Search Market Research Report

Dental Insurance Market Size, Share, Global Trends Analysis Report 2021-2027

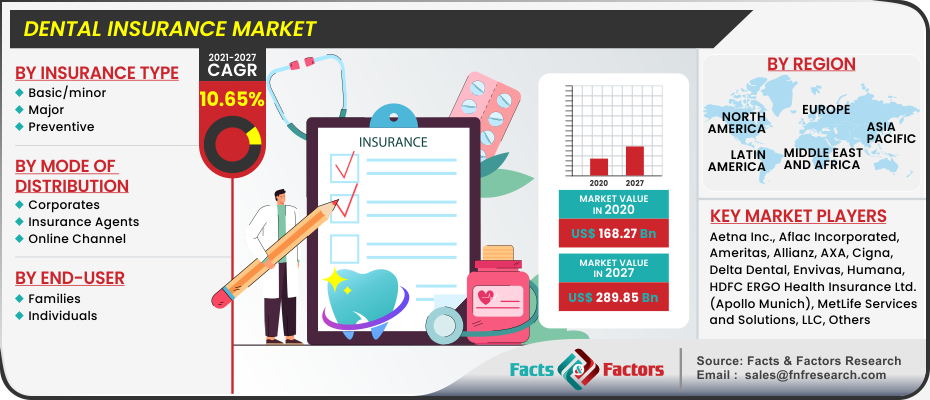

Dental Insurance Market By Insurance Type (Basic/Minor, Major & Preventive), By Mode of Distribution (Corporates, Insurance Agents and Online Channel), and By End-User (Families and Individuals): Global Industry Perspective, Comprehensive Analysis, and Forecast, 2021-2027

Industry Insights

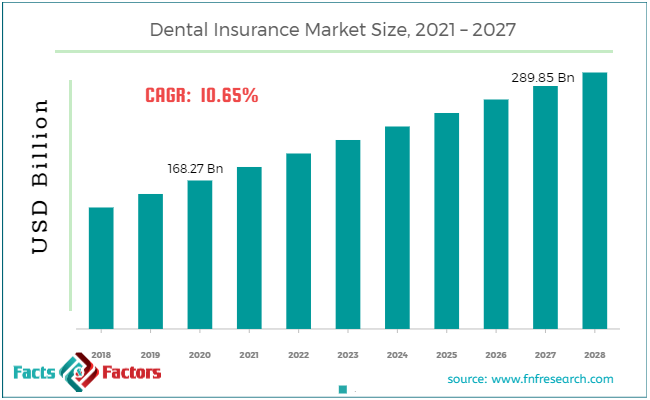

[187+ Pages Report] According to the report published by Facts and Factors, the global dental insurance market size was valued around USD 168.27 billion in 2020 and is expected to grow to around USD 289.85 billion by 2027 with a compound annual growth rate (CAGR) of roughly 10.65% between 2021 and 2027. The report analyzes the global dental insurance market drivers, challenges, and the impact they have on the demands during the forecast period. In addition, the report explores emerging opportunities in the dental insurance market.

Market Overview

Market Overview

Dental insurance solely covers a person's dental health or oral health and reimburses any dental costs spent by patients. Some of the major plans covered by dental insurance are preferred provider organizations (PPO), dental health maintenance organizations (DHMO), and indemnity policies. Depending on the type and scope of the insurance plan, dental insurance can help cover the costs of dental treatment, ranging from basic preventative care to extensive dental work. This industry does not include reinsurance of dental plans; nonetheless, revenue from all dental insurance providers, including commercial health insurance, Medicare, and Medicaid, is included. Dental procedures are very expensive, dental issues are expanding rapidly over the world, and there is a growing awareness of dental insurance, which drives the expansion of the global dental insurance market.

Growth Drivers

Growth Drivers

A large demand for dental hygiene has emerged from a rise in awareness of oral cleanliness, which has become one of the most important parts of human health. As a result of the rising usage of oral hygiene services, demand for dental insurance coverage has surged, propelling the industry forward. Dental insurance also covers a variety of services, such as the treatment of infected nerves, tooth extraction, minor surgical procedures, and the drainage of small oral infections. As a result of the rise in dental procedures, public awareness of oral hygiene has skyrocketed, propelling the growth of the global dental insurance market forward.

The protection of dental insurers against changes in revenues, prices, and yields is fuelling the growth of the dental insurance market, due to the increased assistance from several governments across the world. Furthermore, an increase in initiatives and support across numerous countries enables policyholders to obtain dental insurance coverage with more possibilities and customizable solutions in the market.

The dental insurance market has a huge potential to expand its existing product line of dental coverage. In addition, by implementing insurance coverage technologies, insurers give value-added services to their consumers and increase their product & service offerings. Furthermore, the deployment of technology can help to improve the smoothness of the claim process & minimize manual claim settlement processes, prevent insurance fraud, and reduce overdiagnosis & diagnostic errors. As a result, expansion of existing goods and services, as well as technological implementation, are projected to generate profitable opportunities for dental insurance providers in the next years.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2020 |

USD 168.27 Billion |

Projected Market Size in 2027 |

USD 289.85 Billion |

CAGR Growth Rate |

10.65% CAGR |

Base Year |

2020 |

Forecast Years |

2021-2027 |

Key Market Players |

Aetna Inc., Aflac Incorporated, Ameritas, Allianz, AXA, Cigna, Delta Dental, Envivas, Humana, HDFC ERGO Health Insurance Ltd. (Apollo Munich), MetLife Services and Solutions, LLC, OneExchange, 3M, and United HealthCare Services, Inc. |

Key Segment |

By Insurance Type, By Mode of Distribution, By End-User, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Regional Landscape

Regional Landscape

The North American region managed to hold the greatest market share of roughly 41% because of its increased acceptance of dental insurance. According to the Centre for Disease Control and Prevention, around 49.55% of adults in the United States received dental care coverage through their private health insurance as of May 2019.

Due to increased knowledge of dental insurance and its widespread acceptance, the European area is predicted to account for the second-largest market share. A significant increase is also expected in the Asia Pacific and Japan regions.

Competitive Landscape:

Competitive Landscape:

The key companies profiled in the study who are driving the growth of the global dental insurance market are :

- Aetna Inc.

- Aflac Incorporated

- Ameritas

- Allianz

- AXA

- Cigna

- Delta Dental

- Envivas

- Humana

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions LLC

- OneExchange

- 3M

- United HealthCare Services Inc.

The global Dental Insurance Market is segmented as follows:

By Insurance Type

By Insurance Type

- Basic/minor

- Major

- Preventive

By Mode of Distribution

By Mode of Distribution

- Corporates

- Insurance Agents

- Online Channel

By End-User

By End-User

- Families

- Individuals

By Region

By Region

- North America

- The U.S.

- Canada

- Mexico

- Rest of North America

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Nordic Countries

- Denmark

- Finland

- Iceland

- Sweden

- Norway

- Benelux Union

- Belgium

- The Netherlands

- Luxembourg

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- New Zealand

- Australia

- South Korea

- Southeast Asia

- Indonesia

- Thailand

- Malaysia

- Singapore

- Rest of Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Industry Major Market Players

- Aetna Inc.

- Aflac Incorporated

- Ameritas

- Allianz

- AXA

- Cigna

- Delta Dental

- Envivas

- Humana

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions

- LLC

- OneExchange

- 3M

- United HealthCare Services Inc.

Copyright © 2023 - 2024, All Rights Reserved, Facts and Factors