Search Market Research Report

Dental Insurance Market Size, Share Global Analysis Report, 2024 – 2032

Dental Insurance Market Size, Share, Growth Analysis Report By Coverage Type (DPPO (Dental Preferred Provider Organization), Indemnity Plans, DHMO (Dental Health Maintenance Organizations), and Others), By Procedure (Preventive Care, Basic Procedures, and Major Procedures), By End User (Individuals, Families, and Corporates/Groups), By Distribution Channel (Direct Sales, Brokers/Agents, and Online Distribution), And By Region - Global and Regional Industry Insights, Overview, Comprehensive Analysis, Trends, Statistical Research, Market Intelligence, Historical Data and Forecast 2024 – 2032

Industry Insights

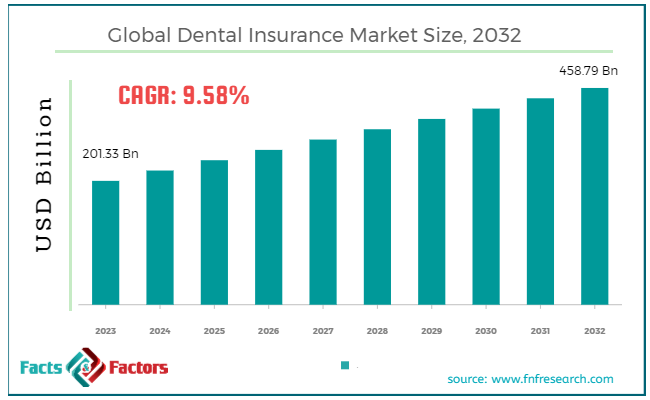

[225+ Pages Report] According to Facts & Factors, the global dental insurance market size in terms of revenue was valued at around USD 201.33 billion in 2023 and is expected to reach a value of USD 458.79 billion by 2032, growing at a CAGR of roughly 9.58% from 2024 to 2032. The global dental insurance market is projected to grow at a significant growth rate due to several driving factors.

Market Overview

Market Overview

Dental insurance is a type of health insurance designed specifically to pay a portion of the costs associated with dental care. There are several types of dental insurance plans, including individual plans, family plans, and group plans typically offered through employers. These plans generally cover a range of dental services such as preventive care (cleanings, routine x-rays, and exams), basic procedures (fillings, root canals, extractions), and major services (crowns, bridges, and orthodontics). Coverage details, including the cost of premiums, co-pays, deductibles, and the maximum annual benefits, can vary widely between plans.

The dental insurance market is substantial and growing, fueled by increasing awareness of the importance of oral health and its connection to overall health, as well as rising dental care costs. As dental procedures become more expensive, more individuals and families are seeking dental insurance to help manage these costs. Additionally, many employers offer dental insurance as part of their benefits packages, which increases accessibility and enrollment rates.

Key Highlights

Key Highlights

- The dental insurance market has registered a CAGR of 9.58% during the forecast period.

- In terms of revenue, the global dental insurance market was estimated at roughly USD 201.33 billion in 2023 and is predicted to attain a value of USD 458.79 billion by 2032.

- The dental insurance market is poised for further growth as it adapts to new healthcare trends, increasing demand for cosmetic dentistry, technological advancements, and changing consumer expectations. This dynamic sector remains crucial for facilitating access to dental care and promoting oral health across different populations.

- On the basis of Coverage, the DPPO (Dental Preferred Provider Organization) segment is projected to dominate the global market due to it offers a balance of affordability and choice for patients.

- Based on Procedure, the preventive care segment is growing at a high rate and is projected to dominate the global market.

- By region, North America is expected to dominate the global market during the forecast period.

Growth Drivers:

Growth Drivers:

- Rising Dental Care Costs: Dental procedures can be expensive, and dental insurance helps make these procedures more affordable for patients. This affordability factor is a major driver of market growth.

- Increased Awareness of Oral Health: Public awareness is growing regarding the link between oral health and overall health. This emphasis on preventive care, which dental insurance often covers, is a significant growth driver.

- Expanding Employer-Sponsored Coverage: More employers are offering dental insurance as part of their employee benefit packages, leading to a wider insured population and market expansion.

Restraints:

Restraints:

- Varying Coverage and High Costs: Dental insurance plans can have significant variations in coverage levels, deductibles, and covered procedures. Additionally, even with insurance, out-of-pocket costs can still be high, potentially discouraging some from seeking dental care.

- Limited Network Restrictions: Some dental insurance plans restrict coverage to dentists within a specific network. While this might offer lower costs, it limits patient choice and can act as a barrier to care.

- Demographic Shifts: An aging population often requires more complex and expensive dental procedures, which can strain dental insurance providers and potentially limit coverage options.

Opportunities:

Opportunities:

- Technological Advancements: Emerging technologies like teledentistry (virtual dental consultations) and digital X-rays hold promise for improving access to dental care and lowering costs. Dental insurance providers can leverage these advancements to offer more comprehensive and affordable plans.

- Focus on Preventive Care: The growing emphasis on preventive care creates an opportunity for dental insurance companies to develop plans that incentivize regular checkups and cleanings, ultimately reducing overall dental costs.

- Untapped Markets: There's significant potential for growth in emerging markets with rising disposable incomes and an increasing focus on healthcare. Dental insurance providers can tailor their offerings to these markets.

Challenges:

Challenges:

- Competition: The dental insurance market is becoming increasingly competitive, with both established players and new entrants vying for market share. This can lead to price pressures and challenges in differentiating services.

- Regulatory Environment: The dental insurance industry operates within a complex regulatory landscape. Navigating these regulations and adapting to potential changes can be challenging for providers.

- Consumer Engagement: Encouraging policyholders to actively utilize their dental insurance benefits can be a challenge. Dental insurance providers need to develop strategies to promote preventive care and educate consumers about the value of their plans.

Dental Insurance Market: Segmentation Analysis

Dental Insurance Market: Segmentation Analysis

The global dental insurance market is segmented based on coverage type, procedure, end user, distribution channel, and region.

By Coverage Type Insights

By Coverage Type Insights

Based on Coverage Type, the global dental insurance market is divided into DPPO (dental preferred provider organization), indemnity plans, DHMO (dental health maintenance organizations), and others. DPPO (Dental Preferred Provider Organization) is dominant segment offers a network of dentists who agree to discounted rates for covered services.

Patients have more freedom in choosing dentists but may face higher out-of-pocket costs if they go outside the network. Indemnity plans reimburse patients for a fixed percentage of covered procedures, regardless of the dentist chosen. While offering more flexibility, they often come with higher premiums and require patients to navigate claim submissions.

By Procedure Insights

By Procedure Insights

Based on Procedure, the global dental insurance market is bifurcated into preventive care, basic procedures, and major procedures. Preventive care segment includes routine check-ups, cleanings, x-rays, and other preventive measures. It typically shows a strong CAGR because these services are widely covered by most dental insurance plans due to their cost-effectiveness in preventing more serious dental issues.

Coverage for basic procedures like fillings, root canals, and extractions. This segment is essential as these are common treatments that most individuals require at some point, driving consistent demand within the market. Major procedures include more extensive and expensive treatments such as crowns, bridges, and orthodontics. Although it represents a smaller portion of the market due to higher costs, it is crucial for comprehensive dental care.

By End User Insights

By End User Insights

On the basis of End User, the global dental insurance market is categorized into individuals, families, and corporates/groups. Individuals segment caters to consumers who purchase dental insurance independently, often outside of employer-sponsored plans. It is a growing segment due to rising awareness of oral health. This segment typically has a healthy growth rate as more individuals recognize the benefits of having dental coverage.

Family segment cover all members of a family under one policy. This segment is growing due to the cost savings and convenience it offers, making it a popular choice among those with dependents. Corporates/Groups dental plans provided by employers or associations as part of employee benefit packages. This is the largest and fastest-growing segment, as employers increasingly view dental benefits as a critical component of employee health benefits, contributing to overall job satisfaction and employee retention.

By Distribution Channel Insights

By Distribution Channel Insights

Based on Distribution Channel, the global dental insurance market is categorized into direct sales, brokers/agents, and online distribution. Direct sales involve purchasing insurance directly from the insurance provider, either online or through an in-house sales team. It is a dominant segment due to its direct approach and often lower costs due to the absence of intermediary fees. Brokers/Agents sold insurance through licensed third parties who can offer plans from multiple providers. This segment is vital for customers who prefer personalized service and assistance in selecting the best plan for their needs. Online distribution is the fastest-growing segment, as more consumers turn to the internet for comparing and purchasing dental insurance. This method is favored for its convenience and the ability to quickly access a wide range of options.

Recent Developments:

Recent Developments:

- In August 2023: Ameritas introduces a new benefit for its group dental plans: a lifetime deductible. This means that once members meet their deductible, they won't need to meet it again as long as they remain with the same company.

- In December 2022: Bupa and YuLife join forces. This collaboration allows companies to include Bupa's dental insurance as an option within YuLife's life insurance policies, catering to both new and existing clients seeking dental coverage for their employees.

- In May 2022: PNB MetLife enters the market, offering a dental plan that covers outpatient dental costs and provides financial support for various dental procedures in India.

- Industry Partnership: ICICI Lombard, a general insurance company, partners with Clove Dental, India's largest network of dental clinics. This collaboration aims to improve access to dental care through insurance coverage.

Report Scope

Report Scope

Report Attribute |

Details |

Market Size in 2023 |

USD 201.33 Billion |

Projected Market Size in 2032 |

USD 458.79 Billion |

CAGR Growth Rate |

9.58% CAGR |

Base Year |

2023 |

Forecast Years |

2024-2032 |

Key Market Players |

Aetna Inc., AFLAC Inc., Allianz SE, Ameritas Life Insurance Corp., AXA, Cigna, Delta Dental Plans Association, HDFC ERGO Health Insurance Ltd. (Apollo Munich), MetLife Services and Solutions LLC, United Concordia, United HealthCare Services Inc., and others., and Others. |

Key Segment |

By Coverage Type, By Procedure, By End User, By Distribution Channel, and By Region |

Major Regions Covered |

North America, Europe, Asia Pacific, Latin America, and the Middle East &, Africa |

Purchase Options |

Request customized purchase options to meet your research needs. Explore purchase options |

Dental Insurance Market: Regional Analysis

Dental Insurance Market: Regional Analysis

- North America is expected to dominate the global market during the forecast period.

North America, particularly the United States and Canada, holds a significant portion of the global dental insurance market. North America dominated the global market with a 43.6% revenue share in 2023. This dominance is supported by high healthcare expenditure, widespread acceptance of insurance for managing healthcare costs, and a robust dental care infrastructure. Employers in North America commonly offer dental benefits, driving enrollment rates. The Centers for Disease Control and Prevention report that 55.7% of US citizens have dental insurance.

Europe maintains a strong position in the dental insurance market, with comprehensive healthcare systems that often include dental coverage in some countries. The market varies across the region; for instance, Scandinavian countries and the UK have higher penetration rates of dental insurance compared to Eastern European countries. The growth in this region is moderate, reflecting the mature nature of the market in Western Europe and gradually increasing rates in Eastern Europe.

The Asia-Pacific region is the fastest-growing in the dental insurance market, driven by increasing awareness of dental health, rising disposable incomes, and improvements in healthcare infrastructure. Countries like China and India are experiencing rapid growth due to economic development and the introduction of health reforms that include dental coverage. The CAGR in this region is the highest among all regions, reflecting dynamic market expansion and increasing adoption of dental insurance policies.

In Latin America, the market is growing but at a slower pace compared to North America and Asia-Pacific. Factors such as improving economic conditions and healthcare reforms are contributing to gradual growth. Brazil and Mexico are leading in the region, with increasing adoption of both individual and corporate dental insurance plans.

The Middle East and Africa (MEA) region has the smallest share of the global dental insurance market but is slowly growing. The market's growth is hindered by lower awareness and less robust healthcare infrastructure. However, certain Gulf Cooperation Council (GCC) countries like the UAE and Saudi Arabia are seeing growth due to government initiatives and an increasing expatriate population looking for comprehensive health benefits, including dental insurance.

Dental Insurance Market: Competitive Landscape

Dental Insurance Market: Competitive Landscape

Some of the main competitors dominating the global dental insurance market include;

- Aetna Inc.

- AFLAC Inc.

- Allianz SE

- Ameritas Life Insurance Corp.

- AXA

- Cigna

- Delta Dental Plans Association

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions, LLC

- United Concordia

- United HealthCare Services, Inc.

The global dental insurance market is segmented as follows:

By Coverage Type Segment Analysis

By Coverage Type Segment Analysis

- DPPO (Dental Preferred Provider Organization)

- Indemnity Plans

- DHMO (Dental Health Maintenance Organizations)

- Others

By Procedure Segment Analysis

By Procedure Segment Analysis

- Preventive Care

- Basic Procedures

- Major Procedures

By End User Segment Analysis

By End User Segment Analysis

- Individuals

- Families

- Corporates/Groups

By Distribution Channel Segment Analysis

By Distribution Channel Segment Analysis

- Direct Sales

- Brokers/Agents

Online Distribution

By Regional Segment Analysis

By Regional Segment Analysis

- North America

- The U.S.

- Canada

- Mexico

- Europe

- France

- The UK

- Spain

- Germany

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Australia

- Southeast Asia

- Rest of Asia Pacific

- The Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- Kuwait

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Table of Content

Industry Major Market Players

- Aetna Inc.

- AFLAC Inc.

- Allianz SE

- Ameritas Life Insurance Corp.

- AXA

- Cigna

- Delta Dental Plans Association

- HDFC ERGO Health Insurance Ltd. (Apollo Munich)

- MetLife Services and Solutions, LLC

- United Concordia

- United HealthCare Services, Inc.

Copyright © 2025 - 2026, All Rights Reserved, Facts and Factors