Search Market Research Report

Disposable Endoscopes Market Size, Share Global Analysis Report, 2025 - 2034

Disposable Endoscopes Market Size, Share, Growth Analysis Report By Product Type (Bronchoscopes, Cystoscopes, Duodenoscopes, Hysteroscopes, Laryngoscopes, Ureteroscopes, and Others), By Application (GI Endoscopy, ENT Endoscopy, Bronchoscopy, Urology, Obstetrics/Gynecology, and Others), By End-Use (Hospitals, Outpatient Facilities, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

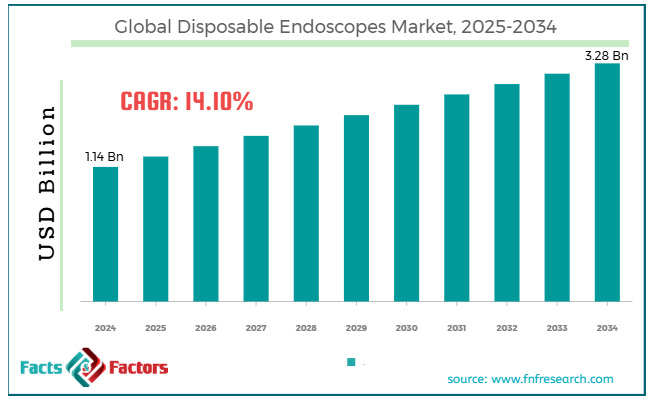

[219+ Pages Report] According to Facts & Factors, the global disposable endoscopes market size was worth around USD 1.14 billion in 2024 and is predicted to grow to around USD 3.28 billion by 2034, with a compound annual growth rate (CAGR) of roughly 14.10% between 2025 and 2034.

Market Overview

Market Overview

Disposable endoscopes are the medical instruments intended for single-use to conduct endoscopic procedures without needing sterilization or reprocessing. They offer a convenient, cost-effective, and hygienic alternative to conventional reusable endoscopes, eliminating the risk of hospital-acquired infections and cross-contamination. The worldwide disposable endoscopes market is driven by the growing elderly population, technological improvements, and mounting healthcare expenses.

With the growing aging population, the cases of gastrointestinal issues, cancer, and respiratory illnesses, which need endoscopic procedures, also rise. This notably propels the demand for medical instruments like disposable endoscopes, to promise early intervention and diagnosis.

Moreover, constant innovation in functionality and design of disposable endoscopes, like enhanced flexibility, imaging systems, and advanced light sources, increases their appeal for therapeutic and diagnostic applications. improvements like AI integration and wireless connectivity are fueling the potential of disposable endoscopes.

In addition, the surge in investments in healthcare systems, especially in developing markets, aids the progress of disposable endoscopes. As more nations prioritize enhancing their healthcare infrastructure, the demand for cost-effective, safe, and easily accessible devices, such as disposable endoscopes, increases.

Nonetheless, the global market progress is hindered by high initial costs and low availability in the emerging regions. Despite disposable endoscopes being cost-efficient in the future, they have a higher initial price tag than the reusable endoscopic instruments. This could refrain the smaller providers or regions from using low financial resources.

Moreover, though disposable incomes are gaining traction in the developed nations, their accessibility in middle and low-income regions is restricted due to distribution challenges, an insufficient healthcare system, and high prices of disposable devices.

Yet, the global disposable endoscopes industry is projected to grow considerably due to technological improvements and telemedicine integration. The current advances in endoscopic technology, like miniature cameras, the incorporation of high-definition video systems, and AI for real-time diagnostics, are increasing the applications of disposable endoscopes. These advancements are improving the capabilities and attention of these instruments.

Furthermore, the rising trend of remote diagnostics and telemedicine offers opportunities for disposable endoscopes. These devices are compatible with telehealth platforms, allowing remote diagnostics and consultations, which is mainly beneficial in rural regions.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global disposable endoscopes market is estimated to grow annually at a CAGR of around 14.10% over the forecast period (2025-2034)

- In terms of revenue, the global disposable endoscopes market size was valued at around USD 1.14 billion in 2024 and is projected to reach USD 3.28 billion by 2034.

- The disposable endoscopes market is projected to grow significantly owing to the mounting cases of gastrointestinal disorders, chronic conditions, and cancer, improvements in disposable endoscopes, and growing focus on infection control and contamination.

- Based on product type, the bronchoscopes segment is expected to lead the market, while the ureteroscopes segment is expected to grow considerably.

- Based on application, the bronchoscopy segment is the dominating segment among others, while the urology segment is projected to witness sizeable revenue over the forecast period.

- Based on end use, the hospitals segment is expected to lead the market as compared to the outpatient facilities segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Will the increased adoption in ambulatory surgical centers boost the disposable endoscopes market growth?

Ambulatory surgical centers are actively demanding and using disposable endoscopes because of their high operational convenience. ASCs usually deal with short procedure times and high patient turnover, increasing the suitability of these devices due to their quick turnaround and low reprocessing needs.

Nearly 70% of ambulatory surgical centers use disposable devices to increase patient outcomes and reduce costs.

These centers are especially driven towards the use of disposable endoscopes for vital procedures like gynecology, urology, and ENT procedures, since they usually comprise quick procedures with high patient turnover.

- Technological improvements in endoscopic devices remarkably fuel the market growth

Improvements in technology have majorly enhanced the performance of single-use endoscopes. These modernizations comprise miniaturization of components, AI-based diagnostic capabilities, and high-definition imaging. With the growing improvements in technologies, the efficacy of disposable scopes also rises, offering a captivating reason for medical facilities to use these devices.

As of 2023, firms like Boston Scientific and AMbu have introduced AI-based colonoscopy and bronchoscopy systems that provide improved diagnostic precision. The launch of AI-based colonoscopy instruments enhances early detection of cancer (colorectal), fueling its adoption in GI procedures.

Restraints

Restraints

- How do limited availability and standardization adversely impact the disposable endoscopes market progress?

The global disposable endoscopes market faces challenges associated with the lack of standardization and varying availability of different endoscope brands. This is especially common in middle-income regions with less advanced healthcare systems. In high-income nations, these endoscopes are readily available due to the high purchasing power and spending of healthcare providers.

Nonetheless, in middle-income and low-income nations, access to such devices is limited, since healthcare infrastructure highlights cost-efficient and reusable devices over disposable substitutes.

Disposable endoscopes differ substantially in terms of performance, design, and quality, which may challenge healthcare professionals to understand which instrument meet their requirements. Without global standards, medical staff and doctors experience intricacies while choosing and using these instruments.

Opportunities

Opportunities

- Does integration with remote diagnostics and telemedicine positively impact the disposable endoscopes market growth?

The growth of remote diagnostics and telemedicine is creating demand for portable, single-use endoscopes that can be used at home or remote locations. This notably expands the geographical reach of healthcare services.

Healthcare protocols have been reinforced, resulting in a 45% increase in the adoption of single-use endoscopes based on compliance. The post-pandemic emphasis on prevention of infection led to a 43% growth in hospital budgets for single-use medical devices, promising safe procedures.

The incorporation of low-weight and wireless disposable endoscopes with improved imaging and illumination potential is backing the growth of the disposable endoscopes industry, especially in telemedicine and remote diagnostics applications.

Challenges

Challenges

- Ecological impact restricts the growth of the market

The broader use of disposable endoscopes adds to the growing medical waste, especially plastic waste. As per WGO, roughly 15% of medical waste is perilous and could be radioactive, toxic, or infectious. The accumulation of such waste increases ecological stress and leads to regulatory measures. For instance, the EU’s ban on disposable plastics has impacted the use of single-use medical devices, including endoscopes.

Producers of disposable endoscopes should essentially direct complex regulatory processes to ensure product efficacy and safety. This process could be expensive and time-consuming. For example, Karl Storz Endoscopy recalled some endoscopes in July 2023 due to sterility issues, underscoring the challenges of adhering to strict standards.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 1.14 Billion |

Projected Market Size in 2034 |

USD 3.28 Billion |

CAGR Growth Rate |

14.10% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Ambu A/S, Boston Scientific Corporation, Olympus Corporation, Fujifilm Holdings Corporation, Karl Storz SE & Co. KG, Medtronic plc, The Surgical Company Endovision, Coloplast Group, Richard Wolf GmbH, Neoscope Inc., AnX Robotica, Obsidio Inc., OTU Medical Inc., Zsquare Medical, Smart Medical Systems Ltd., and others. |

Key Segment |

By Product Type, By Application, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global disposable endoscopes market is segmented based on product type, application, end-use, and region.

Based on product type, the global disposable endoscopes industry is divided into bronchoscopes, cystoscopes, duodenoscopes, hysteroscopes, laryngoscopes, ureteroscopes, and others. The bronchoscopes segment registered a substantial market share in 2024 and is expected to lead in the future owing to better infection control, surging demand, easy operation, and cost-efficiency. The use of disposable endoscopes has increased significantly, especially post-pandemic.

Disposable bronchoscopes majorly decrease cross-contamination, offering reduced risk to patients. They also hold key applications in secretion management, critical care, and emergency departments for intubation and tracheostomy placement. Moreover, they need no reprocessing, enabling speedy throughput in high-pressure medical surroundings. They also have major use in high-volume settings, where they avoid sterilization, cleaning, and repair related to reusable bronchoscopes.

Based on application, the global disposable endoscopes industry is segmented as GI endoscopy, ENT endoscopy, bronchoscopy, urology, obstetrics/gynecology, and others. The bronchoscopy segment registered a substantial market share in the past year and is projected to lead owing to higher cases of respiratory diseases, less painful procedures, and regulatory approvals.

Conditions like chronic obstructive pulmonary disease, lung cancer, asthma, and tuberculosis are widespread, fueling the need for bronchoscopy procedures. The rising adoption of minimally invasive procedures fuels the segmental growth. The latest FSA clearances for disposable bronchoscopes have increased their use in the operating room and ICU.

Based on end use, the global market is segmented into hospitals, outpatient facilities, and others. The hospitals segment captured a larger market share owing to high procedure numbers, better infection control, and technological improvements. Hospitals perform the leading number of endoscopic surgeries in diverse specialties like pulmonology, gynecology, gastrointestinal, and urology. The adoption of disposable endoscopes helps alleviate the risk of HAIs with reprocessed multi-use devices. Hospitals are actively using advanced disposable endoscopes embedded with enhanced imaging potential and performance.

Regional Analysis

Regional Analysis

- What factors will help North America to witness significant growth in the disposable endoscopes market?

North America dominated the global disposable endoscopes market in 2024 and is forecasted to continue to lead over the estimated period. The key reasons for regional growth include improved healthcare systems, a high prevalence of diseases, concerns regarding infection control, technological advancements, and strategic partnerships. North America’s developed healthcare infrastructure supports the adoption of modernized medical technologies like disposable endoscopes. The region also witnesses mounting cases of chronic illnesses, such as gastrointestinal diseases, cancer, and others, which propel the demand for diagnostic surgeries.

Moreover, the growing awareness of HAIs or hospital-acquired infections has increased the demand for single-use endoscopes. It reduces the risk of infections and cross-contamination. Also, improvements in endoscope design, like miniaturization and advanced imaging capabilities, have increased the traction of these endoscopes.

In addition, growing partnerships between healthcare providers and medical device firms have supported the distribution and development of disposable endoscopes, thus growing the industry reach.

Europe holds a second-leading position in the global disposable endoscopes market due to its sophisticated healthcare system, supportive regulatory approvals, technological improvements, and industry competition. Europe brags about its modernized healthcare infrastructure with broad access to medical services and facilities, supporting the adoption of disposable endoscopic solutions. The EU’s regulatory framework backs the use of disposable endoscopes along with other single-use instruments, promising efficacy and safety.

For example, Ambu A/S gained CE mark acceptance for its single-use HD cystoscope, Ambu aScope 5 Cysto HD. Constant improvements in endoscopic solutions improve the prominence and functionality of these endoscopes, fueling their adoption in diverse medical specialties. Moreover, the presence of prominent medical device firms in the region fosters a highly competitive environment. It encourages the distribution and development of improved disposable endoscopic products.

Competitive Analysis

Competitive Analysis

The global disposable endoscopes market is led by players like:

- Ambu A/S

- Boston Scientific Corporation

- Olympus Corporation

- Fujifilm Holdings Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- The Surgical Company Endovision

- Coloplast Group

- Richard Wolf GmbH

- Neoscope Inc.

- AnX Robotica

- Obsidio Inc.

- OTU Medical Inc.

- Zsquare Medical

- Smart Medical Systems Ltd.

Key Market Trends

Key Market Trends

- Growth of applications in medical specialties:

Disposable endoscopes are experiencing mounting use in diverse medical domains besides just gastrointestinal procedures. They are now broadly used in otolaryngology, respiratory endoscopy, gynecology, and urology, widening their industry potential and addressing a broad range of medical demands.

- Growing preference for disposable devices:

Healthcare facilities are actively preferring disposable endoscopes to lessen the risk of hospital-acquired infections and cross-contamination. This inclination is fueled by strict regulatory protocols and recommendations, focusing on the significance of disposable devices in infection control.

The global disposable endoscopes market is segmented as follows:

By Product Type Segment Analysis

By Product Type Segment Analysis

- Bronchoscopes

- Cystoscopes

- Duodenoscopes

- Hysteroscopes

- Laryngoscopes

- Ureteroscopes

- Others

By Application Segment Analysis

By Application Segment Analysis

- GI Endoscopy

- ENT Endoscopy

- Bronchoscopy

- Urology

- Obstetrics/Gynecology

- Others

By End Use Segment Analysis

By End Use Segment Analysis

- Hospitals

- Outpatient Facilities

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Ambu A/S

- Boston Scientific Corporation

- Olympus Corporation

- Fujifilm Holdings Corporation

- Karl Storz SE & Co. KG

- Medtronic plc

- The Surgical Company Endovision

- Coloplast Group

- Richard Wolf GmbH

- Neoscope Inc.

- AnX Robotica

- Obsidio Inc.

- OTU Medical Inc.

- Zsquare Medical

- Smart Medical Systems Ltd.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors