry Insights

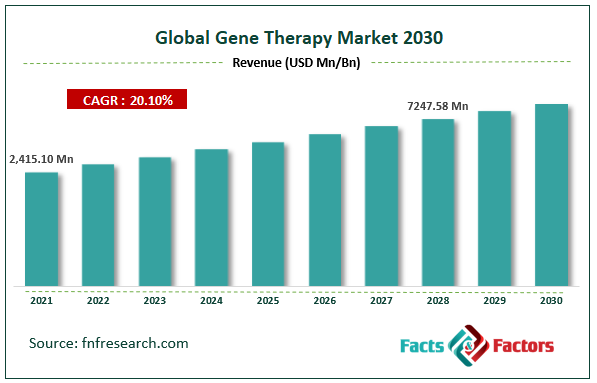

[220+ Pages Report] According to Facts and Factors, the Global Gene Therapy market size was worth around USD 2,415.10 million in 2021 and is estimated to grow to about USD 7247.58 million by 2028, with a compound annual growth rate (CAGR) of approximately 20.10% over the forecast period. The report analyzes the Gene Therapy market’s drivers, restraints/challenges, and their effect on the demands during the projection period. In addition, the report explores emerging opportunities in the Gene Therapy market.

Market Overview

Market Overview

A gene is a fundamental hereditary life unit that contains instructions for performing a specific function. Treatment for cancer, chronic illnesses, infectious diseases, and blood issues is gene therapy. Gene therapy replaces faulty genes in a patient's body with good ones to treat or prevent disease progression. The increase in chronic diseases such as cancer, rare illnesses, genetic disorders, and others is a significant driver driving the Gene Therapy Market Growth. The market is expanding due to rising government backing, ethical recognition of gene therapy as a cancer treatment, and increased cancer prevalence.

Rising healthcare expenses, the presence of healthcare infrastructure, and the availability of reimbursements all present market opportunities for gene therapy. During the anticipated period, it is anticipated that the growing number of clinical trials, product launches, collaborations, and product developments will generate a lucrative potential for the expansion of the gene therapy market. However, gene treatment costs are anticipated to somewhat restrain market expansion throughout the forecast period.

COVID-19 Impact:

COVID-19 Impact:

The COVID-19 pandemic is anticipated to benefit the industry for gene therapy. The creation of COVID-19 vaccines is expected to make substantial use of gene and cell therapy technology. Given that it comes in a single dose and can be stored at room temperature, the vaccine currently being developed is likely to be much more practical than the ones now available on the market.

The therapies of coronavirus from the perspective of RNA interference-based gene therapy also offer a more straightforward approach to combating viral genes and are likely to have a promising future, according to a January 2021 article published under the title, Emerging Patent Landscape for Gene Therapy as a Potential Cure for COVID-19.

Key Insights

Key Insights

- Gene Therapy market share value at a CAGRof 20.10% over the forecast period.

- The increasing prevalence of chronic diseases such as cancer, rare illnesses, genetic disorders, and others is a significant driver driving the Gene Therapy Market Growth.

- By vector type, the vector segment will dominate the market in 2021.

- By application, the oncological disorders segment will dominate the market in 2021.

- North America will dominate the Global Gene Therapy market in 2021.

Growth Drivers

Growth Drivers

- Increasing investments in pharmaceutical R&D are likely to pave the way for global market growth.

Several Pharma companies continue to make significant advancements in new medications and equipment. In the pharmaceutical industry, R&D is crucial. Pharmaceutical companies invest in R&D to bring superior, cutting-edge medicines to market. The trend indicates that major Pharma companies are enhancing their R&D effectiveness through significant R&D investments to see long-term returns for investors and through joint R&D efforts. The rise in pharmaceutical Research and development has resulted in an increased number of cell and gene therapy candidates. To produce cost-effective and efficient gene therapy, it has become essential to outsource manufacturing services.

Restraints

Restraints

- High operational costs may hamper the global market growth.

It is expected that thousands of facilities would be required to manufacture the therapies currently in clinical development. Viral capacity is one of the areas that needs to be accelerated. Most viral vectors are manufactured utilizing adherent production, which is costly vials of 20 million cells that cost between USD 20,000 and USD 30,000. The production cost for gene therapy can range between USD 500,000 to USD 1 million, excluding R&D, clinical trial costs, and the price of constructing the commercial infrastructure required to enable access to patients.

Opportunities

Opportunities

- An increasing number of gene therapy clinical trials bring up several growth opportunities

Clinical trials are the foundation of medical research, assisting pharmaceutical and biopharmaceutical businesses in developing and commercializing innovative cell and gene therapies. Clinical trial demand has increased in recent years, increasing the preference for innovative medications to address unmet medical needs. A considerable increase in the number of gene therapy clinical trials is likely to fuel demand for manufacturing services, propelling growth in the gene therapy market.

Segmentation Analysis

Segmentation Analysis

The global Gene Therapy market is segregated based on Vector Type, Therapy, Gene Type, Application, and Region.

By vector type, the market is divided into Viral Vectors and Non-ViralVectors.Among these, the viral vector segment will dominate the market in 2021. The category for viral vectors dominated the market. A clinicaltrials.gov analysis found that viral vectors are used in about 58 % of developing gene treatments. Adeno-Associated Virus (AAD) is the most commonly used viral vector because of its low immunogenicity, safety, and long-term transient expression. Compared to the viral vector segment, it is predicted that the non-viral vector segment, which comprises bacterial vectors and plasmid DNA, will expand more slowly in the upcoming years.

The market is divided into Oncological Disorders, Rare Diseases, Neurological Disorders, and Other Diseases. Among these, the oncological disorder segment will dominate the market in 2021. Factors driving the segment growth include the rising prevalence of cancer disorders, the increasing importance placed on research to create an effective cancer treatment, and rising cancer research investments. The market is anticipated to increase in the upcoming years due to the availability of numerous gene therapy products that can be used to treat cancer and a sizable patient base.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2021 |

USD 2415.10 Million |

Projected Market Size in 2028 |

USD 7247.58 Million |

CAGR Growth Rate |

20.10% CAGR |

Base Year |

2021 |

Forecast Years |

2022-2028 |

Key Market Players |

Novartis AG, Gilead Sciences., Shanghai Sunway Biotech Co. Ltd., Adaptimmune Therapeutics plc., Orchard Therapeutics., Bristol-Myers Squibb., Amgen Inc., Adverum Biotechnologies Inc., Jazz Pharmaceuticals, Shenzhen SiBiono GeneTech, Abeona Therapeutics Inc., Applied Genetic Technologies Corporation, and others |

Key Segment |

By Vector Type, Therapy, Gene Type, Application, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

- The rising prevalence of spinal problems is likely to help North America dominate the global market.

North America is expected to dominate the gene therapy market in 2021. Due to a robust regulatory environment that supports the development of cellular treatment and the presence of numerous biopharma businesses, several government entities are investing in the area. The local market is advancing as a result of this. The market in North America is anticipated to be driven by institutions and institutes working on gene therapy research and development. Additionally, the market is driven by factors such as the rising incidence of chronic diseases, rising healthcare costs, the development of sophisticated healthcare infrastructure, and the accessibility of reimbursements.

Over the forecast period, Asia Pacific regional market is expected to grow significantly in the Gene Therapy market in 2021. This is done by enhancing vectors like retroviruses and lentiviruses, introducing new methods like induced pluripotent stem cells in conjunction with existing gene-editing models, and even conducting tests on germ cells. Over the projection period, demand for gene therapy is anticipated to be driven by India's rising emphasis on healthcare. Additionally, the number of cancer cases in the nation is increasing, which is pushing the use of gene therapy in oncology treatments.

Recent Developments

Recent Developments

- In June 2021, Biogen Inc. reported favorable Phase 3 STAR study findings for timrepigene emparvovec (BIIB111/AAV2-REP1), experimental gene therapy for the treatment of choroideremia.

- In December 2020, Jazz Pharmaceuticals, Inc. In addition, their collaborator PharmaMar reported a favorable outcome for their ATLANTIS Phase 3 study of Zepzelca in conjunction with Doxorubicin in patients with small cell lung cancer.

Competitive Landscape

Competitive Landscape

Key players within the Global Gene Therapy Market include

- Novartis AG

- Gilead Sciences.

- Shanghai Sunway Biotech Co. Ltd.

- Adaptimmune Therapeutics plc.

- Orchard Therapeutics.

- Bristol-Myers Squibb.

- Amgen Inc.

- Adverum Biotechnologies Inc.

- Jazz Pharmaceuticals

- Shenzhen SiBionoGenentech

- Abeona Therapeutics Inc.

- Applied Genetic Technologies Corporation

- Intellia Therapeutics Inc.

- REGENXBIO Inc.

- Sangamo Therapeutics Inc.

- Astellas Therapeutics Inc.

- Bluebird Bio Inc.

- CRISPR Therapeutics AG

- Uniqure N. V.

- Voyager Therapeutics Inc.

- Merck and Co Inc.

- Dendron Corporation. etc.

Global Gene Therapy market is segmented as follows:

By Vector Type

By Vector Type

- Viral Vector

- Non-Viral Vector

By Therapy

By Therapy

- In Vivo Therapy

- Ex Vivo Therapy

By Gene Type

By Gene Type

- Antigen

- Cytokine

- Tumor Suppressor

- Suicide

- Deficiency

- Growth factors

- Receptors

- Others

By Application

By Application

- Oncological Disorders

- Rare Diseases

- Neurological Disorders

- Other Diseases

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Novartis AG

- Gilead Sciences.

- Shanghai Sunway Biotech Co. Ltd.

- Adaptimmune Therapeutics plc.

- Orchard Therapeutics.

- Bristol-Myers Squibb.

- Amgen Inc.

- Adverum Biotechnologies Inc.

- Jazz Pharmaceuticals

- Shenzhen SiBionoGenentech

- Abeona Therapeutics Inc.

- Applied Genetic Technologies Corporation

- Intellia Therapeutics Inc.

- REGENXBIO Inc.

- Sangamo Therapeutics Inc.

- Astellas Therapeutics Inc.

- Bluebird Bio Inc.

- CRISPR Therapeutics AG

- Uniqure N. V.

- Voyager Therapeutics Inc.

- Merck and Co Inc.

- Dendron Corporation. etc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors