Search Market Research Report

Digital Neuro Biomarkers Market Size, Share Global Analysis Report, 2025 - 2034

Digital Neuro Biomarkers Market Size, Share, Growth Analysis Report By Type (Wearable, Mobile-based Applications, Sensors, and Others), By Clinical Practice (Diagnostic Digital Neuro Biomarkers, Monitoring Digital Neuro Biomarkers, Predictive and Prognostic Digital Neuro Biomarkers, and Others), By End Use (Healthcare Companies, Healthcare Providers, Payers, and Others), And By Region - Global Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2025 - 2034

Industry Insights

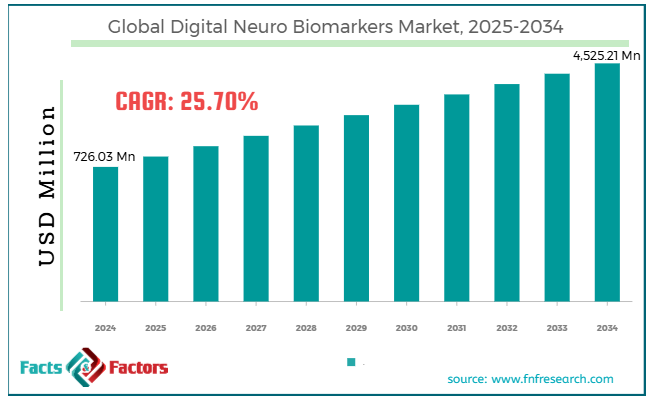

[220+ Pages Report] According to Facts & Factors, the global digital neuro biomarkers market size was worth around USD 726.03 million in 2024 and is predicted to grow to around USD 4525.21 million by 2034, with a compound annual growth rate (CAGR) of roughly 25.70% between 2025 and 2034.

Market Overview

Market Overview

Digital neuro biomarkers are quantifiable indicators of neurological health or brain function that are gathered through digital instruments, such as sensors, wearables, and smartphones. They are used to monitor, detect, and forecast neurological conditions like multiple sclerosis, Parkinson’s, or Alzheimer’s in real-time and mostly outside healthcare facilities. They belong to the broader digital health domain and may offer early diagnosis, continuous monitoring, and personalized treatment.

The global digital neuro biomarkers market is witnessing momentous growth owing to the growing cases of neurological disorders, advancements in mobile applications and wearables, and the rising adoption of RPM. The global rise in disorders like Parkinson's, Alzheimer's, multiple sclerosis, and more has elevated the need for efficient monitoring and diagnostic tools. Also, constant improvements in smartphone apps, wearable devices, and AI-based platforms have improved the potential and capabilities of digital biomarkers, allowing real-time data analysis and collection.

Moreover, the inclination towards monitoring solutions has amplified the dependency on digital biomarkers for constant health examination. In addition, the global market is notably impacted by the rising integration of ML and AI. Using ML and AI algorithms to study complicated biomarker data has enhanced predictive capabilities and diagnostic precision.

Nonetheless, the global market faces a few barriers that could substantially restrain progress over the coming years. These include low knowledge and awareness about digital neuro biomarkers, growing data security and privacy issues, and significantly expensive modernized technologies. The lack of education among patients and medical professionals regarding digital neurobiomarkers may hamper their utilization and adoption.

Also, managing sensitive and confidential neurological data increases security and privacy concerns, thus restricting their acceptance and utilization of biomarkers. Furthermore, the cost associated with well-developed technologies may prevent low-income regions from purchasing and using them.

Nevertheless, the global market is expected to progress notably over the coming years due to increasing integration with digital health platforms, advancements in sensor technologies, and partnerships with pharmaceutical firms. Amalgamating digital biomarkers with EHR and telemedicine platforms may improve their accessibility and utility and enhance patient care. Developing more mature sensors may result in exhaustive and accurate monitoring of neurological health, thus offering prospects for digital neurobiomarkers.

In addition, associating with drug developers to use digital biomarkers in clinical experiments may simplify the drug development process and enhance patient outcomes.

Key Insights:

Key Insights:

- As per the analysis shared by our research analyst, the global digital neuro biomarkers market is estimated to grow annually at a CAGR of around 25.70% over the forecast period (2025-2034)

- In terms of revenue, the global digital neuro biomarkers market size was valued at around USD 726.03 million in 2024 and is projected to reach USD 4525.21 million by 2034.

- The digital neuro biomarkers market is projected to grow significantly due to the increasing focus on personalized healthcare, wearable device improvements, and the rising adoption of remote patient monitoring and telemedicine.

- Based on type, the wearable segment is expected to lead the market, while the sensors segment is expected to register considerable growth.

- Based on clinical practice, the monitoring digital neuro biomarkers segment is the dominating segment. In contrast, the diagnostic digital neuro biomarkers segment is projected to witness sizeable revenue over the forecast period.

- Based on end use, the healthcare providers segment is expected to lead the market as compared to the healthcare companies segment.

- Based on region, North America is projected to dominate the global market during the estimated period, followed by Europe.

Growth Drivers

Growth Drivers

- Will technological developments in digital health drive the digital neuro biomarkers market growth?

Technological improvements in wearables, sensors, and mobile health applications have transformed how neurological biomarkers are gathered and studied. These modernizations allow the monitoring of brain health in real-time, thus simplifying the tracking of neurological diseases.

A notable trend in this domain is the rise of AI-based neurodiagnostics. Solutions like ML and AI help detect strange and unusual patterns in behavior and brain activity that may indicate neurological conditions, enhancing diagnosis accuracy and speed. Further growth of this trend will ultimately impact the progress of the digital neuro biomarkers market.

BrainTale, a prominent neurotechnology newbie, gained CR marking in 2023 for its digital biomarkers application, which utilizes artificial intelligence to monitor brain conditions. The platform uses wearable devices to track cerebral changes, allowing for early intervention and detection efficiently.

- Progresses in drug development and clinical trials propel the market growth

Digital biomarkers are gaining significance in drug development and clinical experiments since they offer real-time insights into disease progression and patient responses. Incorporating digital biomarkers into clinical experiments simplifies research, decreases trial costs, and enhances drug efficacy examination.

Novartis declared an alliance in 2023 with digital health firms to discover how these biomarkers can speed up the development of Alzheimer’s treatments by offering precise and constant data on motor and cognitive functions.

Cambridge Cognition, in 2024, purchased Winterlight, a firm that used speech-powered biomarkers to identify cognitive decline, thus broadening its potential in examining neurological illnesses. This achievement enhances the capacity of firms to conduct remote clinical trials utilizing digital biomarkers to monitor the progression of diseases.

Restraints

Restraints

- The high cost of implementation and technology adversely impact the progress of the digital neuro biomarkers market

The emergence and adoption of advanced solutions for digital neuro biomarkers like sensors, wearables, AI-based analytics applications, and smartphone apps may be costly. These high costs restrict their availability, mainly in resource-limited settings or low-budget nations, thus hampering the global digital neuro biomarkers industry.

Although interest in digital neuro biomarkers is rising, incorporating these instruments into healthcare requires significant spending in research and development and regulatory approval. This weakens the attraction for smaller healthcare systems or hospitals in emerging economies.

In 2024, BrainTale introduced its platform, but its high price, due to sensor technology and AI, increased its accessibility to top healthcare institutes instead of bulk adoption.

Opportunities

Opportunities

- How do the rise in targeted therapies and personalized medicine contribute to the digital neuro biomarkers market growth?

With the shifting interest towards personalized medicine, digital neuro biomarkers can modify treatment depending on the patient's unique neurological and genetic profile. This allows more precise and effective interventions, thus enhancing treatment results and reducing ill effects.

Indivi associated with Biogen in 2024 to develop biomarkers for Parkinson's disease with a high focus on creating tailored treatment protocols. With real-time patient data, these improved biomarkers will aid healthcare providers in regulating schedules depending on the patient's illness progression.

Challenges

Challenges

- Do clinical authentication and reliability limit the growth of the digital neuro biomarkers market?

Despite the capabilities of digital neuro biomarkers, most still lack exhaustive clinical evidence and validation, presenting their predictive power and accuracy. Clinical validation studies are expensive and time-consuming, and without strong evidence of their reliability, medical providers hesitate to integrate digital neuro biomarkers into their standard practice. With insufficient clinical validation, these biomarkers cannot be broadly adopted by medical professionals. This challenge should be essentially resolved before these tools can be incorporated into daily medical practice.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2024 |

USD 726.03 Million |

Projected Market Size in 2034 |

USD 4,525.21 Million |

CAGR Growth Rate |

25.70% CAGR |

Base Year |

2024 |

Forecast Years |

2025-2034 |

Key Market Players |

Mindstrong Health, Cogstate, Winterlight Labs, Cambridge Cognition, Neurotrack, Biogen, Neuroelectrics, HealthRhythms, Empatica, NeuroLex, Aural Analytics, Evidation Health, Novartis (digital neuro biomarker collaborations), Savana Medica, Koneksa Health, and others. |

Key Segment |

By Type, By Clinical Practice, By End Use, and Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Segmentation Analysis

Segmentation Analysis

The global digital neuro biomarkers market is segmented based on type, clinical practice, end use, and region.

Based on type, the global digital neuro biomarkers industry is divided into wearable, mobile-based applications, sensors, and others. The wearable segment leads the market in terms of revenue. Wearable devices like fitness trackers, smartwatches, and advanced wearable sensors are largely adopted to better monitor neuro conditions like Alzheimer’s, Parkinson’s, and different types of epilepsy. Wearable devices offer real-time and continuous data on physical movement, variability in heart rate, and other physiological factors, which are vital for monitoring neurological status.

Based on clinical practice, the global digital neuro biomarkers industry is segmented into diagnostic digital neuro biomarkers, monitoring digital neuro biomarkers, predictive and prognostic digital neuro biomarkers, and others. The monitoring digital neuro biomarkers segment registered a notable market share in 2024 and is expected to lead in the future. Monitoring digital neuro biomarkers is primarily used for the existing tracking of neurological diseases like Alzheimer's and Parkinson's, multiple sclerosis, and epilepsy. These tools offer frequent or continuous data on the progression of diseases, therapy response, and overall patient health.

Based on end-use, the global market is segmented into healthcare companies, providers, payers, etc. The healthcare provider segment has captured the largest market share in recent years and is expected to continue leading, among others. This is because they directly use these biomarkers for monitoring, diagnosing, and managing neurological health status. Healthcare providers utilize these advanced technologies to enhance patient care outcomes, facilitate real-time management, and inform more informed decision-making.

Regional Analysis

Regional Analysis

- What factors will aid North America in witnessing significant growth in the digital neuro biomarkers market?

North America is projected to lead the global digital neuro biomarkers market in revenue, driven by factors such as a well-established healthcare infrastructure, growing adoption of mobile health and wearable devices, and increasing investments in research and development. North America, mainly the U.S., has the most developed healthcare systems globally. This comprises superior monitoring and diagnostic technologies, a specialized workforce, and healthcare professionals. The region has been an early adopter of modern technologies like digital neuro biomarkers, thus impacting regional growth.

The region is home to a dense population that prefers wearable health devices like Fitbit, Apple Watch, and more, which monitor neurological biomarkers. The region also leads in healthcare R&D. Several biotechnology, pharmaceutical, and medical device companies are heavily investing in commercializing and developing these biomarkers for neurological illnesses.

Europe holds a second-leading position in the global digital neuro biomarkers market. This growth is backed by growing incidences of neurological disorders, government funding and support for digital health, and associations among the research industry and institutions. Europe holds a growing senior population, resulting in higher cases of neurological diseases like epilepsy, Alzheimer's, and Parkinson's. The elderly population is among the key factors propelling the industry's growth.

Moreover, European regulatory bodies and governments increasingly promote modern technologies like digital neuro biomarkers. Prominent initiatives like the EU's Horizon 2020 program have offered significant funding in digital health solutions, modernizing these biomarkers for better disease management. The region is also home to several research and academic institutions emphasizing digital health advancements and neuroscience. Alliances among these institutions and the industry have developed cutting-edge biomarkers. Nations like Switzerland, Germany, and the United Kingdom are leaders in integrating digital neuro biomarkers in research studies and clinical experiments.

Competitive Analysis

Competitive Analysis

The global digital neuro biomarkers market is led by players like:

- Mindstrong Health

- Cogstate

- Winterlight Labs

- Cambridge Cognition

- Neurotrack

- Biogen

- Neuroelectrics

- HealthRhythms

- Empatica

- NeuroLex

- Aural Analytics

- Evidation Health

- Novartis (digital neuro biomarker collaborations)

- Savana Medica

- Koneksa Health

Key Market Trends

Key Market Trends

- The growing use of ML and AI for data analysis:

ML and AI are progressing in studying massive quantities of data produced from digital biomarkers. These solutions aid in identifying diverse patterns, projecting disease progression, and enhancing diagnostic precision, especially in Parkinson's and Alzheimer's.

- Precision healthcare and personalized medicine:

There is a surging inclination toward personalized medicine, wherein digital biomarkers are utilized to modify treatment plans depending on the patient’s unique health details. This trend is mainly strong in diseases like Parkinson’s and Alzheimer’s, where persistent data from biomarkers allows customized and effective treatment strategies.

The global digital neuro biomarkers market is segmented as follows:

By Type Segment Analysis

By Type Segment Analysis

- Wearable

- Mobile-based Applications

- Sensors

- Others

By Clinical Practice Segment Analysis

By Clinical Practice Segment Analysis

- Diagnostic Digital Neuro Biomarkers

- Monitoring Digital Neuro Biomarkers

- Predictive and Prognostic Digital Neuro Biomarkers

- Others

By End Use Segment Analysis

By End Use Segment Analysis

- Healthcare Companies

- Healthcare Providers

- Payers

- Others

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Mindstrong Health

- Cogstate

- Winterlight Labs

- Cambridge Cognition

- Neurotrack

- Biogen

- Neuroelectrics

- HealthRhythms

- Empatica

- NeuroLex

- Aural Analytics

- Evidation Health

- Novartis (digital neuro biomarker collaborations)

- Savana Medica

- Koneksa Health

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors